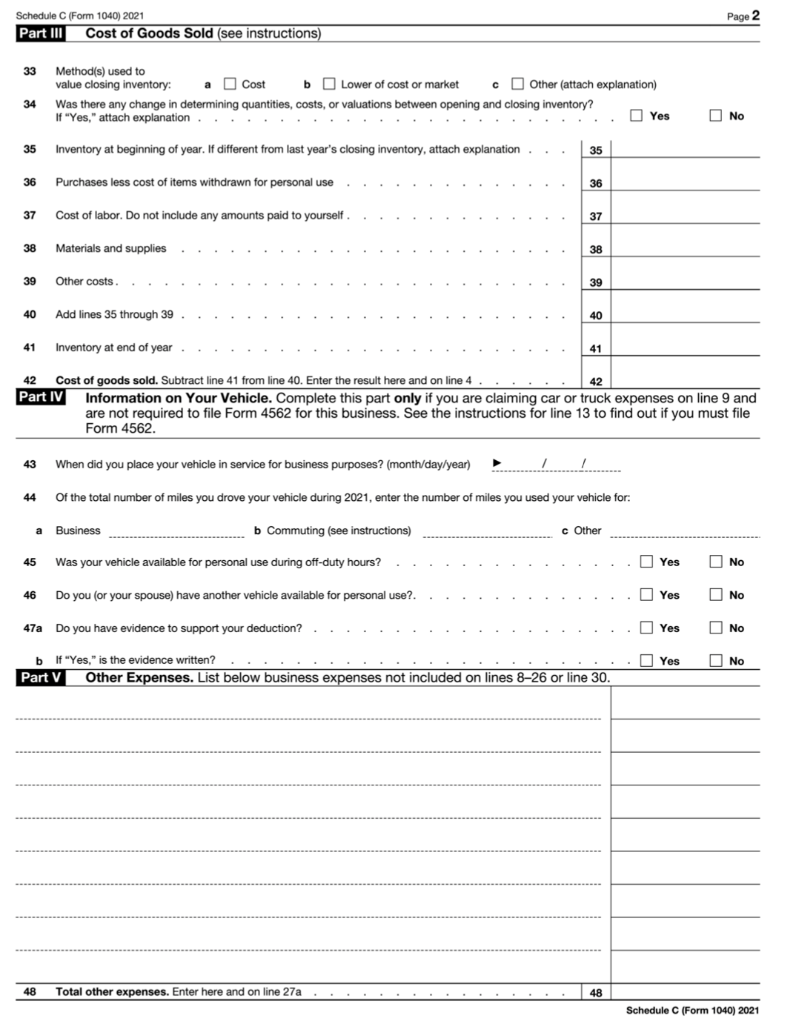

Schedule C

