Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You generally require investments to triple in value over a 5 year period. Based on your above analysis discuss why you would, or would not,

You generally require investments to triple in value over a 5 year period. Based on your above analysis discuss why you would, or would not, acquire this company.

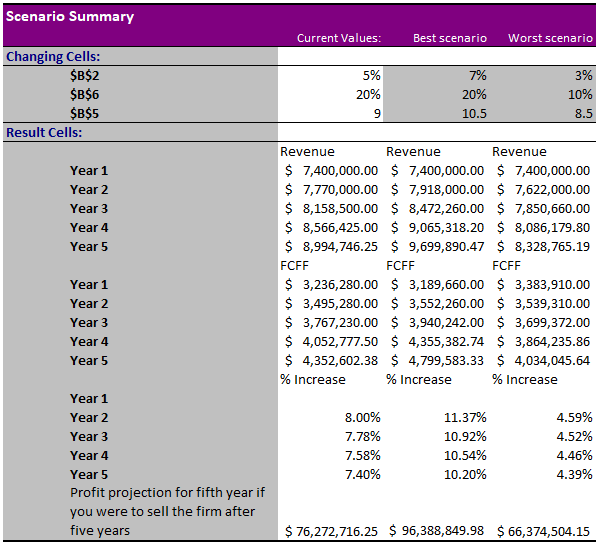

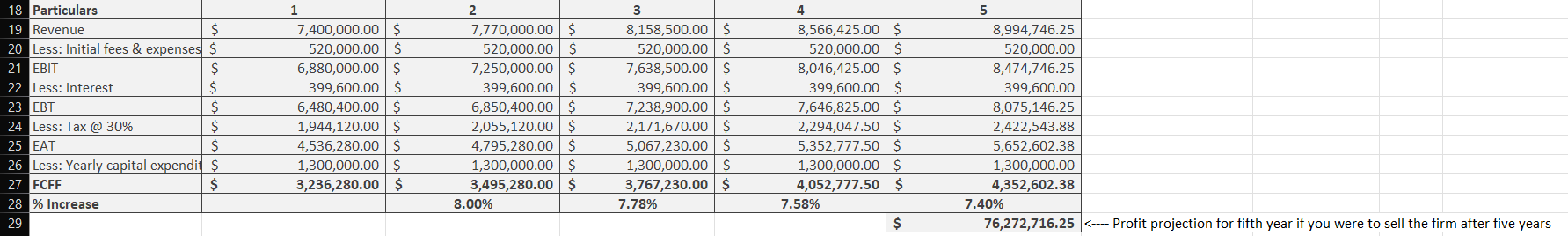

Scenario Summary Changing Cells: $B$2 $B$6 $B$5 Result Cells: Year 1 Year 2 Year 3 Year 4 Year 5 Year 1 Year 2 Year 3 Year 4 Year 5 Year 1 Year 2 Year 3 Year 4 Year 5 Profit projection for fifth year if you were to sell the firm after five years Current Values: 5% 20% 9 Best scenario 8.00% 7.78% 7.58% 7.40% 7% 20% 10.5 Worst scenario Revenue Revenue Revenue $ 7,400,000.00 $ 7,400,000.00 $ 7,400,000.00 $ 7,770,000.00 $ 7,918,000.00 $ 7,622,000.00 $ 8,158,500.00 $ 8,472,260.00 $ 7,850,660.00 $ 8,566,425.00 $ 9,065,318.20 $ 8,086,179.80 $ 8,994,746.25 $ 9,699,890.47 $ 8,328,765.19 FCFF FCFF FCFF $ 3,236,280.00 $3,189,660.00 $ 3,383,910.00 $ 3,495,280.00 $ 3,552,260.00 $3,539,310.00 $ 3,767,230.00 $ 3,940,242.00 $3,699,372.00 $ 4,052,777.50 $4,355,382.74 $ 3,864,235.86 $ 4,352,602.38 $ 4,799,583.33 $ 4,034,045.64 % Increase % Increase % Increase 11.37% 10.92% 10.54% 10.20% 3% 10% 8.5 4.59% 4.52% 4.46% 4.39% $ 76,272,716.25 $ 96,388,849.98 $ 66,374,504.15

Step by Step Solution

★★★★★

3.23 Rating (141 Votes )

There are 3 Steps involved in it

Step: 1

Answer To determine whether acquiring Pillowscom aligns with your investment criteria of tripling in value over a 5year period we need to assess its p...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started