Question

Scenario Maria Gomez is the founder and president of ABC Healthcare Corporation, a company that owns hospitals, ambulatory surgical centers, urgent care centers, and outpatient

Scenario

Maria Gomez is the founder and president of ABC Healthcare Corporation, a company that owns hospitals, ambulatory surgical centers, urgent care centers, and outpatient clinics. She has called on you to review various financial documents and to make recommendations to maximize shareholder value.

Your Role

You are one of Maria's high-performing financial analyst managers at ABC Healthcare Corporation and she trusts your work and leadership.

Here is what your report should provide for Maria:

-A summary of the financial strength of the company through your analysis of the price/earnings and price/book ratios.

The CFO for ABC Healthcare Corporation assessed the market value by reviewing its price/earnings ratios. The price/earnings ratio determines the market value of a stock as compared to the company's earnings. The price/earnings ratios are listed in the chart below. To calculate the price/earnings ratio, the CFO took the earnings per share and divided that into the market value. For example, this means that in 2019 investors were willing to pay $12.10 for $1 of earnings.

| Price/Earnings Ratio | 2019 | 2018 | 2017 |

|---|---|---|---|

| Market Price | 83.62 | 83.62 | 83.62 |

| Earnings Per Share | 6.91 | 7.87 | 9.15 |

| Price/Earnings Ratio | 12.10 | 10.63 | 9.14 |

To further assess the market value, the CFO looked at book value per share. The book value per share ratio is the per-share value of a company in terms of the equity available to stockholders. The book values per share over the past three years are listed in the chart below:

| Price/Ratio Ratio | 2019 | 2018 | 2017 |

|---|---|---|---|

| Market Price | 83.62 | 83.62 | 83.62 |

| Book Value per Share | 199.1 | 209.05 | 226 |

| Price to Book Ratio | .42 | .40 | .37 |

The price-to-book ratio (P/B ratio) compares a firm's market capitalization to its book value. It's calculated by dividing the company's stock price per share by the book value per share. For the fiscal year 2019, the book value per share ratio was 0.42. This explains that investors would pay $0.42 for $1 of book value equity. Price to book value is an important measure to see how much equity shareholders are paying for the net assets value of the company. P/B ratios under 1 are typically considered solid investments.

