Answered step by step

Verified Expert Solution

Question

1 Approved Answer

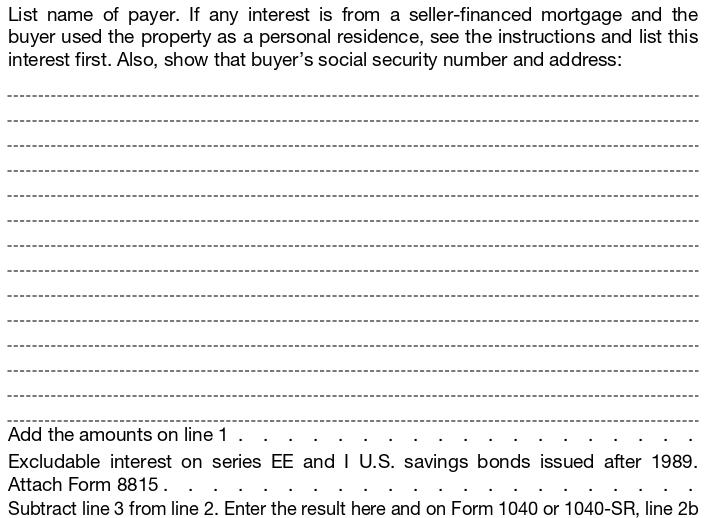

List name of payer. If any interest is from a seller-financed mortgage and the buyer used the property as a personal residence, see the

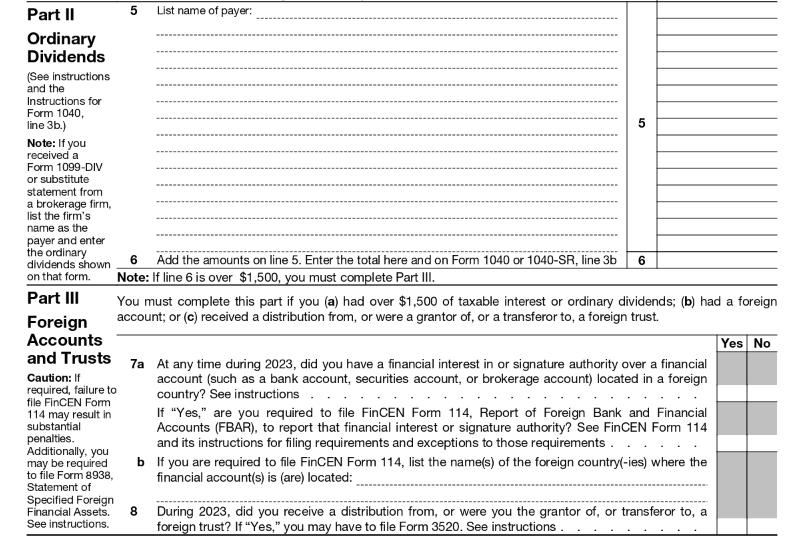

List name of payer. If any interest is from a seller-financed mortgage and the buyer used the property as a personal residence, see the instructions and list this interest first. Also, show that buyer's social security number and address: Add the amounts on line 1. Excludable interest on series EE and I U.S. savings bonds issued after 1989. Attach Form 8815... Subtract line 3 from line 2. Enter the result here and on Form 1040 or 1040-SR, line 2b Part II Ordinary Dividends (See instructions and the Instructions for Form 1040, line 3b.) Note: If you received a Form 1099-DIV or substitute statement from a brokerage firm, list the firm's name as the 5 List name of payer: 5 the ordinary payer and enter 6 Add the amounts on line 5. Enter the total here and on Form 1040 or 1040-SR, line 3b Note: If line 6 is over $1,500, you must complete Part III. 6 dividends shown on that form. Part III Foreign Accounts You must complete this part if you (a) had over $1,500 of taxable interest or ordinary dividends; (b) had a foreign account; or (c) received a distribution from, or were a grantor of, or a transferor to, a foreign trust. and Trusts 7a At any time during 2023, did you have a financial interest in or signature authority over a financial Caution: If required, failure to file FinCEN Form 114 may result in substantial penalties. Additionally, you may be required to file Form 8938, Statement of Specified Foreign Financial Assets. See instructions. account (such as a bank account, securities account, or brokerage account) located in a foreign country? See instructions. If "Yes," are you required to file FinCEN Form 114, Report of Foreign Bank and Financial Accounts (FBAR), to report that financial interest or signature authority? See FinCEN Form 114 and its instructions for filing requirements and exceptions to those requirements. b If you are required to file FinCEN Form 114, list the name(s) of the foreign country(-ies) where the financial account(s) is (are) located: 8 During 2023, did you receive a distribution from, or were you the grantor of, or transferor to, a foreign trust? If "Yes," you may have to file Form 3520. See instructions. Yes No SCHEDULE C (Form 1040) Department of the Treasury Internal Revenue Service Name of proprietor Profit or Loss From Business (Sole Proprietorship) Attach to Form 1040, 1040-SR, 1040-SS, 1040-NR, or 1041; partnerships must generally file Form 1065. Go to www.irs.gov/ScheduleC for instructions and the latest information. OMB No. 1545-0074 2023 Attachment Sequence No. 09 Social security number (SSN) A Principal business or profession, including product or service (see instructions) B Enter code from instructions Business name. If no separate business name, leave blank. D Employer ID number (EIN) (see instr.) E Business address (including suite or room no.) City, town or post office, state, and ZIP code F Accounting method: (1) Cash (2) Accrual (3) Other (specify) G Did you "materially participate" in the operation of this business during 2023? If "No," see instructions for limit on losses H If you started or acquired this business during 2023, check here . I Did you make any payments in 2023 that would require you to file Form(s) 1099? See instructions Yes No J Part I If "Yes," did you or will you file required Form(s) 1099? Yes Yes No No Income 1 Gross receipts or sales. See instructions for line 1 and check the box if this income was reported to you on Form W-2 and the "Statutory employee" box on that form was checked. 1 2 Returns and allowances. 2 3 Subtract line 2 from line 1 3 4 Cost of goods sold (from line 42) 4 5 Gross profit. Subtract line 4 from line 3 5 6 7 Other income, including federal and state gasoline or fuel tax credit or refund (see instructions) Gross income. Add lines 5 and 6 6 7 Part II Expenses. Enter expenses for business use of your home only on line 30. 8 Advertising. 8 18 Office expense (see instructions). 18 9 Car and truck expenses 19 (see instructions) 9 20 Pension and profit-sharing plans. Rent or lease (see instructions): 19 10 Commissions and fees 10 a Vehicles, machinery, and equipment 20a 11 Contract labor (see instructions) 11 b Other business property 20b 12 Depletion 12 21 Repairs and maintenance . 21 13 Depreciation and section 179 expense deduction (not included in Part III) (see instructions) 13 22 22 Supplies (not included in Part III) . 22 23 Taxes and licenses. 23 24 Travel and meals: 14 Employee benefit programs a Travel . 24a (other than on line 19) 14 b Deductible meals (see instructions) 24b 15 Insurance (other than health) 15 25 Utilities 25 16 Interest (see instructions): 26 Wages (less employment credits) 26 a Mortgage (paid to banks, etc.) 16a 27a Other expenses (from line 48). 27a b Other 16b 17 Legal and professional services 17 b Energy efficient commercial bldgs deduction (attach Form 7205). 27b 28 Total expenses before expenses for business use of home. Add lines 8 through 27b. 28 29 Tentative profit or (loss). Subtract line 28 from line 7. 29 30 Expenses for business use of your home. Do not report these expenses elsewhere. Attach Form 8829 unless using the simplified method. See instructions. Simplified method filers only: Enter the total square footage of (a) your home: and (b) the part of your home used for business: . Use the Simplified 31 Method Worksheet in the instructions to figure the amount to enter on line 30 Net profit or (loss). Subtract line 30 from line 29. 30 32 If a profit, enter on both Schedule 1 (Form 1040), line 3, and on Schedule SE, line 2. (If you checked the box on line 1, see instructions.) Estates and trusts, enter on Form 1041, line 3. If a loss, you must go to line 32. If you have a loss, check the box that describes your investment in this activity. See instructions. If you checked 32a, enter the loss on both Schedule 1 (Form 1040), line 3, and on Schedule SE, line 2. (If you checked the box on line 1, see the line 31 instructions.) Estates and trusts, enter on Form 1041, line 3. If you checked 32b, you must attach Form 6198. Your loss may be limited. For Paperwork Reduction Act Notice, see the separate instructions. Cat. No. 11334P 31 32a 32b All investment is at risk. Some investment is not at risk. Schedule C (Form 1040) 2023 Schedule C (Form 1040) 2023 Cost of Goods Sold (see instructions) Part III 33 Method(s) used to value closing inventory: 34 a Cost b Lower of cost or market Other (attach explanation) Was there any change in determining quantities, costs, or valuations between opening and closing inventory? If "Yes," attach explanation. 35 Inventory at beginning of year. If different from last year's closing inventory, attach explanation 36 Purchases less cost of items withdrawn for personal use 37 Cost of labor. Do not include any amounts paid to yourself. 38 Materials and supplies 39 Other costs. . 40 Add lines 35 through 39 41 Inventory at end of year 42 Cost of goods sold. Subtract line 41 from line 40. Enter the result here and on line 4 Part IV 35 36 37 38 39 40 41 42 Page 2 Yes No Information on Your Vehicle. Complete this part only if you are claiming car or truck expenses on line 9 and are not required to file Form 4562 for this business. See the instructions for line 13 to find out if you must file Form 4562. 43 When did you place your vehicle in service for business purposes? (month/day/year) 44 / / Of the total number of miles you drove your vehicle during 2023, enter the number of miles you used your vehicle for: a Business b Commuting (see instructions) 45 Was your vehicle available for personal use during off-duty hours? 46 Do you (or your spouse) have another vehicle available for personal use?. 47a Do you have evidence to support your deduction? c Other Yes No Yes No Yes No b If "Yes," is the evidence written? Part V Yes No Other Expenses. List below business expenses not included on lines 8-26, line 27b, or line 30. 48 Total other expenses. Enter here and on line 27a 48 Schedule C (Form 1040) 2023 SCHEDULE D (Form 1040) Department of the Treasury Internal Revenue Service Name(s) shown on return Capital Gains and Losses Attach to Form 1040, 1040-SR, or 1040-NR. Go to www.irs.gov/ScheduleD for instructions and the latest information. Use Form 8949 to list your transactions for lines 1b, 2, 3, 8b, 9, and 10. OMB No. 1545-0074 2022 Attachment Sequence No. 12 Your social security number Yes No Did you dispose of any investment(s) in a qualified opportunity fund during the tax year? If "Yes," attach Form 8949 and see its instructions for additional requirements for reporting your gain or loss. Part I Short-Term Capital Gains and Losses-Generally Assets Held One Year or Less (see instructions) See instructions for how to figure the amounts to enter on the lines below. This form may be easier to complete if you round off cents to whole dollars. 