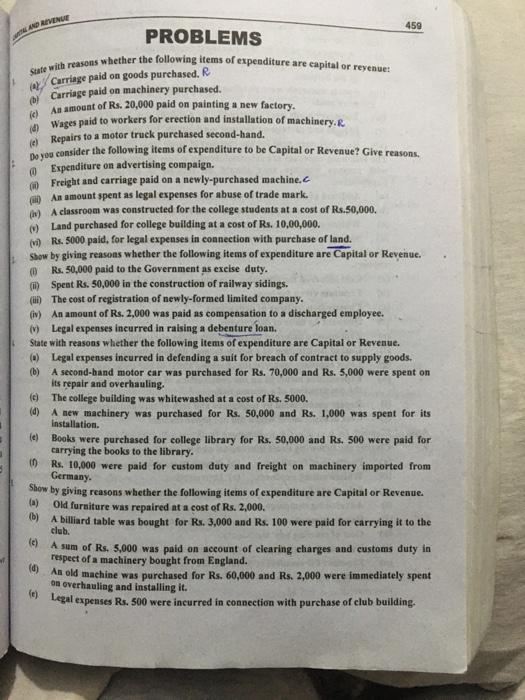

Scale with reasons whether the following items of expenditure are capital or reyenne AND ADVENCE 459 PROBLEMS (d) (0 Carriage paid on goods purchased. R Carriage paid on machinery purchased. An amount of Rs. 20,000 paid on painting a new factory. Wages paid to workers for erection and installation of machinery.R Repairs to a motor truck purchased second-hand. Do you consider the following items of expenditure to be Capital or Revenue? Give reasons, @ Expenditure on advertising compaign. Freight and carriage paid on a newly-purchased machine. An amount spent as legal expenses for abuse of trade mark. (1) A classroom was constructed for the college students at a cost of Rs.50,000. Land purchased for college building at a cost of Rs. 10,00,000. (vRs. 5000 paid, for legal expenses in connection with purchase of land. Show by giving reasons whether the following items of expenditure are Capital or Revenue. Rs. 50,000 paid to the Government as excise duty. Spent Rs. 50,000 in the construction of railway sidings. () The cost of registration of newly-formed limited company. av An amount of Rs. 2,000 was paid as compensation to a discharged employee. () Legal expenses incurred in raising a debenture loan. State with reasons whether the following items of expenditure are Capital or Revenue. (6) Legal expenses incurred in defending a suit for breach of contract to supply goods. A second-hand motor car was purchased for Rs. 70,000 and Rs. 5,000 were spent on its repair and overhauling. () The college building was whitewashed at cost of Rs. 5000. A new machinery was purchased for Rs. 50,000 and Rs. 1,000 was spent for its installation le) Books were purchased for college library for Rs. 50,000 and Rs. 500 were paid for carrying the books to the library. Rs. 10,000 were paid for custom duty and freight on machinery imported from Show by giving reasons whether the following items of expenditure are Capital or Revenue. a) Old furniture was repaired at a cost of Rs. 2,000. 6) A billiard table was bought for Rs. 3,000 and Rs. 100 were paid for carrying it to the A sum of Rs. 5,000 was paid on account of clearing charges and customs duty in respect of a machinery bought from England. An old machine was purchased for Rs. 60,000 and Rs. 2,000 were immediately spent on overhauling and installing it. fe) Legal expenses Rs. 500 were incurred in connection with purchase of club building, (b) (d) Germany. club. (0)