Answered step by step

Verified Expert Solution

Question

1 Approved Answer

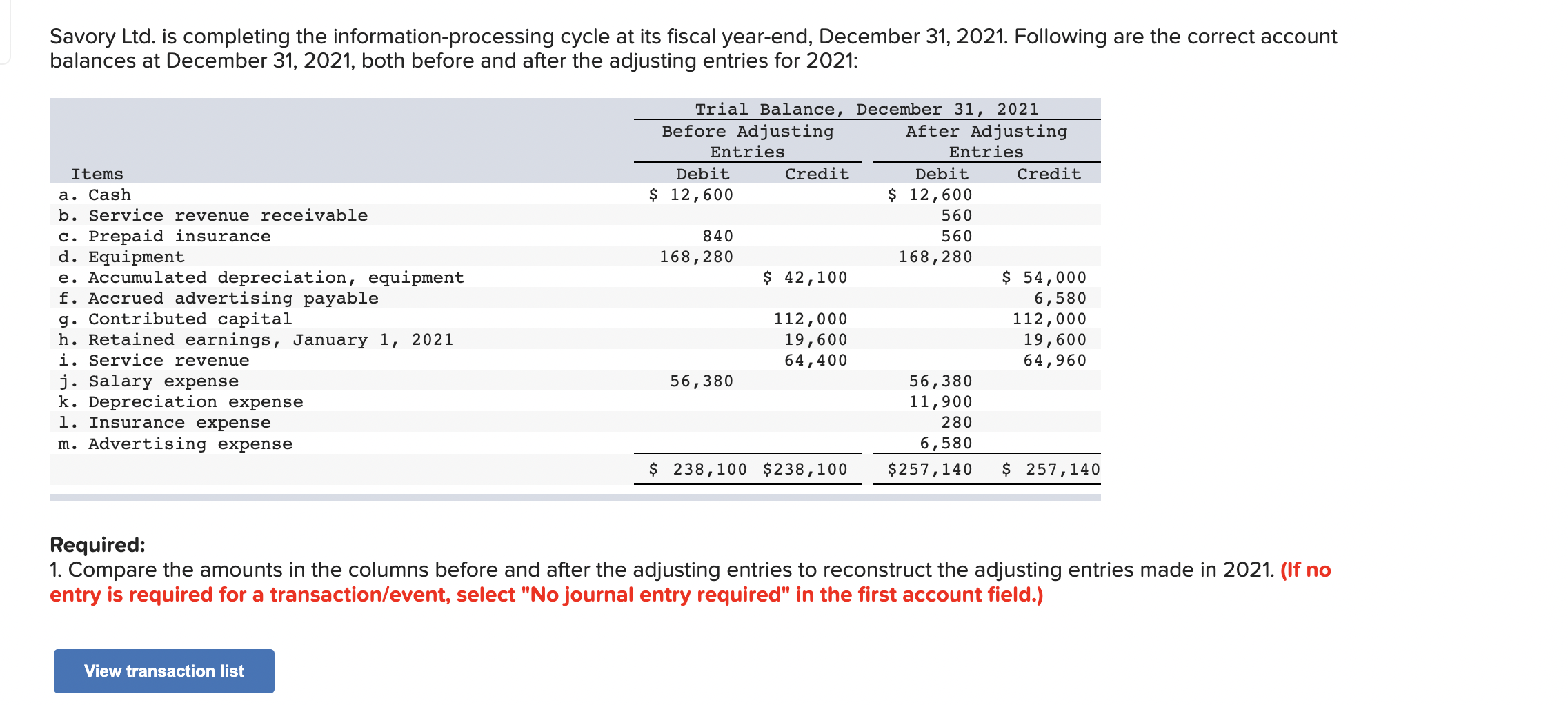

Savory Ltd. is completing the information-processing cycle at its fiscal year-end, December 31, 2021. Following are the correct account balances at December 31, 2021, both