1a Totals for all short-term transactions reported on Form 1099-B for which basis was reported to the IRS and for which you have no adjustments (see instructions). However, if you choose to report all these transactions on Form 8949, leave this line blank and go to line 1b 1b Totals for all transactions reported on Form(s) 8949 with Box A checked 2 Totals for all transactions reported on Form(s) 8949 with Box B checked 3 Totals for all transactions reported on Form(s) 8949 with Box C checked . (d) Proceeds (sales price) (e) Cost (or other basis) (g) Adjustments to gain or loss from Form(s) 8949, Part I, line 2, column (g) (h) Gain or (loss) Subtract column (e) from column (d) and combine the result with column (g) 4 Short-term gain from Form 6252 and short-term gain or (loss) from Forms 4684, 6781, and 8824 4 5 Net short-term gain or (loss) from partnerships, S corporations, estates, and trusts from Schedule(s) K-1 5 6 Short-term capital loss carryover. Enter the amount, if any, from line 8 of your Capital Loss Carryover Worksheet in the instructions 6 ( 7 Net short-term capital gain or (loss). Combine lines 1a through 6 in column (h). If you have any long- term capital gains or losses, go to Part II below. Otherwise, go to Part III on the back Part II 7 Long-Term Capital Gains and Losses-Generally Assets Held More Than One Year (see instructions) See instructions for how to figure the amounts to enter on the lines below. This form may be easier to complete if you round off cents to whole dollars. 8a Totals for all long-term transactions reported on Form 1099-B for which basis was reported to the IRS and for which you have no adjustments (see instructions). However, if you choose to report all these transactions on Form 8949, leave this line blank and go to line 8b . 8b Totals for all transactions reported on Form(s) 8949 with Box D checked 9 Totals for all transactions reported on Form(s) 8949 with Box E checked 10 Totals for all transactions reported on Form(s) 8949 with Box F checked. (d) Proceeds (sales price) (e) Cost (or other basis) (g) Adjustments to gain or loss from Form(s) 8949, Part II, line 2, column (g) (h) Gain or (loss) Subtract column (e) from column (d) and combine the result with column (g) 11 Gain from Form 4797, Part I; long-term gain from Forms 2439 and 6252; and long-term gain or (loss) from Forms 4684, 6781, and 8824 12 Net long-term gain or (loss) from partnerships, S corporations, estates, and trusts from Schedule(s) K-1 13 Capital gain distributions. See the instructions 14 Long-term capital loss carryover. Enter the amount, if any, from line 13 of your Capital Loss Carryover Worksheet in the instructions 15 Net long-term capital gain or (loss). Combine lines 8a through 14 in column (h). Then, go to Part III on the back For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 11338H 11 12 13 = 14( 15 Schedule D (Form 1040) 2022 Schedule D (Form 1040) 2022 Part III Summary 16 Combine lines 7 and 15 and enter the result 17 18 If line 16 is a gain, enter the amount from line 16 on Form 1040, 1040-SR, or 1040-NR, line 7. Then, go to line 17 below. If line 16 is a loss, skip lines 17 through 20 below. Then, go to line 21. Also be sure to complete line 22. If line 16 is zero, skip lines 17 through 21 below and enter -0- on Form 1040, 1040-SR, or 1040-NR, line 7. Then, go to line 22. Are lines 15 and 16 both gains? Yes. Go to line 18. No. Skip lines 18 through 21, and go to line 22. If you are required to complete the 28% Rate Gain Worksheet (see instructions), enter the amount, if any, from line 7 of that worksheet 16 18 19 If you are required to complete the Unrecaptured Section 1250 Gain Worksheet (see instructions), enter the amount, if any, from line 18 of that worksheet 19 20 Are lines 18 and 19 both zero or blank and you are not filing Form 4952? 21 Yes. Complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040, line 16. Don't complete lines 21 and 22 below. No. Complete the Schedule D Tax Worksheet in the instructions. Don't complete lines 21 and 22 below. If line 16 is a loss, enter here and on Form 1040, 1040-SR, or 1040-NR, line 7, the smaller of: The loss on line 16; or ($3,000), or if married filing separately, ($1,500) Note: When figuring which amount is smaller, treat both amounts as positive numbers. 22 Do you have qualified dividends on Form 1040, 1040-SR, or 1040-NR, line 3a? Yes. Complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040, line 16. No. Complete the rest of Form 1040, 1040-SR, or 1040-NR. 21 Page 2 Schedule D (Form 1040) 2022 SCHEDULE SE (Form 1040) Department of the Treasury Internal Revenue Service Self-Employment Tax Go to www.irs.gov/ScheduleSE for instructions and the latest information. Attach to Form 1040, 1040-SR, or 1040-NR. Name of person with self-employment income (as shown on Form 1040, 1040-SR, or 1040-NR) Part I Self-Employment Tax Social security number of person with self-employment income OMB No. 1545-0074 2022 Attachment Sequence No. 17 Note: If your only income subject to self-employment tax is church employee income, see instructions for how to report your income and the definition of church employee income. A If you are a minister, member of a religious order, or Christian Science practitioner and you filed Form 4361, but you had $400 or more of other net earnings from self-employment, check here and continue with Part I Skip lines 1a and 1b if you use the farm optional method in Part II. See instructions. 1a Net farm profit or (loss) from Schedule F, line 34, and farm partnerships, Schedule K-1 (Form 1065), box 14, code A . 1a b If you received social security retirement or disability benefits, enter the amount of Conservation Reserve Program payments included on Schedule F, line 4b, or listed on Schedule K-1 (Form 1065), box 20, code AH 1b Skip line 2 if you use the nonfarm optional method in Part II. See instructions. 2 3 Net profit or (loss) from Schedule C, line 31; and Schedule K-1 (Form 1065), box 14, code A (other than farming). See instructions for other income to report or if you are a minister or member of a religious order Combine lines 1a, 1b, and 2. 4a If line 3 is more than zero, multiply line 3 by 92.35% (0.9235). Otherwise, enter amount from line 3 Note: If line 4a is less than $400 due to Conservation Reserve Program payments on line 1b, see instructions. b If you elect one or both of the optional methods, enter the total of lines 15 and 17 here Combine lines 4a and 4b. If less than $400, stop; you don't owe self-employment tax. Exception: If less than $400 and you had church employee income, enter -0- and continue C 232 24 5a Enter your church employee income from Form W-2. See instructions for definition of church employee income 5a b Multiply line 5a by 92.35% (0.9235). If less than $100, enter -0- 5b 6 Add lines 4c and 5b 6 7 Maximum amount of combined wages and self-employment earnings subject to social security tax or the 6.2% portion of the 7.65% railroad retirement (tier 1) tax for 2022 7 147,000 8a Total social security wages and tips (total of boxes 3 and 7 on Form(s) W-2) and railroad retirement (tier 1) compensation. If $147,000 or more, skip lines 8b through 10, and go to line 11 b Unreported tips subject to social security tax from Form 4137, line 10 c Wages subject to social security tax from Form 8919, line 10. 8a 8b 8c d Add lines 8a, 8b, and 8c 8d 9 10 Subtract line 8d from line 7. If zero or less, enter -0- here and on line 10 and go to line 11 Multiply the smaller of line 6 or line 9 by 12.4% (0.124). 9 10 11 Multiply line 6 by 2.9% (0.029) . 11 12 13 Self-employment tax. Add lines 10 and 11. Enter here and on Schedule 2 (Form 1040), line 4 Deduction for one-half of self-employment tax. 12 Multiply line 12 by 50% (0.50). Enter here and on Schedule 1 (Form 1040), line 15 13 Part II Optional Methods To Figure Net Earnings (see instructions) Farm Optional Method. You may use this method only if (a) your gross farm income wasn't more than $9,060, or (b) your net farm profits were less than $6,540. 14 Maximum income for optional methods 14 6,040 15 Enter the smaller of: two-thirds (2/3) of gross farm income (not less than zero) or $6,040. Also, include this amount on line 4b above 15 . 16 Nonfarm Optional Method. You may use this method only if (a) your net nonfarm profits were less than $6,540 and also less than 72.189% of your gross nonfarm income, 4 and (b) you had net earnings from self-employment of at least $400 in 2 of the prior 3 years. Caution: You may use this method no more than five times. Subtract line 15 from line 14. 16 . 17 Enter the smaller of: two-thirds (2/3) of gross nonfarm income (not less than zero) or the amount on line 16. Also, include this amount on line 4b above 17 3 From Sch. C, line 31; and Sch. K-1 (Form 1065), box 14, code A. 1 From Sch. F, line 9; and Sch. K-1 (Form 1065), box 14, code B. 2 From Sch. F, line 34; and Sch. K-1 (Form 1065), box 14, code A-minus the amount 4 From Sch. C, line 7; and Sch. K-1 (Form 1065), box 14, code C. you would have entered on line 1b had you not used the optional method. For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 11358Z Schedule SE (Form 1040) 2022 $1040 Department of the Treasury-Internal Revenue Service U.S. Individual Income Tax Return 2022 OMB No. 1545-0074 IRS Use Only-Do not write or staple in this space. Filing Status Single Married filing jointly Married filing separately (MFS) Head of household (HOH) Qualifying surviving Check only spouse (QSS) one box. If you checked the MFS box, enter the name of your spouse. If you checked the HOH or QSS box, enter the child's name if the qualifying person is a child but not your dependent: Your first name and middle initial Patrice If joint return, spouse's first name and middle initial Lauren Last name Bergy Last name Bergy Home address (number and street). If you have a P.O. box, see instructions. 