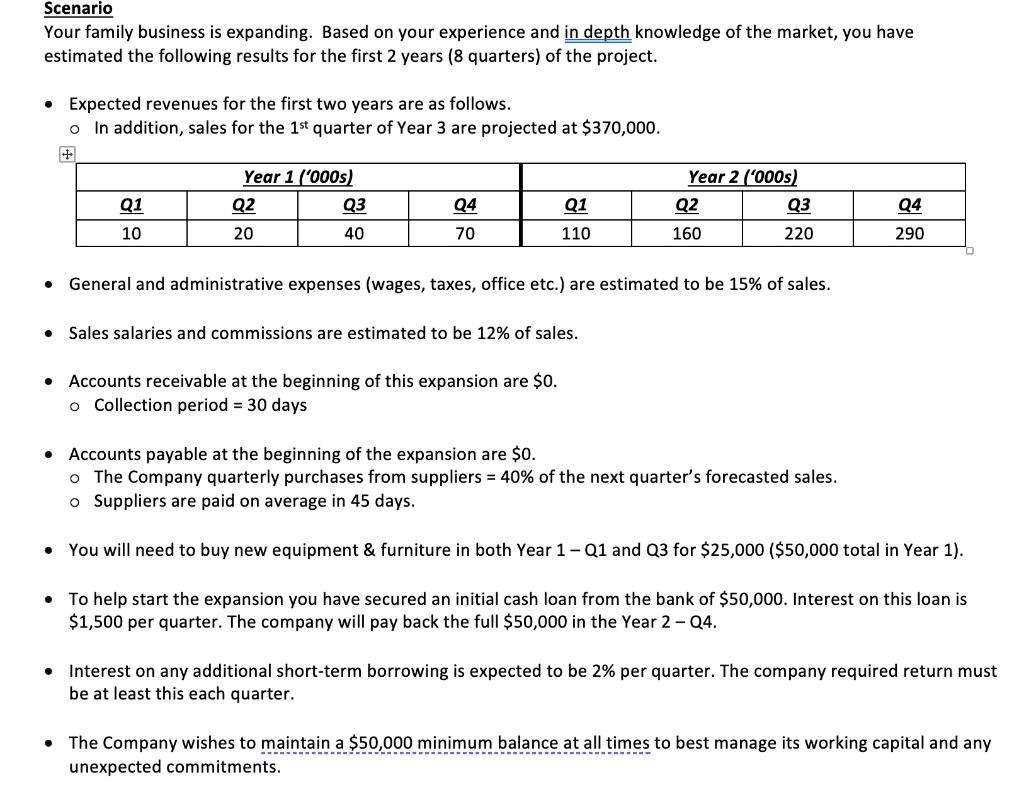

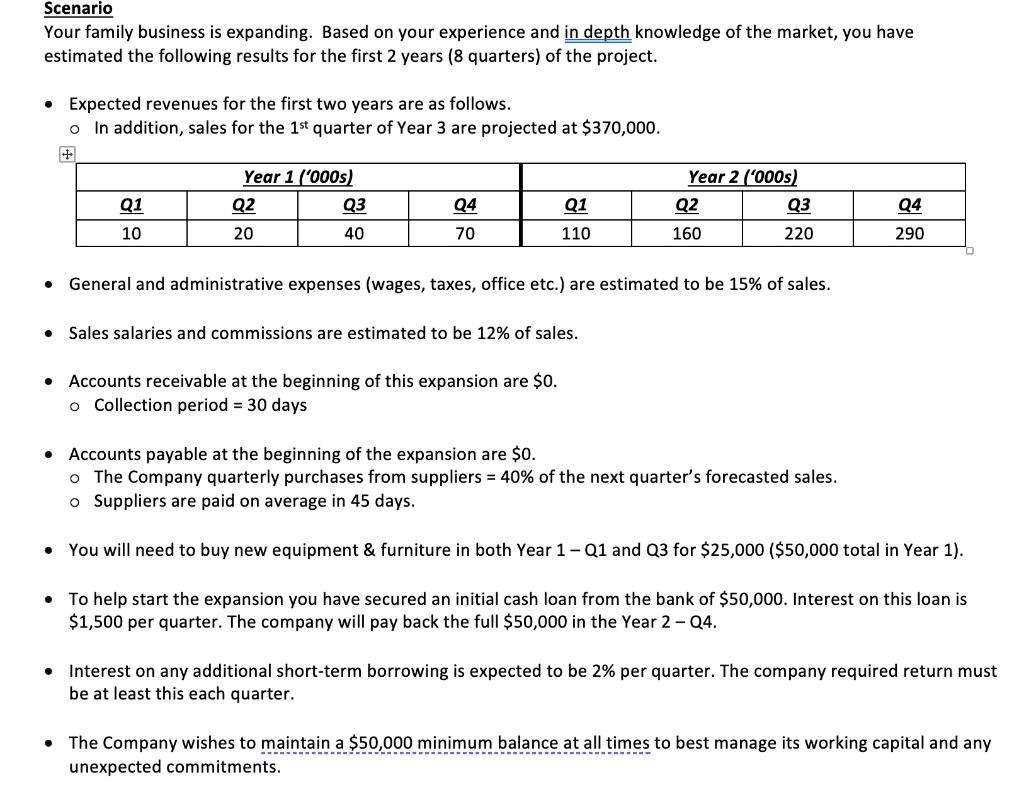

Scenario Your family business is expanding. Based on your experience and in depth knowledge of the market, you have estimated the following results for the first 2 years (8 quarters) of the project. Expected revenues for the first two years are as follows. o In addition, sales for the 1st quarter of Year 3 are projected at $370,000. + Year 1 ('000) Q2 Q3 Q4 Q1 Year 2 ('000s) Q2 Q3 220 Q1 10 Q4 20 40 70 110 160 290 . General and administrative expenses (wages, taxes, office etc.) are estimated to be 15% of sales. . Sales salaries and commissions are estimated to 12% of sales. Accounts receivable at the beginning of this expansion are $0. o Collection period = 30 days . Accounts payable at the beginning of the expansion are $0. o The Company quarterly purchases from suppliers = 40% of the next quarter's forecasted sales. o Suppliers are paid on average in 45 days. You will need to buy new equipment & furniture in both Year 1 - Q1 and Q3 for $25,000 ($50,000 total in Year 1). To help start the expansion you have secured an initial cash loan from the bank of $50,000. Interest on this loan is $1,500 per quarter. The company will pay back the full $50,000 in the Year 2-Q4. . Interest on any additional short-term borrowing is expected to be 2% per quarter. The company required return must be at least this each quarter. . The Company wishes to maintain a $50,000 minimum balance at all times to best manage its working capital and any unexpected commitments. - Question #2 - (10 marks) 300-500 words 1. What are your thoughts on the viability of the expansion? Consider Both the above budgets b. Some of the project