Question

Scenario You are the financial analyst of an investment company. The managing director of your company is considering to diversify its investment into a healthcare

Scenario You are the financial analyst of an investment company. The managing director of your company is considering to diversify its investment into a healthcare company as the healthcare industry has benefited greatly from the Covid-19 pandemic. You are assigned with the role to analyse and propose a good healthcare company to be invested from Bursa Malaysia. After conducting a preliminary selection, you found that Top Glove Corporation Berhad has the potential for generating a good return of investment in the near future. With that, you decided to conduct an in-depth analysis on the company.

Task 2

By using the annual report of the company, discuss the below mentioned questions. You are required to produce your answers by referring to the relevant sections in the annual report.

1. Name and background of company.

2. Using the annual report, provide and comment on the following: The performance of the company as compared to previous year. You need to analyse the items under the consolidated statement of profit or loss for both years 2019 and 2020 in order to provide a detailed analysis on this part.

3. Calculate the profitability, liquidity and efficiency ratios of the company (use the following ratios: gross profit margin, net profit margin, return on capital employed, quick ratio, current ratio, accounts receivable turnover, accounts payables turnover, inventory turnover) for year 2019 and 2020.

4. Critically evaluate the ratios calculated above, and comment on your analysis.

5. Provide recommendations to your managing director on whether the company should invest in Top Glove Corporation Berhad based on fundamental analysis (ratios analysis)Required length –

1,000 words

You must attach a copy of relevant pages (not the whole) of the annual report, highlighting the information/figures cited.

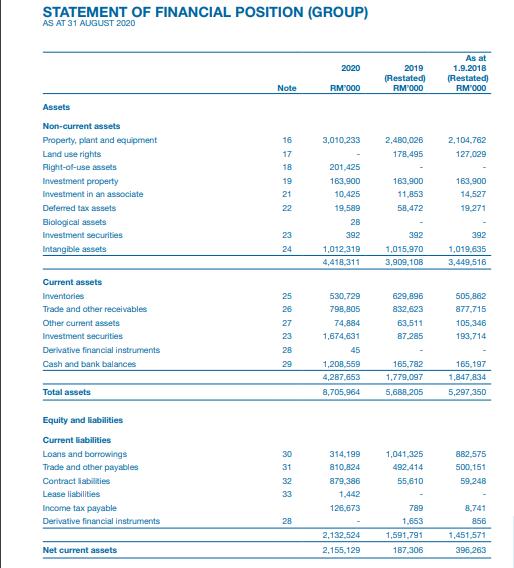

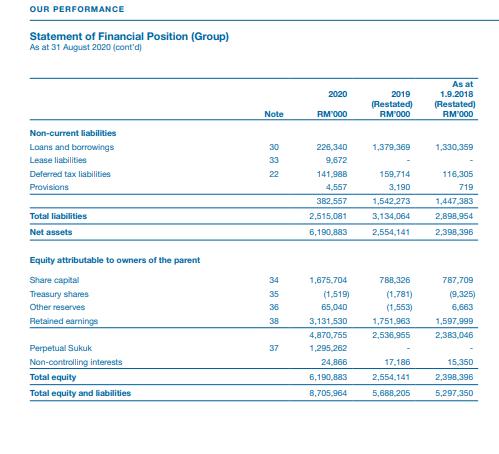

STATEMENT OF FINANCIAL POSITION (GROUP) AS AT 31 AUGUST 2020 As at 2020 2019 1.9.2018 (Restated) RM'000 (Restated) RM'000 Note RM000 Assets Non-current assets Property, plant and equipment 16 3,010,233 2,480,026 2,104,762 Land use rights 17 178,495 127,029 Right-of-use assets 18 201,425 Investment property 19 163,900 163,900 163,900 Investment in an associate 21 10,425 11,853 14,527 Deferred tax assets 22 19,589 58,472 19,271 Biological assets 28 Investment securities 23 392 392 392 Intangible assets 1,019,635 24 1,012,319 1,015,970 4,418,311 3,909,108 3,449,516 Current assets Inventories 25 530,729 629,896 505.862 Trade and other receivables 26 798,805 832,623 877,715 Other current assets 27 74,884 63,511 105,346 Investment securities 23 1,674,631 87.285 193,714 Derivative financial instruments 28 45 Cash and bank balances 29 1,208,559 165,782 165,197 4,287,653 1,779,097 1,847,834 Total assets 8,705,964 5,688,205 5,297,350 Equity and liabilities Current liabilities Loans and borrowings 30 314,199 1,041,325 882,575 Trade and other payables 31 810,824 492,414 500,151 Contract liabilities 32 879.386 55,610 59,248 Lease liabilities 33 1,442 Income tax payable 126,673 789 8,741 Derivative financial instruments 28 1,653 856 2,132,524 1,591,791 1,451,571 Net current assets 2,155,129 187.306 396,263

Step by Step Solution

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Analysis of Financial Statement of Top Glove Corporation Berhad 1 Name and background of company a Name of Company TOP GLOVE CORPORATION BERHAD b Background i Established in 1991 and headquartered in ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started