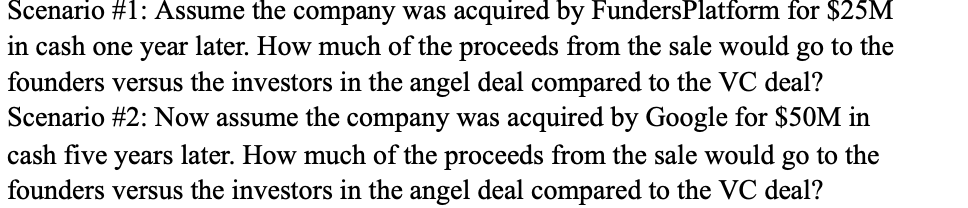

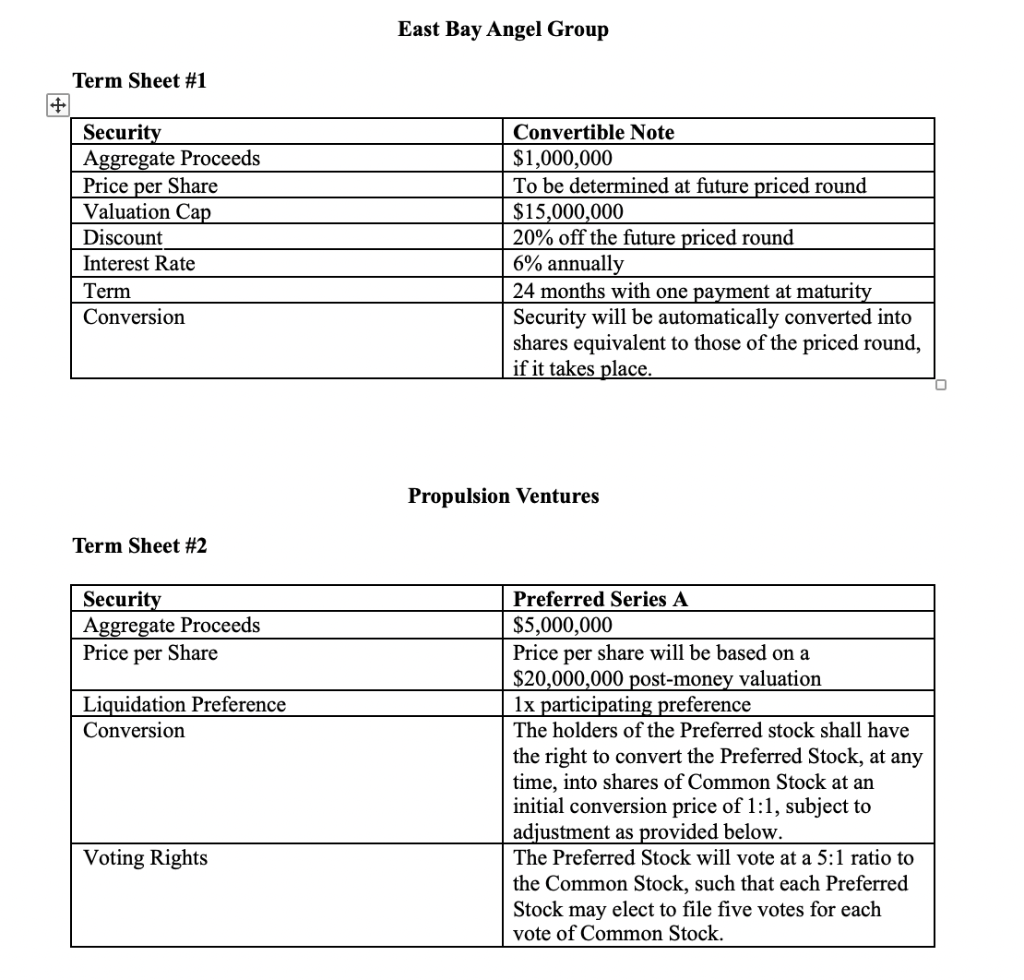

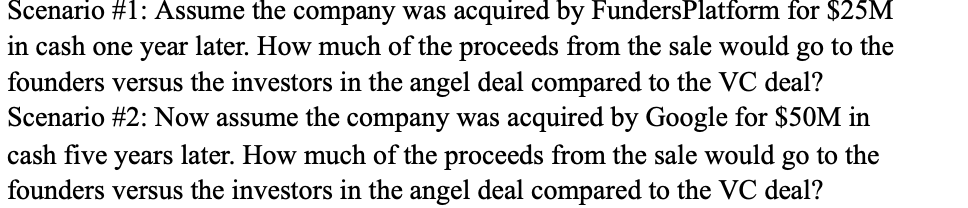

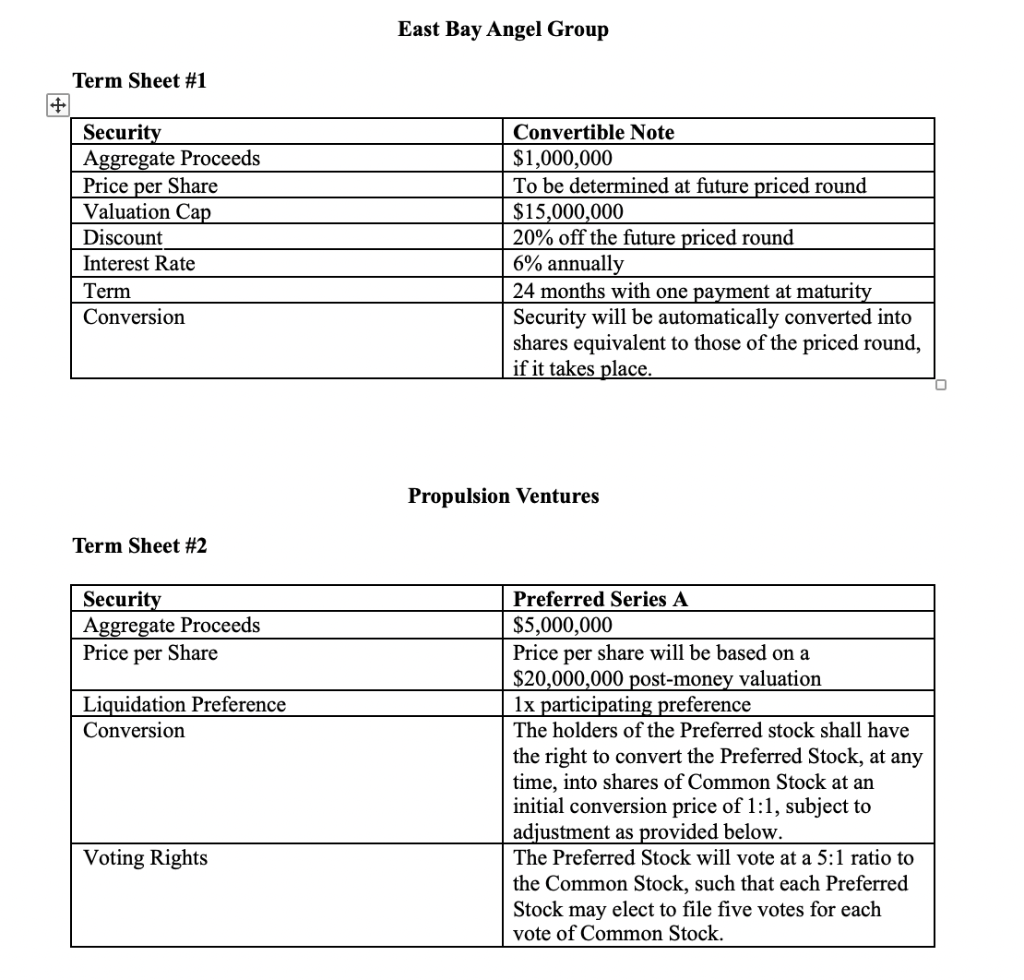

Scenario #1: Assume the company was acquired by Funders Platform for $25M in cash one year later. How much of the proceeds from the sale would go to the founders versus the investors in the angel deal compared to the VC deal? Scenario #2: Now assume the company was acquired by Google for $50M in cash five years later. How much of the proceeds from the sale would go to the founders versus the investors in the angel deal compared to the VC deal? East Bay Angel Group Term Sheet #1 Security Aggregate Proceeds Price per Share Valuation Cap Discount Interest Rate Term Conversion Convertible Note $1,000,000 To be determined at future priced round $15,000,000 20% off the future priced round 6% annually 24 months with one payment at maturity Security will be automatically converted into shares equivalent to those of the priced round, if it takes place. Propulsion Ventures Term Sheet #2 Security Aggregate Proceeds Price per Share Liquidation Preference Conversion Preferred Series A $5,000,000 Price per share will be based on a $20,000,000 post-money valuation 1x participating preference The holders of the Preferred stock shall have the right to convert the Preferred Stock, at any time, into shares of Common Stock at an initial conversion price of 1:1, subject to adjustment as provided below. The Preferred Stock will vote at a 5:1 ratio to the Common Stock, such that each Preferred