Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Scenario Analysis. The common stock of Escapist Films sells for $ 2 5 a share and offers the following payoffs next year: ( LO 1

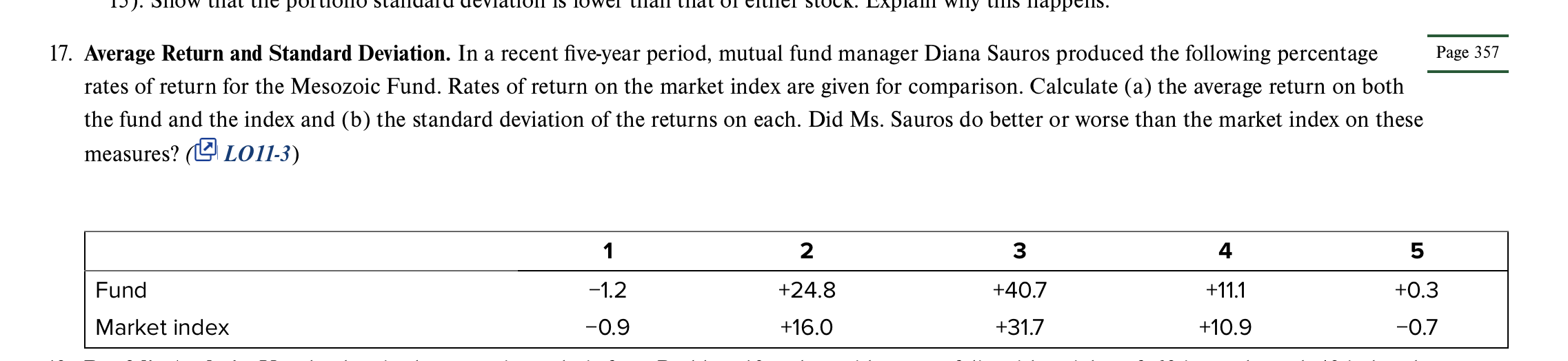

Scenario Analysis. The common stock of Escapist Films sells for $ a share and offers the following payoffs next year: LO Dividend Stock Price $ Boom S Normal economy Recession a Calculate the expected return and standard deviation of Escapist. All three scenarios are equally likely. b Now calculate the expected return and standard deviation of a portfolio half invested in Escapist and half in Leaning Tower of Pita from Problem Show that the portfolio standard deviation is lower than that of either stock. Explain why this happens.Average Return and Standard Deviation. In a recent fiveyear period, mutual fund manager Diana Sauros produced the following percentage

rates of return for the Mesozoic Fund. Rates of return on the market index are given for comparison. Calculate a the average return on both

the fund and the index and b the standard deviation of the returns on each. Did Ms Sauros do better or worse than the market index on these

measures? LO

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started