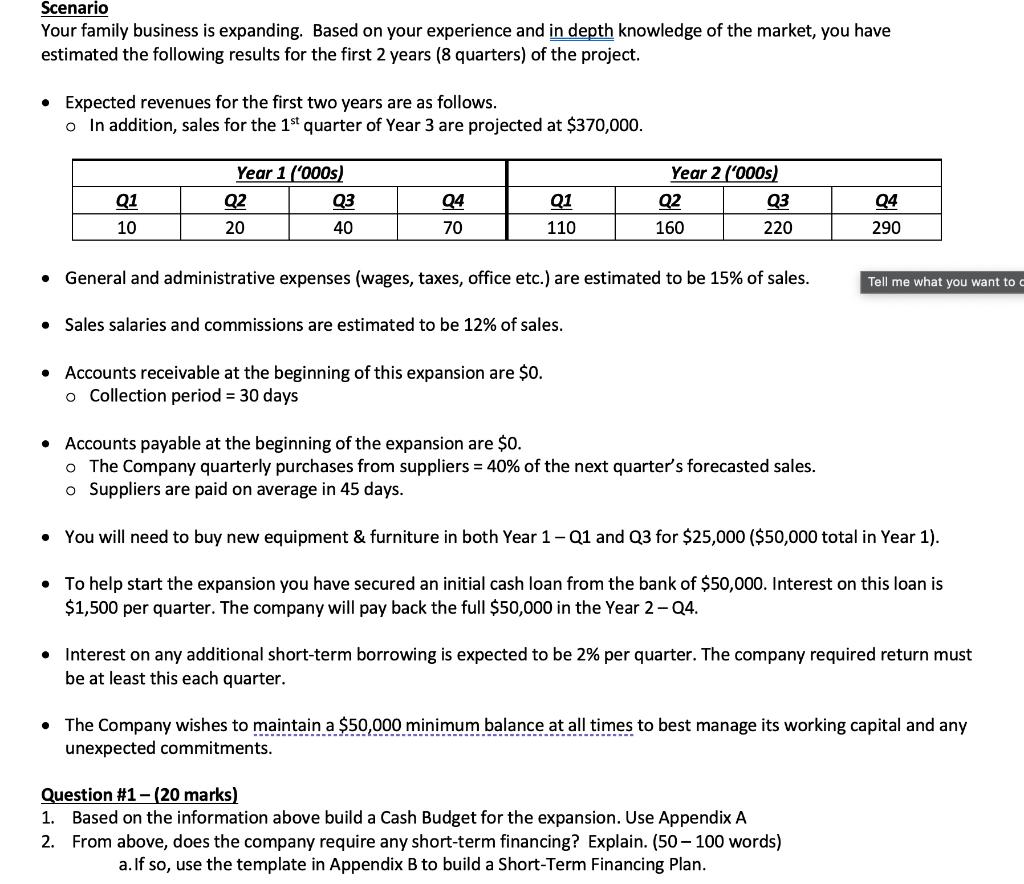

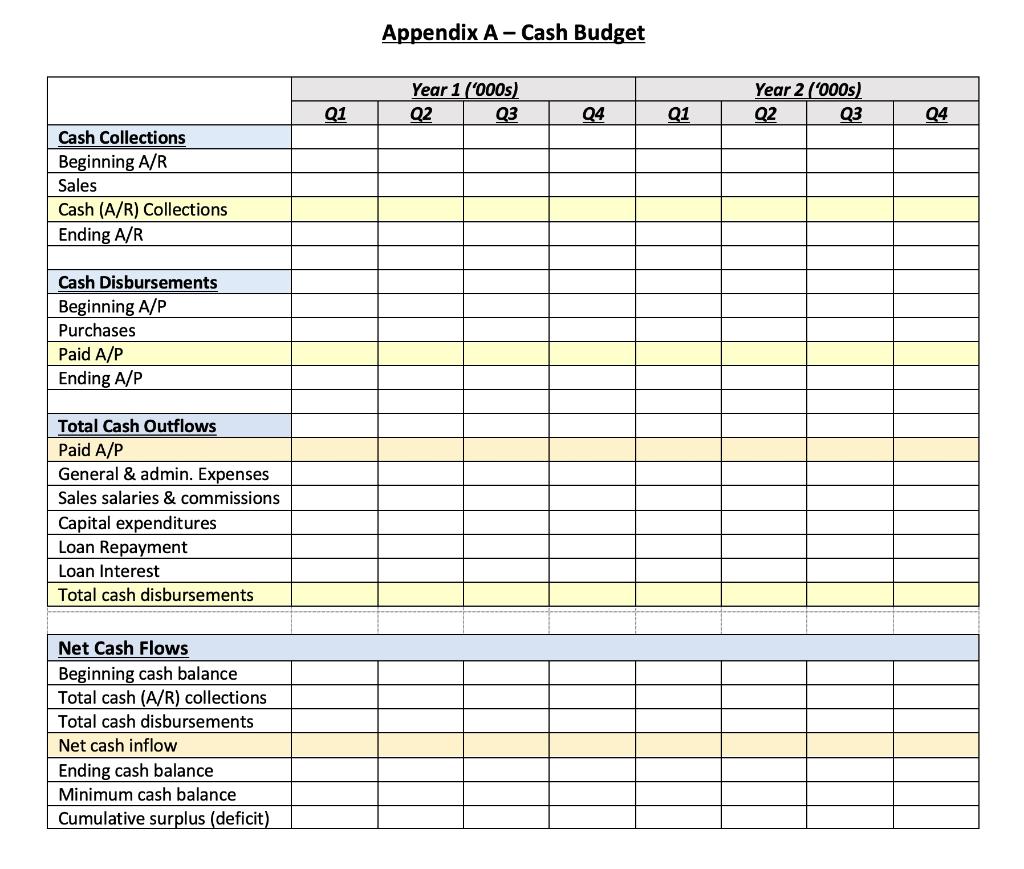

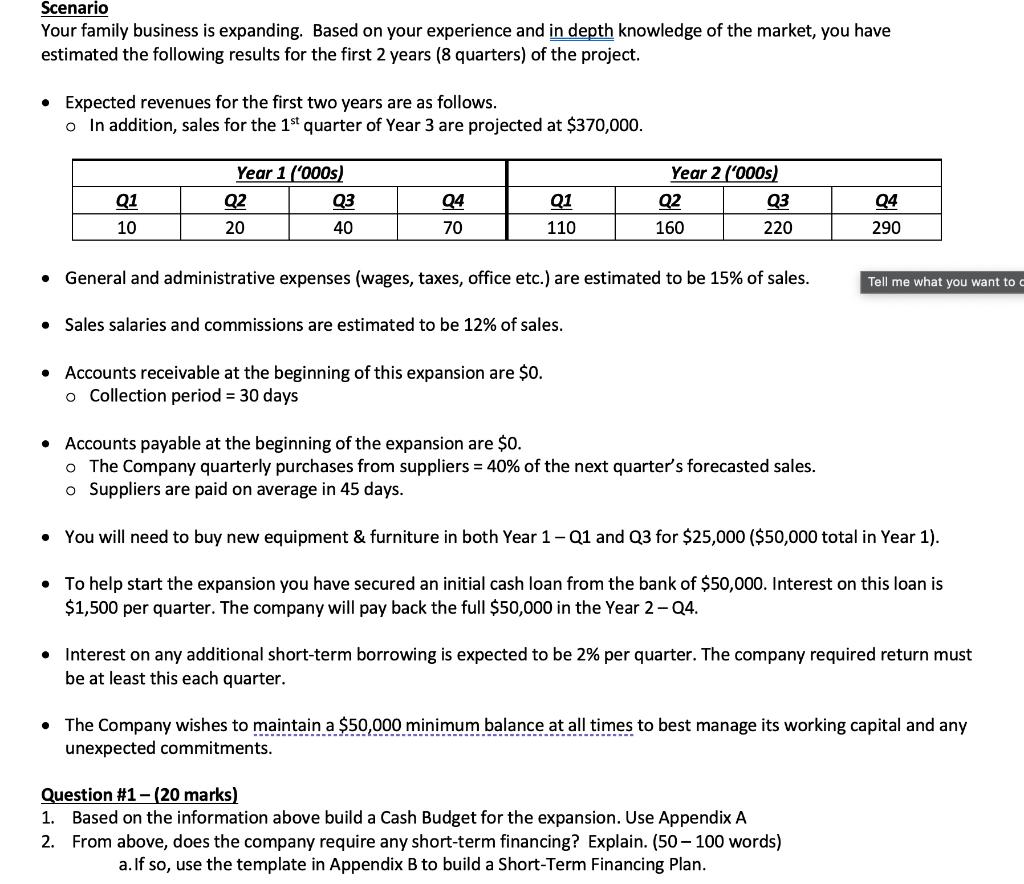

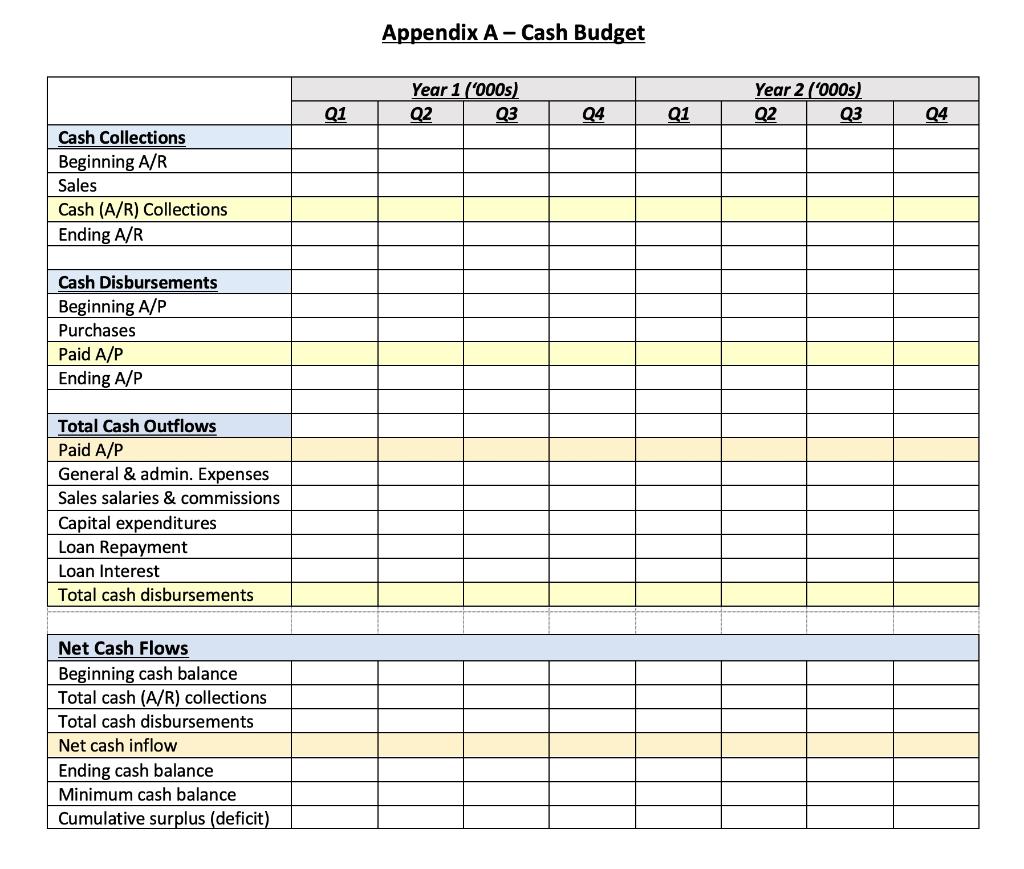

Scenario Your family business is expanding. Based on your experience and in depth knowledge of the market, you have estimated the following results for the first 2 years (8 quarters) of the project. Expected revenues for the first two years are as follows. o In addition, sales for the 1st quarter of Year 3 are projected at $370,000. Year 1 ('000s) Q2 Q3 20 40 Q1 10 24 Q1 110 Year 2 ('000) Q2 Q3 160 220 Q4 290 70 General and administrative expenses (wages, taxes, office etc.) are estimated to be 15% of sales. Tell me what you want to Sales salaries and commissions are estimated to be 12% of sales. . Accounts receivable at the beginning of this expansion