Answered step by step

Verified Expert Solution

Question

1 Approved Answer

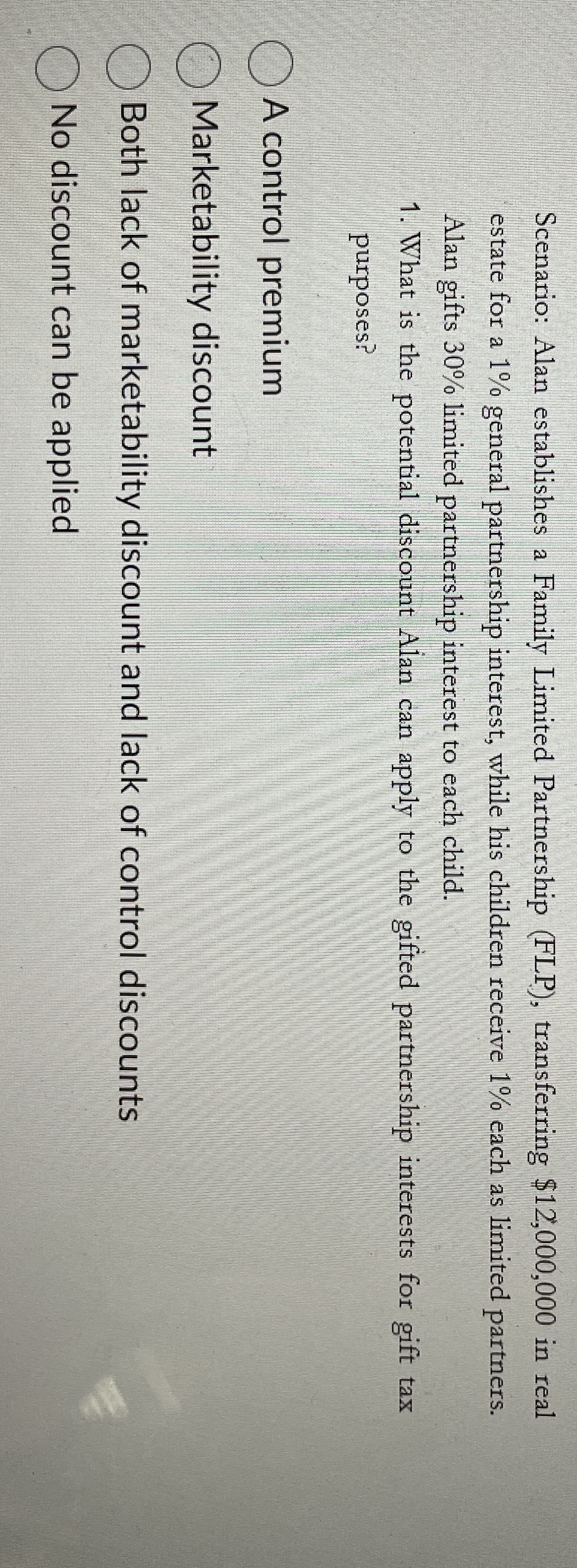

Scenario: Alan establishes a Family Limited Partnership ( FLP ) , transferring $ 1 2 , 0 0 0 , 0 0 0 in real

Scenario: Alan establishes a Family Limited Partnership FLP transferring $ in real estate for a general partnership interest, while his children receive each as limited partners. Alan gifts limited partnership interest to each child.

What is the potential discount Alan can apply to the gifted partnership interests for gift tax purposes?

A control premium

Marketability discount

Both lack of marketability discount and lack of control discounts

No discount can be applied

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started