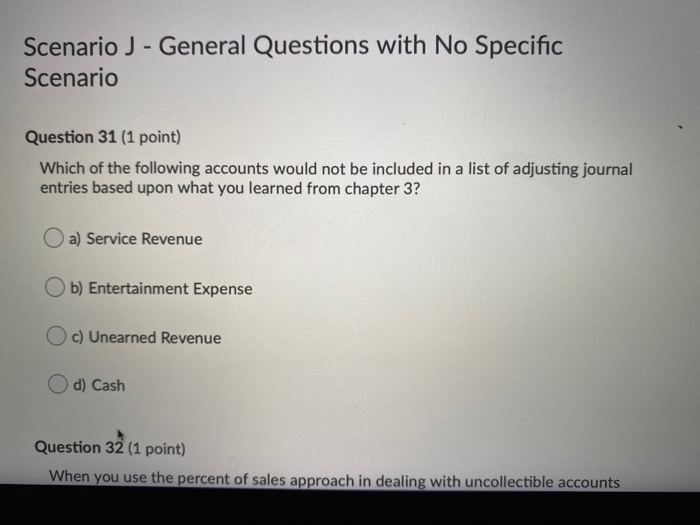

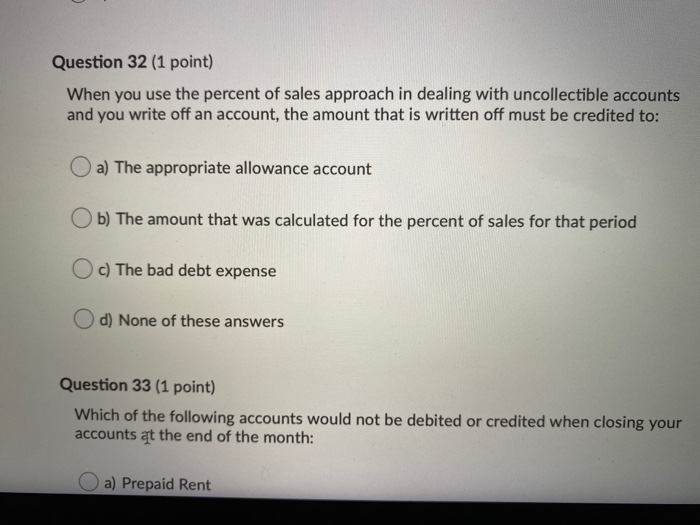

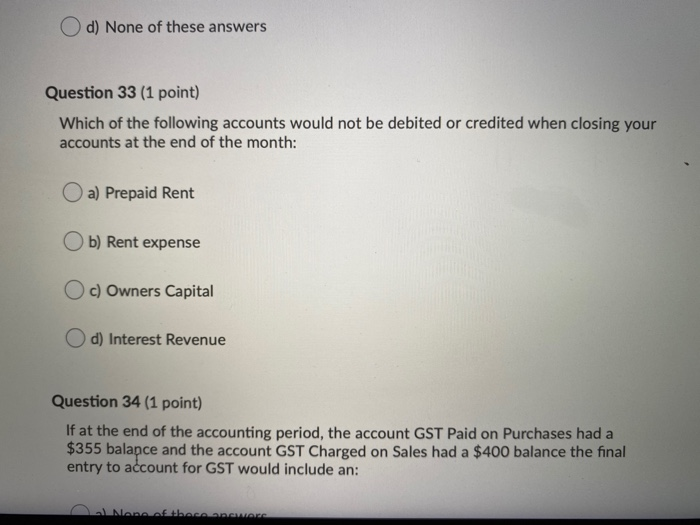

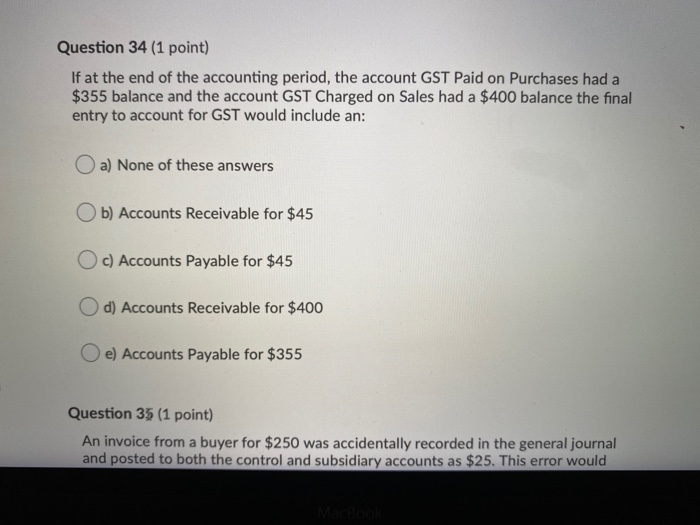

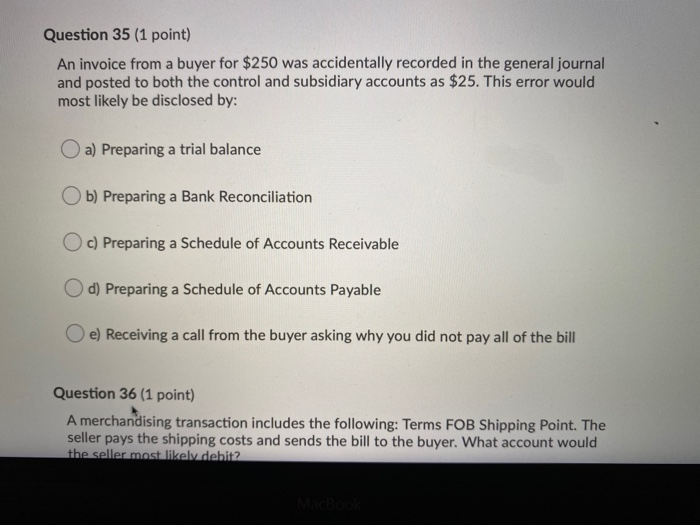

Scenario J - General Questions with No Specific Scenario Question 31 (1 point) Which of the following accounts would not be included in a list of adjusting journal entries based upon what you learned from chapter 3? a) Service Revenue b) Entertainment Expense c) Unearned Revenue d) Cash Question 32 (1 point) When you use the percent of sales approach in dealing with uncollectible accounts Question 32 (1 point) When you use the percent of sales approach in dealing with uncollectible accounts and you write off an account, the amount that is written off must be credited to: a) The appropriate allowance account Ob) The amount that was calculated for the percent of sales for that period Oc) The bad debt expense d) None of these answers Question 33 (1 point) Which of the following accounts would not be debited or credited when closing your accounts at the end of the month: a) Prepaid Rent d) None of these answers Question 33 (1 point) Which of the following accounts would not be debited or credited when closing your accounts at the end of the month: a) Prepaid Rent Ob) Rent expense O c) Owners Capital d) Interest Revenue Question 34 (1 point) If at the end of the accounting period, the account GST Paid on Purchases had a $355 balance and the account GST Charged on Sales had a $400 balance the final entry to account for GST would include an: None of these were Question 34 (1 point) If at the end of the accounting period, the account GST Paid on Purchases had a $355 balance and the account GST Charged on Sales had a $400 balance the final entry to account for GST would include an: a) None of these answers Ob) Accounts Receivable for $45 Oc) Accounts Payable for $45 d) Accounts Receivable for $400 e) Accounts Payable for $355 Question 35 (1 point) An invoice from a buyer for $250 was accidentally recorded in the general journal and posted to both the control and subsidiary accounts as $25. This error would Question 35 (1 point) An invoice from a buyer for $250 was accidentally recorded in the general journal and posted to both the control and subsidiary accounts as $25. This error would most likely be disclosed by: a) Preparing a trial balance Ob) Preparing a Bank Reconciliation Oc) Preparing a Schedule of Accounts Receivable d) Preparing a Schedule of Accounts Payable e) Receiving a call from the buyer asking why you did not pay all of the bill Question 36 (1 point) A merchandising transaction includes the following: Terms FOB Shipping Point. The seller pays the shipping costs and sends the bill to the buyer. What account would the seller most likely debit2