Answered step by step

Verified Expert Solution

Question

1 Approved Answer

SCENARIO & REQUIREMENTS: TimeFlex Inc. represents watch manufacturers both foreign and domestic. The company imports the foreign watches from various countries, and sells them to

SCENARIO & REQUIREMENTS:

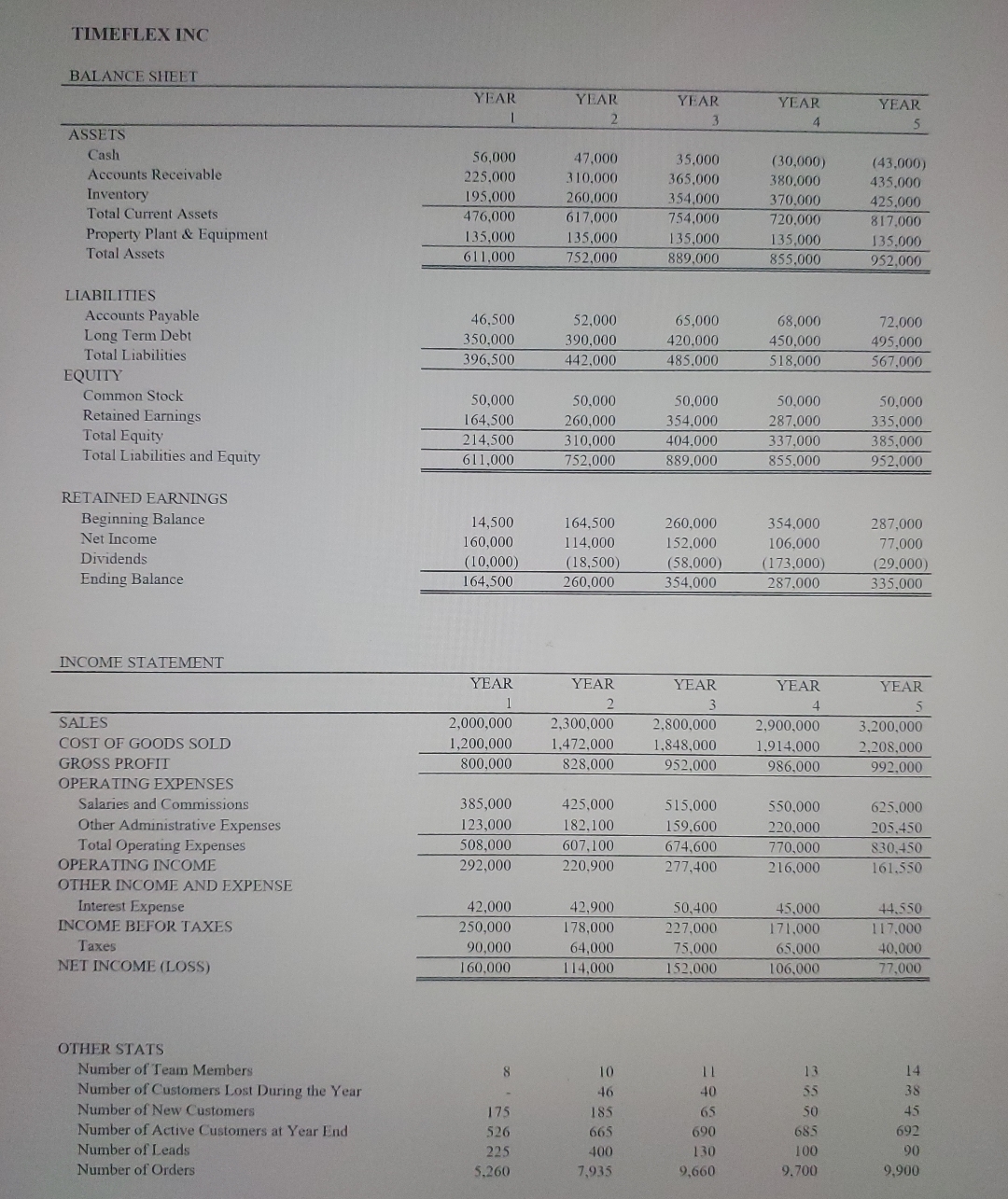

TimeFlex Inc. represents watch manufacturers both foreign and domestic. The company imports the foreign watches from various countries, and sells them to retailers. Domestic watches are purchased and sold to retailers. Customers include independent jewelers as well as stores that sell fashion accessories. The company started years ago.

Leads are primarily generated through trade shows. Follow up is done through telephone sales, emails, mailings, and store visits. There are sales representatives employed by TimeFlex.

The owner, Virginia Day, handles all of the product selection and purchasing. She travels abroad frequently on buying trips. Currently, all purchases are paid for at the time of shipment. Her husband, John, runs the business in her absence

The company has been experiencing severe cash flow problems. So the owner has turned to you for help. Day feels that much of the company's problems stem from price competition from larger distributors and the growth of watch store franchisers such as TimeZone. In the last couple of years her financial position has become increasingly tight, and she's had to leave more equity in the business than she had hoped.

Financial information for the last years is provided in a separate PDF document.

Some additional information about the company may be available. Ask your instructor for specific details.

Requirements:

PART Create an Excel spreadsheet calculating the following ratios for years See Chapter Learning Objective for assistance.

Return on Equity

Return on Assets

Net Profit Margin

Gross Profit Margin

Receivable Turnover Ratio

Inventory Turnover Ratio

Current Ratio

Quick Ratio

Debt to Equity Ratio

TIMEFLEX INBALANCE SHEETASSETSCashAccounts ReceivableInventoryTotal Current AssetsProperty Plant & EquipmentTotal AssetsLIABILITIESAccounts PayableLong Term DebtTotal LiabilitiesEQUITYCommon StockRetained EarningsTotal EquityTotal Liabilities and EquityRETAINED EARNINGSBeginning BalanceNet IncomeDividendsEnding BalanceINCOME STATEMENTSALESCOST OF GOODS SOLDGROSS PROFITOPERATING EXPENSESSalaries and CommissionsOther Administrative ExpensesTotal Operating ExpensesOPERATING INCOMEOTHER INCOME AND EXPENSEInterest ExpenseINCOME BEFOR TAXESTaxesNET INCOME LOSSOTHER STATSNumber of Team MembersNumber of Customers Lost During the YearNumberof New CustomersNumber of Active Customers at Year EndNumber of LeadsNumber of OrdersYEARYEARYEARYEARYEARSYEARSSYEARYEARYEARYEAR

PART Prepare a report for Virginia Day to read during her next buying trip. Include an analysis of the current condition of TimeFlex Inc., identify the strengths and weaknesses of the business, and your recommendations for improvement, with expected results of those improvements.

Your report should include at least one graphical presentation.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started