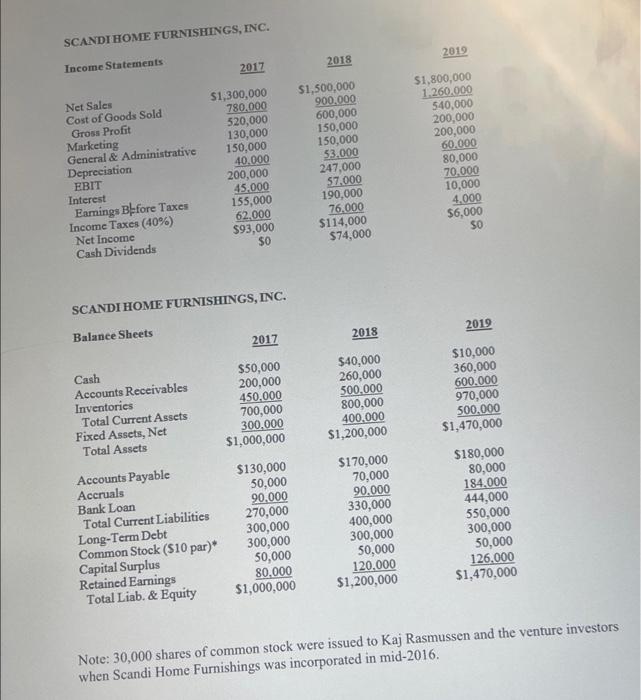

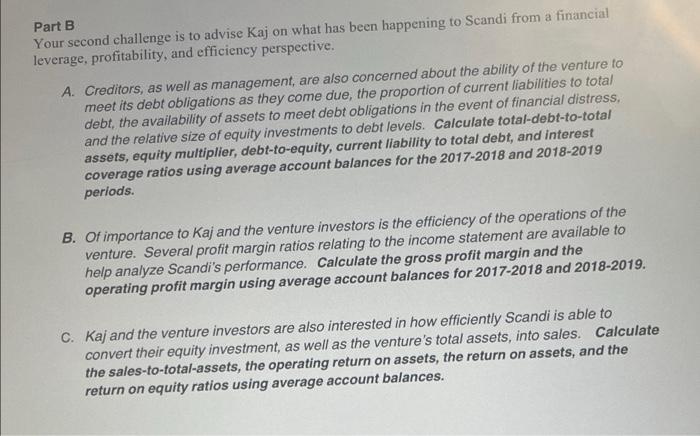

SCANDI HOME FURNISHINGS, INC. 2019 2018 Income Statements 2017 Net Sales Cost of Goods Sold Gross Profit Marketing General & Administrative Depreciation EBIT Interest Earings Before Taxes Income Taxes (40%) Net Income Cash Dividends $1,300,000 780.000 520,000 130,000 150,000 40.000 200,000 45,000 155,000 62.000 $93,000 $0 $1,500,000 900.000 600,000 150,000 150,000 53,000 247,000 57.000 190,000 76.000 $114,000 $74,000 $1,800,000 1.260.000 540,000 200,000 200,000 60.000 80,000 70.000 10,000 4.000 $6,000 50 SCANDI HOME FURNISHINGS, INC. 2019 Balance Sheets 2018 2017 $50,000 200,000 450,000 700,000 300.000 $1,000,000 $40,000 260,000 500.000 800,000 400,000 $1,200,000 Cash Accounts Receivables Inventories Total Current Assets Fixed Assets, Net Total Assets Accounts Payable Accruals Bank Loan Total Current Liabilities Long-Term Debt Common Stock (510 par)* Capital Surplus Retained Earnings Total Liab. & Equity $130,000 50,000 90.000 270,000 300,000 300,000 50,000 80.000 $1,000,000 $170,000 70,000 90.000 330,000 400,000 300,000 50,000 120,000 $1,200,000 $10,000 360,000 600.000 970,000 500.000 $1,470,000 $180,000 80,000 184.000 444,000 550,000 300,000 50,000 126.000 $1,470,000 Note: 30,000 shares of common stock were issued to Kaj Rasmussen and the venture investors when Scandi Home Furnishings was incorporated in mid-2016. Part B Your second challenge is to advise Kaj on what has been happening to Scandi from a financial leverage, profitability, and efficiency perspective. A. Creditors, as well as management, are also concerned about the ability of the venture to meet its debt obligations as they come due, the proportion of current liabilities to total debt, the availability of assets to meet debt obligations in the event of financial distress, and the relative size of equity investments to debt levels. Calculate total-debt-to-total assets, equity multiplier, debt-to-equity, current liability to total debt, and interest coverage ratios using average account balances for the 2017-2018 and 2018-2019 periods. B. Of importance to kaj and the venture investors is the efficiency of the operations of the venture. Several profit margin ratios relating to the income statement are available to help analyze Scandi's performance. Calculate the gross profit margin and the operating profit margin using average account balances for 2017-2018 and 2018-2019. C. Kaj and the venture investors are also interested in how efficiently Scandi is able to convert their equity investment, as well as the venture's total assets, into sales. Calculate the sales-to-total-assets, the operating return on assets, the return on assets, and the return on equity ratios using average account balances