are $0. o Collection period = 30 days Accounts payable at the beginning of the expansion are $0. o The Company quarterly purchases from suppliers = 40% of the next quarter's forecasted sales. o Suppliers are paid on average in 45 days. You will need to buy new equipment & furniture in both Year 1-Q1 and Q3 for $25,000 ($50,000 total in Year 1). To help start the expansion you have secured an initial cash loan from the bank of $50,000. Interest on this loan is $1,500 per quarter. The company will pay back the full $50,000 in the Year 2-Q4. Interest on any additional short-term borrowing is expected to be 2% per quarter. The company required return must be at least this each quarter. . The Company wishes to maintain a $50,000 minimum balance at all times to best manage its working capital and any unexpected commitments. Question #1 - (20 marks) 1. Based on the information above build a Cash Budget for the expansion. Use Appendix A 2. From above, does the company require any short-term financing? Explain. (50 - 100 words) a.If so, use the template in Appendix B to build a Short-Term Financing Plan. Appendix A-Cash Budget Year 1 (000s) Q2 Q3 [ Year 2000s) Q2 Q3 Q1 Q4 Q1 Q4 Cash Collections Beginning A/R Sales Cash (A/R) Collections Ending A/R Cash Disbursements Beginning A/P Purchases Paid A/P Ending A/P Total Cash Outflows Paid A/P General & admin. Expenses Sales salaries & commissions Capital expenditures Loan Repayment Loan Interest Total cash disbursements Net Cash Flows Beginning cash balance Total cash (A/R) collections Total cash disbursements Net cash inflow Ending cash balance Minimum cash balance Cumulative surplus (deficit)