Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Scenario and Activisy. You have been hired as a strategic analys: by a New York based, management consult ancy group and have been asked to

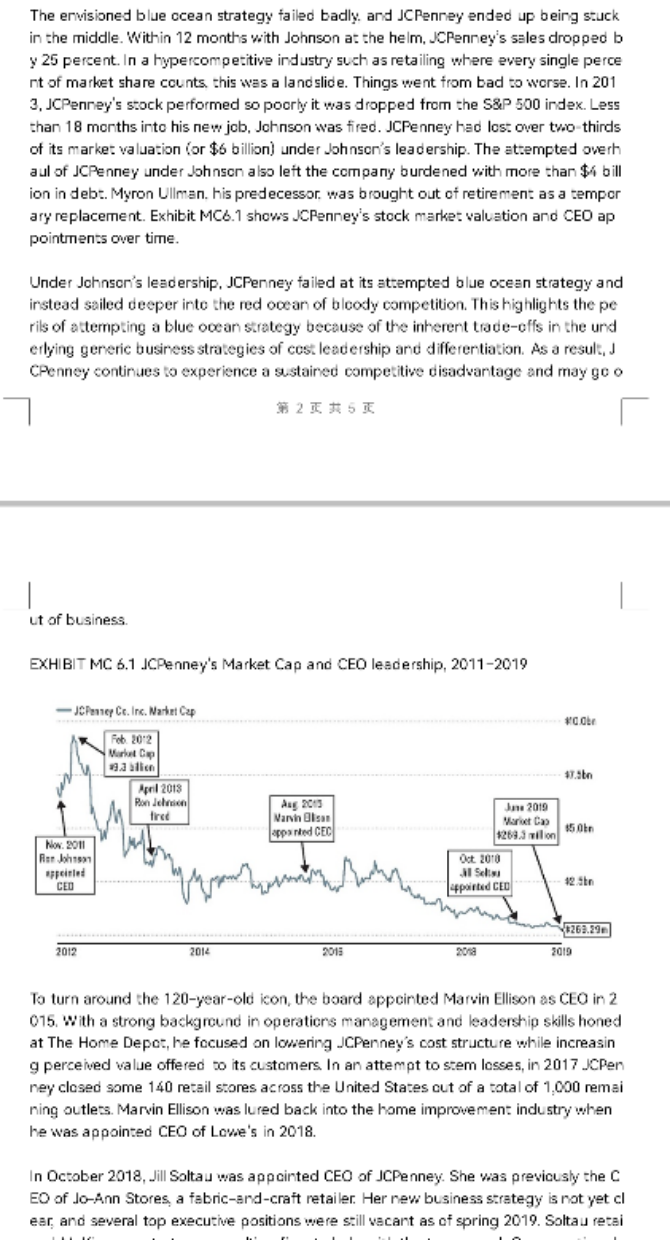

Scenario and Activisy. You have been hired as a strategic analys: by a New York based, management consult ancy group and have been asked to produce a strategic plan for one of the organisati on's established clients; JC Penny. The company has provided you with a brief outline 0 f their most recent history.... JCPenney was once one of the top departmen: stcres in the United States, with more than 2,000 locations a: its peak. Indeed, the retailer was so common in the suburbs th at one could no: imagine a shopping mall without a JCPenney. Generations of America' s children wefe mesmerized by its annual holid ay catalog. As recent as 2007, JCPenney had enjoyed a marke: valuation of $18 billion. In a bit over a decade, JCPenney's mark et eap had fallen to a mere $269 millicn. Thus, the retailer lest. 98.5 percent of its valua tion er $17.7 billicn in a bit ower decade. Many cbserwers expect JCPenrey to follow Se ars-once the kading American retailer-to also fik for bankruptcy, which Scars did in 2018. What wert wrong? . 1 if it 5 it Of course, all retailers are exposed to the same threat, Amazon, which has become syn onymous with coline stopping. Altheugh Walmart, Target, and Bes. Buy all have beco me more competitive in recent years, JCPenney sped up its cwn demise with a bad bu siress strategy: In particular, under fermer CEO Ron Johrson, JCFenney learned the ha rd way how difficult it is to change a strategic position. When hired as JCPenrey's CEO in 2011, Johrson was hailed as a star exccutive. Johnson was poached from Apple, wh ere he had created and led Apple's retail stores since 2000. Apple's steres are the mos ts sccessful retail outtets globally in terms of sales per square foot. No other retail out: et, not even luxury jewelers, achicves more. This poaching didn't come cheap: JCPenn cy paid Ren Johnsen clese to $53millicn in total compensation in 2011, even though h e didn't start until Nowember of that yesr. Once on bosn with JCPenney, Johnson immedistely began to change the company's strategic position from a cost-leadership to a blue ocean strategy, atempting to ccmb ine its traditicnsl cost-lesdership positicn with a differentiation positicn. In particular, h e tried to reposition the department store more toward the high end by providing an i mproved customer experience and more exclusive merchandise through in-store bcuti ques Jchnsch ondered all clearance racks with steeply discounted merchandise, comm on in JCPenney stones, to be removed. He slse did away with JCPenney's long-stand in g practice of mailing discount coupens to its customers. Rather than following industry best practice by testing the more drastic strategic moves in a small number of selecte d stores, Johnson implemented them in all of the then 1,800 stores at once. When one executive raised the issue of pretesting, Johnscn bristled and responded: "We didn't t est at Apple." Under his leadership, JCPenney also got embroiled in a legal batte wi th Macy's because of Johnson's attempt to lure sway homemaking maven Marths Ste wart and her exclusive merchandise collection. The envisioned blue ccean strategy failed badly. and JCPenney ended up being stuck The envisioned blue ccean strategy failed badly. and JCPenrey ended up being stuck in the middle. Within 12 months with Johnson a: the helm, JCPenney's ssles dropped b y 25 percent. In a hypercompetitive industry such as retailing where every single perce rt of market share ccunts. this was a land slide. Things went from bad to worse. In 201 3, JCPenney's