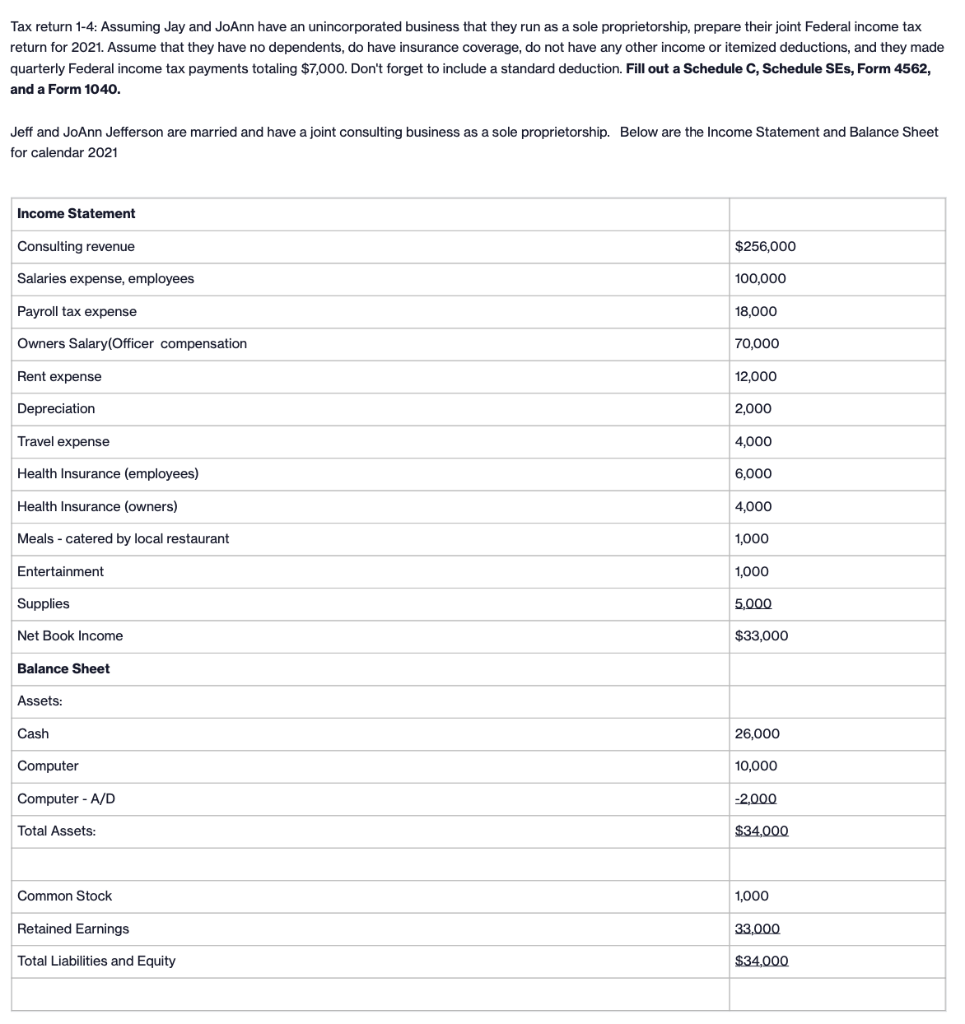

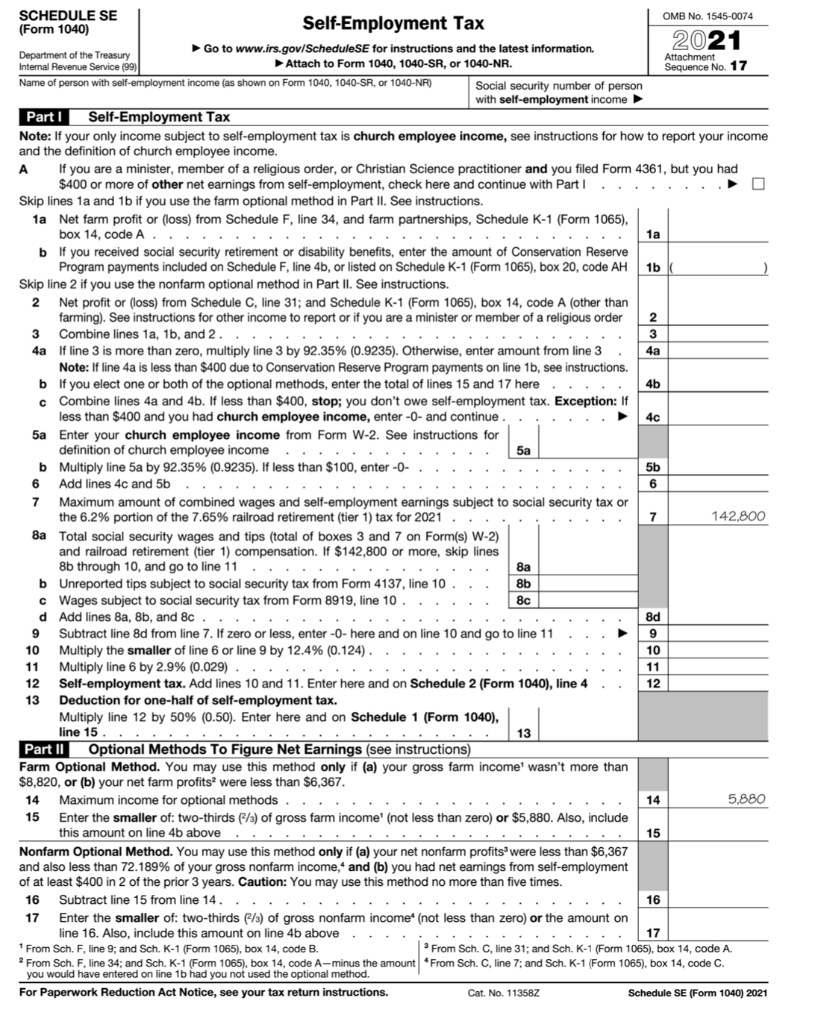

