Question

Scenario: You were recently hired as an entry-level bookkeeper for a service business that recently opened. This is the first month in operation for the

Scenario: You were recently hired as an entry-level bookkeeper for a service business that recently opened. This is the first month in operation for the business and your first task is to record business transactions for their first month using the source documents and transaction data the owner will provide to you. Because this is a small business that does not use computerized accounting, you will apply the accounting cycle in Excel to record transactions and generate financial reporting results for the owner.

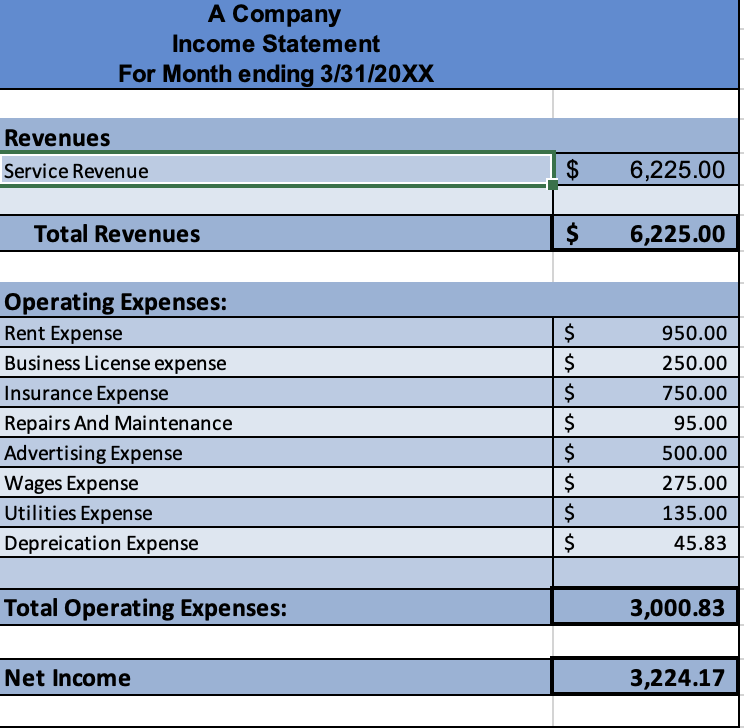

a. Discuss the results regarding the profitability of the first month of operations, and consider how well the company is positioned to meet current liabilities. Be sure to include the percentage of revenues that result in profitet income and the current ratio when discussing profitability and liquidity based on the recorded months results. Consider key points in your observations of results: is the company operating profitably (what percent of revenues result in profitet income)? How well-poised are they to meet liabilities (discuss liquidity and current ratio)?

b. Discuss accounting considerations associated with the acquisition of additional long-term/fixed assets, and the addition of merchandise inventory. How will the company account for the costs of long-term assets? How will the method of depreciation be determined? (Expand on 2 different methods of depreciation to demonstrate the ideal application). How does accounting change with the addition of merchandise inventory? How will it be determined which inventory costing method to apply? (Discuss how the FIFO, LIFO, and Average methods differ and provide examples of the types of merchandising scenarios that would be ideally applicable in each case.

