Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PART A REQUIREMENTS a. Prepare a property, plant and equipment schedule for the year ended 31 March 20x2. Hint: you will find the information you

PART A REQUIREMENTS

a. Prepare a property, plant and equipment schedule for the year ended 31 March 20x2. Hint: you will find the information you need in the unadjusted trial balance and supplementary information.

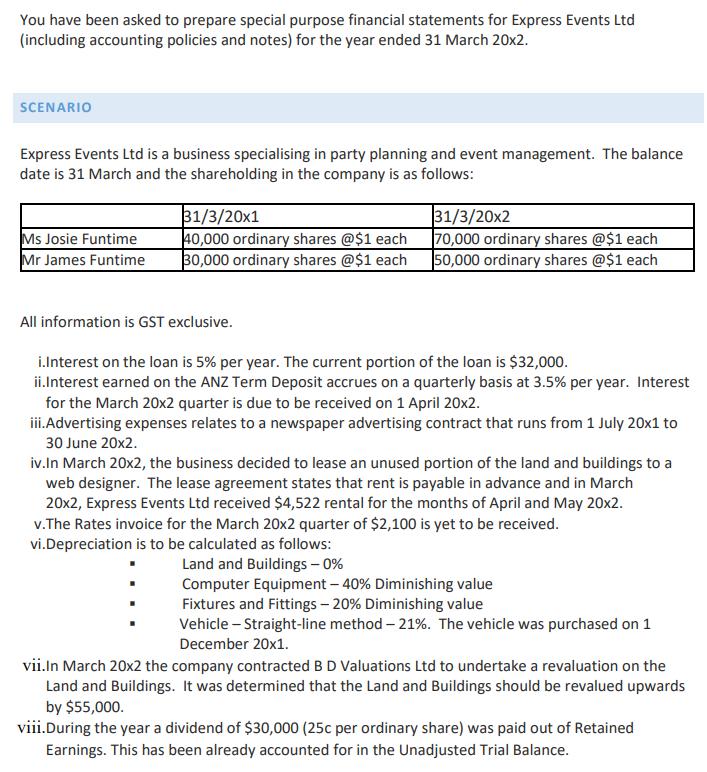

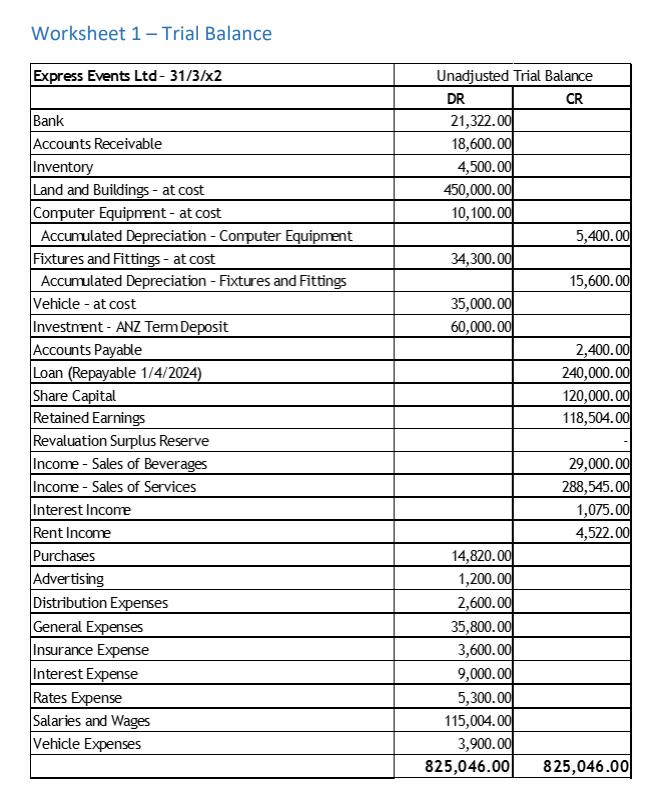

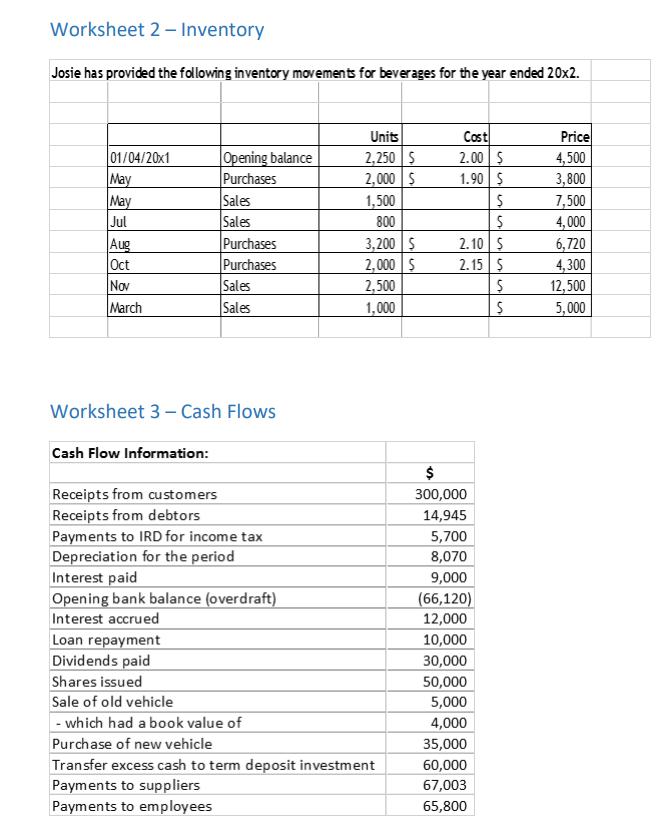

You have been asked to prepare special purpose financial statements for Express Events Ltd (including accounting policies and notes) for the year ended 31 March 20x2. SCENARIO Express Events Ltd is a business specialising in party planning and event management. The balance date is 31 March and the shareholding in the company is as follows: Ms Josie Funtime Mr James Funtime 31/3/20x1 40,000 ordinary shares @$1 each 30,000 ordinary shares @$1 each All information is GST exclusive. 31/3/20x2 70,000 ordinary shares @$1 each 50,000 ordinary shares @$1 each i.Interest on the loan is 5% per year. The current portion of the loan is $32,000. ii.Interest earned on the ANZ Term Deposit accrues on a quarterly basis at 3.5% per year. Interest for the March 20x2 quarter is due to be received on 1 April 20x2. iii.Advertising expenses relates to a newspaper advertising contract that runs from 1 July 20x1 to 30 June 20x2. iv.In March 20x2, the business decided to lease an unused portion of the land and buildings to a web designer. The lease agreement states that rent is payable in advance and in March 20x2, Express Events Ltd received $4,522 rental for the months of April and May 20x2. v.The Rates invoice for the March 20x2 quarter of $2,100 is yet to be received. vi.Depreciation is to be calculated as follows: Land and Buildings - 0% Computer Equipment - 40% Diminishing value Fixtures and Fittings -20% Diminishing value Vehicle - Straight-line method -21%. The vehicle was purchased on 1 December 20x1. vii.In March 20x2 the company contracted B D Valuations Ltd to undertake a revaluation on the Land and Buildings. It was determined that the Land and Buildings should be revalued upwards by $55,000. viii. During the year a dividend of $30,000 (25c per ordinary share) was paid out of Retained Earnings. This has been already accounted for in the Unadjusted Trial Balance.

Step by Step Solution

★★★★★

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Question PARTICULARS MS JOSIE FUNTIME MS JAMES FUNTIME ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started