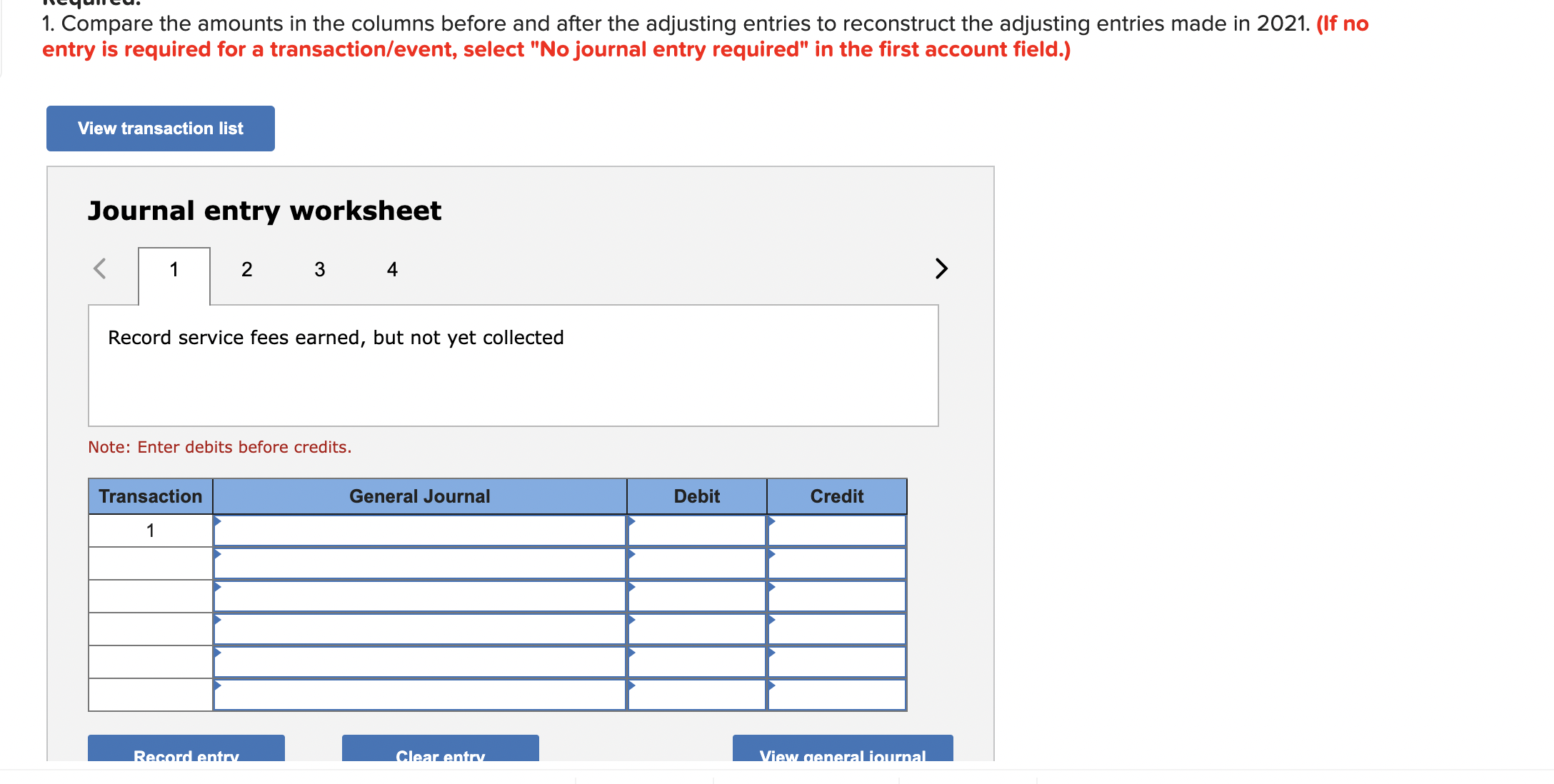

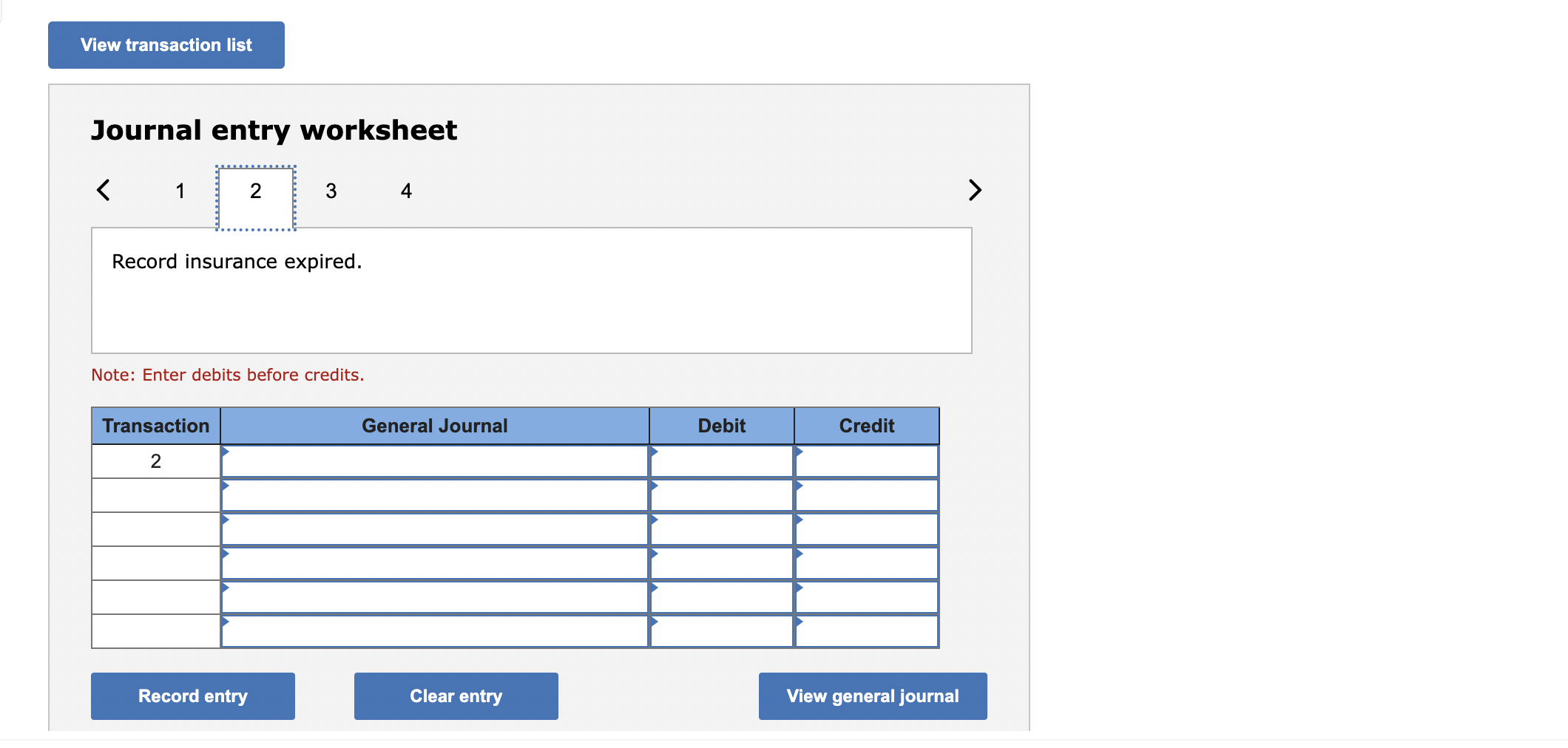

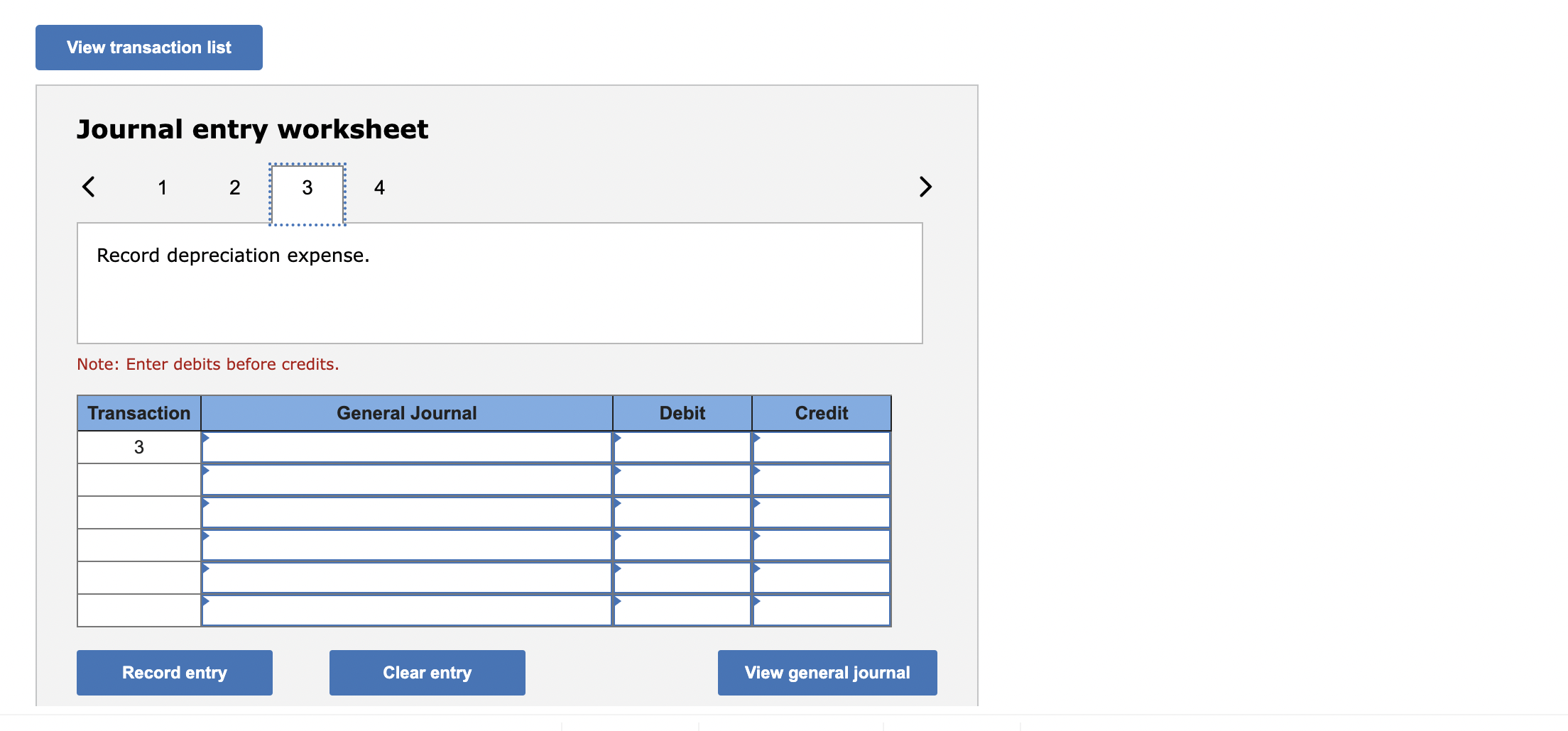

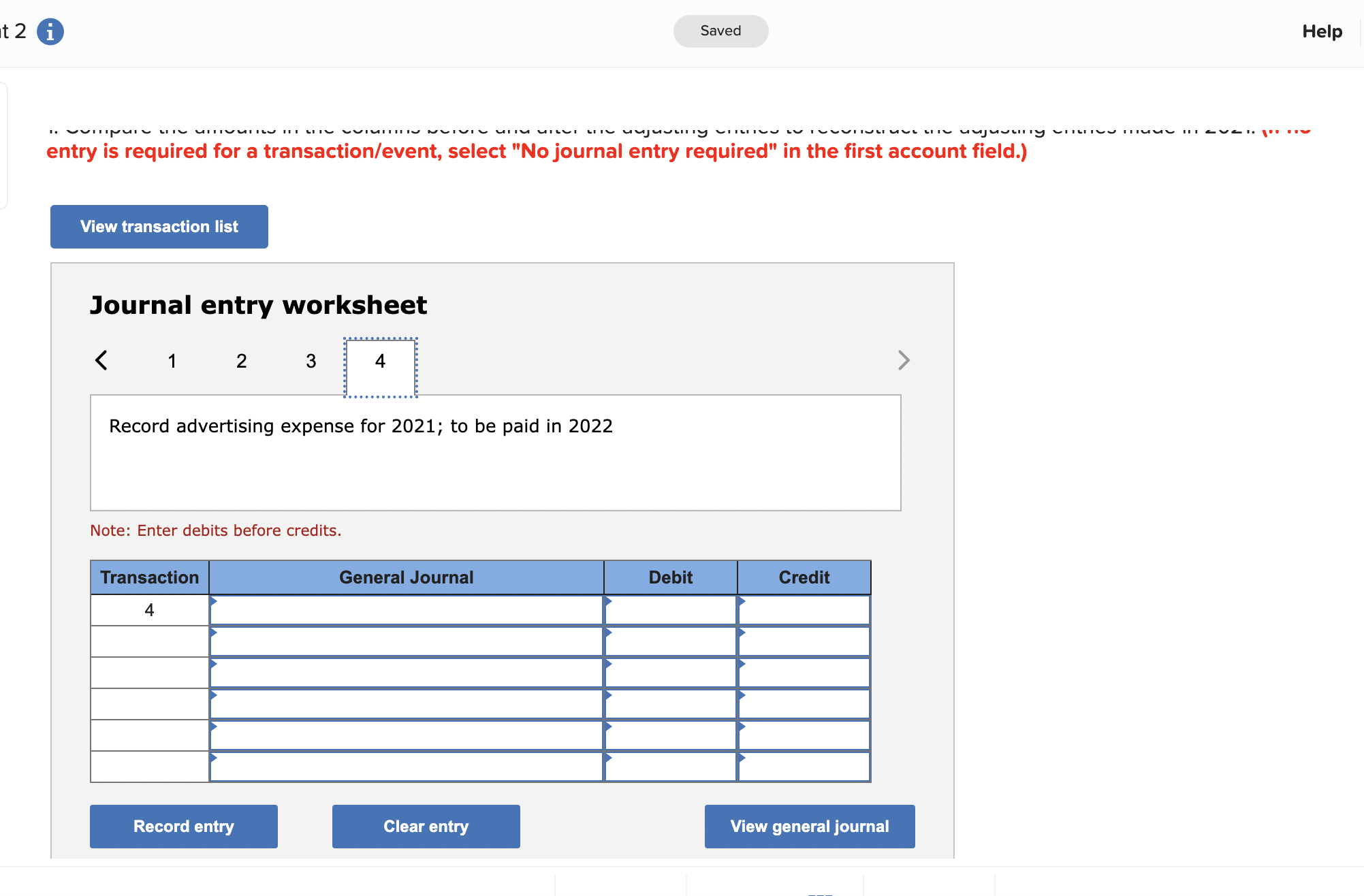

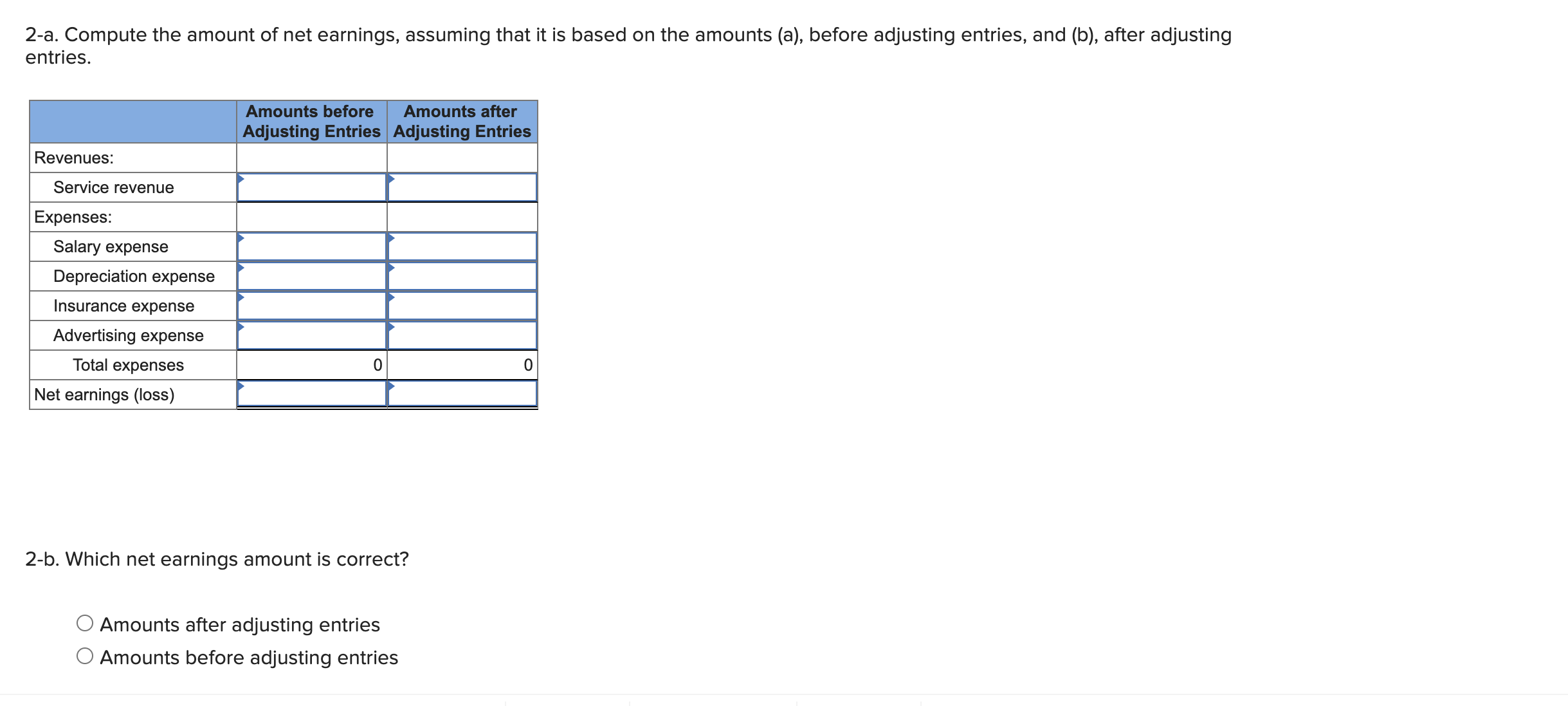

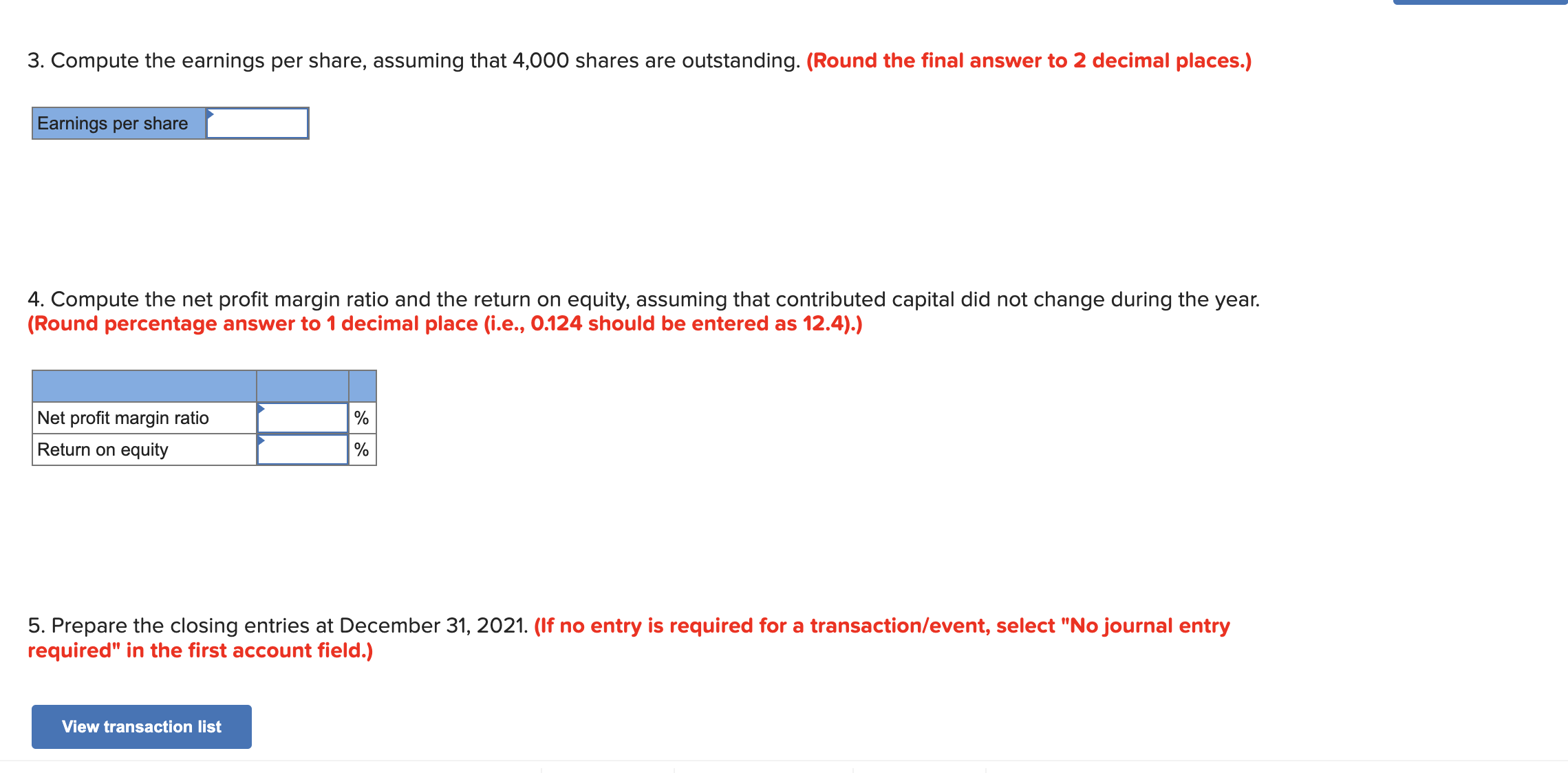

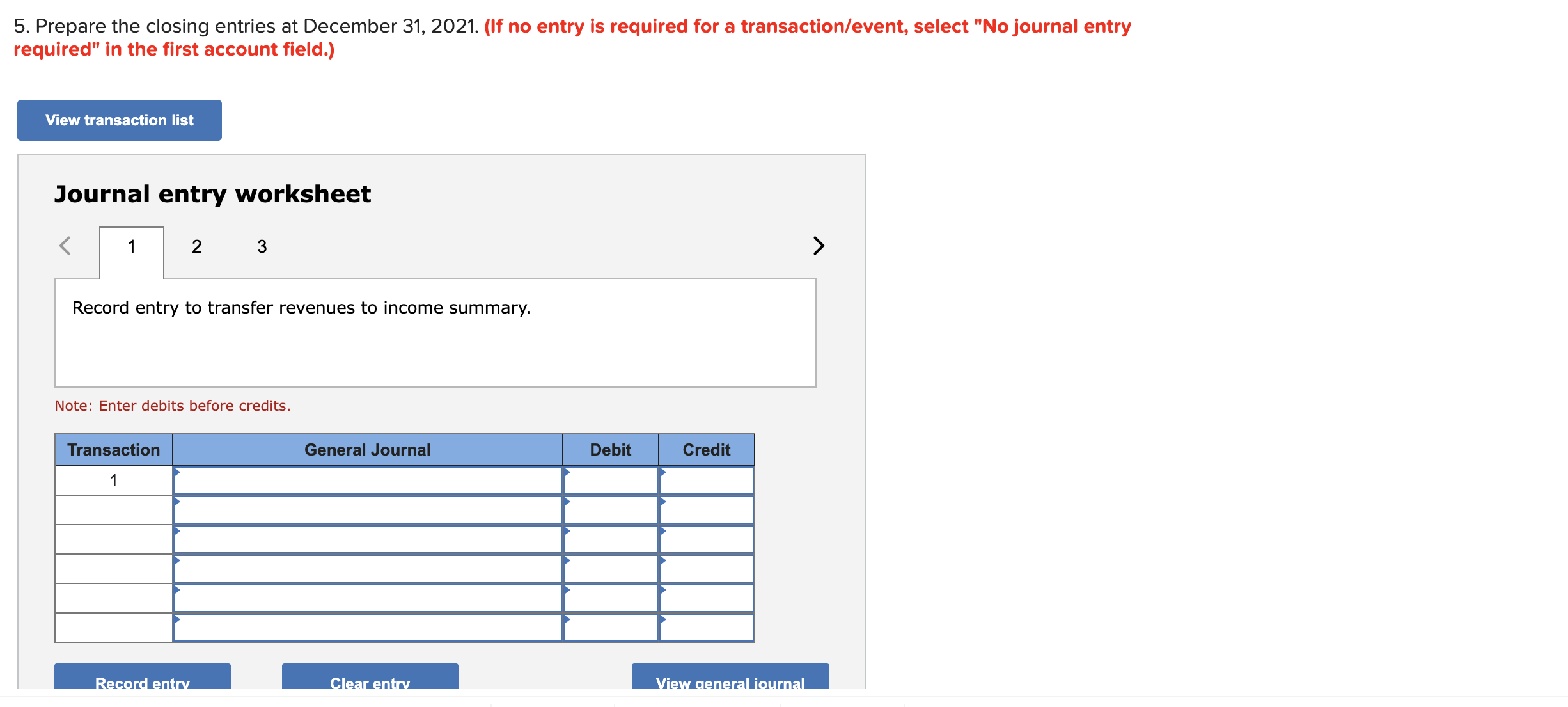

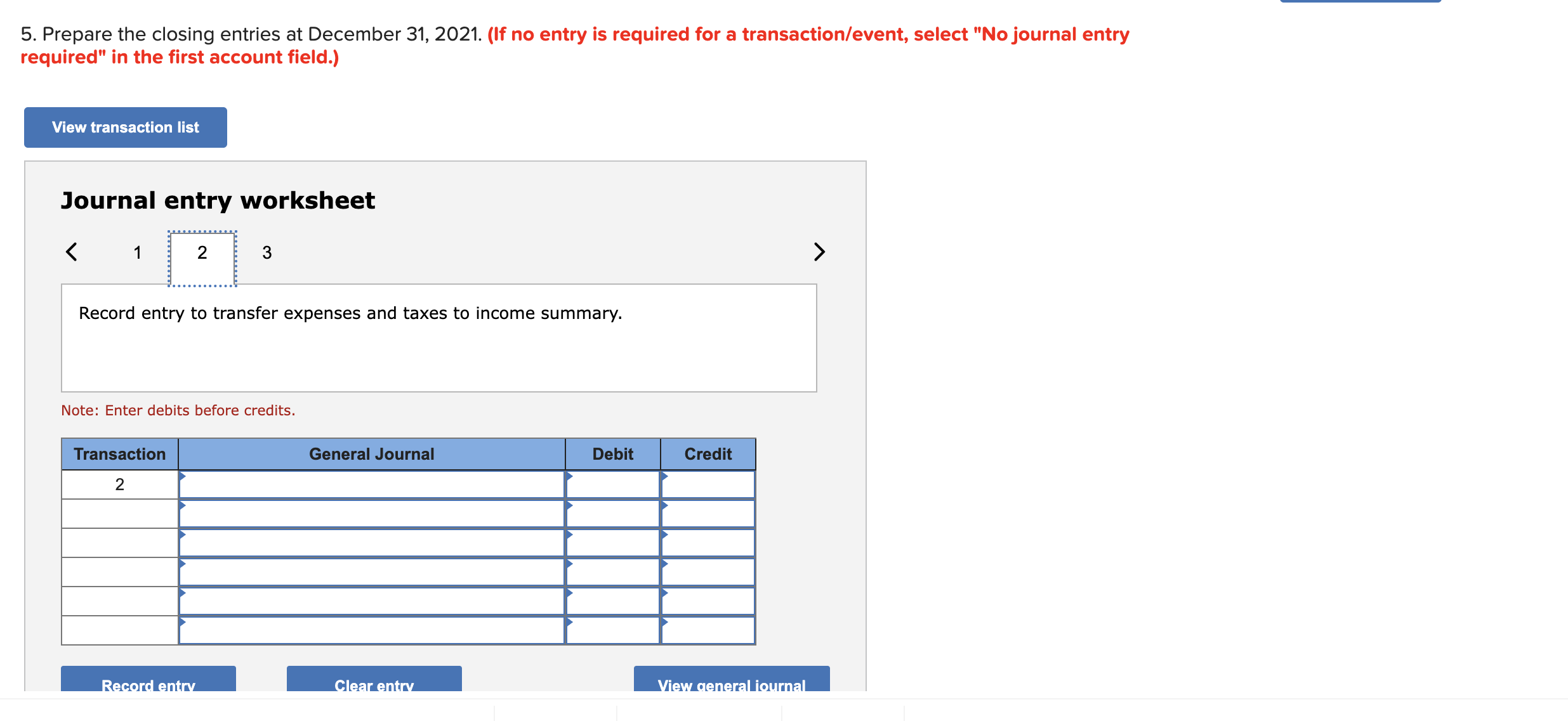

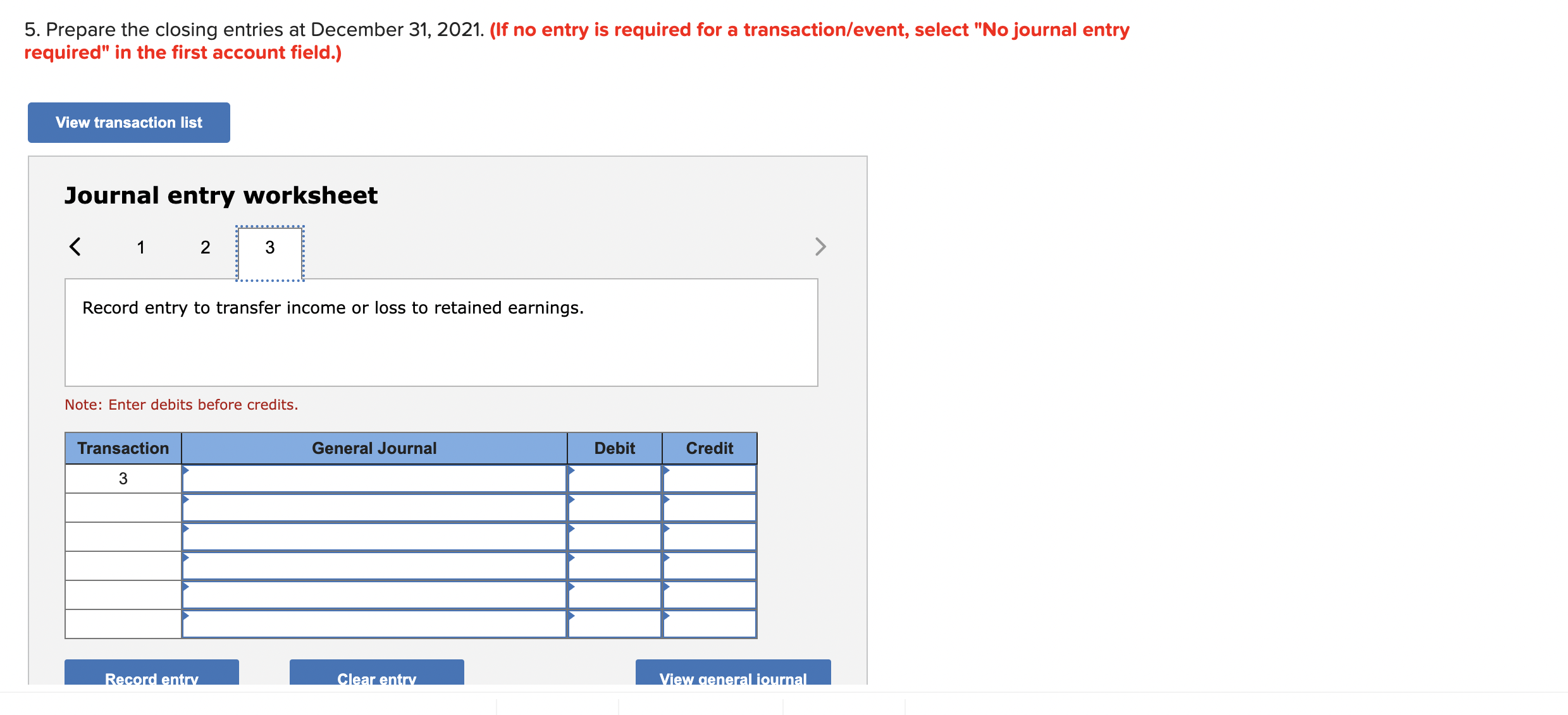

Savory Ltd. is completing the information-processing cycle at its fiscal year-end, December 31, 2021. Following are the correct account balances at December 31, 2021, both before and after the adjusting entries for 2021: Required: 1. Compare the amounts in the columns before and after the adjusting entries to reconstruct the adjusting entries