Answered step by step

Verified Expert Solution

Question

1 Approved Answer

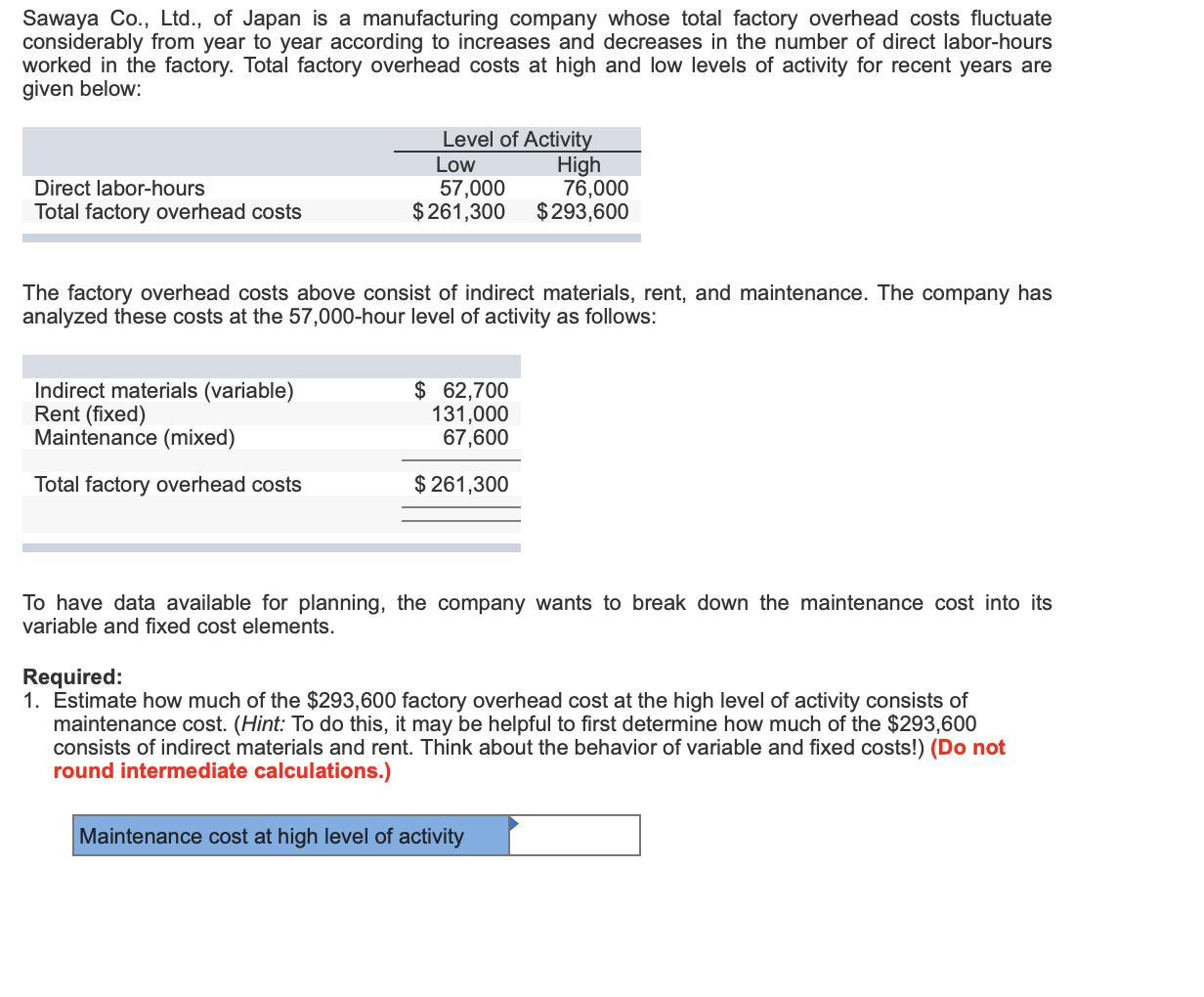

Sawaya Co., Ltd., of Japan is manufacturing company whose total factory overhead costs fluctuate considerably from year to year according to increases and decreases