stock performed so pocrly it was dropped from the S\&P 500 index. Less than 18 months into his new job, Johnson was fired. JCPenney had los: over two-thirds of its marke: valuation (or $6 billion) under Johnscn's leadership. The attempted overh aul of JCPenney under Johnscn also left the company burdened with more than \$ bill ion in debt. Myron Ullman. his predecessor. was brought out of retirement as a tempor ary replacement. Exhibit MC6.1 shows JCPenney's stock marke: valuation and CEO ap pointments over time. Under Johnsor's leadership, JCPenney failed at its attempted blue ocean strategy and instead sailed deeper into the red ocean of blcody competition. Thishighlights the pe rils of attempting a blue ocean strategy because of the inherent trade-offs in the und erlying generic business strategies of ccst leadership and differentiation. As a result, J CPenney continues to experience a sustained competitive disadvantage and may go o 2 5 ut of business EXHIBIT MC 6.1 JCPenney's Market Cap and CEO leadership, 2011-2019 To turn around the 120-year-old icon, the board appointed Marvin Ellison as CEO in 2 015. With a strong background in operaticns management and leadership skills honed at The Home Depot, he focused on lowering JCPenney's cost structure while increasin g perceived value offered to its customers. In an attempt to stem losses, in 2017 JCPen ney closed some 140 retail stores across the United States cut of a total of 1,000 remai ning outlers. Marvin Ellison was lured back into the home improvement industry when he was appointed CEO of Lowe's in 2018. In October 2018, Jill Soltau was appcinted CEO of JCPenney. She was previcusly the C EO of Jo-Ann Stores, a fabric-and-craft retailer. Her new business strategy is not yet al ear, and several top executive positions were s:ill vacant as of spring 2019. Soltau retai In October 2018. Jill Soltau was appointed CEO of JCPenney. She was previously the C EO of J-An Stores, a fabric-and-craft retailer. Her new business strategy is not yet d ear, and several to p executive positicns were still vacant as of spring 2019. Soltau retai ned McKinsey, a strategy consulting firm, to help with the turnaround. One question sh e faces is whether to continue selling appliances, which her predecessor brought back in 2016 to take away sales from failing Sears. JCFenney had discontinued sales of appl iances in 1983 to focus on apparel, and the majcrity of JCPenney's sales still come fro m apparel, an area the retailer has neglected in recent years, even though JCFenney Was once the go-to apparel retailer for American middle-class families. Whether Solta u will successfully stharpen JCPenney's strategic position and thus make the American i con compesitive again remains to be seen. OBJECTNE: The client is keen to expand its business so the report must include recommendations for growth with full justificaticn and rationale. You are expected to make use of recogn ised intermal and extemal analytical tools and models. The Strategic plan is to be written up as part of the formal report and will compri 13 5 se two parts: Part A: You are to complete an internal and external analysis that provides a platf orm for strategic decision making: 1. Analysis and critical evaluation of the competitive emvironment using Porter's Fi ve Forces model (20 marks). 2. Devise valid strategies and tactical objectives to achieve overall strategic objec tives (20 marks). Part B: On the basis of this analysis critically evaluate and justify strategic option s for the organisation: 1. Critically evaluate the different types of strategic directions available to the or ganization (20 marks). 2. Justify and recommend the most appropriate platform/s and strategies ( 20mar ks). 