made in 2021 . (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) 1. Compare the amounts in the columns before and after the adjusting entries to reconstruct the adjusting entries made in 2021 . (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet 4 Record service fees earned, but not yet collected Note: Enter debits before credits. Journal entry worksheet 4 Record insurance expired. Note: Enter debits before credits. Journal entry worksheet Record depreciation expense. Note: Enter debits before credits. entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Record advertising expense for 2021; to be paid in 2022 Note: Enter debits before credits. 2-a. Compute the amount of net earnings, assuming that it is based on the amounts (a), before adjusting entries, and (b), after adjusting entries. 2-b. Which net earnings amount is correct? Amounts after adjusting entries Amounts before adjusting entries 3. Compute the earnings per share, assuming that 4,000 shares are outstanding. (Round the final answer to 2 decimal places.) 4. Compute the net profit margin ratio and the return on equity, assuming that contributed capital did not change during the year. (Round percentage answer to 1 decimal place (i.e., 0.124 should be entered as 12.4).) 5. Prepare the closing entries at December 31, 2021. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) 5. Prepare the closing entries at December 31, 2021. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Record entry to transfer revenues to income summary. Note: Enter debits before credits. 5. Prepare the closing entries at December 31, 2021. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Record entry to transfer expenses and taxes to income summary. Note: Enter debits before credits. 5. Prepare the closing entries at December 31, 2021. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Record entry to transfer income or loss to retained earnings. Note: Enter debits before credits

Savory Ltd. is completing the information-processing cycle at its fiscal year-end, December 31, 2021. Following are the correct account balances at December 31, 2021, both before and after the adjusting