Stock may elect to file five votes for each vote of Common Stock. Voting Rights Scenario #1: Assume the company was acquired by Funders Platform for $25M in cash one year later. How much of the proceeds from the sale would go to the founders versus the investors in the angel deal compared to the VC deal? Scenario #2: Now assume the company was acquired by Google for $50M in cash five years later. How much of the proceeds from the sale would go to the founders versus the investors in the angel deal compared to the VC deal? East Bay Angel Group Term Sheet #1 Security Aggregate Proceeds Price per Share Valuation Cap Discount Interest Rate Term Conversion Convertible Note $1,000,000 To be determined at future priced round $15,000,000 20% off the future priced round 6% annually 24 months with one payment at maturity Security will be automatically converted into shares equivalent to those of the priced round, if it takes place. Propulsion Ventures Term Sheet #2 Security Aggregate Proceeds Price per Share Liquidation Preference Conversion Preferred Series A $5,000,000 Price per share will be based on a $20,000,000 post-money valuation 1x participating preference The holders of the Preferred stock shall have the right to convert the Preferred Stock, at any time, into shares of Common Stock at an initial conversion price of 1:1, subject to adjustment as provided below. The Preferred Stock will vote at a 5:1 ratio to the Common Stock, such that each Preferred Stock may elect to file five votes for each vote of Common Stock. Voting Rights