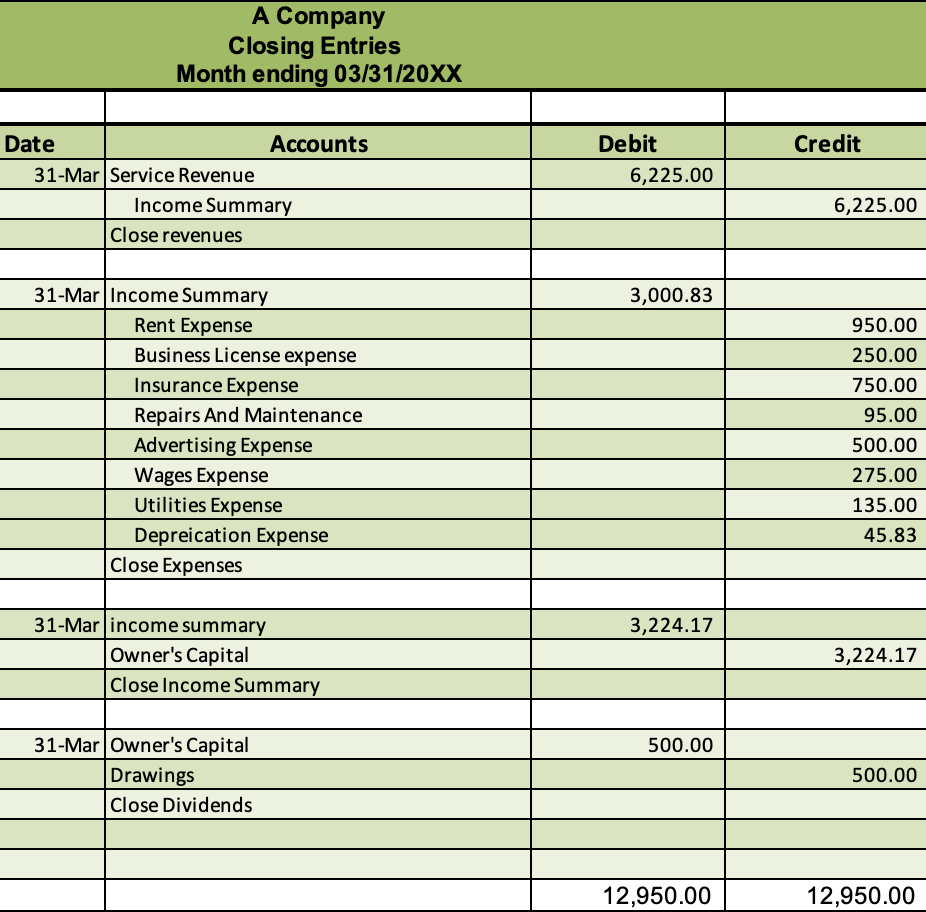

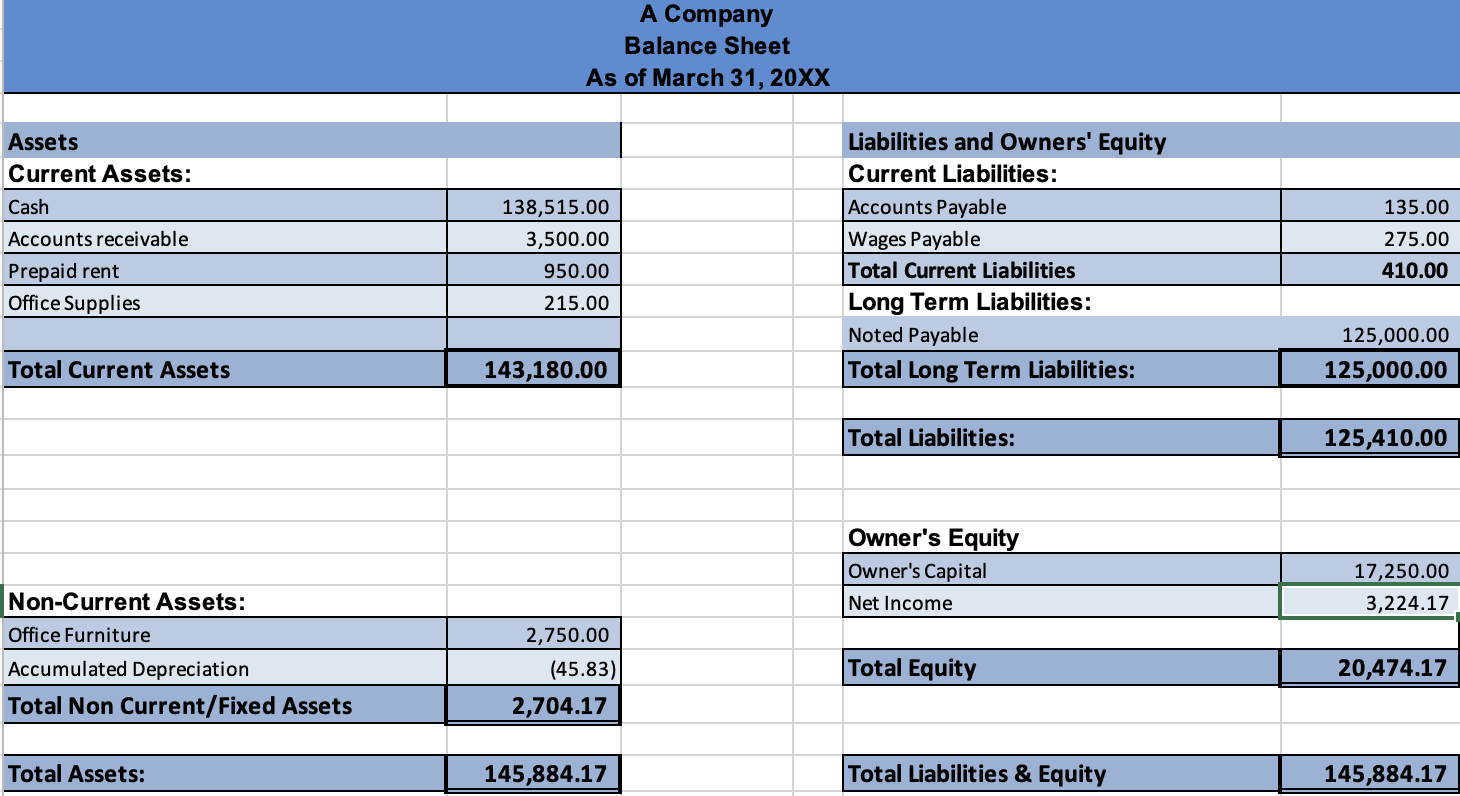

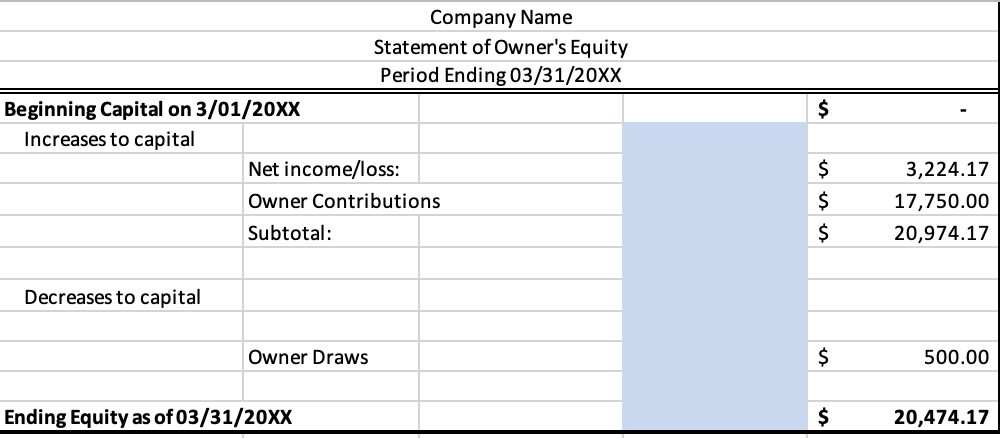

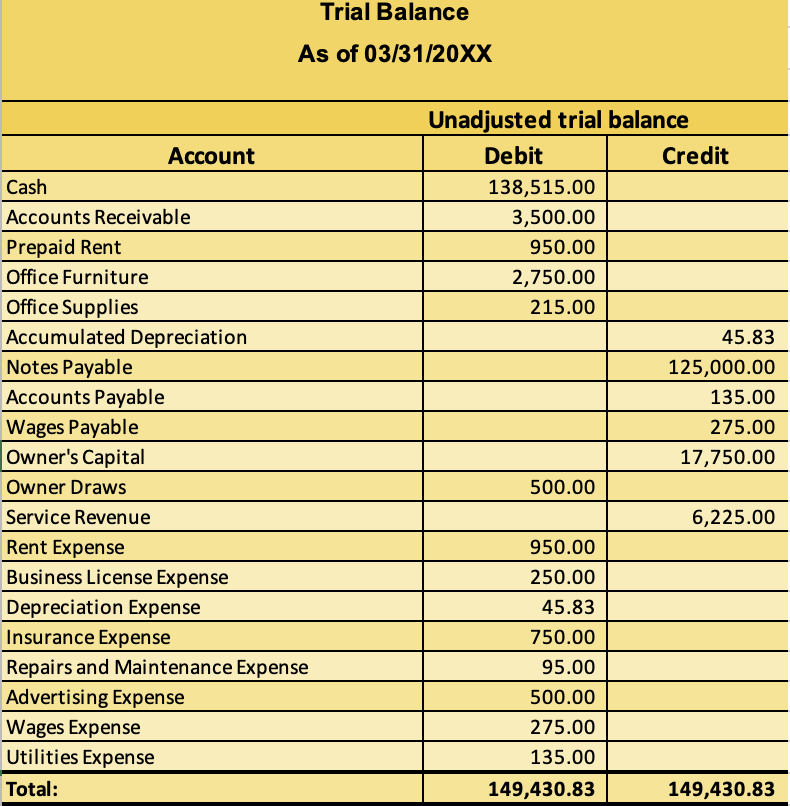

A Company Closing Entries Month ending 03/31/20XX A Company Balance Sheet As of March 31, 20XX Assets Current Assets: \begin{tabular}{l|r|} \hline Cash & 138,515.00 \\ \hline Accounts receivable & 3,500.00 \\ \hline Prepaid rent & 950.00 \\ \hline Office Supplies & 215.00 \\ \hline & \\ \hline Total Current Assets & 143,180.00 \\ \hline \end{tabular} Non-Current Assets: Office Furniture Accumulated Depreciation Total Non Current/Fixed Assets \begin{tabular}{l|r|} \hline Total Assets: & 145,884.17 \\ \hline \end{tabular} Liabilities and Owners' Equity Current Liabilities: \begin{tabular}{|l|r|} \hline Accounts Payable & 135.00 \\ \hline Wages Payable & 275.00 \\ \hline Total Current Liabilities & 410.00 \\ \hline Long Term Liabilities: & \\ \hline Noted Payable & 125,000.00 \\ \hline Total Long Term Liabilities: & 125,000.00 \\ \hline \end{tabular} \begin{tabular}{|l|r|} \hline Total