Question

Scenario: You purchased a new vehicle for $16,000 on Dec 1, 2013. Your first monthly payment will be due on January 1, 2014. The interest

Scenario: You purchased a new vehicle for $16,000 on Dec 1, 2013. Your first monthly payment will be due on January 1, 2014. The interest rate is 3.50% and the finance period is 4 years. Calculate now.

Answer: If you calculated $692.90 or somewhere close to that, you have made the same mistake as the student in my example. Think about how you have calculated this, and why this does not make sense. If you are questioning the interest rate, the interest rate does not say it is a monthly rate, quarterly rate, or etc; so it is a yearly rate. I worded the problem this way on purpose to help you be aware of the fact that real-life problems as well as many of the problems in Chapter 3 and on the tests are worded this way (leaving out the words yearly rate). Anytime a problem does not specify the rate per ??? (month, etc), then it is always a yearly rate. Re-calculate.

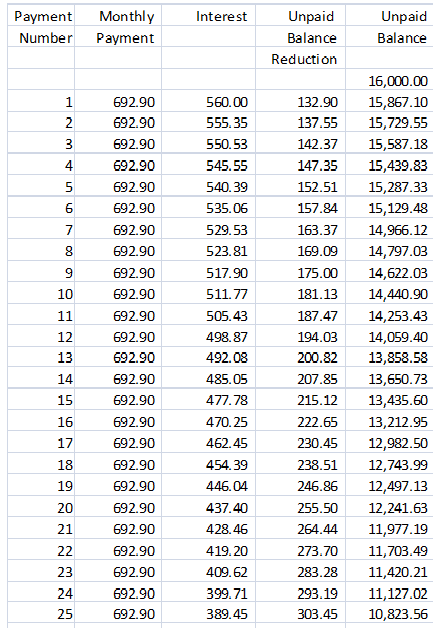

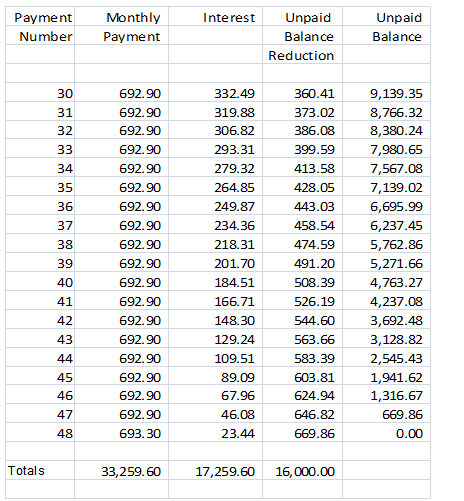

Did you get $357.70 now or the first time? I rounded the monthly interest rate. Take the yearly rate 0.035 and divide by 12 = 0.00291666667. Always round on the second digit that repeats. So, I used 0.0029167 in my formula. In my scenario, I had the student prepare a monthly amortization schedule similar to Table 1 on page 158 in your book. The amortization schedule in Figure A below is what the student prepared. Create your amortization schedule using the correct monthly payment and compare the differences.

1. How would a student determine there is a huge red flag in this answer just by using some basic calculations? Show some calculations.

2. In reality, what yearly interest rate was the formula using?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started