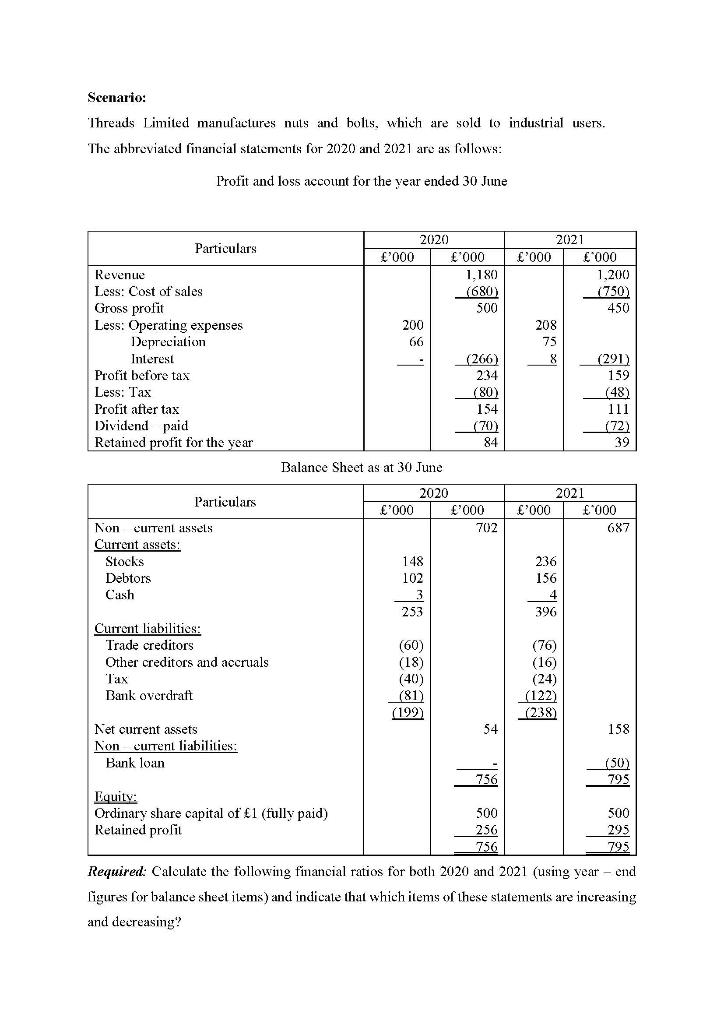

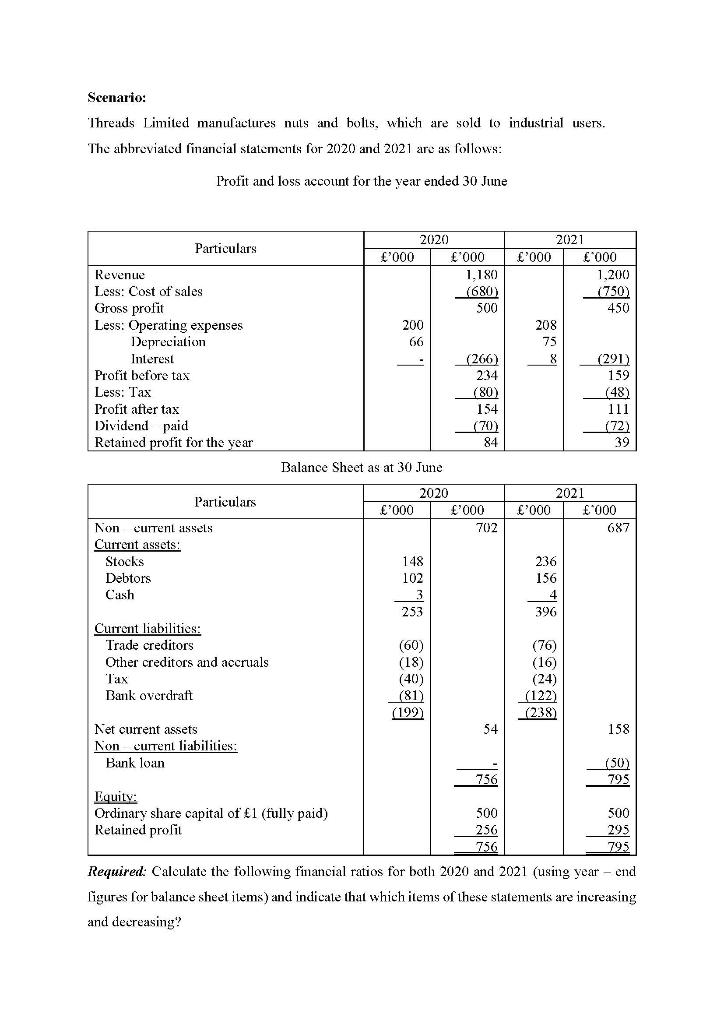

Scenario: Threads Limited manufactures nuts and bolls, which are sold to industrial users. The abbreviated financial statements for 2020 and 2021 are as follows: Profit and loss account for the year ended 30 June Particulars Revenue Less: Cost of sales Gross profit Less: Operating expenses Depreciation Interest Profit before tax Less: Tax Profit after tax Dividend paid Retained profit for the year 2020 '000 '000 1.180 (680) 500 200 66 (266) 234 (80) 154 (70) 84 2021 '000 '000 1,200 (750) 450 208 75 8 (291) 159 (48) 111 (72) 39 8237 38300 Balance Sheet as at 30 June Particulars 2020 '000 '000 702 2021 '000 000 687 Non current assets Current assets: Stocks Debtors Cash 148 102 3 253 236 156 4 4 396 Current liabilities: Trade creditors Other creditors and accruals Tax Bank overdraft (60) (18) (40) (81) (199) ( (76) (16) (24) (122) (238) 54 158 Net current assets Non current liabilities: Bank loan (50) 795 756 Equity: Ordinary share capital of 1 (fully paid) Retained profit 500 256 756 2191 500 295 795 Required: Calculate the following financial ratios for both 2020 and 2021 (using year-end ligures for balance sheet items) and indicate that which items of these statements are increasing and decreasing? Scenario: Threads Limited manufactures nuts and bolls, which are sold to industrial users. The abbreviated financial statements for 2020 and 2021 are as follows: Profit and loss account for the year ended 30 June Particulars Revenue Less: Cost of sales Gross profit Less: Operating expenses Depreciation Interest Profit before tax Less: Tax Profit after tax Dividend paid Retained profit for the year 2020 '000 '000 1.180 (680) 500 200 66 (266) 234 (80) 154 (70) 84 2021 '000 '000 1,200 (750) 450 208 75 8 (291) 159 (48) 111 (72) 39 8237 38300 Balance Sheet as at 30 June Particulars 2020 '000 '000 702 2021 '000 000 687 Non current assets Current assets: Stocks Debtors Cash 148 102 3 253 236 156 4 4 396 Current liabilities: Trade creditors Other creditors and accruals Tax Bank overdraft (60) (18) (40) (81) (199) ( (76) (16) (24) (122) (238) 54 158 Net current assets Non current liabilities: Bank loan (50) 795 756 Equity: Ordinary share capital of 1 (fully paid) Retained profit 500 256 756 2191 500 295 795 Required: Calculate the following financial ratios for both 2020 and 2021 (using year-end ligures for balance sheet items) and indicate that which items of these statements are increasing and decreasing