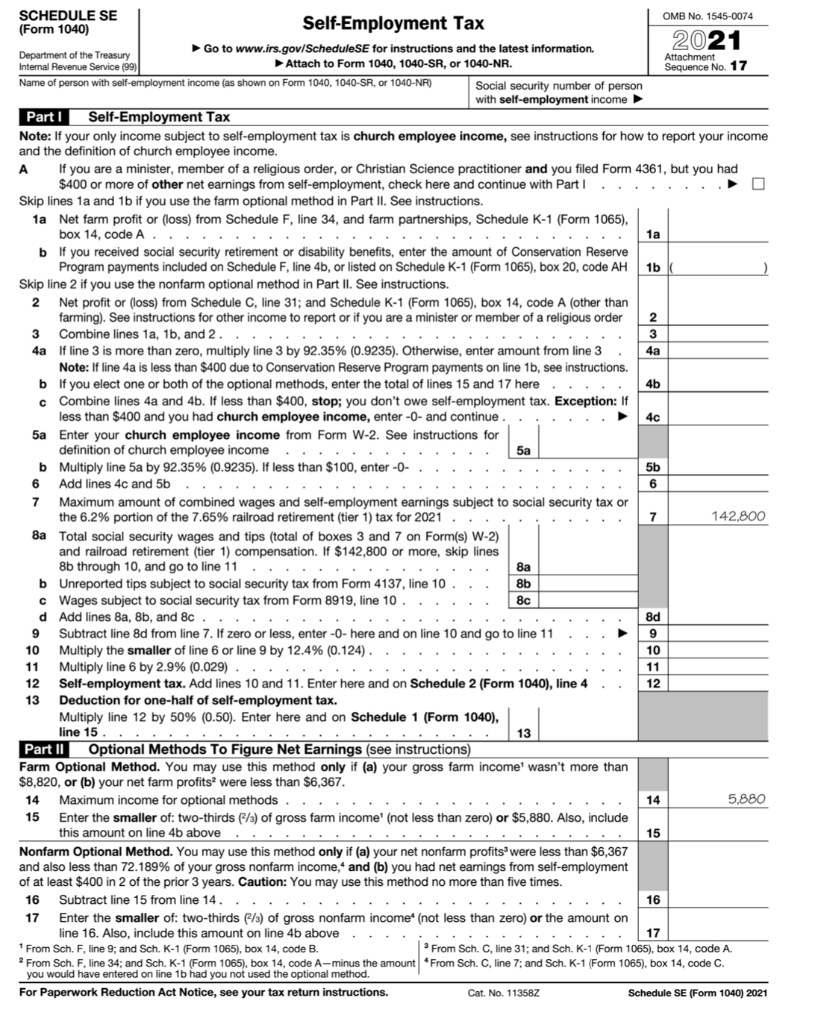

Schedule SE

Schedule SE