entries for 2021: Required: 1. Compare the amounts in the columns before and after the adjusting entries to reconstruct the adjusting entries made in 2021 . (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) 1. Compare the amounts in the columns before and after the adjusting entries to reconstruct the adjusting entries made in 2021 . (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet 4 Record service fees earned, but not yet collected Note: Enter debits before credits. Journal entry worksheet 4 Record insurance expired. Note: Enter debits before credits. Journal entry worksheet Record depreciation expense. Note: Enter debits before credits. entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Record advertising expense for 2021; to be paid in 2022 Note: Enter debits before credits. 2-a. Compute the amount of net earnings, assuming that it is based on the amounts (a), before adjusting entries, and (b), after adjusting entries. 2-b. Which net earnings amount is correct? Amounts after adjusting entries Amounts before adjusting entries 3. Compute the earnings per share, assuming that 4,000 shares are outstanding. (Round the final answer to 2 decimal places.) 4. Compute the net profit margin ratio and the return on equity, assuming that contributed capital did not change during the year. (Round percentage answer to 1 decimal place (i.e., 0.124 should be entered as 12.4).) 5. Prepare the closing entries at December 31, 2021. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) 5. Prepare the closing entries at December 31, 2021. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Record entry to transfer revenues to income summary. Note: Enter debits before credits. 5. Prepare the closing entries at December 31, 2021. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Record entry to transfer expenses and taxes to income summary. Note: Enter debits before credits. 5. Prepare the closing entries at December 31, 2021. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Record entry to transfer income or loss to retained earnings. Note: Enter debits before credits Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started