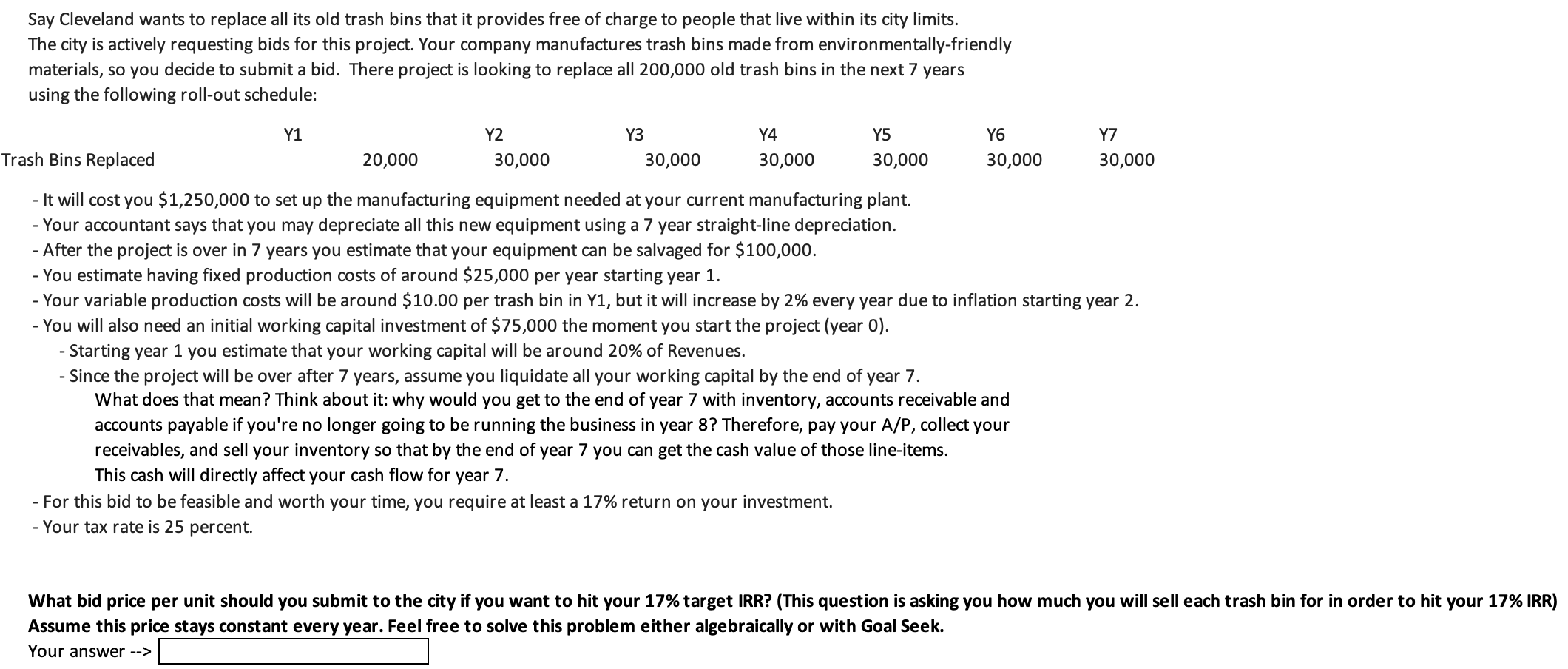

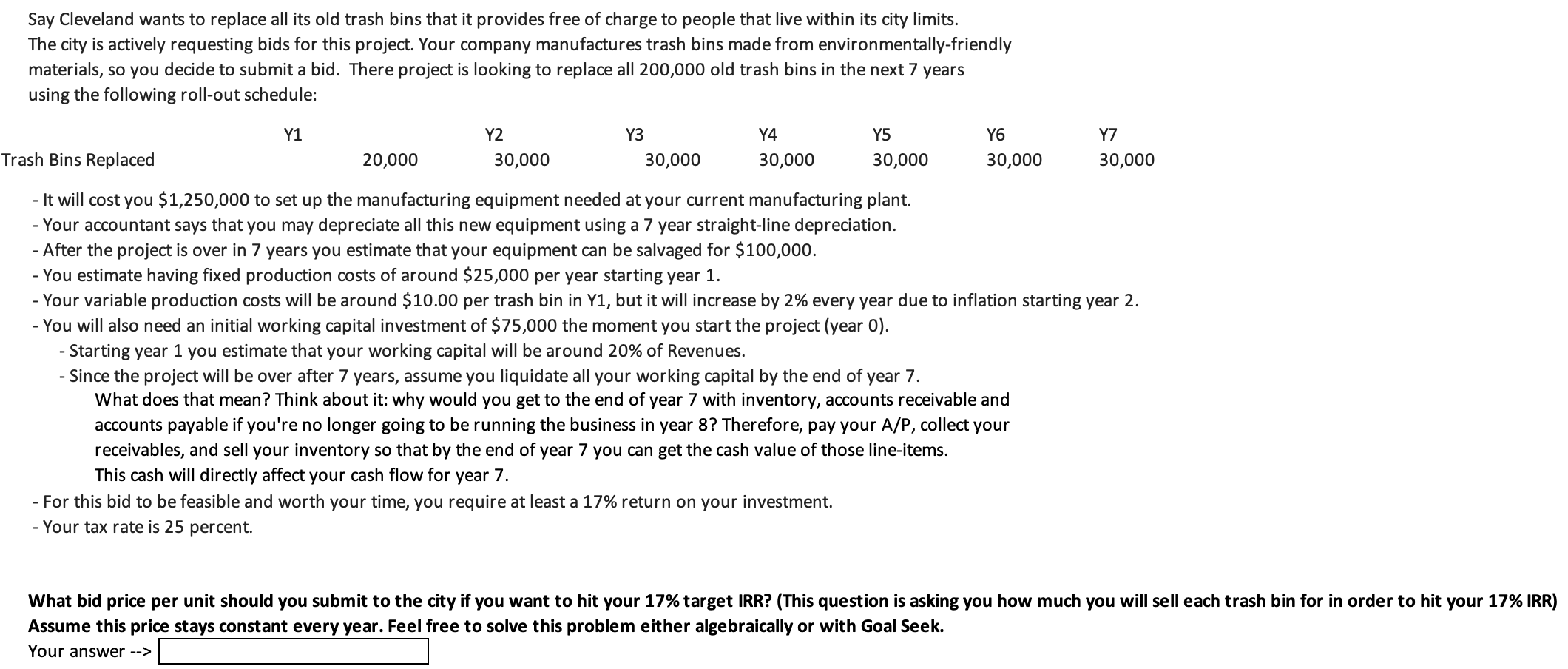

Say Cleveland wants to replace all its old trash bins that it provides free of charge to people that live within its city limits. The city is actively requesting bids for this project. Your company manufactures trash bins made from environmentally-friendly materials, so you decide to submit a bid. There project is looking to replace all 200,000 old trash bins in the next 7 years using the following roll-out schedule: \begin{tabular}{llllllll} Y1 & \multicolumn{1}{l}{ Y2 } & Y3 & Y4 & Y5 & Y6 & Y7 \\ & 20,000 & 30,000 & 30,000 & 30,000 & 30,000 & 30,000 & 30,000 \end{tabular} Trash Bins Replaced - It will cost you $1,250,000 to set up the manufacturing equipment needed at your current manufacturing plant. - Your accountant says that you may depreciate all this new equipment using a 7 year straight-line depreciation. - After the project is over in 7 years you estimate that your equipment can be salvaged for $100,000. - You estimate having fixed production costs of around $25,000 per year starting year 1. - Your variable production costs will be around $10.00 per trash bin in Y1, but it will increase by 2% every year due to inflation starting year 2 . - You will also need an initial working capital investment of $75,000 the moment you start the project (year 0 ). - Starting year 1 you estimate that your working capital will be around 20% of Revenues. - Since the project will be over after 7 years, assume you liquidate all your working capital by the end of year 7 . What does that mean? Think about it: why would you get to the end of year 7 with inventory, accounts receivable and accounts payable if you're no longer going to be running the business in year 8 ? Therefore, pay your A/P, collect your receivables, and sell your inventory so that by the end of year 7 you can get the cash value of those line-items. This cash will directly affect your cash flow for year 7 . - For this bid to be feasible and worth your time, you require at least a 17\% return on your investment. - Your tax rate is 25 percent. What bid price per unit should you submit to the city if you want to hit your 17\% target IRR? (This question is asking you how much you will sell each trash bin for in order to hit your 17\% IRR) Assume this price stavs constant everv vear. Feel free to solve this problem either algebraically or with Goal Seek. Your answer -->