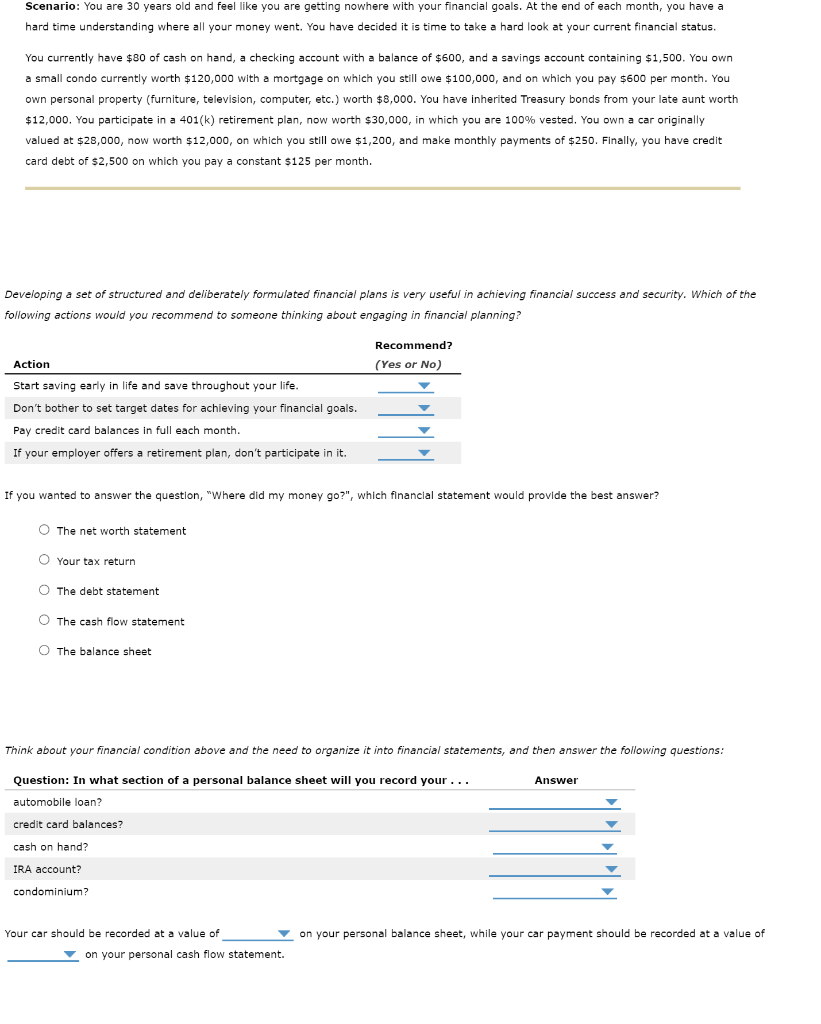

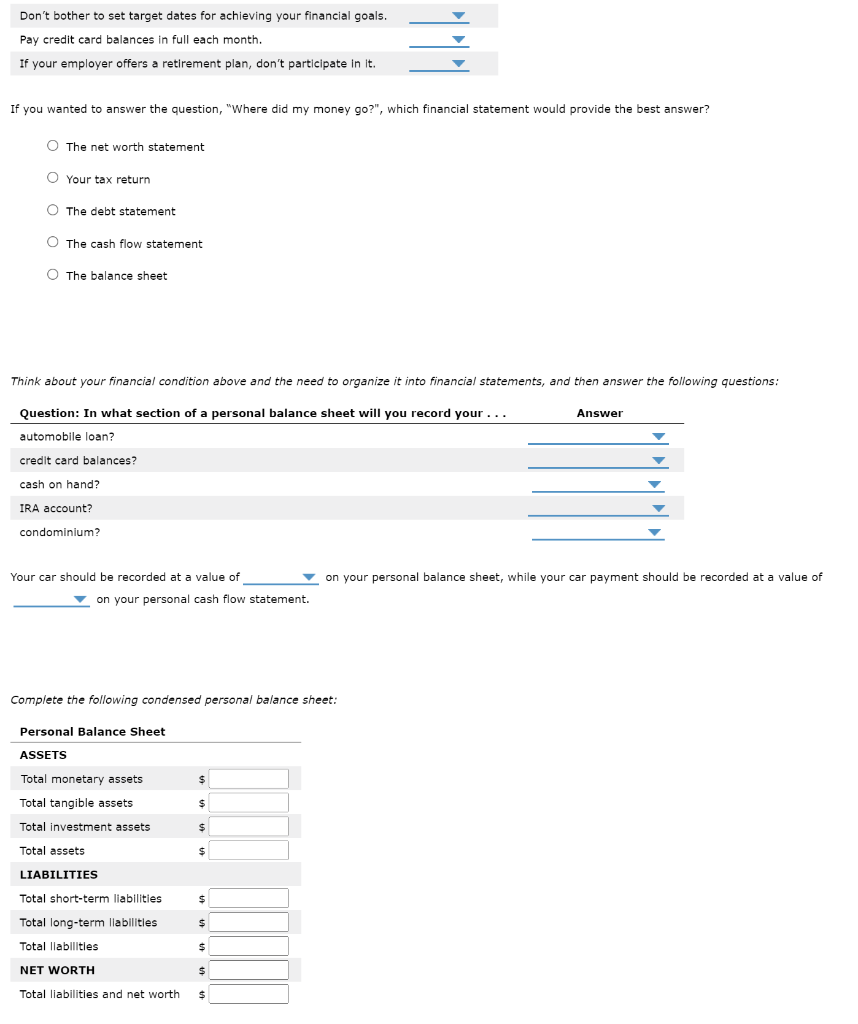

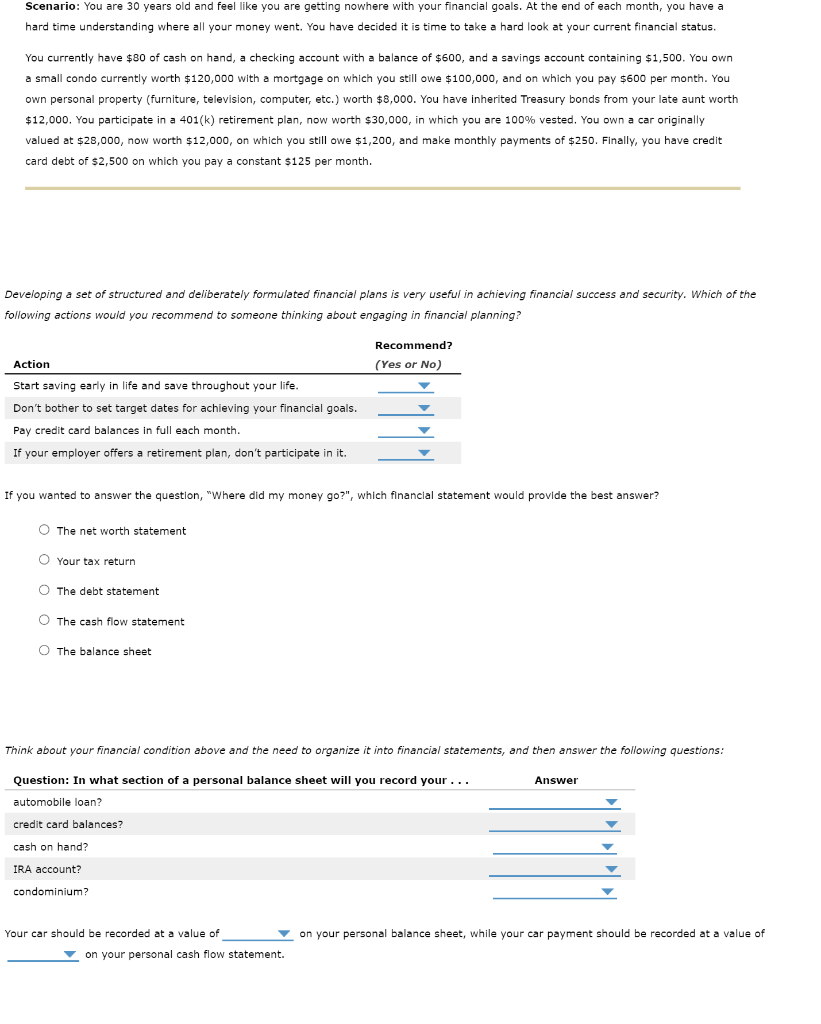

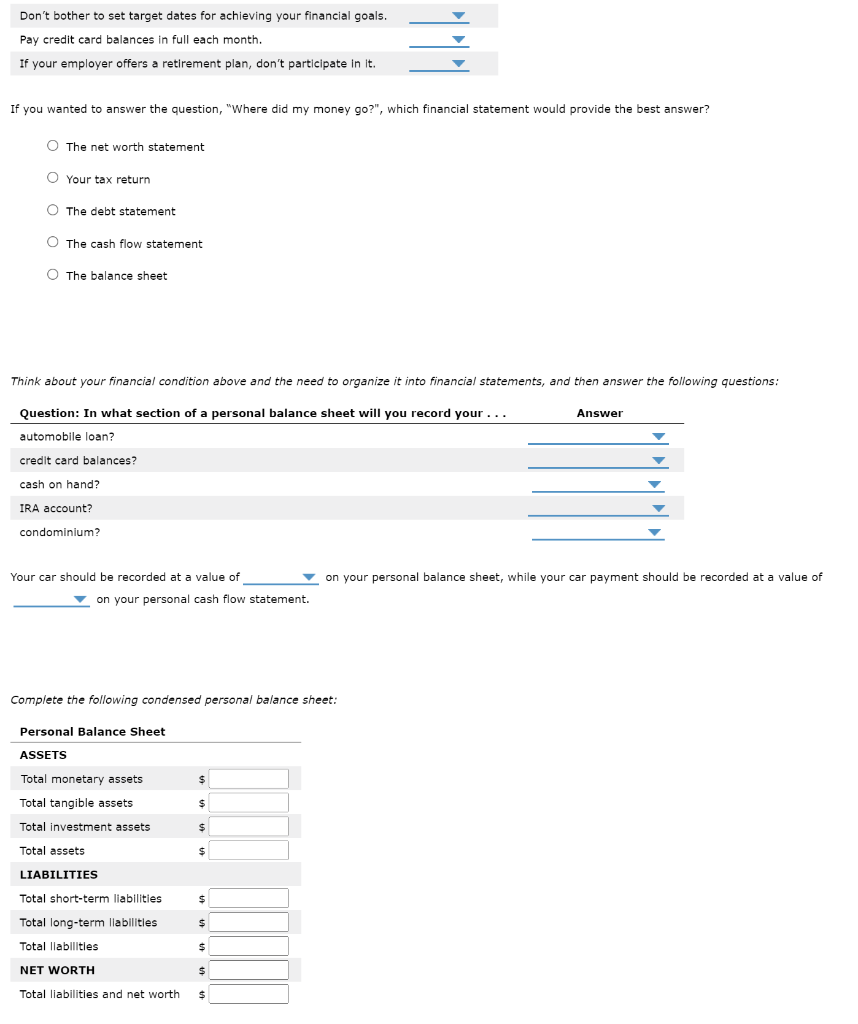

Scenario: You are 30 years old and feel like you are getting nowhere with your financial goals. At the end of each month, you have a hard time understanding where all your money went. You have decided it is time to take a hard look at your current financial status. You currently have $80 of cash on hand, a checking account with a balance of $600, and a savings account containing $1,500. You own a small condo currently worth $120,000 with a mortgage on which you still owe $100,000, and on which you pay $600 per month. You own personal property (furniture, television, computer, etc.) worth $8,000. You have inherited Treasury bonds from your late aunt worth $12,000. You participate in a 401(k) retirement plan, now worth $30,000, in which you are 100% vested. You own a car originally valued at $28,000, now worth $12,000, on which you still owe $1,200, and make monthly payments of $250. Finally, you have credit card debt of $2,500 on which you pay a constant $125 per month. Developing a set of structured and