Answered step by step

Verified Expert Solution

Question

1 Approved Answer

SB Exercise 7-16 through Exercise 7-17 (Algo) [The following information applies to the questions displayed below.) Raner, Harris and Chan is a consulting firm that

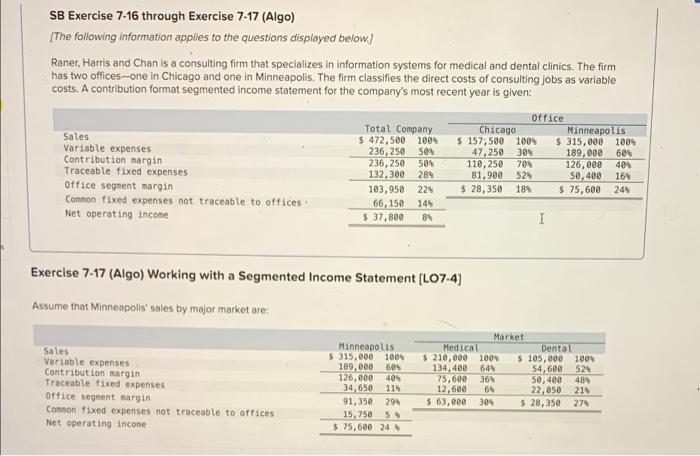

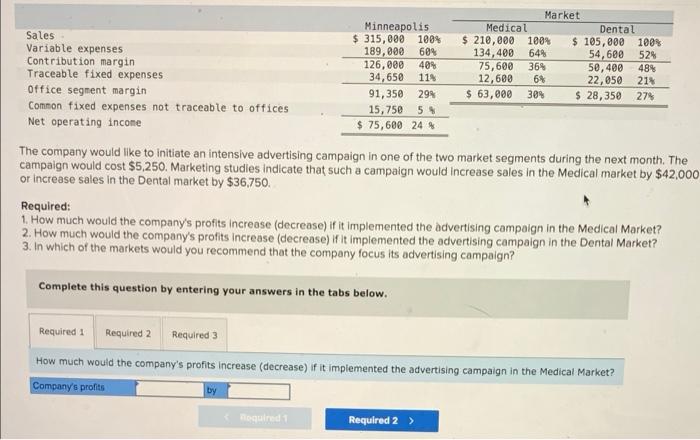

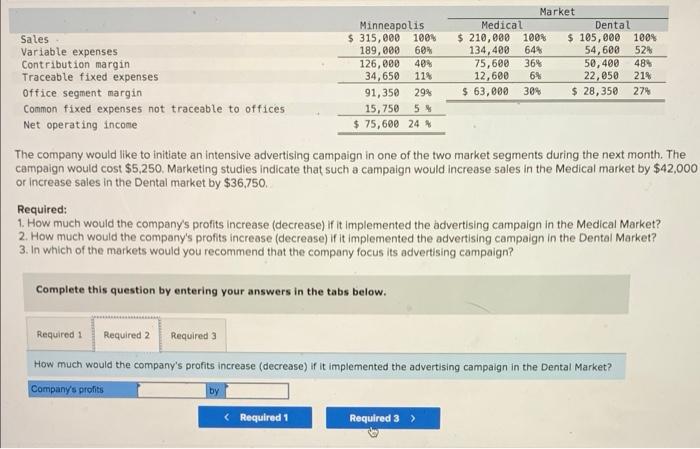

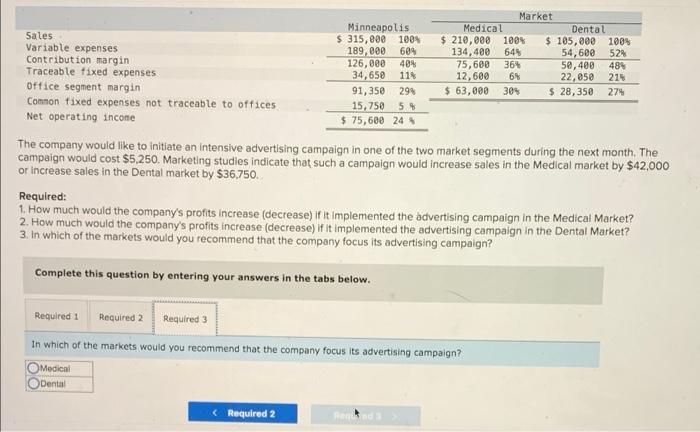

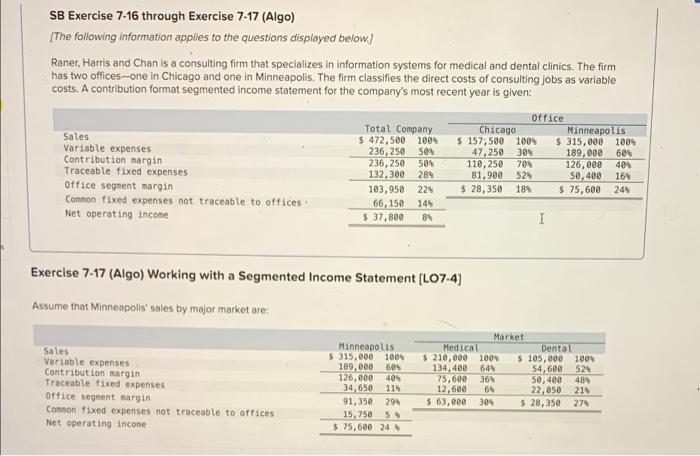

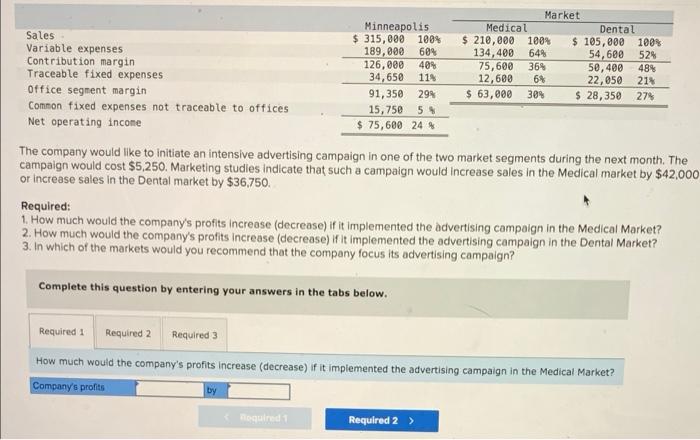

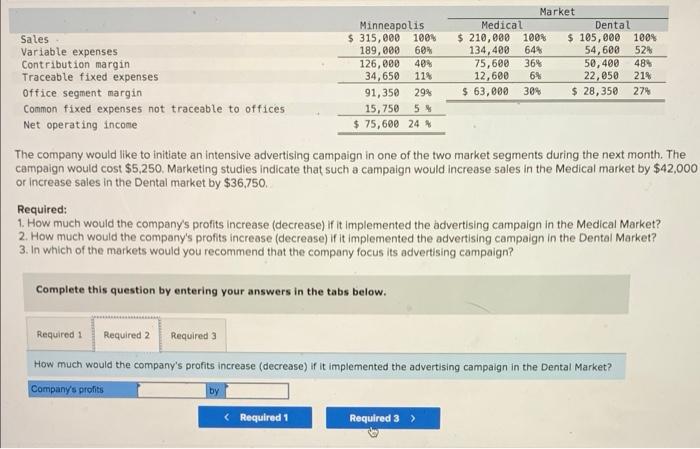

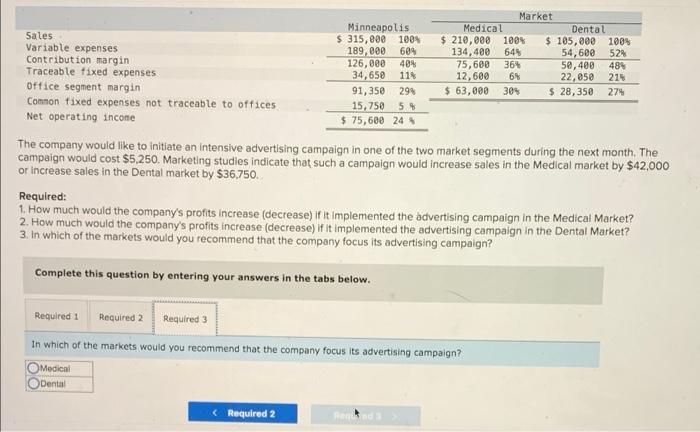

SB Exercise 7-16 through Exercise 7-17 (Algo) [The following information applies to the questions displayed below.) Raner, Harris and Chan is a consulting firm that specializes in information systems for medical and dental clinics. The firm has two offices-one in Chicago and one in Minneapolis. The firm classifies the direct costs of consulting jobs as variable costs. A contribution format segmented income statement for the company's most recent year is given: Sales Variable expenses Contribution margin Traceable fixed expenses office segment margin Common fixed expenses not traceable to offices Net operating income Total Company $ 472,580 100% 236, 250 504 236,250 50 132,300 284 103,950 224 66,150 149 $ 37,800 BS Office Chicago Minneapolis $ 157,500 1009 5 315,000 1004 47,250 30 189,000 60% 110,250 704 126,000 404 81,900 524 50,400 165 $ 28,350 189 $ 75,600 249 1 Exercise 7-17 (Algo) Working with a Segmented Income Statement (L07.4) Assume that Minneapolis sales by major market are: Sales Variable expenses Contribution margin Traceable fixed expenses Office segment margin Connon fixed expenses not traceable to offices Net operating income Minneapolis $ 315,000 100 189,000 604 126.000 404 34,650 114 91,350 294 15,250 5 $ 75,600 24 Market Medical Dental $ 210,000 1004 $ 105,000 1001 134,400 644 54,600 52 75,600 368 50,400 