Answered step by step

Verified Expert Solution

Question

1 Approved Answer

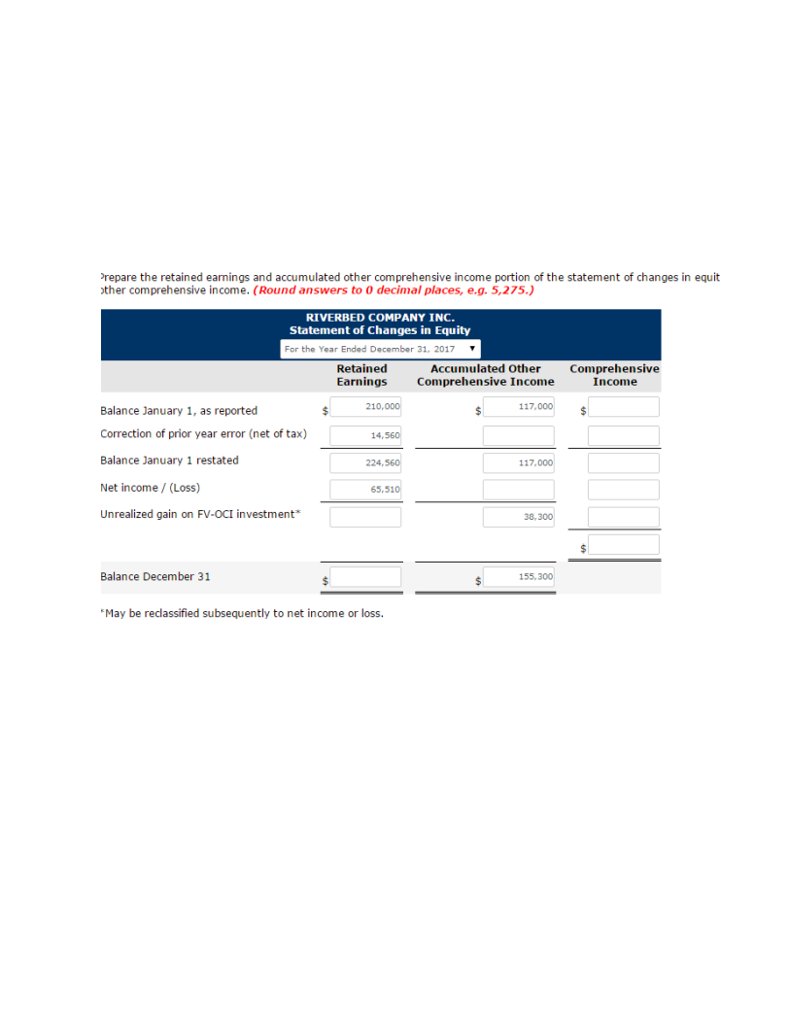

Says: Assuming an opening balance of $117,000 in accumulated other comprehensive income RIVERBED COMPANY INC. Income Statement For the Year Ended December 31, 2017 Sales

Says: Assuming an opening balance of $117,000 in accumulated other comprehensive income