deliberately formulated financial plans is very useful in achieving financial success and security. Which of the following actions would you recommend to someone thinking about engaging in financial planning? Recommend? (Yes or No) Action Start saving early in life and save throughout your life. Don't bother to set target dates for achieving your financial goals. Pay credit card balances in full each month. If your employer offers a retirement plan, don't participate in it. If you wanted to answer the question, "Where did my money go?", which financial statement would provide the best answer? The net worth statement O Your tax return The debt statement O The cash flow statement The balance sheet Think about your financial condition above and the need to organize it into financial statements, and then answer the following questions: Answer Question: In what section of a personal balance sheet will you record your ... automobile loan? credit card balances? cash on hand? IRA account? condominium Your car should be recorded at a value of on your personal balance sheet, while your car payment should be recorded at a value of on your personal cash flow statement. Don't bother to set target dates for achieving your financial goals. Pay credit card balances in full each month. If your employer offers a retirement plan, don't participate in it. 111 If you wanted to answer the question, "Where did my money go?", which financial statement would provide the best answer? The net worth statement O Your tax return O The debt statement O The cash flow statement O The balance sheet Think about your financial condition above and the need to organize it into financial statements, and then answer the following questions: Question: In what section of a personal balance sheet will you record your ... Answer automobile loan? credit card balances? cash on hand? IRA account? condominium? Your car should be recorded at a value of on your personal balance sheet, while your car payment should be recorded at a value of on your personal cash flow statement. Complete the following condensed personal balance sheet: Personal Balance Sheet ASSETS Total monetary assets $ $ Total tangible assets Total investment assets $ Total assets $ LIA $ Total short-term liabilities Total long-term liabilities $ Total llabilities $ NET WORTH $ Total liabilities and net worth $