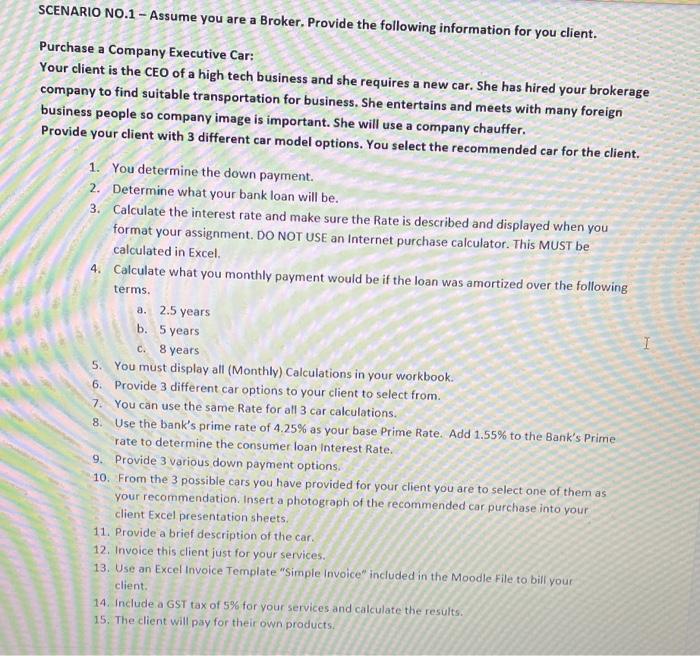

SCENARIO NO.1 - Assume you are a Broker. Provide the following information for you client. Purchase a Company Executive Car: Your client is the CEO of a high tech business and she requires a new car. She has hired your brokerage company to find suitable transportation for business. She entertains and meets with many foreign business people so company image is important. She will use a company chauffer. Provide your client with 3 different car model options. You select the recommended car for the client. c. 1. You determine the down payment. 2. Determine what your bank loan will be. 3. Calculate the interest rate and make sure the Rate is described and displayed when you format your assignment. DO NOT USE an Internet purchase calculator. This MUST be calculated in Excel 4. Calculate what you monthly payment would be if the loan was amortized over the following terms. a. 2.5 years b. 5 years 8 years 5. You must display all (Monthly) Calculations in your workbook. 6. Provide 3 different car options to your client to select from 7. You can use the same Rate for all 3 car calculations. 8. Use the bank's prime rate of 4.25% as your base Prime Rate. Add 1.55% to the Bank's Prime rate to determine the consumer loan interest Rate. 9. Provide 3 various down payment options. 10. From the 3 possible cars you have provided for your client you are to select one of them as your recommendation, Insert a photograph of the recommended car purchase into your client Excel presentation sheets. 11. Provide a brief description of the car. 12. Invoice this client just for your services. 13. Use an Excel Invoice Template "Simple Invoice" included in the Moodle File to bill your client. 14. Include a GST tax of 5% for your services and calculate the results. 15. The client will pay for their own products. SCENARIO NO.1 - Assume you are a Broker. Provide the following information for you client. Purchase a Company Executive Car: Your client is the CEO of a high tech business and she requires a new car. She has hired your brokerage company to find suitable transportation for business. She entertains and meets with many foreign business people so company image is important. She will use a company chauffer. Provide your client with 3 different car model options. You select the recommended car for the client. c. 1. You determine the down payment. 2. Determine what your bank loan will be. 3. Calculate the interest rate and make sure the Rate is described and displayed when you format your assignment. DO NOT USE an Internet purchase calculator. This MUST be calculated in Excel 4. Calculate what you monthly payment would be if the loan was amortized over the following terms. a. 2.5 years b. 5 years 8 years 5. You must display all (Monthly) Calculations in your workbook. 6. Provide 3 different car options to your client to select from 7. You can use the same Rate for all 3 car calculations. 8. Use the bank's prime rate of 4.25% as your base Prime Rate. Add 1.55% to the Bank's Prime rate to determine the consumer loan interest Rate. 9. Provide 3 various down payment options. 10. From the 3 possible cars you have provided for your client you are to select one of them as your recommendation, Insert a photograph of the recommended car purchase into your client Excel presentation sheets. 11. Provide a brief description of the car. 12. Invoice this client just for your services. 13. Use an Excel Invoice Template "Simple Invoice" included in the Moodle File to bill your client. 14. Include a GST tax of 5% for your services and calculate the results. 15. The client will pay for their own products