484 12,600 69 22,050 215 $ 63,000 309 5.28, 350 278 Market Minneapolis Medical Dental Sales $ 315,000 100% $ 210,000 100% $ 105,000 100% Variable expenses 189,000 604 134,400 64% 54,600 524 Contribution margin 126,000 40% 75,600 36% 50,400 48% Traceable fixed expenses 34,650 11% 12,600 6% 22,050 21% Office segment margin 91,350 29% $ 63,000 309 $ 28,350 27% Common fixed expenses not traceable to offices 15,750 5 % Net operating income $ 75,600 24 % The company would like to initiate an intensive advertising campaign in one of the two market segments during the next month. The campaign would cost $5,250. Marketing studies indicate that such a campaign would increase sales in the Medical market by $42,000 or increase sales in the Dental market by $36,750. Required: 1. How much would the company's profits increase (decrease) if it implemented the advertising campaign in the Medical Market? 2. How much would the company's profits increase (decrease) it implemented the advertising campaign in the Dental Market? 3. In which of the markets would you recommend that the company focus its advertising campaign? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 How much would the company's profits increase (decrease) if it implemented the advertising campaign in the Medical Market? Company's profits by noquired Required 2 > Sales Variable expenses Contribution margin Traceable fixed expenses Office segment margin Common fixed expenses not traceable to offices Net operating income Minneapolis $ 315,000 100% 189,000 60 126,000 409 34,650 11% 91,350 29% 15,750 5 $ 75,600 24% Market Medical Dental $ 210,000 100% $ 105,000 100% 134,400 649 54,608 52% 75,600 36% 50,400 48% 12,600 6% 22,050 21% $ 63,000 30% $ 28,350 274 The company would like to initiate an intensive advertising campaign in one of the two market segments during the next month. The campaign would cost $5,250. Marketing studies indicate that such a campaign would increase sales in the Medical market by $42,000 or increase sales in the Dental market by $36,750. Required: 1. How much would the company's profits Increase (decrease) if it implemented the advertising campaign in the Medical Market? 