Answered step by step

Verified Expert Solution

Question

1 Approved Answer

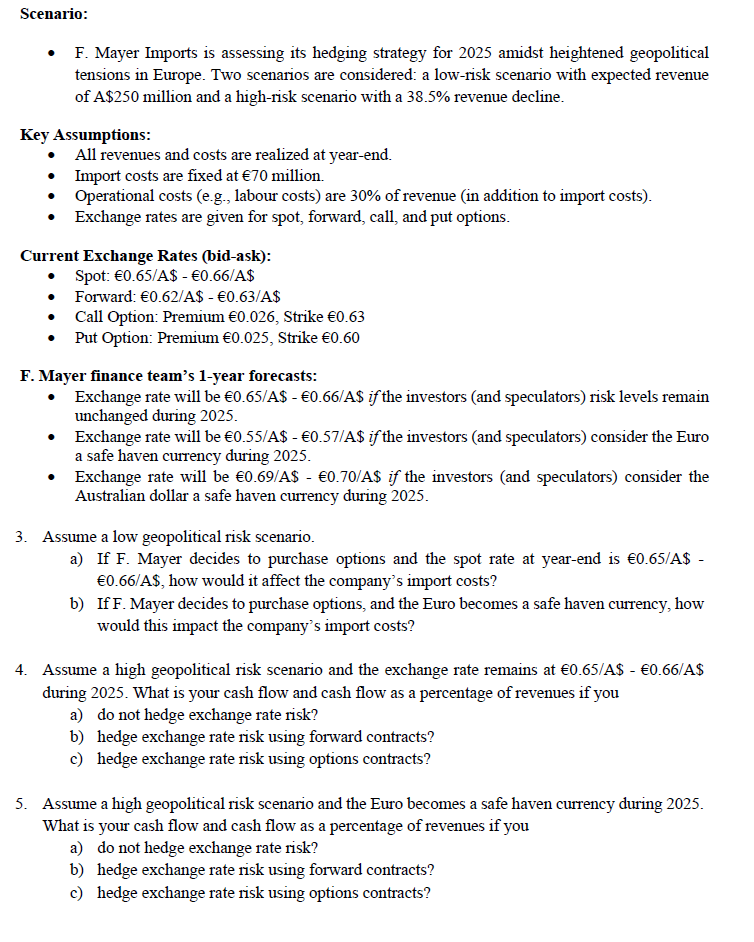

Scenario: F . Mayer Imports is assessing its hedging strategy for 2 0 2 5 amidst heightened geopolitical tensions in Europe. Two scenarios are considered:

Scenario:

F Mayer Imports is assessing its hedging strategy for amidst heightened geopolitical

tensions in Europe. Two scenarios are considered: a lowrisk scenario with expected revenue

of $ million and a highrisk scenario with a revenue decline.

Key Assumptions:

All revenues and costs are realized at yearend.

Import costs are fixed at million.

Operational costs eg labour costs are of revenue in addition to import costs

Exchange rates are given for spot, forward, call, and put options.

Current Exchange Rates bidask:

Spot: $ $

Forward: $$

Call Option: Premium Strike

Put Option: Premium Strike

F Mayer finance team's year forecasts:

Exchange rate will be $$ if the investors and speculators risk levels remain

unchanged during

Exchange rate will be $$ if the investors and speculators consider the Euro

a safe haven currency during

Exchange rate will be $$ if the investors and speculators consider the

Australian dollar a safe haven currency during

Assume a low geopolitical risk scenario.

a If F Mayer decides to purchase options and the spot rate at yearend is $

$ how would it affect the company's import costs?

b If F Mayer decides to purchase options, and the Euro becomes a safe haven currency, how

would this impact the company's import costs?

Assume a high geopolitical risk scenario and the exchange rate remains at $$

during What is your cash flow and cash flow as a percentage of revenues if you

a do not hedge exchange rate risk?

b hedge exchange rate risk using forward contracts?

c hedge exchange rate risk using options contracts?

Assume a high geopolitical risk scenario and the Euro becomes a safe haven currency during

What is your cash flow and cash flow as a percentage of revenues if you

a do not hedge exchange rate risk?

b hedge exchange rate risk using forward contracts?

c hedge exchange rate risk using options contracts?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started