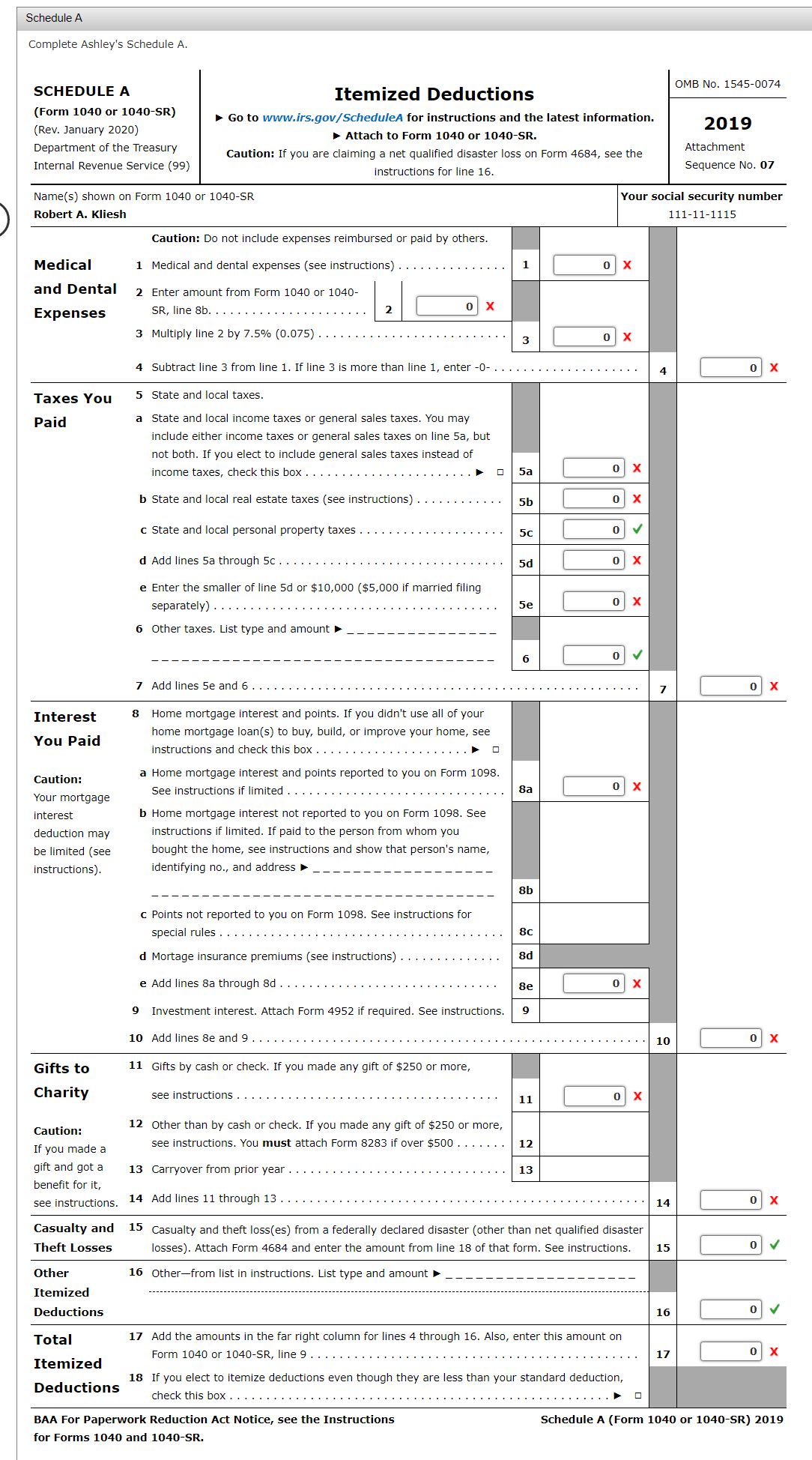

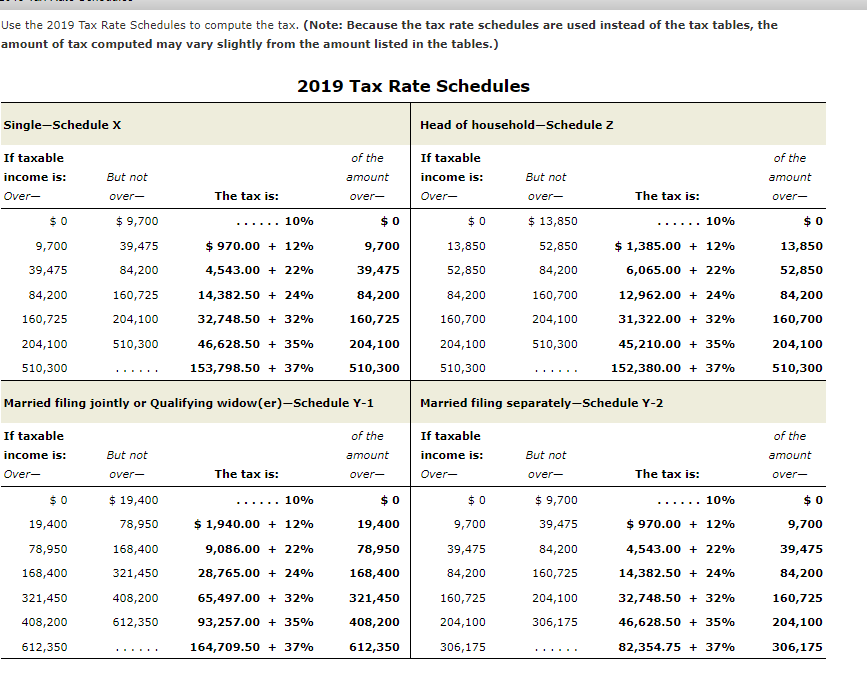

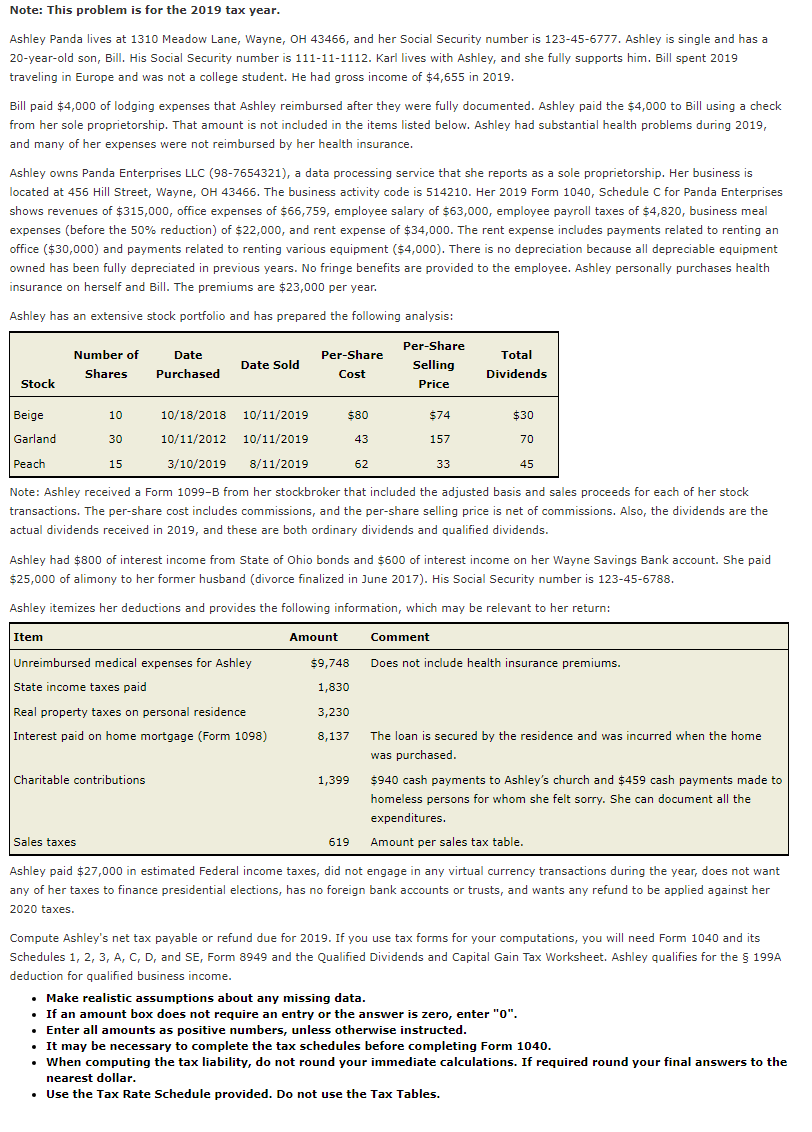

Schedule A Complete Ashley's Schedule A. OMB No. 1545-0074 SCHEDULE A Itemized Deductions (Form 1040 or 1040-SR) Go to www.irs.gov/ScheduleA for instructions and the latest information. (Rev. January 2020) 2019 Attach to Form 1040 or 1040-SR. Department of the Treasury Caution: If you are claiming a net qualified disaster loss on Form 4684, see the Attachment Internal Revenue Service (99) nce No. 07 instructions for line 16. Name(s) shown on Form 1040 or 1040-SR Your social security number Robert A. Kliesh 111-11-1115 Caution: Do not include expenses reimbursed or paid by others. Medical 1 Medical and dental expenses (see instructions) . . . . . . . 1 O X and Dental 2 Enter amount from Form 1040 or 1040- Expenses SR, line 8b. . . . .. 2 O X 3 Multiply line 2 by 7.5% (0.075) . .. 3 O X 4 Subtract line 3 from line 1. If line 3 is more than line 1, enter -0- . . . . . . . . . . . . . . . . . . . . 4 O X Taxes You 5 State and local taxes. Paid a State and local income taxes or general sales taxes. You may include either income taxes or general sales taxes on line 5a, but not both. If you elect to include general sales taxes instead of income taxes, check this box . .. 5a O X b State and local real estate taxes (see instructions) . . .. 5b O X c State and local personal property taxes . . . . . 50 O V d Add lines 5a through 5c . . . . . . . . 5d O X e Enter the smaller of line 5d or $10,000 ($5,000 if married filing separately) . . . . . . . . . 5e O X 6 Other taxes. List type and amount 6 OV 7 Add lines 5e and 6 . . . . . . . . . . . . . . . . . . . . . . . .. 7 O X Interest Home mortgage interest and points. If you didn't use all of your You Paid home mortgage loan(s) to buy, build, or improve your home, see instructions and check this box . . Caution: a Home mortgage interest and points reported to you on Form 1098. See instructions if limited . . 8a O X Your mortgage interest b Home mortgage interest not reported to you on Form 1098. See deduction may instructions if limited. If paid to the person from whom you be limited (see bought the home, see instructions and show that person's name, instructions). identifying no., and address 8b c Points not reported to you on Form 1098. See instructions for special rules . . . . . . . 