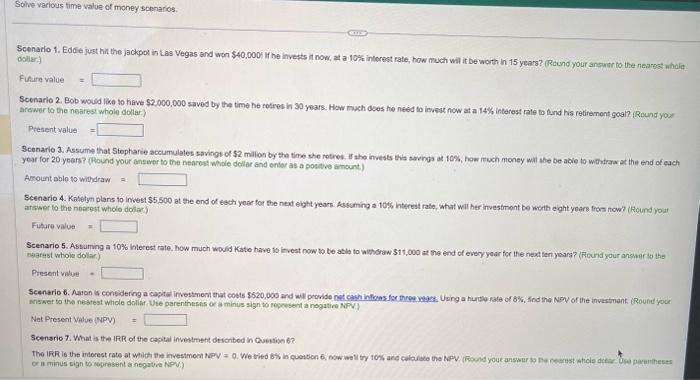

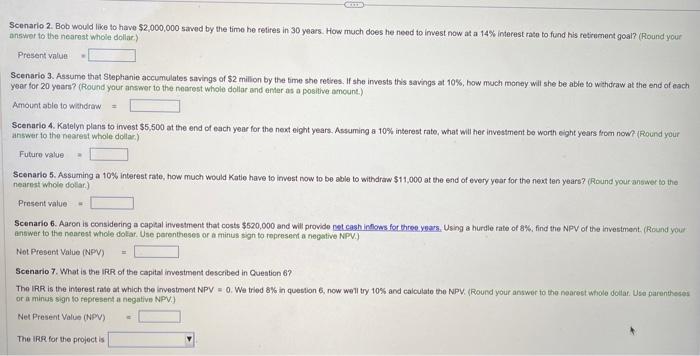

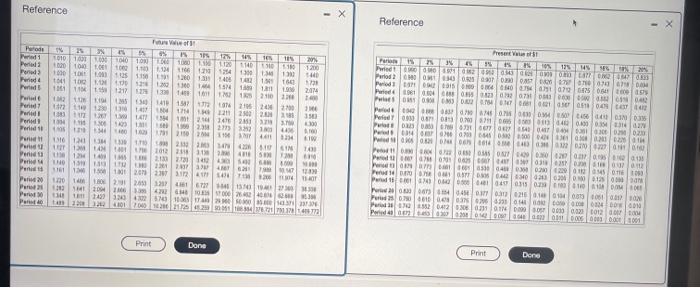

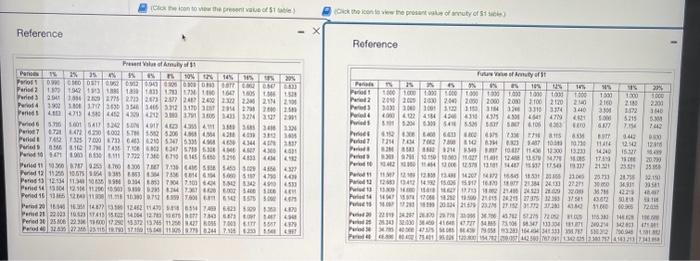

Scenario 1. Edde just hit the jackpot in Las Vegas and won $40,000 if he invests it now, at a 10% interest rate, how much will it be worth in 15 years? (Reund your ansuner to the nearest wheie. doller.) Futire value = Scenarie 2. Bob would like to have $2,000,000 saved by the time he rotres in 30 years. How much does he need to invest now at a 14% interest rile to And hs retirement goal? (Reund you arswer to the neares whole dollar? Present value = year for 20 yoers? (Round your answer to the nearest while dellar and entar as a poeatee amount) Amount ablo to witharaw = Scenario 4. Katetyti plans to insest $5500 at the end of each year for the neat eight years. Assuming a 100 intereat rate, what wil her investment be worth eght yoars from now? ikound yout arseser to the noerest whole dolari) Future value = Bearast whole doltari) Presont value = Miswer to tha nestest whole dollar. Wie parentheses or a minus sign to repevsent a nogation NPV.) Net Present Nalue (NPV) = Setnario z. What is the IRR of the capitar investmett described in Question 6 ? or a minus sign to ebpresent a negatue NPV:? Scenarie 2. Bob would like to have $2,000,000 sawed by the time he retires in 30 years. How much does he need to imest now at a 14% interest rato to fund his retirement goal? (Round your answer to the nearost whole dollar.) Present valuet Scenarie 3. Assume that Stephanie accumulates savings of $2 million by the time she reties. If she invests this aavings at 10%, how much money will she be able to withdraw at the end of each year for 20 yoars? (Round your answer to the noarest whole dollar and emer as a posithe amcunt.) Amount able to wandraw = Scenario 4. Kalelyn plans to invest $5,500 at the end of each year for the next eight years. Assuming a 10% interest rate, what will her investment be worth eight years trom now? (Round your answer to the nearest whole dolac, Future value Scenarie 5. Assuming a 10\%6 interest rate, how much would Katie have to imvest now to be able to withdraw $11,000 at the end of every yoar for the neat ten years? (Round your answer to the nearnst whole doliar.) Present value = Scenario 6. Aaron is considering a captal investment that costs $520,000 and will provide ret cash ipmows for three years, Using a hurdle rate of a\%s, find the NPV of the investment. (Round your answer to the nearest whole dolar. Use parentheses or a minus sign to ropresent a negative NPV.) Not Present Value (NPV) = Scenario 7. What is the IRR of the capital imvestment described in Cueation 6 ? The IRR is the inserest mato at which the investment NPV =0. We tried 8% in question 6 , now well try 10% and calculate the NPV. (Round your answer to the nearest whole dollar. USa parantheses or a miniss sign to fapresent a negative NPV.) Net Present Value (NPV) = The IRR for the projoct is Reforence Reference x Reference