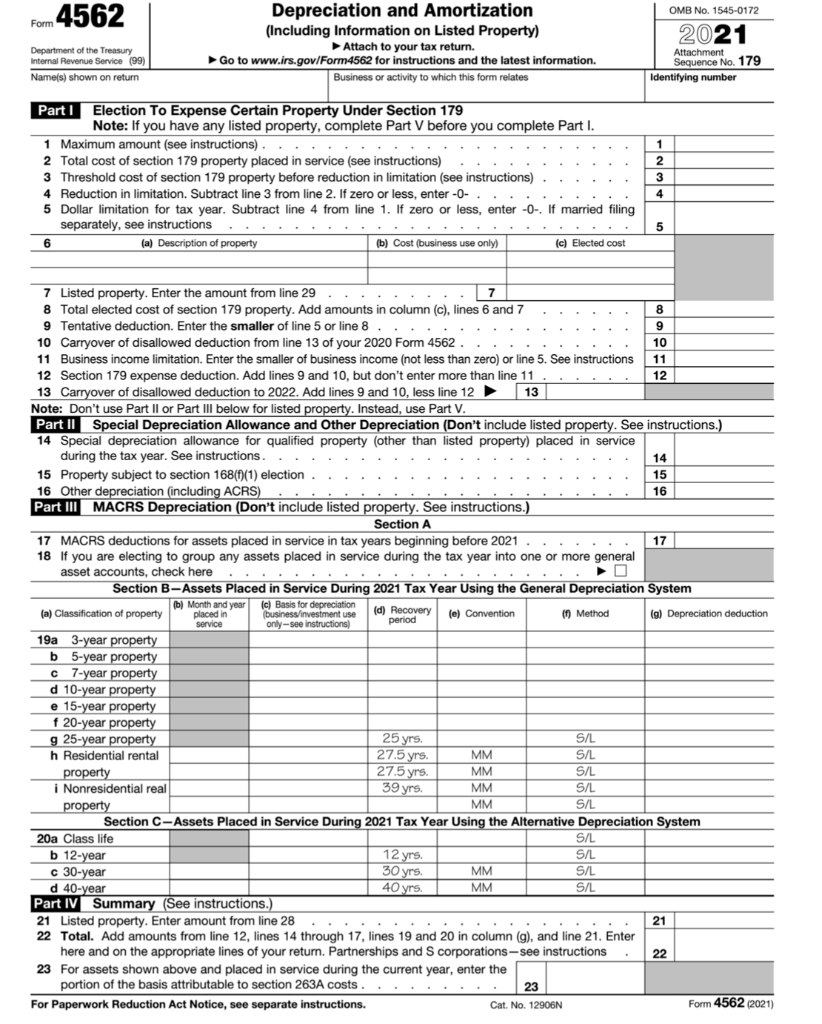

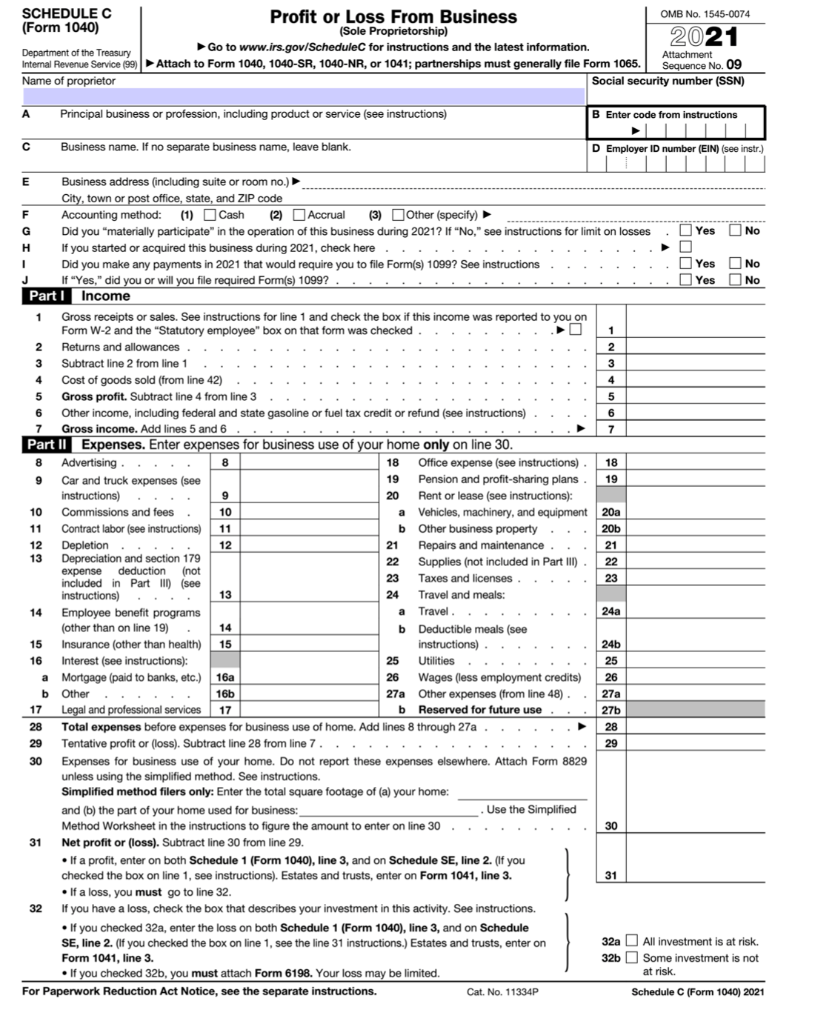

