Answered step by step

Verified Expert Solution

Question

1 Approved Answer

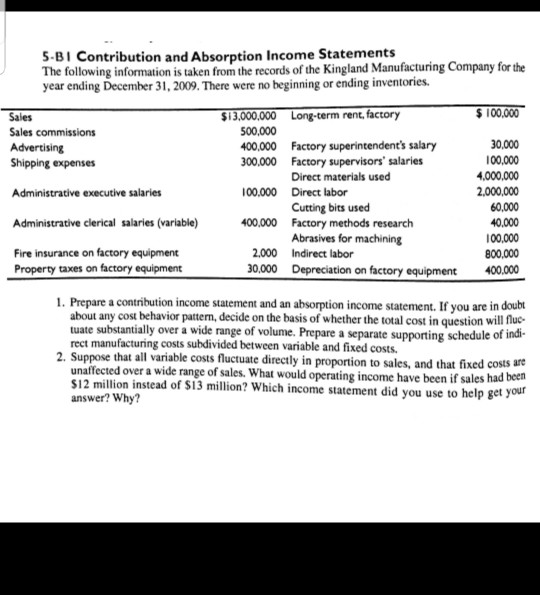

S-BI Contribution and Absorption Income Statements The following information is taken from the records of the Kingland Manufacturing Company for the year ending December 31,

S-BI Contribution and Absorption Income Statements The following information is taken from the records of the Kingland Manufacturing Company for the year ending December 31, 2009. There were no beginning or ending inventories. $13,000.000 Long-term rent, factory $100,000 Sales Sales commissions Advertising Shipping expenses 500,000 400.000 Factory superintendents salary 00,000 Factory supervisors' salaries 30,000 100,000 Direct materials used 100.000 Direct labor 2,000,000 60,000 40.000 00,000 800,000 400,000 Administrative executive salaries Cutting bits used Factory methods research Abrasives for machining Administrative clerical salaries (variable) 400,000 Fire insurance on factory equipment Property taxes on factory equipment 2.000 Indirect labor 0,000 Depreciation on factory equipment 1. Prepare a contribution income statement and an absorption income statement. If you are in doubt about any cost behavior pattern, decide on the basis of whether the total cost in question will flue tuate substantially over a wide range of volume. Prepare a separate supporting schedule of indi- rect manufacturing costs subdivided between variable and fixed costs. 2. Suppose that all variable costs fluctuate directly in proportion to sales, and that fixed costs are unaffected over a wide range of sales. What would operating income have been if sales had beren S12 million instead of S13 million? Which income statement did you answer? Why? use to help get your

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started