2. How much would the company's profits increase (decrease) if it implemented the advertising campaign in the Dental Market? 3. In which of the markets would you recommend that the company focus its advertising campaign? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 How much would the company's profits increase (decrease) if it implemented the advertising campaign in the Dental Market? Company's profits Required 1 Required 3 > by Market Minneapolis Medical Dental Sales $ 315,000 100 $ 210,000 100% $ 105,000 1004 Variable expenses 189,000 609 134,400 649 54,600 52% Contribution margin 126,000 40% 75,600 36% 50,400 489 Traceable fixed expenses 34,650 114 12,600 6% 22,050 21% office segment margin 91,350 294 $ 63,000 30% $ 28,350 274 Connon fixed expenses not traceable to offices 15,750 5 % Net operating income $ 75,600 24 The company would like to initiate an intensive advertising campaign in one of the two market segments during the next month. The campaign would cost $5,250. Marketing studies indicate that such a campaign would increase sales in the Medical market by $42,000 or increase sales in the Dental market by $36,750. Required: 1. How much would the company's profits increase (decrease) if it implemented the advertising campaign in the Medical Market? 2. How much would the company's profits increase (decrease) if it implemented the advertising campaign in the Dental Market? 3. In which of the markets would you recommend that the company focus its advertising campaign? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 In which of the markets would you recommend that the company focus its advertising campaign? Medical Dental