8c d Mortage insurance premiums (see instructions) . 8d e Add lines 8a through 8d . . . . . Be O X 9 Investment interest. Attach Form 4952 if required. See instructions. 9 10 Add lines 8e and 9 10 O X Gifts to 11 Gifts by cash or check. If you made any gift of $250 or more, Charity see instructions . . . . . . . . . 11 O X Caution: 12 Other than by cash or check. If you made any gift of $250 or more, If you made a see instructions. You must attach Form 8283 if over $500 . . . . 12 gift and got a 13 Carryover from prior year . 13 benefit for it, see instructions. 14 Add lines 11 through 13 . . 14 O X Casualty and 15 Casualty and theft loss(es) from a federally declared disaster (other than net qualified disaster Theft Losses osses). Attach Form 4684 and enter the amount from line 18 of that form. See instructions. 15 O V Other 16 Other-from list in instructions. List type and amount Itemized Deductions 16 0 Total 17 Add the amounts in the far right column for lines 4 through 16. Also, enter this amount on Form 1040 or 1040-SR, line 9 . . . . . . . . 17 O X Itemized 18 If you elect to itemize deductions even though they are less than your standard deduction, Deductions check this box . . . . . . . . . . . . . . . BAA For Paperwork Reduction Act Notice, see the Instructions Schedule A (Form 1040 or 1040-SR) 2019 for Forms 1040 and 1040-SR.Use the 2019 Tax Rate Schedules to compute the tax. (Note: Because the ta): rate schedules are used instead at the tax tables, the amount of tax computed may vary slightly fr0m the amount listed in the tables.) SingleSched ule K II" ta). hle income is: Over $ 0 9,200 30,425 34,200 160,225 204,100 510,300 But not DVE'F $ 9,200 39,425 34,200 160,225 204,100 510,300 The tax is: 2019 Tax Rate Schedules ...... 10% $ 920.I0 4, 543.0 14,332.50 32,243.50 46,623.50 153,293.50 .|_ 12% 22% 24% 32% 35% 3T% 01' the amount over 3 0 9,200 39,425 34,200 160,225 204,100 510,300 Married ling ioiny or Qualifying widow{er]Schedule Y-l Il' ta)- hle income is: Over $ 0 19,400 23,950 163,400 321,450 403,200 612,350 But not DVE'F $ 19,400 23,950 163,400 321,450 403,200 612,350 The tax is: ...... 10% s 1,94-0.ID 9,036.00 23,265.00 65,492.I0 93,251.!) 164, 709.50 + 12% 22% 24% 32% 35% 3?