37 Hat Trick Road Apt. no. State ZIP code MA 01930 Foreign postal code City, town, or post office. If you have a foreign address, also complete spaces below. Gloucester Foreign country name Foreign province/state/county Your social security number 1 1 1 2 2 1 1 1 1 Spouse's social security number 1 2 3 4 5 6 7 8 9 Presidential Election Campaign Check here if you, or your spouse if filing jointly, want $3 to go to this fund. Checking a box below will not change your tax or refund. Digital At any time during 2022, did you: (a) receive (as a reward, award, or payment for property or services); or (b) sell, Assets exchange, gift, or otherwise dispose of a digital asset (or a financial interest in a digital asset)? (See instructions.) Standard Someone can claim: You as a dependent Your spouse as a dependent Deduction Spouse itemizes on a separate return or you were a dual-status alien Age/Blindness You: Were born before January 2, 1958 Dependents (see instructions): If more (1) First name Last name You Spouse Yes No Are blind Spouse: (2) Social security number to you Was born before January 2, 1958 (3) Relationship (4) Check the box if qualifies for (see instructions): Child tax credit Credit for other dependents Is blind than four dependents, see instructions and check here. Income Attach Form(s) W-2 here. Also attach Forms W-2G and 1a b Total amount from Form(s) W-2, box 1 (see instructions) Household employee wages not reported on Form(s) W-2 C Tip income not reported on line 1a (see instructions) d Medicaid waiver payments not reported on Form(s) W-2 (see instructions) Taxable dependent care benefits from Form 2441, line 26 Employer-provided adoption benefits from Form 8839, line 29 e 1099-R if tax was withheld. f If you did not g Wages from Form 8919, line 6. get a Form h Other earned income (see instructions) W-2, see i Nontaxable combat pay election (see instructions) instructions. Z Add lines 1a through 1h Attach Sch. B 2a Tax-exempt interest 2a 725 b Taxable interest if required. Qualified dividends 3a 2,552 b Ordinary dividends 4a IRA distributions. 4a 6,000 b Taxable amount Standard 5a Pensions and annuities 5a b Taxable amount Deduction for 6a Social security benefits 6a b Taxable amount Single or Married filing separately, $12,950 7 Married filing 8 If you elect to use the lump-sum election method, check here (see instructions) Capital gain or (loss). Attach Schedule D if required. If not required, check here Other income from Schedule 1, line 10 jointly or 9 Qualifying surviving spouse, 10 $25,900 Head of Head household, $19,400 11 12 Standard deduction or itemized deductions (from Schedule A) If you checked 13 any box under Standard 14 Deduction, 15 see instructions. Qualified business income deduction from Form 8995 or Form 8995-A Add lines 12 and 13. Subtract line 14 from line 11. If zero or less, enter -0-. This is your taxable income For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. Add lines 1z, 2b, 3b, 4b, 5b, 6b, 7, and 8. This is your total income Adjustments to income from Schedule 1, line 26 Subtract line 10 from line 9. This is your adjusted gross income 1a 68,609 1b 1c 83,469 1g 1h 4b 5b 6b = p 88 c 1d 1e . 1z 2b 3b 650 2,886 Cat. No. 11320B 7 425 8 9 188,499 10 11 12 13 14 15 Form 1040 (2022) Form 1040 (2022) Page 2 Tax and 16 Tax (see instructions). Check if any from Form(s): 1 8814 2 4972 3 16 Credits 17 Amount from Schedule 2, line 3 17 18 Add lines 16 and 17. 18 19 Child tax credit or credit for other dependents from Schedule 8812 19 20 Amount from Schedule 3, line 8 20 21 Add lines 19 and 20 21 22 Subtract line 21 from line 18. If zero or less, enter -0- 22 23 Other taxes, including self-employment tax, from Schedule 2, line 21 23 24 Add lines 22 and 23. This is your total tax 24 Payments 25 Federal income tax withheld from: a Form(s) W-2 b Form(s) 1099 C Other forms (see instructions) 25a 14,000 25b 25c d Add lines 25a through 25c 25d 14,000 If you have a qualifying child, attach Sch. EIC. 222225 26 2022 estimated tax payments and amount applied from 2021 return. 26 27 Earned income credit (EIC). 27 28 Additional child tax credit from Schedule 8812 28 29 American opportunity credit from Form 8863, line 8. 29 Reserved for future use. 30 31 Amount from Schedule 3, line 15 31 33 Add lines 27, 28, 29, and 31. These are your total other payments and refundable credits Add lines 25d, 26, and 32. These are your total payments 32 33 34 Refund 35a If line 33 is more than line 24, subtract line 24 from line 33. This is the amount you overpaid Amount of line 34 you want refunded to you. If Form 8888 is attached, check here 34 35a Direct deposit? b Routing number : Checking Savings See instructions. d Account number 36 Amount of line 34 you want applied to your 2023 estimated tax. 36 Amount 37 You Owe 38 Subtract line 33 from line 24. This is the amount you owe. For details on how to pay, go to www.irs.gov/Payments or see instructions Estimated tax penalty (see instructions) 37 38 Third Party Designee Do you want to allow another person to discuss this return with the IRS? See instructions Designee's name Phone no. Yes. Complete below. Personal identification number (PIN) | No Sign Here Date Paid Preparer Use Only Firm's name Firm's address Go to www.irs.gov/Form 1040 for instructions and the latest information. Joint return? See instructions. Keep a copy for your records. Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief, they are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge. Your signature Your occupation Business Owner Spouse's signature. If a joint return, both must sign. Date Spouse's occupation Teacher Phone no. Preparer's name Email address Preparer's signature If the IRS sent you an Identity Protection PIN, enter it here (see inst.) If the IRS sent your spouse an Identity Protection PIN, enter it here (see inst.) Date PTIN Phone no. Check if: Self-employed Firm's EIN Form 1040 (2022) Form 4562 Department of the Treasury Internal Revenue Service Name(s) shown on return Part I Depreciation and Amortization (Including Information on Listed Property) Attach to your tax return. Go to www.irs.gov/Form4562 for instructions and the latest information. Business or activity to which this form relates Election To Expense Certain Property Under Section 179 Note: If you have any listed property, complete Part V before you complete Part I. 1 Maximum amount (see instructions). . 2 Total cost of section 179 property placed in service (see instructions) 3 Threshold cost of section 179 property before reduction in limitation (see instructions) 4 Reduction in limitation. Subtract line 3 from line 2. If zero or less, enter -0- 5 Dollar limitation for tax year. Subtract line 4 from line 1. If zero or less, enter -0-. If married filing separately, see instructions 6 (a) Description of property (b) Cost (business use only) OMB No. 1545-0172 2022 Attachment Sequence No. 179 Identifying number 1 2 3 4 5 (c) Elected cost 7 Listed property. Enter the amount from line 29 7 8 Total elected cost of section 179 property. Add amounts in column (c), lines 6 and 7 9 Tentative deduction. Enter the smaller of line 5 or line 8. 10 Carryover of disallowed deduction from line 13 of your 2021 Form 4562. 8 9 10 11 Business income limitation. Enter the smaller of business income (not less than zero) or line 5. See instructions 12 Section 179 expense deduction. Add lines 9 and 10, but don't enter more than line 11 13 Carryover of disallowed deduction to 2023. Add lines 9 and 10, less line 12 Note: Don't use Part II or Part III below for listed property. Instead, use Part V. 11 12 . 13 Part II Special Depreciation Allowance and Other Depreciation (Don't include listed property. See instructions.) 14 Special depreciation allowance for qualified property (other than listed property) placed in service during the tax year. See instructions. 15 Property subject to section 168(f)(1) election 14 156 15 16 16 Other depreciation (including ACRS) Part III MACRS Depreciation (Don't include listed property. See instructions.) Section A 17 MACRS deductions for assets placed in service in tax years beginning before 2022 18 If you are electing to group any assets placed in service during the tax year into one or more general asset accounts, check here 17 Section B-Assets Placed in Service During 2022 Tax Year Using the General Depreciation System (b) Month and year (a) Classification of property placed in service (c) Basis for depreciation (business/investment use only-see instructions) (d) Recovery period (e) Convention 19a 3-year property b 5-year property 7-year property d 10-year property (f) Method (g) Depreciation deduction e 15-year property f 20-year property g 25-year property 25 yrs. S/L h Residential rental 27.5 yrs. MM S/L property 27.5 yrs. MM S/L i Nonresidential real 39 yrs. MM S/L MM S/L property Section C-Assets Placed in Service During 2022 Tax Year Using the Alternative Depreciation System S/L 20a Class life b 12-year c 30-year d 40-year 12 yrs. 30 yrs. 40 yrs. S/L MM S/L MM S/L Part IV Summary (See instructions.) 