Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Say an individual is faced with the decision of whether to buy home fire insurance or not (Let's not worry about a world with

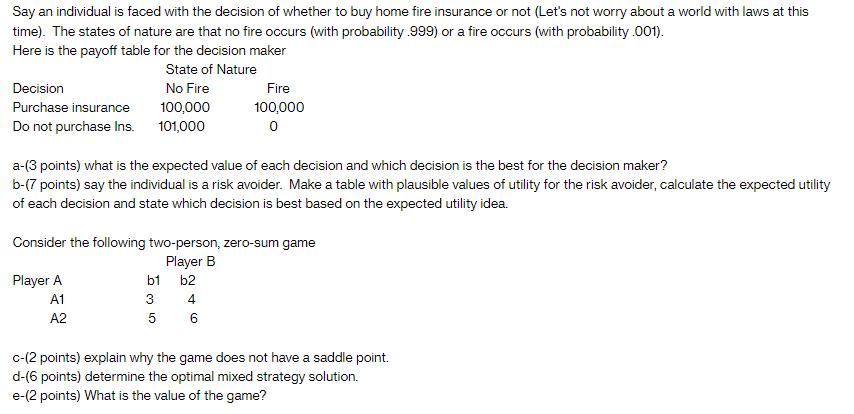

Say an individual is faced with the decision of whether to buy home fire insurance or not (Let's not worry about a world with laws at this time). The states of nature are that no fire occurs (with probability .999) or a fire occurs (with probability .001). Here is the payoff table for the decision maker State of Nature No Fire Decision Purchase insurance Do not purchase Ins. a-(3 points) what is the expected value of each decision and which decision is the best for the decision maker? b-(7 points) say the individual is a risk avoider. Make a table with plausible values of utility for the risk avoider, calculate the expected utility of each decision and state which decision is best based on the expected utility idea. Player A A1 A2 100,000 101,000 Consider the following two-person, zero-sum game Player B b1 b2 4 3 5 Fire 100,000 0 6 c-(2 points) explain why the game does not have a saddle point. d-(6 points) determine the optimal mixed strategy solution. e-(2 points) What is the value of the game?

Step by Step Solution

★★★★★

3.47 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started