say if answer is positive or negative

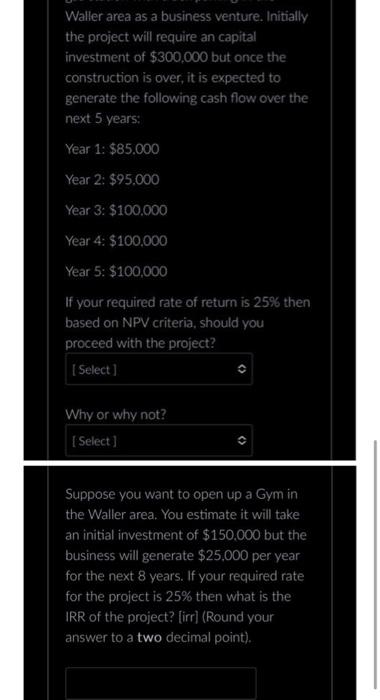

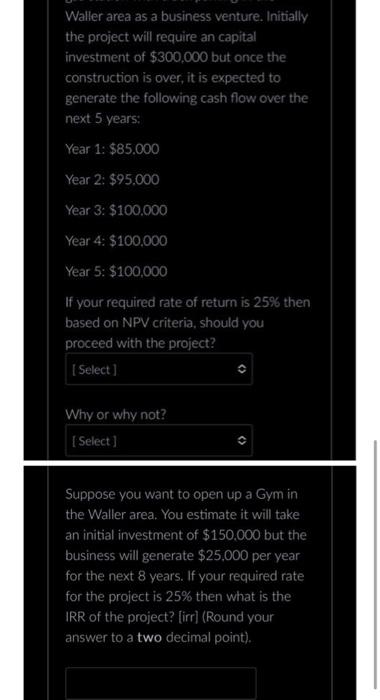

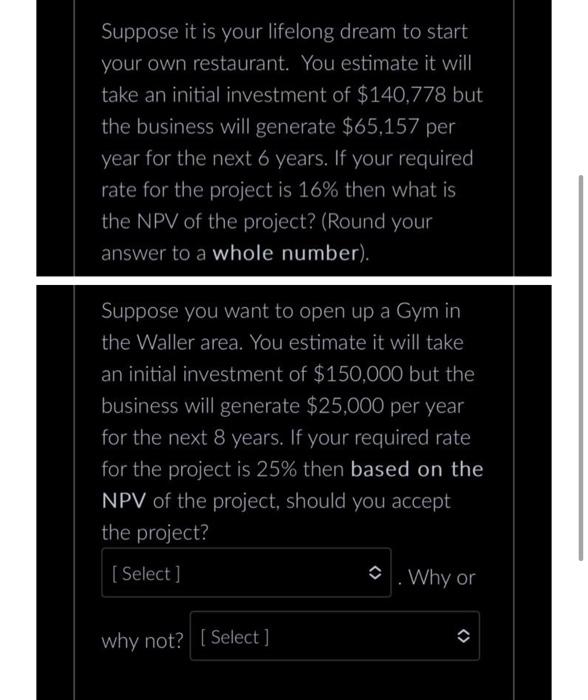

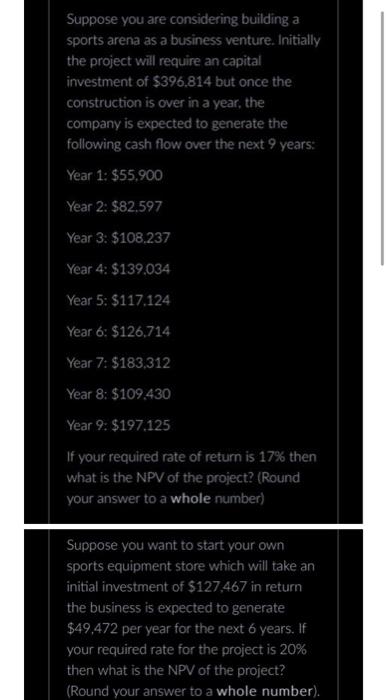

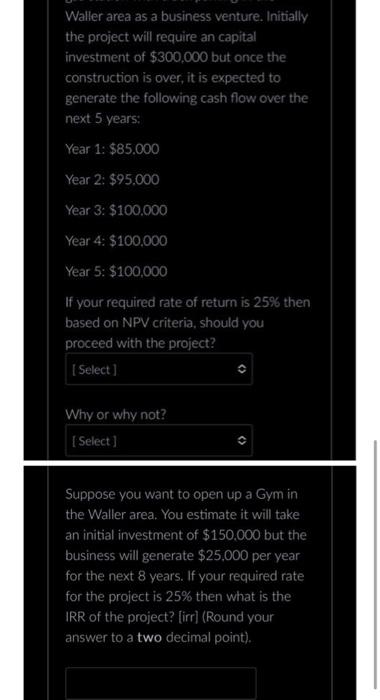

Waller area as a business venture. Initially the project will require an capital investment of $300,000 but once the construction is over, it is expected to generate the following cash flow over the next 5 years: Year 1: $85.000 Year 2: $95,000 Year 3: $100.000 Year 4:$100.000 Year 5:$100,000 If your required rate of return is 25% then based on NPV criteria, should you proceed with the project? Suppose you want to open up a Gym in the Waller area. You estimate it will take an initial investment of $150.000 but the business will generate $25,000 per year for the next 8 years. If your required rate for the project is 25% then what is the IRR of the project? [irr) (Round your answer to a two decimal point). Suppose it is your lifelong dream to start your own restaurant. You estimate it will take an initial investment of $140,778 but the business will generate $65,157 per year for the next 6 years. If your required rate for the project is 16% then what is the NPV of the project? (Round your answer to a whole number). Suppose you want to open up a Gym in the Waller area. You estimate it will take an initial investment of $150,000 but the business will generate $25,000 per year for the next 8 years. If your required rate for the project is 25% then based on the NPV of the project, should you accept the project? Why or why not? Suppose you are considering building a sports arena as a business venture. Initially the project will require an capital investment of $396,814 but once the construction is over in a year, the company is expected to generate the following cash flow over the next 9 years: Year 1: $55,900 Year 2:\$82.597 Year 3.\$108.237 Year 4:$139.034 Year 5:$117,124 Year 6: $126,714 Year 7:\$183,312 Year 8: $109.430 Year 9: $197,125 If your required rate of return is 17% then What is the NPV of the project? (Round your answer to a whole number) Suppose you want to start your own sports equipment store which will take an initial investment of $127,467 in return the business is expected to generate $49,472 per year for the next 6 years. If your required rate for the project is 20% then what is the NPV of the project? (Round your answer to a whole number)