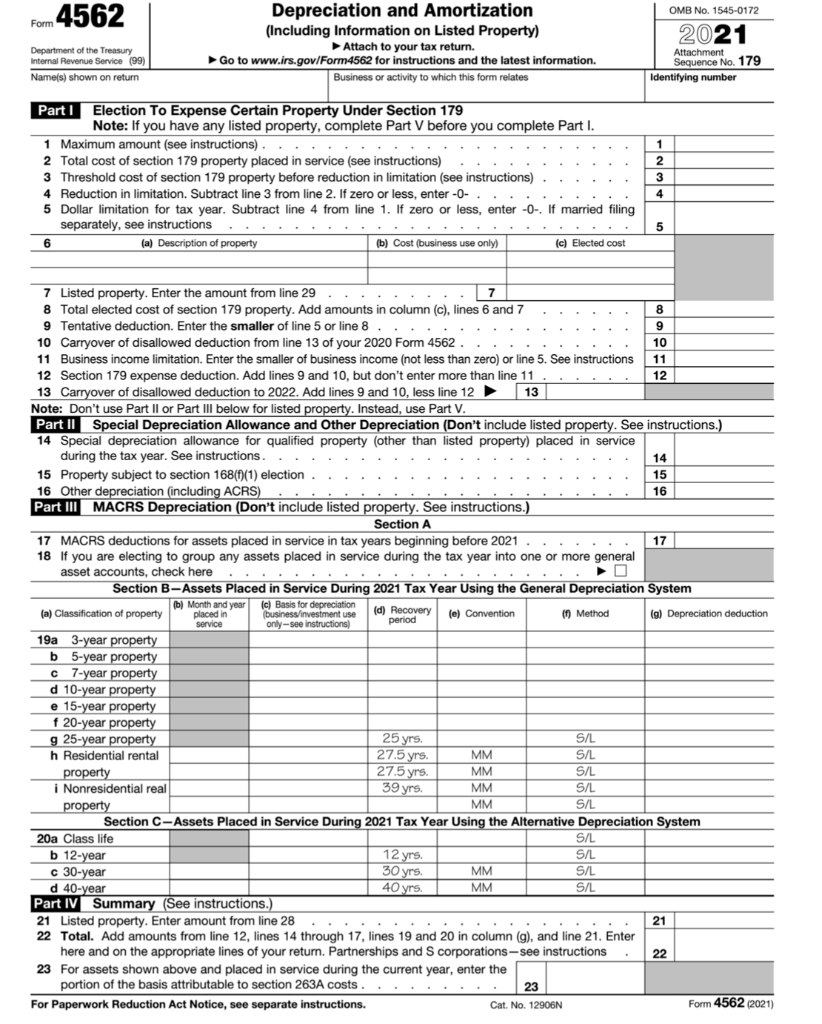

Form 4562

Form 4562

