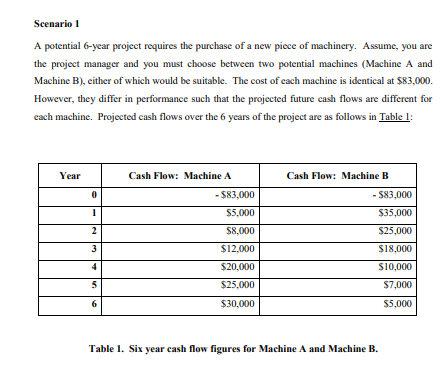

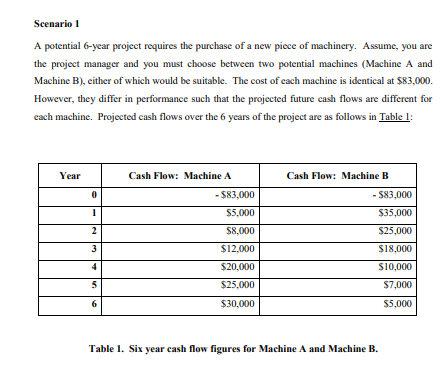

Scenario 1 A potential 6-year project requires the purchase of a new piece of machinery. Assume, you are the project manager and you must choose between two potential machines (Machine A and Machine B), either of which would be suitable. The cost of each machine is identical at $83,000. However, they differ in performance such that the projected future cash flows are different for cach machine. Projected cash flows over the 6 years of the project are as follows in Table 1: Year Cash Flow: Machine A Cash Flow: Machine B 0 - $83,000 - $83,000 $5.000 1 $35,000 $25,000 2 3 $8.000 $12.000 $20,000 $25,000 4 $18,000 $10,000 $7,000 5 6 $30,000 $5,000 Table 1. Six year cash flow figures for Machine A and Machine B. Task 1) By simple inspection of the cash flow figures, state which machine you would choose and justify your choice. (20 marks) Task 2) If your colleague disagrees with your choice. Discuss a one valid reason why your colleague's choice may be justified? (10 marks) Task 3) According to the above disagreement, as the project manager, think that you have to use another selection method to select the optimum option to invest money and purchase the machine for the project. Therefore use all the other financial project selection models (Net profit / ROI / NPV & IRR) to analyze which investment option introduces more profit to the business. NOTE: each machine option needs to be analyzed through all the financial methods recommended above, separately. Net profit (5 marks) ROI (10 marks) NPV for a discount rate of 7% (15 marks) IRR (10 marks) Task 4) Conclude the decision of selecting the optimum investment option by critically evaluating the results obtained through the above considered selection methods. Furthermore gather advantageous and disadvantageous of each financial method considered above. Advantageous and disadvantageous written (10 marks) Conclusion with critical evaluation (20 marks) Scenario 1 A potential 6-year project requires the purchase of a new piece of machinery. Assume, you are the project manager and you must choose between two potential machines (Machine A and Machine B), either of which would be suitable. The cost of each machine is identical at $83,000. However, they differ in performance such that the projected future cash flows are different for cach machine. Projected cash flows over the 6 years of the project are as follows in Table 1: Year Cash Flow: Machine A Cash Flow: Machine B 0 - $83,000 - $83,000 $5.000 1 $35,000 $25,000 2 3 $8.000 $12.000 $20,000 $25,000 4 $18,000 $10,000 $7,000 5 6 $30,000 $5,000 Table 1. Six year cash flow figures for Machine A and Machine B. Task 1) By simple inspection of the cash flow figures, state which machine you would choose and justify your choice. (20 marks) Task 2) If your colleague disagrees with your choice. Discuss a one valid reason why your colleague's choice may be justified? (10 marks) Task 3) According to the above disagreement, as the project manager, think that you have to use another selection method to select the optimum option to invest money and purchase the machine for the project. Therefore use all the other financial project selection models (Net profit / ROI / NPV & IRR) to analyze which investment option introduces more profit to the business. NOTE: each machine option needs to be analyzed through all the financial methods recommended above, separately. Net profit (5 marks) ROI (10 marks) NPV for a discount rate of 7% (15 marks) IRR (10 marks) Task 4) Conclude the decision of selecting the optimum investment option by critically evaluating the results obtained through the above considered selection methods. Furthermore gather advantageous and disadvantageous of each financial method considered above. Advantageous and disadvantageous written (10 marks) Conclusion with critical evaluation (20 marks)