Answered step by step

Verified Expert Solution

Question

1 Approved Answer

SaZue Bhd entered into an agreement with ZS Equipment to lease a machinery on 1 January 2020. SaZue Bhd has the right to use

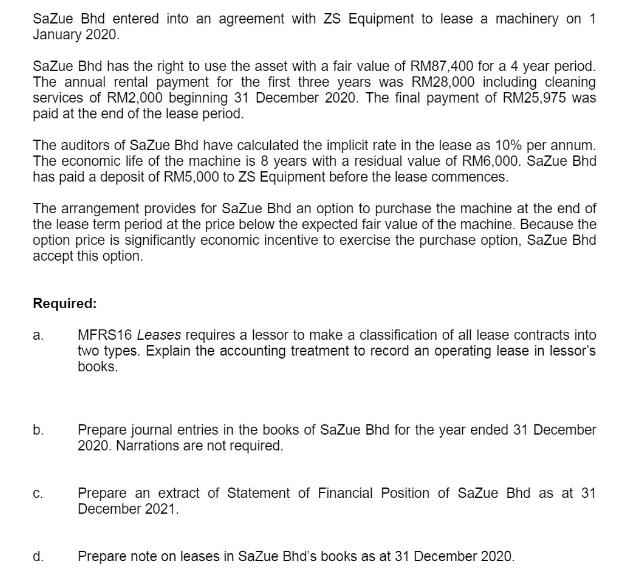

SaZue Bhd entered into an agreement with ZS Equipment to lease a machinery on 1 January 2020. SaZue Bhd has the right to use the asset with a fair value of RM87,400 for a 4 year period. The annual rental payment for the first three years was RM28,000 including cleaning services of RM2,000 beginning 31 December 2020. The final payment of RM25,975 was paid at the end of the lease period. The auditors of SaZue Bhd have calculated the implicit rate in the lease as 10% per annum. The economic life of the machine is 8 years with a residual value of RM6,000. SaZue Bhd has paid a deposit of RM5,000 to ZS Equipment before the lease commences. The arrangement provides for SaZue Bhd an option to purchase the machine at the end of the lease term period at the price below the expected fair value of the machine. Because the option price is significantly economic incentive to exercise the purchase option, SaZue Bhd accept this option. Required: a. b. C. d. MFRS16 Leases requires a lessor to make a classification of all lease contracts into two types. Explain the accounting treatment to record an operating lease in lessor's books. Prepare journal entries in the books of SaZue Bhd for the year ended 31 December 2020. Narrations are not required. Prepare an extract of Statement of Financial Position of SaZue Bhd as at 31 December 2021. Prepare note on leases in SaZue Bhd's books as at 31 December 2020.

Step by Step Solution

★★★★★

3.49 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

a Under MFRS 16 the lessor must determine whether a lease contract is an operating lease or a finance lease In an operating lease the lessor retains the risks and rewards associated with ownership of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started