21 Listed property. Enter amount from line 28 21 22 Total. Add amounts from line 12, lines 14 through 17, lines 19 and 20 in column (g), and line 21. Enter here and on the appropriate lines of your return. Partnerships and S corporations-see instructions 23 For assets shown above and placed in service during the current year, enter the portion of the basis attributable to section 263A costs For Paperwork Reduction Act Notice, see separate instructions. 23 Cat. No. 12906N 22 Form 4562 (2022) Form 4562 (2022) Part V Listed Property (Include automobiles, certain other vehicles, certain aircraft, and property used for entertainment, recreation, or amusement.) Page 2 Note: For any vehicle for which you are using the standard mileage rate or deducting lease expense, complete only 24a, 24b, columns (a) through (c) of Section A, all of Section B, and Section C if applicable. Section A-Depreciation and Other Information (Caution: See the instructions for limits for passenger automobiles.) 24a Do you have evidence to support the business/investment use claimed? Yes No 24b If "Yes," is the evidence written? Yes No (c) (a) Business/ (b) (d) Type of property (list Date placed investment use Cost or other basis vehicles first) in service percentage (e) Basis for depreciation (business/investment use only) (f) Recovery (g) Method/ period Convention (h) Depreciation deduction 25 Special depreciation allowance for qualified listed property placed in service during the tax year and used more than 50% in a qualified business use. See instructions. 25 26 Property used more than 50% in a qualified business use: (i) Elected section 179 cost % % % 27 Property used 50% or less in a qualified business use: % % % S/L- S/L- S/L- 28 28 Add amounts in column (h), lines 25 through 27. Enter here and on line 21, page 1 29 Add amounts in column (i), line 26. Enter here and on line 7, page 1 . Section B-Information on Use of Vehicles 29 Complete this section for vehicles used by a sole proprietor, partner, or other "more than 5% owner," or related person. If you provided vehicles to your employees, first answer the questions in Section C to see if you meet an exception to completing this section for those vehicles. 30 Total business/investment miles driven during the year (don't include commuting miles) 31 Total commuting miles driven during the year 32 Total other personal (noncommuting) miles driven (a) Vehicle 1 (b) (c) (d) (e) (f) Vehicle 2 Vehicle 3 Vehicle 4 Vehicle 5 Vehicle 6 33 Total miles driven during the year. Add lines 30 through 32 34 Was the vehicle available for personal use during off-duty hours? Yes No Yes No Yes No Yes No Yes No Yes No 35 Was the vehicle used primarily by a more than 5% owner or related person? 36 Is another vehicle available for personal use? Section C-Questions for Employers Who Provide Vehicles for Use by Their Employees Answer these questions to determine if you meet an exception to completing Section B for vehicles used by employees who aren't more than 5% owners or related persons. See instructions. 37 Do you maintain a written policy statement that prohibits all personal use of vehicles, including commuting, by Yes No your employees? . . 38 Do you maintain a written policy statement that prohibits personal use of vehicles, except commuting, by your employees? See the instructions for vehicles used by corporate officers, directors, or 1% or more owners 39 Do you treat all use of vehicles by employees as personal use? 40 Do you provide more than five vehicles to your employees, obtain information from your employees about the use of the vehicles, and retain the information received? 41 Do you meet the requirements concerning qualified automobile demonstration use? See instructions Note: If your answer to 37, 38, 39, 40, or 41 is "Yes," don't complete Section B for the covered vehicles. Part VI Amortization (a) Description of costs. (b) Date amortization begins (c) Amortizable amount 42 Amortization of costs that begins during your 2022 tax year (see instructions): 43 Amortization of costs that began before your 2022 tax year 44 Total. Add amounts in column (f). See the instructions for where to report (d) Code section (e) Amortization period or percentage (f) Amortization for this year 43 44 Form 4562 (2022) Form 4684 Department of the Treasury Internal Revenue Service Name(s) shown on tax return. Casualties and Thefts Go to www.irs.gov/Form4684 for instructions and the latest information. Attach to your tax return. Use a separate Form 4684 for each casualty or theft. OMB No. 1545-0177 2022 Attachment Sequence No. 26 Identifying number SECTION A-Personal Use Property (Use this section to report casualties and thefts of property not used in a trade or business or for income-producing purposes. For tax years 2018 through 2025, if you are an individual, casualty or theft losses of personal-use property are deductible only if the loss is attributable to a federally declared disaster. You must use a separate Form 4684 (through line 12) for each casualty or theft event involving personal-use property. If reporting a qualified disaster loss, see the instructions for special rules that apply before completing this section.) If the casualty or theft loss is attributable to a federally declared disaster, check here and enter the DR- declaration number assigned by FEMA. (See instructions.) or EM- 1 Description of properties (show type, location (city, state, and ZIP code), and date acquired for each property). Use a separate line for each property lost or damaged from the same casualty or theft. If you checked the box and entered the FEMA disaster declaration number above, enter the ZIP code for the property most affected on the line for Property A. Property A Property B Property C Property D Type of Property City and State ZIP Code Date Acquired Properties A B D 2 Cost or other basis of each property 2 3 Insurance or other reimbursement (whether or not you filed a claim) (see instructions). 3 Note: If line 2 is more than line 3, skip line 4. 4 Gain from casualty or theft. If line 3 is more than line 2, enter the difference here and skip lines 5 through 9 for that column. See instructions if line 3 includes insurance or other reimbursement you did not claim, or you received payment for your loss in a later tax year 5 Fair market value before casualty or theft 6 Fair market value after casualty or theft 7 Subtract line 6 from line 5 8 Enter the smaller of line 2 or line 7 9 Subtract line 3 from line 8. If zero or less, enter -0- . 4 5 6 7 8 9 10 Casualty or theft loss. Add the amounts on line 9 in columns A through D 11 Enter $100 ($500 if qualified disaster loss rules apply; see instructions) 12 Subtract line 11 from line 10. If zero or less, enter -0- . Caution: Use only one Form 4684 for lines 13 through 18. 13 Add the amounts on line 4 of all Forms 4684 14 Add the amounts on line 12 of all Forms 4684. If you have losses not attributable to a federally declared disaster, see the instructions . Caution: See instructions before completing line 15. 15 If line 13 is more than line 14, enter the difference here and on Schedule D. Do not complete the rest of this section. If line 13 is equal to line 14, enter -0- here. Do not complete the rest of this section. If line 13 is less than line 14, and you have no qualified disaster losses subject to the $500 reduction on line 11 on any Form(s) 4684, enter -0- here and go to line 16. If you have qualified disaster losses subject to the $500 reduction, subtract line 13 from line 14 and enter the smaller of this difference or the amount on line 12 of the Form(s) 4684 reporting those losses. Enter that result here and on Schedule A (Form 1040), line 16; or Schedule A (Form 1040-NR), line 7. If you claim the standard deduction, also include on Schedule A (Form 1040), line 16, the amount of your standard deduction (see the Instructions for Form 1040). Do not complete the rest of this section if all of your casualty or theft losses are subject to the $500 reduction. 10 11 12 13 14 15 16 Add lines 13 and 15. Subtract the result from line 14 16 17 Enter 10% of your adjusted gross income from Form 1040, 1040-SR, or 1040-NR, line 11. Estates and trusts, see instructions 17 18 Subtract line 17 from line 16. If zero or less, enter -0-. Also, enter the result on Schedule A (Form 1040), line 15; or Schedule A (Form 1040-NR), line 6. Estates and trusts, enter the result on the "Other deductions" line of your tax return For Paperwork Reduction Act Notice, see instructions. 18 Cat. No. 129970 Form 4684 (2022) Form 4684 (2022) Attachment Sequence No. 26 Name(s) shown on tax return. Do not enter name and identifying number if shown on other side. SECTION B-Business and Income-Producing Property Page 2 Identifying number Part I Casualty or Theft Gain or Loss (Use a separate Part I for each casualty or theft.) 19 Description of properties (show type, location, and date acquired for each property). Use a separate line for each property lost or damaged from the same casualty or theft. See instructions if claiming a loss due to a Ponzi-type investment scheme and Section C is not completed. Property A Property B Property C Property D Properties A B D 20 Cost or adjusted basis of each property. 20 21 Insurance or other reimbursement (whether or not you filed a claim). See the instructions for line 3. Note: If line 20 is more than line 21, skip line 22. 