Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Scenario 6 : A major sports team has just negotiated a contract with one of the top free agent players available this year. After months

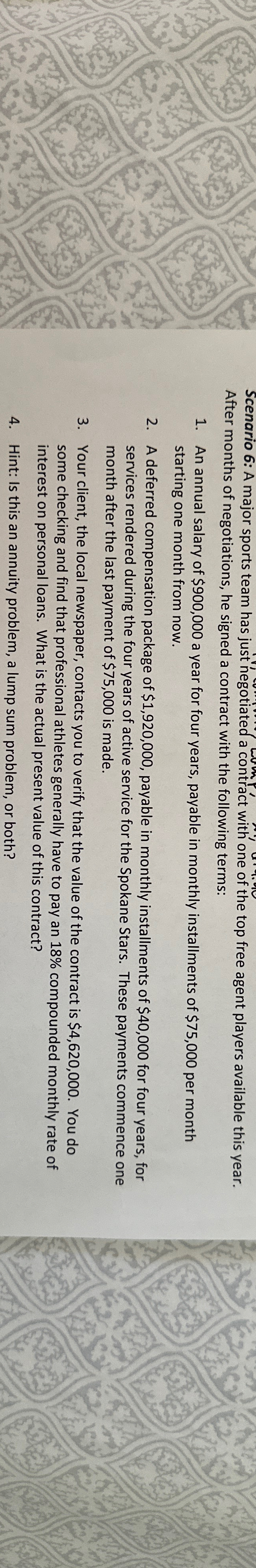

Scenario : A major sports team has just negotiated a contract with one of the top free agent players available this year. After months of negotiations, he signed a contract with the following terms:

An annual salary of $ a year for four years, payable in monthly installments of $ per month starting one month from now.

A deferred compensation package of $ payable in monthly installments of $ for four years, for services rendered during the four years of active service for the Spokane Stars. These payments commence one month after the last payment of $ is made.

Your client, the local newspaper, contacts you to verify that the value of the contract is $ You do some checking and find that professional athletes generally have to pay an compounded monthly rate of interest on personal loans. What is the actual present value of this contract?

Hint: Is this an annuity problem, a lump sum problem, or both?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started