evaluation tools from Chapters 9 & 10. a. Scenario Your family business is expanding. Based on your experience and in depth knowledge of the market, you have estimated the following results for the first 2 years (8 quarters) of the project. Expected revenues for the first two years are as follows. o In addition, sales for the 1st quarter of Year 3 are projected at $370,000. + Year 1 ('000) Q2 Q3 Q4 Q1 Year 2 ('000s) Q2 Q3 220 Q1 10 Q4 20 40 70 110 160 290 . General and administrative expenses (wages, taxes, office etc.) are estimated to be 15% of sales. . Sales salaries and commissions are estimated to 12% of sales. Accounts receivable at the beginning of this expansion are $0. o Collection period = 30 days . Accounts payable at the beginning of the expansion are $0. o The Company quarterly purchases from suppliers = 40% of the next quarter's forecasted sales. o Suppliers are paid on average in 45 days. You will need to buy new equipment & furniture in both Year 1 - Q1 and Q3 for $25,000 ($50,000 total in Year 1). To help start the expansion you have secured an initial cash loan from the bank of $50,000. Interest on this loan is $1,500 per quarter. The company will pay back the full $50,000 in the Year 2-Q4. . Interest on any additional short-term borrowing is expected to be 2% per quarter. The company required return must be at least this each quarter. . The Company wishes to maintain a $50,000 minimum balance at all times to best manage its working capital and any unexpected commitments. - Question #2 - (10 marks) 300-500 words 1. What are your thoughts on the viability of the expansion? Consider Both the above budgets b. Some of the project evaluation tools from Chapters 9 & 10. a