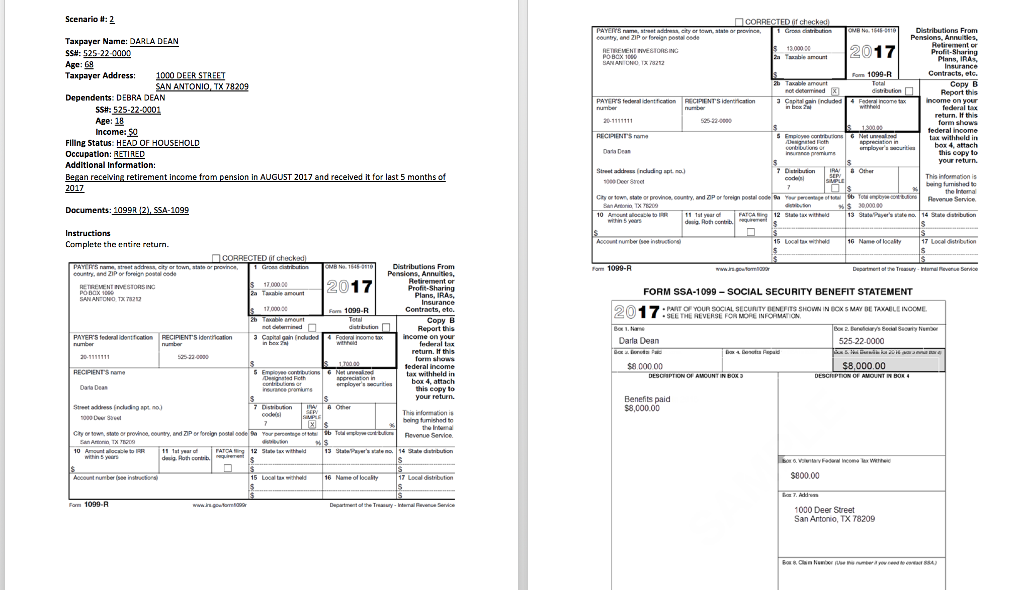

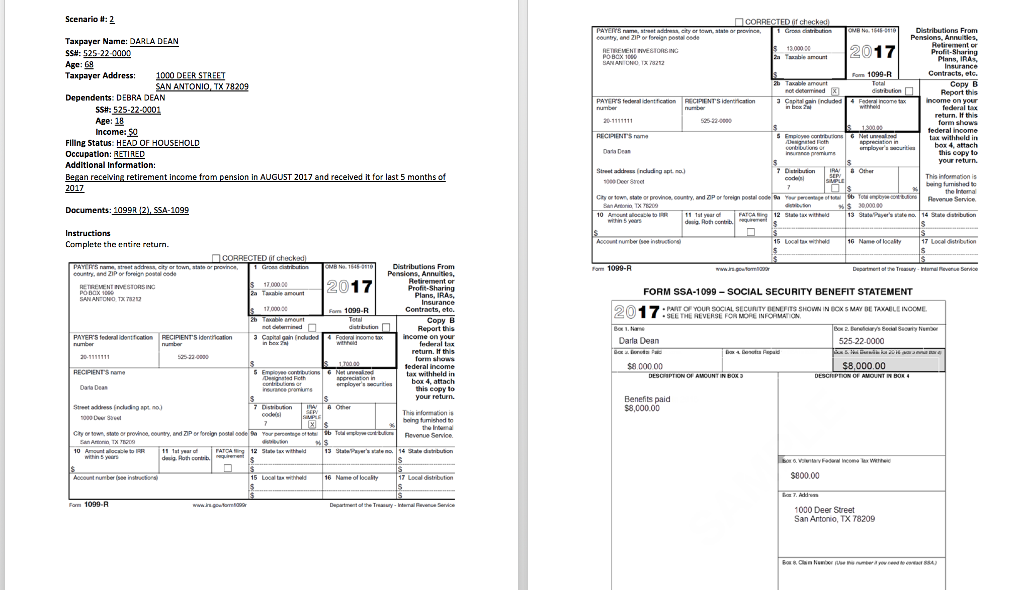

Scenario 11: 2 CORRECTED i Taxpayer Name: DARLA DEAN 2a Taonble amount Age: 6A Taxpayer Address1000 DEER STREET Plans, IRAs Contracts, etc. Copy B Dependents: DEBRA DEAN 3 Capta gain Endluded SS#:525-224001 Age: 18 return. If this tederal inoome Fling Status: HEAD OF HOUSEHOLD Occupation: RETIRED Additional Information: box 4, attach s copy to your return Oata Dean an recewine retirement income from pension in AUGU 2017 and received This informarion is 000 Deer 8ce the Intemal Reverue Service S 3000000 dasig. Roth Complete the entir: return. 1G Locdl tawil1 Name of locality Farm 1099-A eountry, ind Z1P or oreign poal code Plans, IRAs, FORM SSA-1099 SOCIAL SECURITY BENEFIT STATEMENT 13 00000 PART OF YOUR SOCIAL SECURITY DENE FITS SHOWN IN EC 5 MAY BE TAKABLE INCONE Contraots, eto. Copy B Report this income on your o 1099-R EVERSE Fcn INFORMATION Darla Dean 525-22-0000 Hthis $8 00000 $8,000.00 Oata Dean eopy lo your return Benefits paid $8,000.00 Street addess [nclading apt no) This irformmation is tmiched to 5 Locdl tanwihl 16 Name of locelit 17 Local distribution $800.00 Fom 1099-R 1000 Deer Street San Antonio, TX T8209 Scenario 11: 2 CORRECTED i Taxpayer Name: DARLA DEAN 2a Taonble amount Age: 6A Taxpayer Address1000 DEER STREET Plans, IRAs Contracts, etc. Copy B Dependents: DEBRA DEAN 3 Capta gain Endluded SS#:525-224001 Age: 18 return. If this tederal inoome Fling Status: HEAD OF HOUSEHOLD Occupation: RETIRED Additional Information: box 4, attach s copy to your return Oata Dean an recewine retirement income from pension in AUGU 2017 and received This informarion is 000 Deer 8ce the Intemal Reverue Service S 3000000 dasig. Roth Complete the entir: return. 1G Locdl tawil1 Name of locality Farm 1099-A eountry, ind Z1P or oreign poal code Plans, IRAs, FORM SSA-1099 SOCIAL SECURITY BENEFIT STATEMENT 13 00000 PART OF YOUR SOCIAL SECURITY DENE FITS SHOWN IN EC 5 MAY BE TAKABLE INCONE Contraots, eto. Copy B Report this income on your o 1099-R EVERSE Fcn INFORMATION Darla Dean 525-22-0000 Hthis $8 00000 $8,000.00 Oata Dean eopy lo your return Benefits paid $8,000.00 Street addess [nclading apt no) This irformmation is tmiched to 5 Locdl tanwihl 16 Name of locelit 17 Local distribution $800.00 Fom 1099-R 1000 Deer Street San Antonio, TX T8209