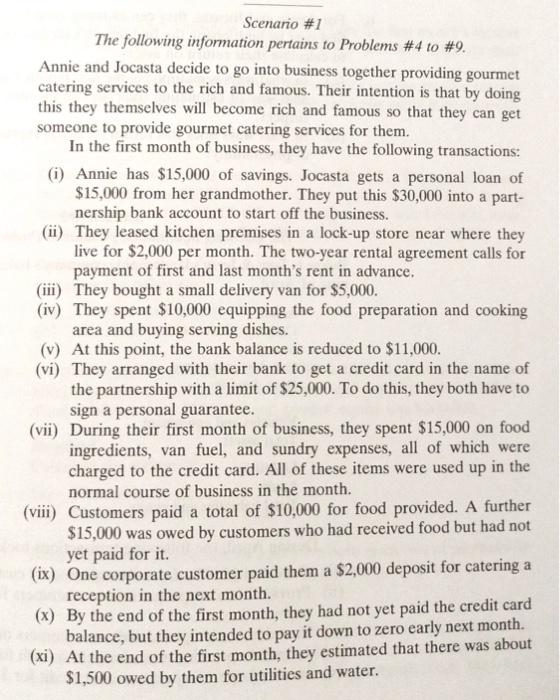

Scenario \#1 The following information pertains to Problems \#4 to \#9. Annie and Jocasta decide to go into business together providing gourmet catering services to the rich and famous. Their intention is that by doing this they themselves will become rich and famous so that they can get someone to provide gourmet catering services for them. In the first month of business, they have the following transactions: (i) Annie has $15,000 of savings. Jocasta gets a personal loan of $15,000 from her grandmother. They put this $30,000 into a partnership bank account to start off the business. (ii) They leased kitchen premises in a lock-up store near where they live for $2,000 per month. The two-year rental agreement calls for payment of first and last month's rent in advance. (iii) They bought a small delivery van for $5,000. (iv) They spent $10,000 equipping the food preparation and cooking area and buying serving dishes. (v) At this point, the bank balance is reduced to $11,000. (vi) They arranged with their bank to get a credit card in the name of the partnership with a limit of $25,000. To do this, they both have to sign a personal guarantee. (vii) During their first month of business, they spent $15,000 on food ingredients, van fuel, and sundry expenses, all of which were charged to the credit card. All of these items were used up in the normal course of business in the month. (viii) Customers paid a total of $10,000 for food provided. A further $15,000 was owed by customers who had received food but had not yet paid for it. (ix) One corporate customer paid them a $2,000 deposit for catering a reception in the next month. (x) By the end of the first month, they had not yet paid the credit card balance, but they intended to pay it down to zero early next month. (xi) At the end of the first month, they estimated that there was about $1,500 owed by them for utilities and water. (xii) At the end of the first month, they each took $2,000 out of the bank account as a personal withdrawal. (xiii) Their best estimate of depreciation on the van and the catering equipment was $500 for the month. 4. Use the accounting equation to show how each of the above transactions would be recorded in the partnership's accounting records. Indicate the effect of each one on assets, liabilities, and equity