3. Evaluate ways and means by which the chosen strategy/ies can be monitored in order to ensure success ( 20 marks). Scenario and Activisy. You have been hired as a strategic analys: by a New York based, management consult ancy group and have been asked to produce a strategic plan for one of the organisati on's established clients; JC Penny. The company has provided you with a brief outline 0 f their most recent history.... JCPenney was once one of the top departmen: stcres in the United States, with more than 2,000 locations a: its peak. Indeed, the retailer was so common in the suburbs th at one could no: imagine a shopping mall without a JCPenney. Generations of America' s children wefe mesmerized by its annual holid ay catalog. As recent as 2007, JCPenney had enjoyed a marke: valuation of $18 billion. In a bit over a decade, JCPenney's mark et eap had fallen to a mere $269 millicn. Thus, the retailer lest. 98.5 percent of its valua tion er $17.7 billicn in a bit ower decade. Many cbserwers expect JCPenrey to follow Se ars-once the kading American retailer-to also fik for bankruptcy, which Scars did in 2018. What wert wrong? . 1 if it 5 it Of course, all retailers are exposed to the same threat, Amazon, which has become syn onymous with coline stopping. Altheugh Walmart, Target, and Bes. Buy all have beco me more competitive in recent years, JCPenney sped up its cwn demise with a bad bu siress strategy: In particular, under fermer CEO Ron Johrson, JCFenney learned the ha rd way how difficult it is to change a strategic position. When hired as JCPenrey's CEO in 2011, Johrson was hailed as a star exccutive. Johnson was poached from Apple, wh ere he had created and led Apple's retail stores since 2000. Apple's steres are the mos ts sccessful retail outtets globally in terms of sales per square foot. No other retail out: et, not even luxury jewelers, achicves more. This poaching didn't come cheap: JCPenn cy paid Ren Johnsen clese to $53millicn in total compensation in 2011, even though h e didn't start until Nowember of that yesr. Once on bosn with JCPenney, Johnson immedistely began to change the company's strategic position from a cost-leadership to a blue ocean strategy, atempting to ccmb ine its traditicnsl cost-lesdership positicn with a differentiation positicn. In particular, h e tried to reposition the department store more toward the high end by providing an i mproved customer experience and more exclusive merchandise through in-store bcuti ques Jchnsch ondered all clearance racks with steeply discounted merchandise, comm on in JCPenney stones, to be removed. He slse did away with JCPenney's long-stand in g practice of mailing discount coupens to its customers. Rather than following industry best practice by testing the more drastic strategic moves in a small number of selecte d stores, Johnson implemented them in all of the then 1,800 stores at once. When one executive raised the issue of pretesting, Johnscn bristled and responded: "We didn't t est at Apple." Under his leadership, JCPenney also got embroiled in a legal batte wi th Macy's because of Johnson's attempt to lure sway homemaking maven Marths Ste wart and her exclusive merchandise collection. The envisioned blue ccean strategy failed badly. and JCPenney ended up being stuck The envisioned blue ccean strategy failed badly. and JCPenrey ended up being stuck in the middle. Within 12 months with Johnson a: the helm, JCPenney's ssles dropped b y 25 percent. In a hypercompetitive industry such as retailing where every single perce rt of market share ccunts. this was a land slide. Things went from bad to worse. In 201 3, JCPenney's stock performed so pocrly it was dropped from the S\&P 500 index. Less than 18 months into his new job, Johnson was fired. JCPenney had los: over two-thirds of its marke: valuation (or $6 billion) under Johnscn's leadership. The attempted overh aul of JCPenney under Johnscn also left the company burdened with more than \$ bill ion in debt. Myron Ullman. his predecessor. was brought out of retirement as a tempor ary replacement. Exhibit MC6.1 shows JCPenney's stock marke: valuation and CEO ap pointments over time. Under Johnsor's leadership, JCPenney failed at its attempted blue ocean strategy and instead sailed deeper into the red ocean of blcody competition. Thishighlights the pe rils of attempting a blue ocean strategy because of the inherent trade-offs in the und erlying generic business strategies of ccst leadership and differentiation. As a result, J CPenney continues to experience a sustained competitive disadvantage and may go o 2 5 ut of business EXHIBIT MC 6.1 JCPenney's Market Cap and CEO leadership, 2011-2019 To turn around the 120-year-old icon, the board appointed Marvin Ellison as CEO in 2 015. With a strong background in operaticns management and leadership skills honed at The Home Depot, he focused on lowering JCPenney's cost structure while increasin g perceived value offered to its customers. In an attempt to stem losses, in 2017 JCPen ney closed some 140 retail stores across the United States cut of a total of 1,000 remai ning outlers. Marvin Ellison was lured back into the home improvement industry when he was appointed CEO of Lowe's in 2018. In October 2018, Jill Soltau was appcinted CEO of JCPenney. She was previcusly the C EO of Jo-Ann Stores, a fabric-and-craft retailer. Her new business strategy is not yet al ear, and several top executive positions were s:ill vacant as of spring 2019. Soltau retai In October 2018. Jill Soltau was appointed CEO of JCPenney. She was previously the C EO of J-An Stores, a fabric-and-craft retailer. Her new business strategy is not yet d ear, and several to p executive positicns were still vacant as of spring 2019. Soltau retai ned McKinsey, a strategy consulting firm, to help with the turnaround. One question sh e faces is whether to continue selling appliances, which her predecessor brought back in 2016 to take away sales from failing Sears. JCFenney had discontinued sales of appl iances in 1983 to focus on apparel, and the majcrity of JCPenney's sales still come fro m apparel, an area the retailer has neglected in recent years, even though JCFenney Was once the go-to apparel retailer for American middle-class families. Whether Solta u will successfully stharpen JCPenney's strategic position and thus make the American i con compesitive again remains to be seen. OBJECTNE: The client is keen to expand its business so the report must include recommendations for growth with full justificaticn and rationale. You are expected to make use of recogn ised intermal and extemal analytical tools and models. The Strategic plan is to be written up as part of the formal report and will compri 13 5 se two parts: Part A: You are to complete an internal and external analysis that provides a platf orm for strategic decision making: 1. Analysis and critical evaluation of the competitive emvironment using Porter's Fi ve Forces model (20 marks). 2. Devise valid strategies and tactical objectives to achieve overall strategic objec tives (20 marks). Part B: On the basis of this analysis critically evaluate and justify strategic option s for the organisation: 1. Critically evaluate the different types of strategic directions available to the or ganization (20 marks). 2. Justify and recommend the most appropriate platform/s and strategies ( 20mar ks). 3. Evaluate ways and means by which the chosen strategy/ies can be monitored in order to ensure success ( 20 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started