% 0f the amount over $ 0 19,400 23,950 163,400 321,450 403,200 612,350 Head of householdSchedule 2 If ta)- hle income is: Over $ 0 13,350 52,350 34,200 160,200 204,100 510,300 But not over 3 13,350 52,350 34,200 160,200 204,100 510,300 $ 1,335.00 + 6,065.00 + 12,962.00 + 31,322.00 + 45,210.00 + 152,330.00 + Married filing separatelySchedule Y-Z If ta)- hle income is: Over $ 0 9,200 30,425 34,200 160,225 204,100 306,125 But not over 3 9,200 39,425 34,200 160,225 204,100 306,125 $920.00 + 4,543.00 + 14,332.50 + 32,243.50 + 46,628.50 + 82,354.3'5 + 22% 24% 32% 35% 3T% 10% 12% 22% 24% 32% 35% 3T% of the amount over 3 0 13,350 52,350 34,200 160,200 204,100 510,300 of the amount over $ 0 9,200 39,425 34,200 160,225 204,100 30 6,125 Note: This problem is for the 2619 tax year. Ashley Panda lives at 1316 Meadow Lane, Il'll'ayne, OH 43466, and her Social Security number is 123-45-6??? Ashley is single and has a 26-yearold son, Bill. His Social Security number is 111-11-1112. Karl lives with Ashley, and she fully supports him. Bill spent 2619 traveling in Europe and was not a college student. He had gross income of $4,655 in 2619. Bill paid $4,666 of lodging expenses that Ashley reimbursed after they were fully documented. Ashley paid the 54,666 to Bill using a check from her sole proprietorship. That amount is not included in the items listed below. Ashley had substantial health problems during 2619, and many of her expenses were not reimbursed by her health insurance. Ashley owns Panda Enterprises LLC (93-?654321], a data processing service that she reports as a sole proprietorship. Her business is located at 456 Hill Street, 1.Itl'ayne, OH 43466. The business activity code is 514216. Her 2619 Form 1646, Schedule C for Panda Enterprises shows revenues of $315,666, ofce expenses of $66,259, employee salary of 563,666, employee payroll taxes of 54,326, business meal expenses [before the 56% reduction) of $22,666, and rent expense of $34,666. The rent expense includes payments related to renting an office ($36,666) and payments related to renting various equipment ($4,666). There is no depreciation because all depreciable equipment owned has been fully depreciated in previous years. No fringe benefits are provided to the employee. Ashley personally purchases health insurance on herself and Bill. The premiums are $23,666 per year. Ashley has an extensive stock portfolio and has prepared the following analysis: PerShare Number of Date PerShare Total Date Sold Selli Shares Purchased Cost: ng Dividends Stock Price 16f13f2613 16J'11J'2619 $36 $?4 $36 1611 1;"2612 16f11f2619 43 15? 