Liabilities: & 125,410.00 \\ \hline \end{tabular} Owner's Equity \begin{tabular}{|l|r|} \hline Owner's Capital & 17,250.00 \\ \hline Net Income & 3,224.17 \\ \hline & \\ \hline Total Equity & 20,474.17 \\ \hline & \\ \hline Total Liabilities \& Equity & 145,884.17 \\ \hline \end{tabular} Company Name Statement of Owner's Equity Period Ending 03/31/20XX A Company Income Statement For Month ending 3/31/20XX Revenues \begin{tabular}{|c|lr|} \hline Service Revenue & $ & 6,225.00 \\ \hline Total Revenues & $ & 6,225.00 \\ \hline \end{tabular} \begin{tabular}{|l|rr|} \hline Operating Expenses: & & \\ \hline Rent Expense & $ & 950.00 \\ \hline Business License expense & $ & 250.00 \\ \hline Insurance Expense & $ & 750.00 \\ \hline Repairs And Maintenance & $ & 95.00 \\ \hline Advertising Expense & $ & 500.00 \\ \hline Wages Expense & $ & 275.00 \\ \hline Utilities Expense & $ & 135.00 \\ \hline Depreication Expense & $ & 45.83 \\ \hline & & \\ \hline Total Operating Expenses: & & 3,000.83 \\ \hline & & \\ \hline Net Income & & \\ \hline \end{tabular} Trial Balance