21 . 22 Gain from casualty or theft. If line 21 is more than line 20, enter the difference here and on line 29 or line 34, column (c), except as provided in the instructions for line 33. Also, skip lines 23. through 27 for that column. See the instructions for line 4 if line 21 includes insurance or other reimbursement you did not claim, or you received payment for your loss in a later tax year 23 Fair market value before casualty or theft 24 Fair market value after casualty or theft 25 Subtract line 24 from line 23 26 Enter the smaller of line 20 or line 25 Note: If the property was totally destroyed by casualty or lost from theft, enter on line 26 the amount from line 20. 27 Subtract line 21 from line 26. If zero or less, enter -0- . 22 23 24 25 26 27 28 Casualty or theft loss. Add the amounts on line 27. Enter the total here and on line 29 or line 34. See instructions Part II Summary of Gains and Losses (from separate Parts I) 28 (b) Losses from casualties or thefts (i) Trade, business, rental, or royalty property (a) Identify casualty or theft Casualty or Theft of Property Held One Year or Less (ii) Income- producing property (c) Gains from casualties or thefts includible in income 29 30 Totals. Add the amounts on line 29 30 ( 31 Combine line 30, columns (b)(i) and (c). Enter the net gain or (loss) here and on Form 4797, line 14. If Form 4797 is not otherwise required, see instructions 32 Enter the amount from line 30, column (b)(ii), here. Individuals, enter the amount from income-producing property on Schedule A (Form 1040), line 16; or Schedule A (Form 1040-NR), line 7. (Do not include any loss on property used as an employee.) Estates and trusts, partnerships, and S corporations, see instructions. Casualty or Theft of Property Held More Than One Year 33 Casualty or theft gains from Form 4797, line 32. 34 35 Total losses. Add amounts on line 34, columns (b)(i) and (b)(ii) 36 Total gains. Add lines 33 and 34, column (c). 37 Add amounts on line 35, columns (b)(i) and (b)(ii) 38 If the loss on line 37 is more than the gain on line 36: 35 31 32 33 36 37 a Combine line 35, column (b)(i), and line 36, and enter the net gain or (loss) here. Partnerships and S corporations, see the Note below. All others, enter this amount on Form 4797, line 14. If Form 4797 is not otherwise required, see instructions b Enter the amount from line 35, column (b)(ii), here. Individuals, enter the amount from income-producing property on Schedule A (Form 1040), line 16; or Schedule A (Form 1040-NR), line 7. (Do not include any loss on property used as an employee.) Estates and trusts, enter on the "Other deductions" line of your tax return. Partnerships and S corporations, see the Note below. 39 If the loss on line 37 is less than or equal to the gain on line 36, combine lines 36 and 37 and enter here. Partnerships, see the Note below. All others, enter this amount on Form 4797, line 3 Note: Partnerships, enter the amount from line 38a, 38b, or 39 on Form 1065, Schedule K, line 11. S corporations, enter the amount from line 38a or 38b on Form 1120-S, Schedule K, line 10. 38a 38b 39 Form 4684 (2022) Form 4684 (2022) Name(s) shown on tax return Attachment Sequence No. 26 Page 3 Identifying number SECTION C-Theft Loss Deduction for Ponzi-Type Investment Scheme Using the Procedures in Revenue Procedure 2009-20 (Complete this section in lieu of Appendix A in Revenue Procedure 2009-20. See instructions.) Part I Computation of Deduction 40 Initial investment. 41 Subsequent investments (see instructions) 42 Income reported on your tax returns for tax years prior to the discovery year (see instructions) 43 Add lines 40, 41, and 42 44 Withdrawals for all years (see instructions) 45 Subtract line 44 from line 43. This is your total qualified investment 46 Enter 0.95 (95%) if you have no potential third-party recovery. Enter 0.75 (75%) if you have potential third-party recovery. 47 Multiply line 46 by line 45 48 Actual recovery. 49 Potential insurance/Securities Investor Protection Corporation (SIPC) recovery 50 Add lines 48 and 49. This is your total recovery. 51 Subtract line 50 from line 47. This is your deductible theft loss. Include this amount on line 28 of Section B, Part I. Do not complete lines 19-27 for this loss. Then complete Section B, Part II Part II Required Statements and Declarations (See instructions.) 40 41 42 43 44 45 46 47 48 49 50 51 I am claiming a theft loss deduction pursuant to Revenue Procedure 2009-20 from a specified fraudulent arrangement conducted by the following individual or entity. Name of individual or entity Taxpayer identification number (if known) Address I have written documentation to support the amounts reported in Part I of this Section C. I am a qualified investor, as defined in section 4.03 of Revenue Procedure 2009-20. If I have determined the amount of my theft loss deduction using 0.95 on line 46 above, I declare that I have not pursued and do not intend to pursue any potential third-party recovery, as that term is defined in section 4.10 of Revenue Procedure 2009-20. I agree to comply with the conditions and agreements set forth in Revenue Procedure 2009-20 and this Section C. If I have already filed a return or amended return that does not satisfy the conditions in section 6.02 of Revenue Procedure 2009-20, I agree to all adjustments or actions that are necessary to comply with those conditions. The tax year(s) for which I filed the return(s) or amended return(s) and the date(s) on which they were filed are as follows: Form 4684 (2022) Form 4684 (2022) Attachment Sequence No. 26 Page 4 Name(s) shown on tax return Identifying number SECTION DElection To Deduct Federally Declared Disaster Loss in Preceding Tax Year (See instructions.) Part I Election Statement By providing all of the information below, the taxpayer elects, under section 165(i) of the Internal Revenue Code, to deduct a loss attributable to a federally declared disaster and that occurred in a federally declared disaster area in the tax year immediately preceding the tax year the loss was sustained. Attach this Section D to your return or amended return for the tax year immediately preceding the tax year the loss was sustained to claim the disaster loss deduction. 52 Provide the name or a description of the federally declared disaster. 53 Provide the date or dates (mm/dd/yyyy) of the loss or losses attributable to the federally declared disaster. 54 Specify the address, including the city or town, county or parish, state, and ZIP code where the damaged or destroyed property was located at the time of the disaster. Part II Revocation of Prior Election By providing all of the information below, the taxpayer revokes the prior election under section 165(i) of the Internal Revenue Code to deduct a loss attributable to a federally declared disaster and that occurred in a federally declared disaster area in the tax year immediately preceding the tax year the loss was sustained. Attach this Section D to your amended return for the tax year immediately preceding the tax year the loss was sustained to remove the previous disaster loss deduction. 55 Provide the name or a description of the federally declared disaster and the address of the property that was damaged or destroyed and for which the election was claimed. 56 Specify the date (mm/dd/yyyy) you filed the prior election, which you are now revoking. (See instructions and note that new rules went into effect on October 13, 2016.) 57 Enclose your payment or otherwise provide evidence for, or explanation of, your arrangements for the repayment of the amount of any credit or refund which you received and which resulted from the prior election (which you are now revoking). Form 4684 (2022) Form 8949 Department of the Treasury Internal Revenue Service Name(s) shown on return Sales and Other Dispositions of Capital Assets Go to www.irs.gov/Form8949 for instructions and the latest information. OMB No. 1545-0074 2022 Attachment Sequence No. 12A File with your Schedule D to list your transactions for lines 1b, 2, 3, 8b, 9, and 10 of Schedule D. Social security number or taxpayer identification number Before you check Box A, B, or C below, see whether you received any Form(s) 1099-B or substitute statement(s) from your broker. A substitute statement will have the same information as Form 1099-B. Either will show whether your basis (usually your cost) was reported to the IRS by your broker and may even tell you which box to check. Part I Short-Term. Transactions involving capital assets you held 1 year or less are generally short-term (see instructions). For long-term transactions, see page 2. Note: You may aggregate all short-term transactions reported on Form(s) 1099-B showing basis was reported to the IRS and for which no adjustments or codes are required. Enter the totals directly on Schedule D, line 1a; you aren't required to report these transactions on Form 8949 (see instructions). You must check Box A, B, or C below. Check only one box. If more than one box applies for your short-term transactions, complete a separate Form 8949, page 1, for each applicable box. If you have more short-term transactions than will fit on this page for one or more of the boxes, complete as many forms with the same box checked as you need. 1 (A) Short-term transactions reported on Form(s) 1099-B showing basis was reported to the IRS (see Note above) (B) Short-term transactions reported on Form(s) 1099-B showing basis wasn't reported to the IRS (C) Short-term transactions not reported to you on Form 1099-B (a) (d) Proceeds Description of property (Example: 100 sh. XYZ Co.) (b) Date acquired (c) Date sold or disposed of (Mo., day, yr.) (Mo., day, yr.) (sales price) (see instructions) (e) Cost or other basis See the Note below and see Column (e) in the separate instructions. Adjustment, if any, to gain or loss If you enter an amount in column (g), enter a code in column (f). See the separate instructions. (f) Code(s) from instructions (g) Amount of adjustment (h) Gain or (loss) Subtract column (e) from column (d) and combine the result with column (g). 