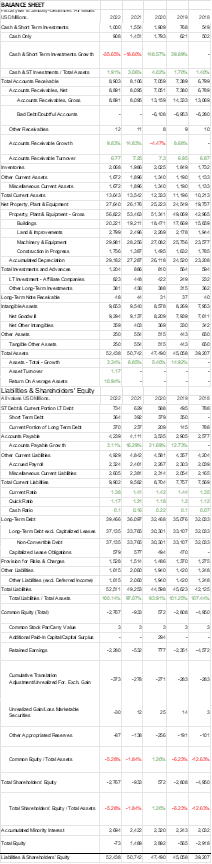

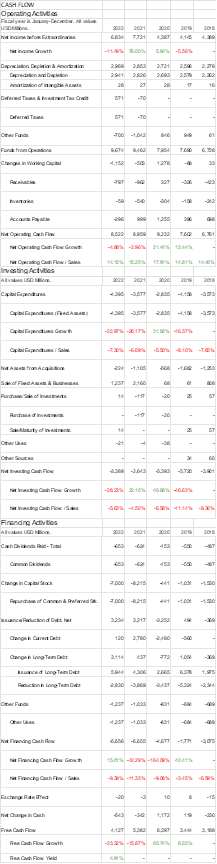

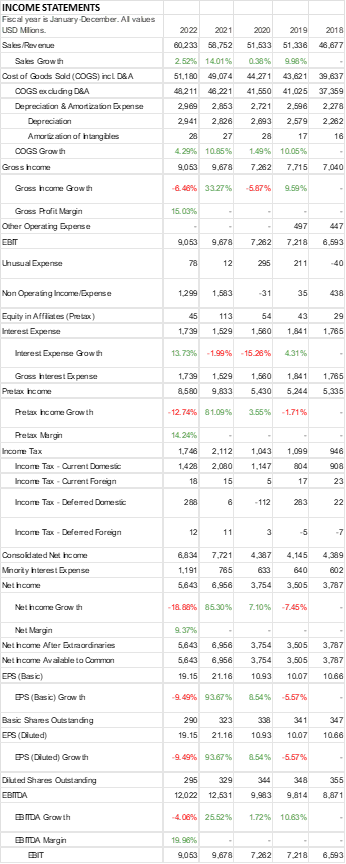

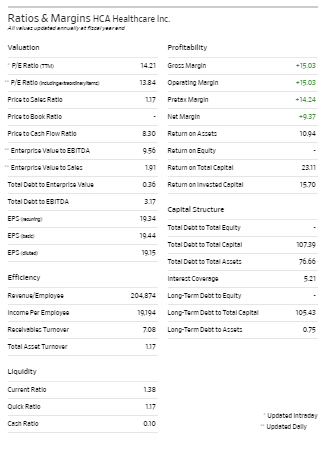

RIVAL HCA HEALTHCARE data:

provide at least three recommendations to Maria that maximize shareholder value for ABC Healthcare Corporation

Ratios \& Margins HCA Healthcare Inc. all vaive upoistad annullyat ficcal yearmed Walustion Profitability F/ EaRa10(70) 1421 Groz Margin F/E Ra:lo (ircuehge twotherlarne 13.84 Opara:ing Marpin Price to Salez Ratio 117 Protsw Margin Price to Book Ratio - Nat Margin Price to Cach Flow Ratio 830 Retum on Azst Enterprieo Value to EsITDA 9.56 Retum on Equity Enterprize Value to Solaz 1.91 Ratum on Totsl Cspital Total Dobt ts Entergrias Valus 0.36 Retum on linvested Copital Total Dabt to EBITDA 3.7 Capltal Structure 1934 Total Dabt ts Total Equlty EPS late 19.44 Total Dobt to Total Copitsl EPS Illutil 19.15 Total Dabted Total mezats 76.66 Efticlency Interect Covirspo 521 Rqunu:/Emplay: Incom: Fqr Employ ao 19,194 Long-Tirm Dett to Totsi Csp 7.08 Long-Tarm Debt to Acsats Llquld ty \begin{tabular}{ll} Current Ratio & 1.38 \\ \hline Qulck Ratio & 117 \\ \hline Cach Ratio & 0.10 \end{tabular} ' Updsted lntrsds Updated Dally Ratios \& Margins HCA Healthcare Inc. all vaive upoistad annullyat ficcal yearmed Walustion Profitability F/ EaRa10(70) 1421 Groz Margin F/E Ra:lo (ircuehge twotherlarne 13.84 Opara:ing Marpin Price to Salez Ratio 117 Protsw Margin Price to Book Ratio - Nat Margin Price to Cach Flow Ratio 830 Retum on Azst Enterprieo Value to EsITDA 9.56 Retum on Equity Enterprize Value to Solaz 1.91 Ratum on Totsl Cspital Total Dobt ts Entergrias Valus 0.36 Retum on linvested Copital Total Dabt to EBITDA 3.7 Capltal Structure 1934 Total Dabt ts Total Equlty EPS late 19.44 Total Dobt to Total Copitsl EPS Illutil 19.15 Total Dabted Total mezats 76.66 Efticlency Interect Covirspo 521 Rqunu:/Emplay: Incom: Fqr Employ ao 19,194 Long-Tirm Dett to Totsi Csp 7.08 Long-Tarm Debt to Acsats Llquld ty \begin{tabular}{ll} Current Ratio & 1.38 \\ \hline Qulck Ratio & 117 \\ \hline Cach Ratio & 0.10 \end{tabular} ' Updsted lntrsds Updated DallyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started