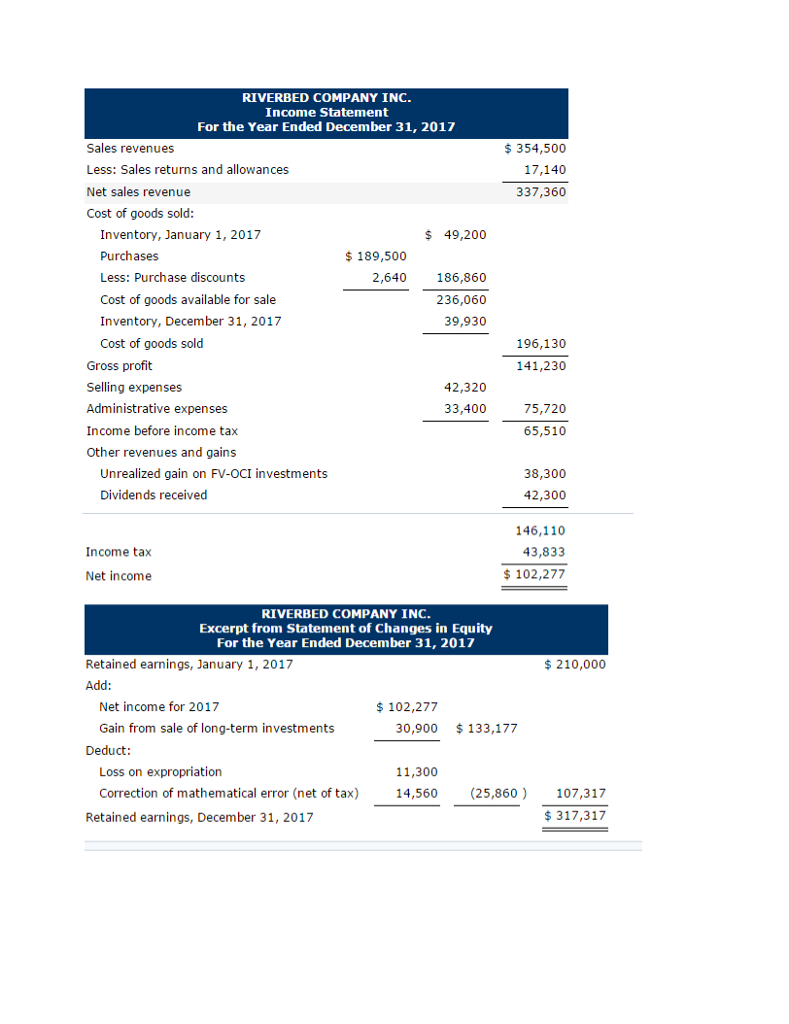

RIVERBED COMPANY INC. Income Statement For the Year Ended December 31, 2017 Sales revenues Less: Sales returns and allowances Net sales revenue Cost of goods sold $354,500 17,140 337,360 $49,200 Inventory, January 1, 2017 Purchases Less: Purchase discounts Cost of goods available for sale Inventory, December 31, 2017 Cost of goods sold 189,500 2,640 186,860 236,060 39,930 196,130 Gross profit Selling expenses Administrative expenses Income before income tax Other revenues and gains 141,230 42,320 33,400 75,720 65,510 Unrealized gain on FV-OCI investments Dividends received 38,300 42,300 146,110 43,833 102,277 Income tax Net income RIVERBED COMPANY INC. Excerpt from Statement of Changes in Equity For the Year Ended December 31, 2017 Retained earnings, January 1, 2017 Add: $210,000 Net income for 2017 $102,277 Gain from sale of long-term investments 30,900 133,177 Deduct: 11,300 Loss on expropriation Correction of mathematical error (net of tax 14,560 25,860 107,317 317,317 Retained earnings, December 31, 2017 RIVERBED COMPANY INC. Income Statement For the Year Ended December 31, 2017 Sales revenues Less: Sales returns and allowances Net sales revenue Cost of goods sold $354,500 17,140 337,360 $49,200 Inventory, January 1, 2017 Purchases Less: Purchase discounts Cost of goods available for sale Inventory, December 31, 2017 Cost of goods sold 189,500 2,640 186,860 236,060 39,930 196,130 Gross profit Selling expenses Administrative expenses Income before income tax Other revenues and gains 141,230 42,320 33,400 75,720 65,510 Unrealized gain on FV-OCI investments Dividends received 38,300 42,300 146,110 43,833 102,277 Income tax Net income RIVERBED COMPANY INC. Excerpt from Statement of Changes in Equity For the Year Ended December 31, 2017 Retained earnings, January 1, 2017 Add: $210,000 Net income for 2017 $102,277 Gain from sale of long-term investments 30,900 133,177 Deduct: 11,300 Loss on expropriation Correction of mathematical error (net of tax 14,560 25,860 107,317 317,317 Retained earnings, December 31, 2017Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started