2 Totals. Add the amounts in columns (d), (e), (g), and (h) (subtract negative amounts). Enter each total here and include on your Schedule D, line 1b (if Box A above is checked), line 2 (if Box B above is checked), or line 3 (if Box C above is checked). Note: If you checked Box A above but the basis reported to the IRS was incorrect, enter in column (e) the basis as reported to the IRS, and enter an adjustment in column (g) to correct the basis. See Column (g) in the separate instructions for how to figure the amount of the adjustment. For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 37768Z Form 8949 (2022) Form 8949 (2022) Attachment Sequence No. 12A Name(s) shown on retum. Name and SSN or taxpayer identification no. not required if shown on other side Social security number or taxpayer identification number Page 2 Before you check Box D, E, or F below, see whether you received any Form(s) 1099-B or substitute statement(s) from your broker. A substitute statement will have the same information as Form 1099-B. Either will show whether your basis (usually your cost) was reported to the IRS by your broker and may even tell you which box to check. Part II Long-Term. Transactions involving capital assets you held more than 1 year are generally long-term (see instructions). For short-term transactions, see page 1. Note: You may aggregate all long-term transactions reported on Form(s) 1099-B showing basis was reported to the IRS and for which no adjustments or codes are required. Enter the totals directly on Schedule D, line 8a; you aren't required to report these transactions on Form 8949 (see instructions). You must check Box D, E, or F below. Check only one box. If more than one box applies for your long-term transactions, complete a separate Form 8949, page 2, for each applicable box. If you have more long-term transactions than will fit on this page for one or more of the boxes, complete as many forms with the same box checked as you need. 1 (D) Long-term transactions reported on Form(s) 1099-B showing basis was reported to the IRS (see Note above) (E) Long-term transactions reported on Form(s) 1099-B showing basis wasn't reported to the IRS (F) Long-term transactions not reported to you on Form 1099-B (a) (d) Proceeds Description of property (Example: 100 sh. XYZ Co.) (b) Date acquired (Mo., day, yr.) (c) Date sold or disposed of (Mo., day, yr.) (sales price) (see instructions) (e) Cost or other basis See the Note below and see Column (e) in the separate instructions. Adjustment, if any, to gain or loss If you enter an amount in column (g), enter a code in column (f). See the separate instructions. (f) Code(s) from instructions (g) Amount of adjustment (h) Gain or (loss) Subtract column (e) from column (d) and combine the result with column (g). 2 Totals. Add the amounts in columns (d), (e), (g), and (h) (subtract negative amounts). Enter each total here and include on your Schedule D, line 8b (if Box D above is checked), line 9 (if Box E above is checked), or line 10 (if Box F above is checked). Note: If you checked Box D above but the basis reported to the IRS was incorrect, enter in column (e) the basis as reported to the IRS, and enter an adjustment in column (g) to correct the basis. See Column (g) in the separate instructions for how to figure the amount of the adjustment. Form 8949 (2022) Form 8995 Department of the Treasury Internal Revenue Service Name(s) shown on return Qualified Business Income Deduction Simplified Computation Attach to your tax return. Go to www.irs.gov/Form8995 for instructions and the latest information. OMB No. 1545-2294 2022 Attachment Sequence No. 55 Your taxpayer identification number Note. You can claim the qualified business income deduction only if you have qualified business income from a qualified trade or business, real estate investment trust dividends, publicly traded partnership income, or a domestic production activities deduction passed through from an agricultural or horticultural cooperative. See instructions. Use this form if your taxable income, before your qualified business income deduction, is at or below $170,050 ($340,100 if married filing jointly), and you aren't a patron of an agricultural or horticultural cooperative. 1 i ii iii iv V (a) Trade, business, or aggregation name (b) Taxpayer identification number (c) Qualified business income or (loss) 3456 2 Total qualified business income or (loss). Combine lines 1i through 1v, column (c) Qualified business net (loss) carryforward from the prior year. Total qualified business income. Combine lines 2 and 3. If zero or less, enter -0- Qualified business income component. Multiply line 4 by 20% (0.20) 234 5 Qualified REIT dividends and publicly traded partnership (PTP) income or (loss) (see instructions) 6 7 Qualified REIT dividends and qualified PTP (loss) carryforward from the prior year. 7( 8 Total qualified REIT dividends and PTP income. Combine lines 6 and 7. If zero or less, enter -0- 8 9 REIT and PTP component. Multiply line 8 by 20% (0.20) 9 10 11 12 Qualified business income deduction before the income limitation. Add lines 5 and 9 Taxable income before qualified business income deduction (see instructions) Net capital gain (see instructions) 10 11 13 Subtract line 12 from line 11. If zero or less, enter -0- 123 12 13 14 Income limitation. Multiply line 13 by 20% (0.20) . 14 15 Qualified business income deduction. Enter the smaller of line 10 or line 14. Also enter this amount on the applicable line of your return (see instructions) 16 17 Total qualified business (loss) carryforward. Combine lines 2 and 3. If greater than zero, enter -0- . Total qualified REIT dividends and PTP (loss) carryforward. Combine lines 6 and 7. If greater than zero, enter -0- 15 16 ( 17 For Privacy Act and Paperwork Reduction Act Notice, see instructions. Cat. No. 37806C Form 8995 (2022) SCHEDULE A (Form 1040-NR) Department of the Treasury Internal Revenue Service Name shown on Form 1040-NR Itemized Deductions Go to www.irs.gov/Form 1040NR for instructions and the latest information. Attach to Form 1040-NR. Caution: If you are claiming a net qualified disaster loss on Form 4684, see instructions for line 7. OMB No. 1545-0074 2022 Attachment Sequence No. 7A Your identifying number Taxes You Paid 1a State and local income taxes 1a b Enter the smaller of line 1a or $10,000 ($5,000 if married filing separately) 1b Gifts to U.S. 2 Charities Gifts by cash or check. If you made any gift of $250 or more, see instructions 2 Caution: If 3 you made a Other than by cash or check. If you made any gift of $250 or more, see instructions. You must attach Form 8283 if over $500. 3 gift and got a benefit 4 Carryover from prior year 4 for it, see instructions. 5 Add lines 2 through 4 5 Casualty 6 and Theft Losses Casualty and theft loss(es) from a federally declared disaster (other than net qualified disaster losses). Attach Form 4684 and enter the amount from line 18 of that form. See instructions 6 Other 7 Otherfrom list in instructions. List type and amount: Itemized Deductions 7 Total Itemized Deductions 8 Add the amounts in the far right column for lines 1b through 7. Also, enter this amount on Form 1040-NR, line 12 8 For Paperwork Reduction Act Notice, see the Instructions for Form 1040-NR. Cat. No. 72749E Schedule A (Form 1040-NR) 2022 INDIVIDUAL TAX RETURN PROJECT PATRICE BERGY INDIVIDUAL FEDERAL INCOME TAX RETURN 2022-2023 ANNUAL EDITION ALL DATES RELATE TO YEAR 2022 UNLESS STATED OTHERWISE Patrice G. (age 41), SSN 111-22-1111, married Lauren (age 43) Bergy, SSN 123-45-6789, in 2016. Patrice and Lauren reside at 37 Hat Trick Road, Gloucester, MA 01930. Patrice is self- employed and Lauren works as a teacher in Gloucester. Patrice owns his own Consulting business that he operates in town. Patrice was divorced from Sarah Bergy, SSN 100-55-1234, in January of 2019. Under the divorce agreement, Patrice is to pay Sarah $1,000 per month for the next 10 years or until Sarah's death, whichever occurs first. Patrice paid Sarah $12,000 in 2022. Patrice does not pay child support to Sarah. The following filing information relates to Patrice and Lauren: Patrice and Lauren do not elect to contribute to the Presidential Election Campaign Fund. Patrice and Lauren are calendar year taxpayers. Patrice and Lauren follow the cash basis method. . Patrice and Lauren prefer that any tax overpayment to be refunded to them. Round all cents to the nearest dollar (Round up .50 Round down .49) No cents on the return. 