Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Scenario 2: Max Botha, CA (SA), is employed by the local municipality in the procurement department. He is responsible for awarding tenders to local contractors.

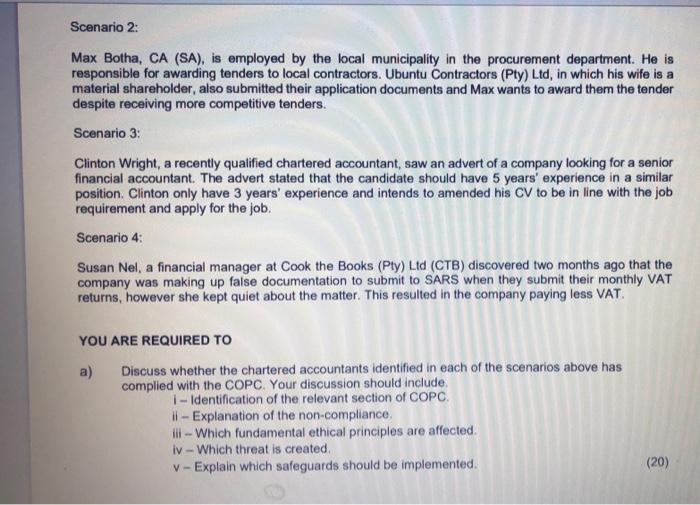

Scenario 2: Max Botha, CA (SA), is employed by the local municipality in the procurement department. He is responsible for awarding tenders to local contractors. Ubuntu Contractors (Pty) Ltd, in which his wife is a material shareholder, also submitted their application documents and Max wants to award them the tender despite receiving more competitive tenders. Scenario 3: Clinton Wright, a recently qualified chartered accountant, saw an advert of a company looking for a senior financial accountant. The advert stated that the candidate should have 5 years' experience in a similar position. Clinton only have 3 years' experience and intends to amended his CV to be in line with the job requirement and apply for the job. Scenario 4: Susan Nel, a financial manager at Cook the Books (Pty) Ltd (CTB) discovered two months ago that the company was making up false documentation to submit to SARS when they submit their monthly VAT returns, however she kept quiet about the matter. This resulted in the company paying less VAT YOU ARE REQUIRED TO a) Discuss whether the chartered accountants identified in each of the scenarios above has complied with the COPC. Your discussion should include, 1 - Identification of the relevant section of COPC il - Explanation of the non-compliance il - Which fundamental ethical principles are affected. iv - Which threat is created V-Explain which safeguards should be implemented (20)

Scenario 2: Max Botha, CA (SA), is employed by the local municipality in the procurement department. He is responsible for awarding tenders to local contractors. Ubuntu Contractors (Pty) Ltd, in which his wife is a material shareholder, also submitted their application documents and Max wants to award them the tender despite receiving more competitive tenders. Scenario 3: Clinton Wright, a recently qualified chartered accountant, saw an advert of a company looking for a senior financial accountant. The advert stated that the candidate should have 5 years' experience in a similar position. Clinton only have 3 years' experience and intends to amended his CV to be in line with the job requirement and apply for the job. Scenario 4: Susan Nel, a financial manager at Cook the Books (Pty) Ltd (CTB) discovered two months ago that the company was making up false documentation to submit to SARS when they submit their monthly VAT returns, however she kept quiet about the matter. This resulted in the company paying less VAT YOU ARE REQUIRED TO a) Discuss whether the chartered accountants identified in each of the scenarios above has complied with the COPC. Your discussion should include, 1 - Identification of the relevant section of COPC il - Explanation of the non-compliance il - Which fundamental ethical principles are affected. iv - Which threat is created V-Explain which safeguards should be implemented (20)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started