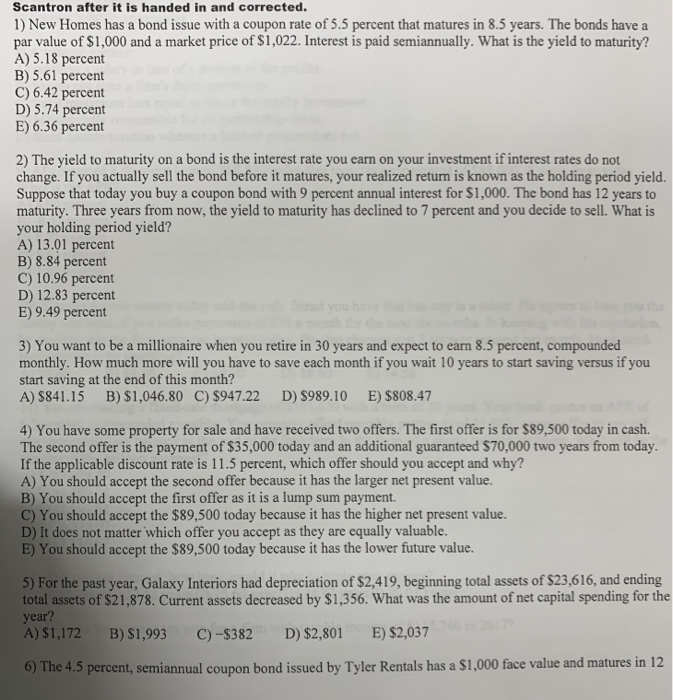

Scantron after it is handed in and corrected. 1) New Homes has a bond issue with a coupon rate of 5.5 percent that matures in 8.5 years. The bonds have a par value of $1,000 and a market price of $1,022. Interest is paid semiannually. What is the yield to maturity? A) 5.18 percent B) 5.61 percent C) 6.42 percent D) 5.74 percernt E) 6.36 percent 2) The yield to maturity on a bond is the interest rate you earn on your investment if interest rates do not change. If you actually sell the bond before it matures, your realized return is known as the holding period yield Suppose that today you buy a coupon bond with 9 percent annual interest for $1,000. The bond has 12 years to maturity. Three years from now, the yield to maturity has declined to 7 percent and you decide to sell. What is your holding period yield? A) 13.01 percent B) 8.84 percent C) 10.96 percent D) 12.83 percent E) 9.49 percent 3) You want to be a millionaire when you retire in 30 years and expect to earn 8.5 percent, compounded monthly. How much more will you have to save each month if you wait 10 years to start saving versus if you start saving at the end of this month? A) S841.15 B) $1,046.80 C) S947.22 D) S989.10 E) $808.47 4) You have some property for sale and have received two offers. The first offer is for $89,500 today in cash The second offer is the payment of $35,000 today and an additional guaranteed $70,000 two years from today If the applicable discount rate is 11.5 percent, which offer should you accept and why? A) You should accept the second offer because it has the larger net present value. B) You should accept the first offer as it is a lump sum payment. C) You should accept the $89,500 today because it has the higher net present value. D) It does not matter which offer you accept as they are equally valuable. E) You should accept the $89,500 today because it has the lower future value. 5) For the past year, Galaxy Interiors had depreciation of $2,419, beginning total assets of $23,616, and ending s of $21,878. Current assets decreased by $1,356. What was the amount of net capital spending for the year? A) $1,172 B) $1,993 C)-$382 D) $2,801 E) S2,037 6) The 4.5 percent, semiannual coupon bond issued by Tyler Rentals has a S1,000 face value and matures in 12