1. Lauren's annual salary from Gloucester Schools is included on the attached W-2. 2. Patrice maintains a consulting practice, Patrice Bergy Training, through which he advises clients on various training matters. Patrice rents office space in town, at 45 Main Street, Gloucester, MA 01931. He drives to some of his clients to conduct training sessions at their location. He uses his personal car to drive to these locations. His professional activity code is 621610 and his employer identification number is 04-9876543. His clients consist of people who desire to be trained in the mental and physical aspects of sports. Patrice collected $205,213 in revenues during 2022. This total includes a $4,500 payment for work he performed in 2021 and does not include $3,000 he billed in December for work performed in late 2022. In addition, Patrice has an unpaid invoice from a client for $2,500 for work he performed in 2020. This client has not been heard from since January 2021. Patrice tried to locate this individual to no avail. Patrice feels certain that he will never collect the $2,500 he is owed. His business expenses for 2022 are as follows: Wages (NOT COGS) Meals (on perspective clients) Office Expense Advertising Legal Fees Utilities Speeding Ticket Rent Health Insurance (this policy covers the whole family) Business portion of Repairs, Gas and Oil on Jeep $98,004 2,500 3,550 4,089 950 6,061 500 9,600 9,050 2,300 In addition, Patrice drove his 2021 Jeep (purchased on February 19, 2021) 4,180 miles (assume they were all driven prior to July 1) to perform consulting duties with his clients. Patrice does not know if he can take the standard mileage, actual cost allocated to the car or both. Patrice drove the Jeep a total of 12,500 miles in 2022. Patrice utilized the following assets in his training business: Description of Property: Date Placed Adjusted Basis when into Service: Placed into Service: Business Use: Equipment 3/14/19 $6,002 100% Computer 8/7/20 959 100% Equipment 4/21/21 4,978 100% Laptop 2/19/22 1,934 100% 3D Printer 3/28/22 2,299 100% All of the assets listed above were purchased new by Patrice on the date they were placed into service. For Assets placed in service in 2022, Patrice elected the cost recovery method that yielded the highest possible cost recovery deduction method for that year (Patrice does not want to take additional first year depreciation). For assets purchased prior to 2022, all these assets were depreciated under the MACRS method (None were depreciated under Section 179 or additional first year depreciation). For each year of acquisition, the highest possible deduction under MACRS was elected. Accordingly, the expense method of 179 and additional first year depreciation was not elected. 3. On a morning walk in November 2020, Patrice was injured when he was sideswiped by a delivery truck. Patrice was hospitalized for several days, and the driver of the truck was ticketed and charged with DUI. The owner of the truck, a national parcel delivery service, was concerned that further adverse publicity might result if the matter went to court. Consequently, the owner offered Patrice a settlement if he would sign a release. Under the settlement, his medical expenses were paid, and he will receive a cash award of $325,000. Since he suffered no permanent injury due to the accident, he signed the release in April 2022 and received the $325,000 settlement. The damages awarded were $250,000 for personal injury, $20,000 for punitive damages against the driver and $55,000 for loss of income because his injuries prevented him from working for some time. 4. A. Patrice sold no stock that was reported on Form 1099-B B. Patrice also sold the following capital assets: 1,000 shares of Bar Down Corp. The shares were purchased by Patrice for $3,737 on the New York Stock Exchange on January 20. They were sold on the New York Stock Exchange for $7,005 on October 31. Patrice inherited a baseball card collection from his father when he died, on January 4, consisting of many rare cards from the stars of the past. Patrice thinks his father's cost basis was $1,500 for these cards, the collection had a date-of-death value of $22,500. Concerned about the security of the collection, Patrice sold them to a dealer for $27,000 on December 30. 800 shares of Toe Pick Corporation. These shares were received by Patrice as a gift from his sister on March 17, 2016. His sister purchased the stock on January 20, 2014, for $3,760. The fair market value of the stock at the time of the gift was $4,897. No gift tax was paid on the transfer. The shares were sold to an unrelated party on November 25 for $8,888. Patrice acquired 1,000 shares of common stock in Habs, Inc. on May 12, 2017, to hold for investment purposes. Patrice performed services for the company in late 2016, submitting a bill for $3,333. Because Habs, Inc. was experiencing cash-flow problems at the time, Patrice accepted the stock as payment for his services. Unfortunately, Habs Inc is currently in bankruptcy, and expectations are that the shareholders will not recover anything on their stock investments. The stock is not publicly traded. Patrice has a long-term capital loss carryover of $3,120 from 2021 All of the capital assets listed above were held by the Bergys for investment purposes. 5. In March 2020, Joan Myers, one of Patrice's clients, left town to get away from a troublesome ex-husband. In order to help Joan establish a business elsewhere, Patrice loaned her $5,000. Joan signed a note dated March 3, 2020, that was payable in one year with 6% interest. On December 3, 2022, Patrice learned that Joan declared bankruptcy and was awaiting trial on felony theft charges. Patrice never received payment from Joan, nor did he receive any interest on the loan. 6. Besides the items previously noted, the Patrice had the following receipts for 2022: Interest income: Commonwealth of MA bonds TD Bank Corporate bonds Bank of America Cash gifts from Patrice's parents Federal income tax refund (2021 return) Gambling Winnings $725 415 235 $1,375 25,000 905 8,000 Patrice was the beneficiary of a life insurance policy that his cousin purchased on his own life. Patrice's cousin passed away on July 1. Patrice collected $100,000 from the life insurance policy on October 22. 7. In addition to the items already noted, the Patrice had the following expenditures for 2022: Patrice's contribution to Traditional IRA $6,000 Gambling loss 9,758 Life insurance premiums 3,500 Medical and dental expenses for Patrice 9,954 Medical expenses paid by Patrice for Jeanne 2,095 Taxes: Taxes on Real Estate $4,850 Ad valorem taxes on personal property 950 State and local sales taxes 2,725 $8,525 Interest paid on VISA credit card during the year $2,445 Interest paid on Lauren's car 570 Principal payments on Lauren's car loan 3,170 Cash Contributions: Salvation Army (Massachusetts branch) $4,000 Gifts to Church of God 950 Cash given to a local family 350 Donation to Massachusetts governor's election fund 250 $5,550 In addition to the donations above, Patrice donated his time to the local college hockey camp this summer. Patrice spent a week training the students who attended the summer camp. The summer camp is a fundraiser for the school. The school provided all the resources that Patrice needed to provide his service. Patrice estimated that he would have charged $800 for the services he donated to the charitable event. The life insurance premiums relate to the universal life insurance policies that Patrice owns. The first beneficiary of the policy is Patrice's daughter. Patrice contributed to the governor's campaign fund because he thinks his influence is key in getting business. In March 2022, the Massachusetts Department of Revenue audited Patrice's state income tax returns for 2019 and 2020. He was assessed additional state income tax of $1,125 for these years. Surprisingly, no interest was included in the assessment. Patrice paid the back taxes promptly. 8. The Bergys second home, acquired July 15, 2015, in Hampton, NH, 03842, was destroyed from heavy flooding. The area was declared a Federally Declared Disaster area (FEMA declaration number DR-2022-NH). The market value of the house was $425,000 before the flood occurred. The insurance company provided funds of $200,000 to cover the damage. Patrice purchased the home in 2015 for $250,000. 9. Relevant Social Security numbers are as follows: Name and Social Security Number - Matty Bergy, SSN 123-45-6783, son of Patrice. Born May 31, 1999. Full-time student at the University of New Hampshire. Thomas lives with Patrice and Lauren, and they provided 55% of his support. His income consisted of wages of $25,000. Catherine Bergy, SSN 123-45-6784, daughter of Patrice. Born August 2, 2001. Molly works in a restaurant. Catherine finished classes at BHCC in 2021. Patrice and Lauren provide 40% of her support while Catherine provides 30% and the balance came from other sources. Catherine lives with Patrice and Lauren. Her income consisted of wages of $19,000. Jeanne Bergy, SSN 123-45-6785, daughter of Patrice. Born February 19, 2002. Jeanne works part-time in a local shop. Jeanne is a full-time student at UMass. Patrice and Lauren provided 70 percent of her support. Her income consisted of wages of $21,000. She lives with Patrice and Lauren. Patrice Bergy Jr., SSN 123-45-6786, son of Patrice. Born November 1, 2006. Full-time student at Gloucester High School. Patrice and Lauren provided 100 percent of his support. He earned no income. He lives with Patrice and Lauren. Patrice also supported the following person: - Patricia Koe, mother of Lauren, SSN 123-45-6787. Widow. Born June 24, 1948. Resides in The Villages, Florida. Patrice provided 75 percent of her total support. Her sole income consisted of $5,900 of pension income and $7,000 of Social Security benefits. Bill Horton, cousin of Patrice, SSN 123-45-6788. Widower. Born October 8, 1976. Patrice provided 65 percent of his total support. His sole income consisted of $9,100 of Social Security benefits. He lives with Patrice and Lauren. 