3'6 3f16r'2619 Bfllf26l9 62 33 45 Note: Ashley received a Form 16996 from her stockbroker that included the adjusted basis and sales proceeds for each of her stock tiansactions. The per-share cost includes commissions, and the per-share selling price is net of commissions. Also, the dividends are the actual dividends received in 2619, and these are both ordinary dividends and qualied dividends. Ashley had $366 of interest income from State of Ohio bonds and 5666 of interest income on her 1.l'u'ayne Savings Bank account. She paid 525,666 of alimony to her former husband {divorce nalized in June 261?). His Social Security number is 123-45-6?33. Ashley itemizes her deductions and provides the following information, which may be relevant to her return: Item Amount Comment Unreimbursed medical expenses for Ashley $9,243 Does not include health insurance premiums. State income taxes paid 1,336 Real property taxes on personal residence 3,236 Interest paid on home mortgage {Form 1693} 3,133Ir 111e loan is secured by the residence and was incurred when the home was purchased. Charitable contributions 1,399 $946 cash payments to Ashley's church and $459 cash payments made to homeless persons for whom she felt sorry. She can document all the expenditures. Sales taxes 1519 Amount per sales tax table. Ashley paid $22,666 in estimated Federal income taxes, did not engage in any virtual currency transactions during the year, does not want any of her taxes to finance presidential elections, has no foreign bank accounts or trusts, and wants any refund to be applied against her 2626 taxes. Compute Ashley's net tax payable or refund due for 2619.1fyou use tax forms for your computations, you will need Form 1646 and its Schedules 1, 2, 3, A, C, D, and SE, Form 3949 and the Qualied Dividends and Capital Gain Tax Worksheet. Ashley qualifies for the 199A deduction for qualied business income. I Make realistic assumptions about any missing data. - If an amount box does not require an entry or tile answer is zero, enter "6". - Enter all amounts as positive numbers, unless otherwise instructed. - It may be necessary to complete the tax schedules before completing Form 164-6. I When computing tile tax liability, do not round your immediate calculations. It required round your nal answers to the nearest dollar. - Use tile Tax Rate Schedule provided. Do not use the Tax Tables