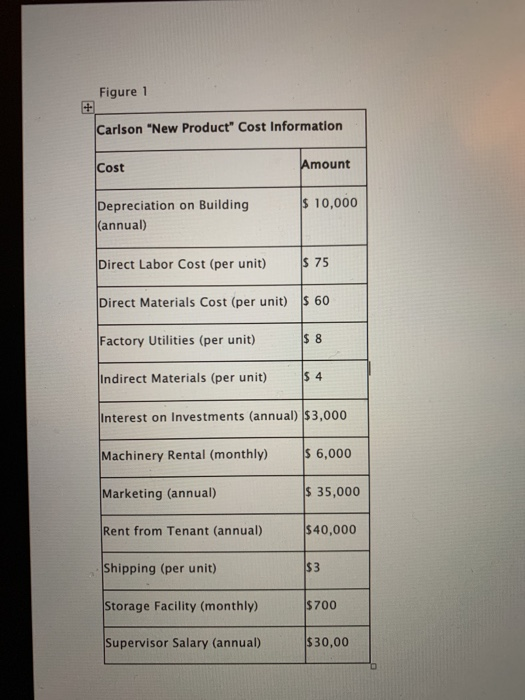

Scenario Several years ago, Carlson Manufacturing moved to a larger production facility to accommodate its growing business. Instead of selling their old facility, they rented it to another firm and have been receiving rental income from the tenant. The tenant's lease is getting ready to expire but instead of renewing the lease, Carlson has decided to take the building back and use it to manufacture a new product. Carlson will continue to depreciate the building on a straight-line basis as they have done in prior years, so there will be no change in depreciation expense. The old building is large enough to house the majority of operations, but they will need to rent a small storage building for raw materials. They have also decided that instead of purchasing the machinery necessary for production, they will rent the equipment on a monthly basis. Their existing workforce is unable to accommodate the production of the new product so Carlson will hire new workers and a supervisor to oversee production. The existing marketing department has the ability to handle the marketing of the new product, provided they receive additional funds to cover the cost. Since this is a new venture, their bank is hesitant to fund the start-up of operations so Carlson has decided to liquidate some short-term investments to cover start-up costs and provide them with working capital. Although they will lose the return on these short-term investments, they are comfortable that in the long run the investment in this new product will be worth it. You have been asked by management to classify the costs associated with the start- up of this new product line. Using the cost information provided below, classify each cost under the appropriate heading according to Figure 1 provided below and explain the reason you placed it there. Note that some costs may be classified under more than one heading. For example, a cost may be a fixed cost and a period cost. You will need to recreate the chart headings and columns shown below on your answer sheet: Variable Cost Fixed Cost Direct Materials Direct Labor Factory Overhead Period Cost Prime Cost Conversion Cost Figure 1 Carlson "New Product" Cost Information Cost Amount $ 10,000 Depreciation on Building (annual) Direct Labor Cost (per unit) s 75 Direct Materials Cost (per unit) $ 60 Factory Utilities (per unit) S 8 Indirect Materials (per unit) s 4 Interest on Investments (annual) $3,000 Machinery Rental (monthly) $ 6,000 Marketing (annual) $ 35,000 Rent from Tenant (annual) $40,000 Shipping (per unit) $3 Storage Facility (monthly) $700 Supervisor Salary (annual) $30,00