SB Exercise 7-16 through Exercise 7-17 (Algo) [The following information applies to the questions displayed below.) Raner, Harris and Chan is a consulting firm that specializes in information systems for medical and dental clinics. The firm has two offices-one in Chicago and one in Minneapolis. The firm classifies the direct costs of consulting jobs as variable costs. A contribution format segmented income statement for the company's most recent year is given: Sales Variable expenses Contribution margin Traceable fixed expenses office segment margin Common fixed expenses not traceable to offices Net operating income Total Company $ 472,580 100% 236, 250 504 236,250 50 132,300 284 103,950 224 66,150 149 $ 37,800 BS Office Chicago Minneapolis $ 157,500 1009 5 315,000 1004 47,250 30 189,000 60% 110,250 704 126,000 404 81,900 524 50,400 165 $ 28,350 189 $ 75,600 249 1 Exercise 7-17 (Algo) Working with a Segmented Income Statement (L07.4) Assume that Minneapolis sales by major market are: Sales Variable expenses Contribution margin Traceable fixed expenses Office segment margin Connon fixed expenses not traceable to offices Net operating income Minneapolis $ 315,000 100 189,000 604 126.000 404 34,650 114 91,350 294 15,250 5 $ 75,600 24 Market Medical Dental $ 210,000 1004 $ 105,000 1001 134,400 644 54,600 52 75,600 368 50,400 484 12,600 69 22,050 215 $ 63,000 309 5.28, 350 278 Market Minneapolis Medical Dental Sales $ 315,000 100% $ 210,000 100% $ 105,000 100% Variable expenses 189,000 604 134,400 64% 54,600 524 Contribution margin 126,000 40% 75,600 36% 50,400 48% Traceable fixed expenses 34,650 11% 12,600 6% 22,050 21% Office segment margin 91,350 29% $ 63,000 309 $ 28,350 27% Common fixed expenses not traceable to offices 15,750 5 % Net operating income $ 75,600 24 % The company would like to initiate an intensive advertising campaign in one of the two market segments during the next month. The campaign would cost $5,250. Marketing studies indicate that such a campaign would increase sales in the Medical market by $42,000 or increase sales in the Dental market by $36,750. Required: 1. How much would the company's profits increase (decrease) if it implemented the advertising campaign in the Medical Market? 2. How much would the company's profits increase (decrease) it implemented the advertising campaign in the Dental Market? 3. In which of the markets would you recommend that the company focus its advertising campaign? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 How much would the company's profits increase (decrease) if it implemented the advertising campaign in the Medical Market? Company's profits by noquired Required 2 > Sales Variable expenses Contribution margin Traceable fixed expenses Office segment margin Common fixed expenses not traceable to offices Net operating income Minneapolis $ 315,000 100% 189,000 60 126,000 409 34,650 11% 91,350 29% 15,750 5 $ 75,600 24% Market Medical Dental $ 210,000 100% $ 105,000 100% 134,400 649 54,608 52% 75,600 36% 50,400 48% 12,600 6% 22,050 21% $ 63,000 30% $ 28,350 274 The company would like to initiate an intensive advertising campaign in one of the two market segments during the next month. The campaign would cost $5,250. Marketing studies indicate that such a campaign would increase sales in the Medical market by $42,000 or increase sales in the Dental market by $36,750. Required: 1. How much would the company's profits Increase (decrease) if it implemented the advertising campaign in the Medical Market? 2. How much would the company's profits increase (decrease) if it implemented the advertising campaign in the Dental Market? 3. In which of the markets would you recommend that the company focus its advertising campaign? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 How much would the company's profits increase (decrease) if it implemented the advertising campaign in the Dental Market? Company's profits Required 1 Required 3 > by Market Minneapolis Medical Dental Sales $ 315,000 100 $ 210,000 100% $ 105,000 1004 Variable expenses 189,000 609 134,400 649 54,600 52% Contribution margin 126,000 40% 75,600 36% 50,400 489 Traceable fixed expenses 34,650 114 12,600 6% 22,050 21% office segment margin 91,350 294 $ 63,000 30% $ 28,350 274 Connon fixed expenses not traceable to offices 15,750 5 % Net operating income $ 75,600 24 The company would like to initiate an intensive advertising campaign in one of the two market segments during the next month. The campaign would cost $5,250. Marketing studies indicate that such a campaign would increase sales in the Medical market by $42,000 or increase sales in the Dental market by $36,750. Required: 1. How much would the company's profits increase (decrease) if it implemented the advertising campaign in the Medical Market? 2. How much would the company's profits increase (decrease) if it implemented the advertising campaign in the Dental Market? 3. In which of the markets would you recommend that the company focus its advertising campaign? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 In which of the markets would you recommend that the company focus its advertising campaign? Medical Dental

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started