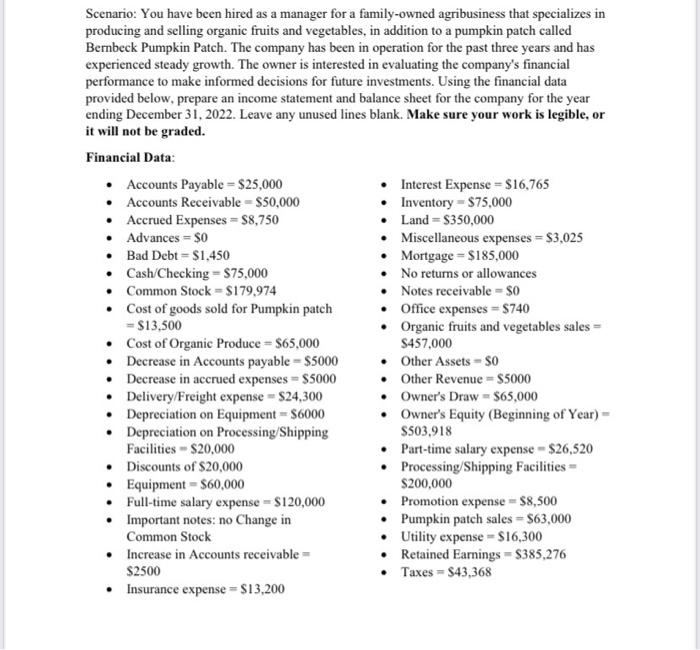

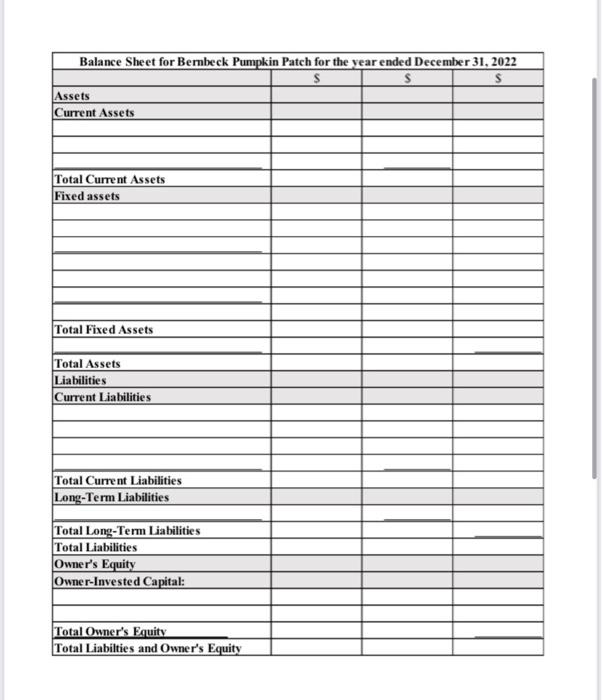

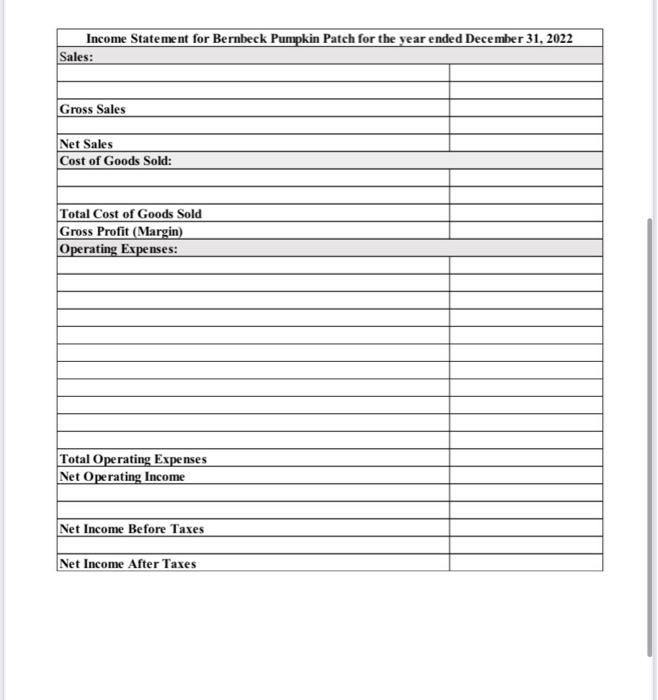

Scenario: You have been hired as a manager for a family-owned agribusiness that specializes in producing and selling organic fruits and vegetables, in addition to a pumpkin patch called Bernbeck Pumpkin Patch. The company has been in operation for the past three years and has experienced steady growth. The owner is interested in evaluating the company's financial performance to make informed decisions for future investments. Using the financial data provided below, prepare an income statement and balance sheet for the company for the year ending December 31, 2022. Leave any unused lines blank. Make sure your work is legible, or it will not be graded. Financial Data: - Accounts Payable =$25,000 - Interest Expense =$16,765 - Accounts Receivable =$50,000 - Inventory =$75,000 - Accrued Expenses = $8,750 - Land =$350,000 - Advances =$0 - Miscellaneous expenses =$3,025 - Bad Debt =$1,450 - Mortgage =$185,000 - Cash/Checking =$75,000 - No returns or allowances - Common Stock = $179,974 - Notes receivable =$0 - Cost of goods sold for Pumpkin patch - Office expenses =$740 =$13,500 - Organic fruits and vegetables sales = - Cost of Organic Produce =$65,000 $457,000 - Decrease in Accounts payable =$5000 - Other Assets =$0 - Decrease in accrued expenses =$5000 - Other Revenue =$5000 - Delivery/Freight expense =$24,300 - Owner's Draw =$65,000 - Depreciation on Equipment =$6000 - Owner's Equity (Beginning of Year) = - Depreciation on Processing/Shipping $503,918 Facilities =$20,000 - Part-time salary expense =$26,520 - Discounts of $20,000 - Processing/Shipping Facilities = - Equipment =$60,000 $200,000 - Full-time salary expense =$120,000 - Promotion expense =$8,500 - Important notes: no Change in - Pumpkin patch sales =$63,000 Common Stock - Utility expense =$16,300 - Increase in Accounts receivable = - Retained Earnings = $385,276 $2500 - Taxes =$43,368 - Insurance expense =$13,200 Scenario: You have been hired as a manager for a family-owned agribusiness that specializes in producing and selling organic fruits and vegetables, in addition to a pumpkin patch called Bernbeck Pumpkin Patch. The company has been in operation for the past three years and has experienced steady growth. The owner is interested in evaluating the company's financial performance to make informed decisions for future investments. Using the financial data provided below, prepare an income statement and balance sheet for the company for the year ending December 31, 2022. Leave any unused lines blank. Make sure your work is legible, or it will not be graded. Financial Data: - Accounts Payable =$25,000 - Interest Expense =$16,765 - Accounts Receivable =$50,000 - Inventory =$75,000 - Accrued Expenses = $8,750 - Land =$350,000 - Advances =$0 - Miscellaneous expenses =$3,025 - Bad Debt =$1,450 - Mortgage =$185,000 - Cash/Checking =$75,000 - No returns or allowances - Common Stock = $179,974 - Notes receivable =$0 - Cost of goods sold for Pumpkin patch - Office expenses =$740 =$13,500 - Organic fruits and vegetables sales = - Cost of Organic Produce =$65,000 $457,000 - Decrease in Accounts payable =$5000 - Other Assets =$0 - Decrease in accrued expenses =$5000 - Other Revenue =$5000 - Delivery/Freight expense =$24,300 - Owner's Draw =$65,000 - Depreciation on Equipment =$6000 - Owner's Equity (Beginning of Year) = - Depreciation on Processing/Shipping $503,918 Facilities =$20,000 - Part-time salary expense =$26,520 - Discounts of $20,000 - Processing/Shipping Facilities = - Equipment =$60,000 $200,000 - Full-time salary expense =$120,000 - Promotion expense =$8,500 - Important notes: no Change in - Pumpkin patch sales =$63,000 Common Stock - Utility expense =$16,300 - Increase in Accounts receivable = - Retained Earnings = $385,276 $2500 - Taxes =$43,368 - Insurance expense =$13,200