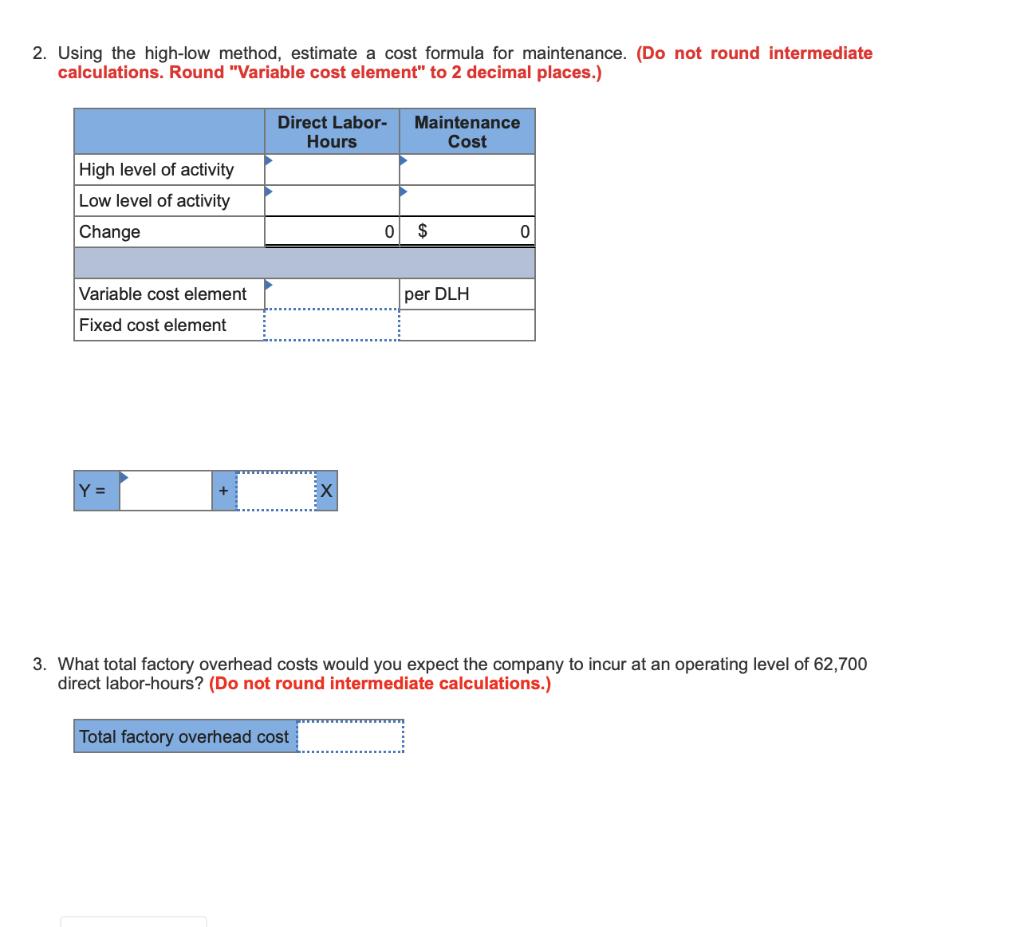

Sawaya Co., Ltd., of Japan is manufacturing company whose total factory overhead costs fluctuate considerably from year to year according to increases and decreases in the number of direct labor-hours worked in the factory. Total factory overhead costs at high and low levels of activity for recent years are given below: Direct labor-hours Total factory overhead costs Level of Activity Low 57,000 $261,300 Indirect materials (variable) Rent (fixed) Maintenance (mixed) Total factory overhead costs The factory overhead costs above consist of indirect materials, rent, and maintenance. The company has analyzed these costs at the 57,000-hour level of activity as follows: $ 62,700 131,000 67,600 $261,300 High 76,000 $293,600 To have data available for planning, the company wants to break down the maintenance cost into its variable and fixed cost elements. Required: 1. Estimate how much of the $293,600 factory overhead cost at the high level of activity consists of maintenance cost. (Hint: To do this, it may be helpful to first determine how much of the $293,600 consists of indirect materials and rent. Think about the behavior of variable and fixed costs!) (Do not round intermediate calculations.) Maintenance cost at high level of activity 2. Using the high-low method, estimate a cost formula for maintenance. (Do not round intermediate calculations. Round "Variable cost element" to 2 decimal places.) High level of activity Low level of activity Change Variable cost element Fixed cost element Y = + Direct Labor- Hours EX Total factory overhead cost 0 Maintenance Cost $ per DLH 0 3. What total factory overhead costs would you expect the company to incur at an operating level of 62,700 direct labor-hours? (Do not round intermediate calculations.)

Step by Step Solution

★★★★★

3.37 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Indirect materials variable ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started