As of 03/31/20XX \begin{tabular}{l|r|r} \hline \multicolumn{3}{|c}{ Unadjusted trial balance } \\ \hline \multicolumn{1}{|c|}{ Account } & \multicolumn{1}{c}{ Debit } & \multicolumn{1}{c}{ Credit } \\ \hline Cash & 138,515.00 & \\ \hline Accounts Receivable & 3,500.00 & \\ \hline Prepaid Rent & 950.00 & \\ \hline Office Furniture & 2,750.00 & \\ \hline Office Supplies & 215.00 & \\ \hline Accumulated Depreciation & & 45.83 \\ \hline Notes Payable & & 125,000.00 \\ \hline Accounts Payable & & 135.00 \\ \hline Wages Payable & & 275.00 \\ \hline Owner's Capital & & 17,750.00 \\ \hline Owner Draws & & \\ \hline Service Revenue & & 650.225 .00 \\ \hline Rent Expense & 250.00 & \\ \hline Business License Expense & 45.83 & \\ \hline Depreciation Expense & 750.00 & \\ \hline Insurance Expense & 95.00 & \\ \hline Repairs and Maintenance Expense & 500.00 & \\ \hline Advertising Expense & 275.00 & \\ \hline Wages Expense & 135.00 & \\ \hline Utilities Expense & 149,430.83 & 149,430.83 \\ \hline Total: & & \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started