Question

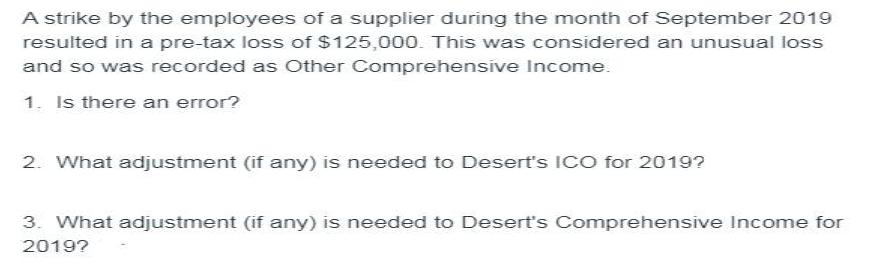

A strike by the employees of a supplier during the month of September 2019 resulted in a pre-tax loss of $125,000. This was considered

A strike by the employees of a supplier during the month of September 2019 resulted in a pre-tax loss of $125,000. This was considered an unusual loss and so was recorded as Other Comprehensive Income. 1. Is there an error? 2. What adjustment (if any) is needed to Desert's ICO for 2019? 3. What adjustment (if any) is needed to Desert's Comprehensive Income for 2019?

Step by Step Solution

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

1Is there an error Yes this should be reported as part of ICO instead ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Statistics For Management And Economics Abbreviated

Authors: Gerald Keller

10th Edition

978-1-305-0821, 1285869648, 1-305-08219-2, 978-1285869643

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App