10. Patrice made the following deposits with the United States Treasury for their Federal income tax liability from their own personal checking account on the dates indicated: April 17, 2022 June 15,2022 September 17, 2022 December 15,2022 $1,250 1,250 1,250 1,250 11. You will need to complete Form 8995 to calculate the Qualified Business Income Deduction (Line 13 on Form 1040). The qualified business income for Patrice consists of the Schedule C income less the expenses associated with the business that are not deducted on the Schedule C. These expenses are the Deductions FOR AGI. You must reduce the Schedule C income by the three deductions for AGI, which relate to Patrice's business, to arrive at the qualified business income. 12. All source documents for wages, dividends and interest paid are at the end of this packet. These items are not reported in any of the information above. 13. Form 8812 - Credit for Qualifying Children and Other Dependents does not have to be completed. You can put the dependent credit amount on line 19 of Form 1040. REQUIREMENT Prepare the Federal income tax return with all supporting schedules and attachments for Patrice Bergy for 2022. Specifically, submit the following completed forms with required schedules (www.irs.gov/forms): Form 1040: U.S. Individual Income Tax Return (including Schedules 1 & 2) Form 1040 Schedule A: Itemized Deductions Form 1040 Schedule B: Interest and Ordinary Dividends Form 1040 Schedule C: Profit and Loss from Business Form 1040 Schedule D: Capital Gains and Losses Form 8949: Sales and Other Dispositions of Capital Assets Schedule SE (From 1040): Self-Employment Tax Form 4684: Casualties and Thefts Form 8995: Qualified Business Income Deduction Simplified Computation Form 4562: Depreciation and Amortization (For Schedule C) Use all opportunities to minimize tax liability. In this regard, assume that the Bergys always prefer to forego potential future tax savings in favor of current year tax savings. a Employee's social security number 123-45-6789 OMB No. 1545-0008 b Employer identification number (EIN) 1 Wages, tips, other compensation 83469 04-8754634 c Employer's name, address, and ZIP code TOWN OF GLOUCESTER 35 RIVER ROAD GLOUCESTER MA 01930 d Control number e Employee's first name and initial LAUREN 37 HAT TRICK ROAD GLOUCESTER MA 01930 Last name BERGY 3 Social security wages 83469 5 Medicare wages and tips 2 Federal income tax withheld 14000 4 Social security tax withheld 5175 83469 7 Social security tips 9 Suff. 11 Nonqualified plans 6 Medicare tax withheld 1210 8 Allocated tips 10 Dependent care benefits 12a 13 Statutory employee Retirement Third-party 12b plan sick pay 14 Other 12c 12d f Employee's address and ZIP code 15 State Employer's state ID number MA 04875463 16 State wages, tips, etc. 17 State income tax 18 Local wages, tips, etc. 19 Local income tax 20 Locality name 83469 4005 Form W-2 Wage and Tax Statement 2022 Department of the Treasury-Intemal Revenue Service a Employee's social security number OMB No. 1545-0008 b Employer identification number (EIN) 1 Wages, tips, other compensation 2 Federal income tax withheld c Employer's name, address, and ZIP code 3 Social security wages 4 Social security tax withheld 5 Medicare wages and tips 6 Medicare tax withheld 7 Social security tips 8 Allocated tips d Control number 9 10 Dependent care benefits e Employee's first name and initial Last name Suff. 11 Nonqualified plans 12a g 13 Statutory employee Retirement plan Third-party 12b sick pay 14 Other 12c 12d f Employee's address and ZIP code 15 State Employer's state ID number 16 State wages, tips, etc. 17 State income tax 18 Local wages, tips, etc. 19 Local income tax 20 Locality name Form W-2 Wage and Tax Statement Department of the Treasury-Intemal Revenue Service 9191 CORRECTED PAYER'S name, street address, city or town, state or province, country, ZIP or foreign postal code, and telephone no. VOID 1a Total ordinary dividends OMB No. 1545-0110 $ Form 1099-DIV 879 KEY WEST FUND 4500 FEDERAL STREET ALBANY, NY 12084 1b Qualified dividends (Rev. January 2022) For calendar year Dividends and Distributions $ 547 20 22 2a Total capital gain distr. 2b Unrecap. Sec. 1250 gain $ 425 $ Copy A For PAYER'S TIN RECIPIENT'S TIN 2c Section 1202 gain $ 2d Collectibles (28%) gain $ Internal Revenue Service Center 12-4754638 111-22-1111 $ RECIPIENT'S name $ $ PATRICE BERGY Street address (including apt. no.) 37 HAT TRICK ROAD 5 Section 199A dividends $ 7 Foreign tax paid City or town, state or province, country, and ZIP or foreign postal code $ GLOUCESTER, MA 01930 9 Cash liquidation distributions 10 Noncash liquidation distributions $ $ 2e Section 897 ordinary dividends | 21 Section 897 capital gain $ 3 Nondividond distributions 4 Federal income tax withhold $ File with Form 1096. For Privacy Act and Paperwork Reduction Act Notice, see the 8 Foreign country or U.S. possession current General Instructions for Certain Information Returns. 6 Investment expenses 11 FATCA filing requirement 12 Exempt-interest dividends 13 Specified private activity bond interest dividends Account number (see instructions) $ 2nd TIN not. $ 14 State 15 State Identification no. 16 State tax withheld Form 1099-DIV (Rev. 1-2022) Cat. No. 14415N Do Not Cut or Separate Forms on This Page www.irs.gov/Form1099DIV Department of the Treasury - Internal Revenue Service Do Not Cut or Separate Forms on This Page 9191 CORRECTED PAYER'S name, street address, city or town, state or province, country, ZIP or foreign postal code, and telephone no. VOID 1a Total ordinary dividends OMB No. 1545-0110 $ Form 1099-DIV 2005 MINUTEMAN FUND 1b Qualified dividends 70 STATE STREET BOSTON, MA 02177 $ 2005 2a Total capital gain distr. $ $ PAYER'S TIN RECIPIENT'S TIN 2c Section 1202 gain 2d Collectibles (28%) gain $ $ 20 Section 897 ordinary dividends 21 Section 897 capital gain 12-4754638 111-22-1111 $ $ RECIPIENT'S namo 3 Nondividend distributions 4 Federal income tax withheld $ $ PATRICE BERGY Street address (including apt. no.) 37 HAT TRICK ROAD City or town, state or province, country, and ZIP or foreign postal code GLOUCESTER, MA 01930 9 Cash liquidation distributions 10 Noncash liquidation distributions 5 Section 199A dividends 6 Investment expenses $ $ 7 Foreign tax paid $ (Rev. January 2022) For calendar year 20 22 2b Unrecap. Sec. 1250 gain Dividends and Distributions Copy A For Internal Revenue Service Center File with Form 1096. For Privacy Act and Paperwork Reduction Act Notice, see the 8 Foreign country or U.S. possession current General Instructions for Certain Information Returns. $ $ 11 FATCA filing requirement 12 Exempt-interest dividends 13 Specified private activity bond interest dividends $ $ Account number (see instructions) 2nd TIN not. 14 State 15 State identification no. 16 State tax withheld $ $ Form 1099-DIV (Rev.1-2022) Cat. No. 14415N www.irs.gov/Form 1099DIV Department of the Treasury - Internal Revenue Service Do Not Cut or Separate Forms on This Page Do Not Cut or Separate Forms on This Page CORRECTED OMB No. 1545-1380 8181 VOID RECIPIENT'S/LENDER'S name, street address, city or town, state or province, country, ZIP or foreign postal code, and telephone no. THE FIRST BANK 134 FRONT STREET BOSTON, MA 02178 RECIPIENT'S/LENDER'S TIN PAYER'S/BORROWER'S TIN 45-24256543 111-22-2234 PAYER'S/BORROWER'S name $ PATRICE BERGY Street address (Including apt. no.) 37 HAT TRICK ROAD City or town, state or province, country, and ZIP or foreign postal code GLOUCESTER, MA 01930 9 Number of properties securing the 10 Other mortgage Account number (see instructions) 2022 Mortgage Interest Statement Form 1098 1 Mortgage Interest received from payer(s)/borrower(s) $ 2 Outstanding mortgage principal $ 4 Refund of overpaid interest 8,150 3 Mortgage origination date 245,684 01/20/2009 5 Mortgage insurance premiums $ 6 Points paid on purchase of principal residence $ 7 If address of property socuring mortgage is the same as PAYER'S/BORROWER'S address, check the box, or enter the address or description box 8. 8 Address or description instructions) property securing mortgage (see Copy A For Internal Revenue Service Center File with Form 1096. For Privacy Act and Paperwork Reduction Act Notice, see the 2019 General Instructions for Certain Information Returns. PRIMARY RESIDENCE 11 Mortgage acquisition date Form 1098 Cat. No. 14402K Do Not Cut or Separate Forms on This Page www.irs.gov/Form1098 Department of the Treasury - Internal Revenue Service Do Not Cut or Separate Forms on This Page

Step by Step Solution

★★★★★

3.41 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started