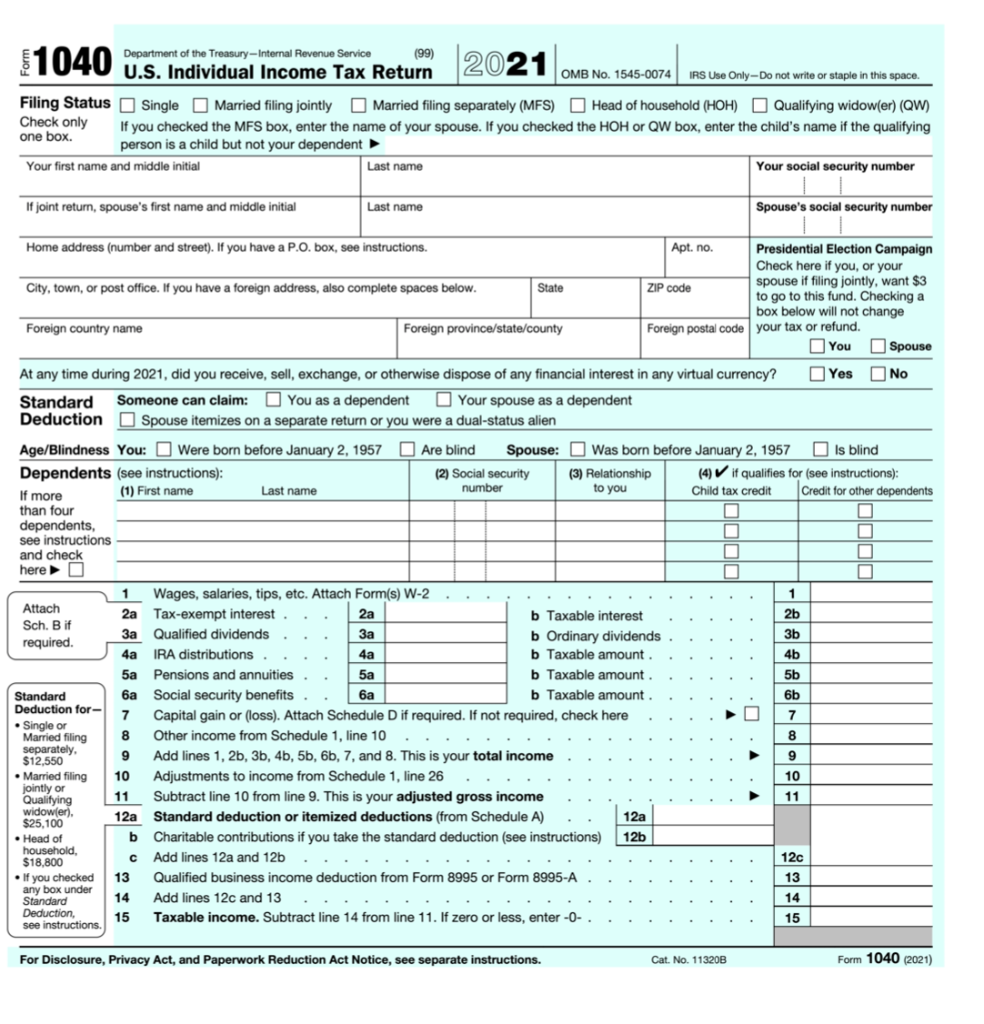

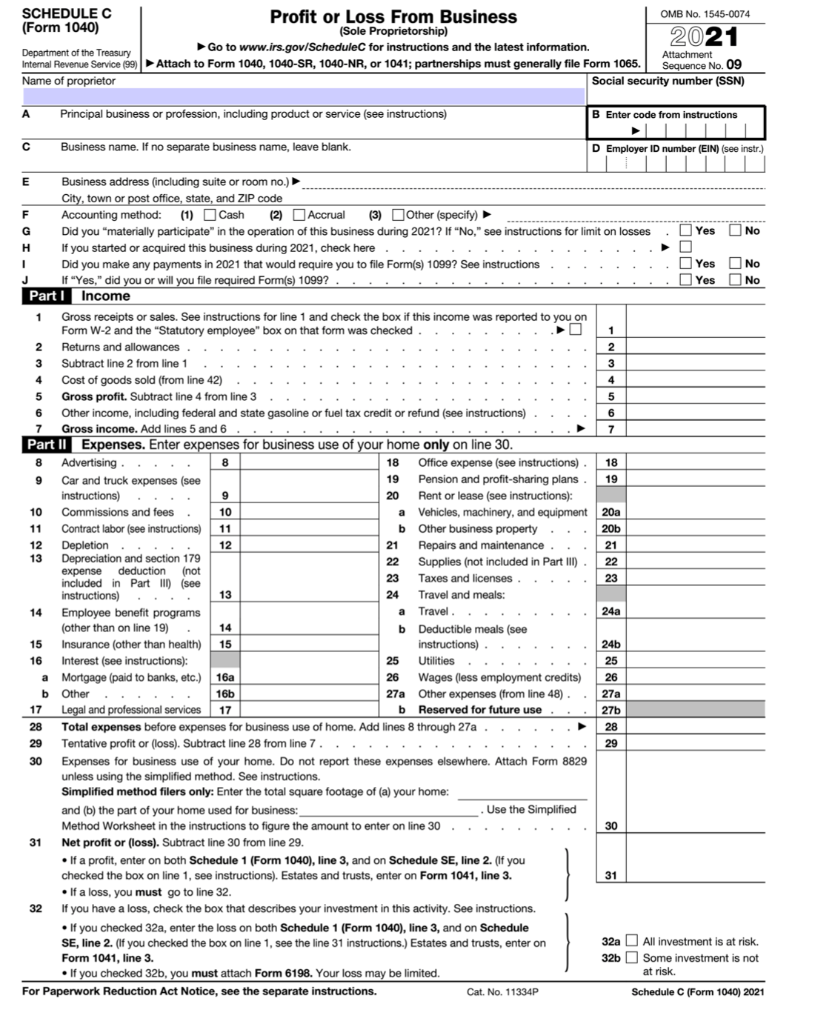

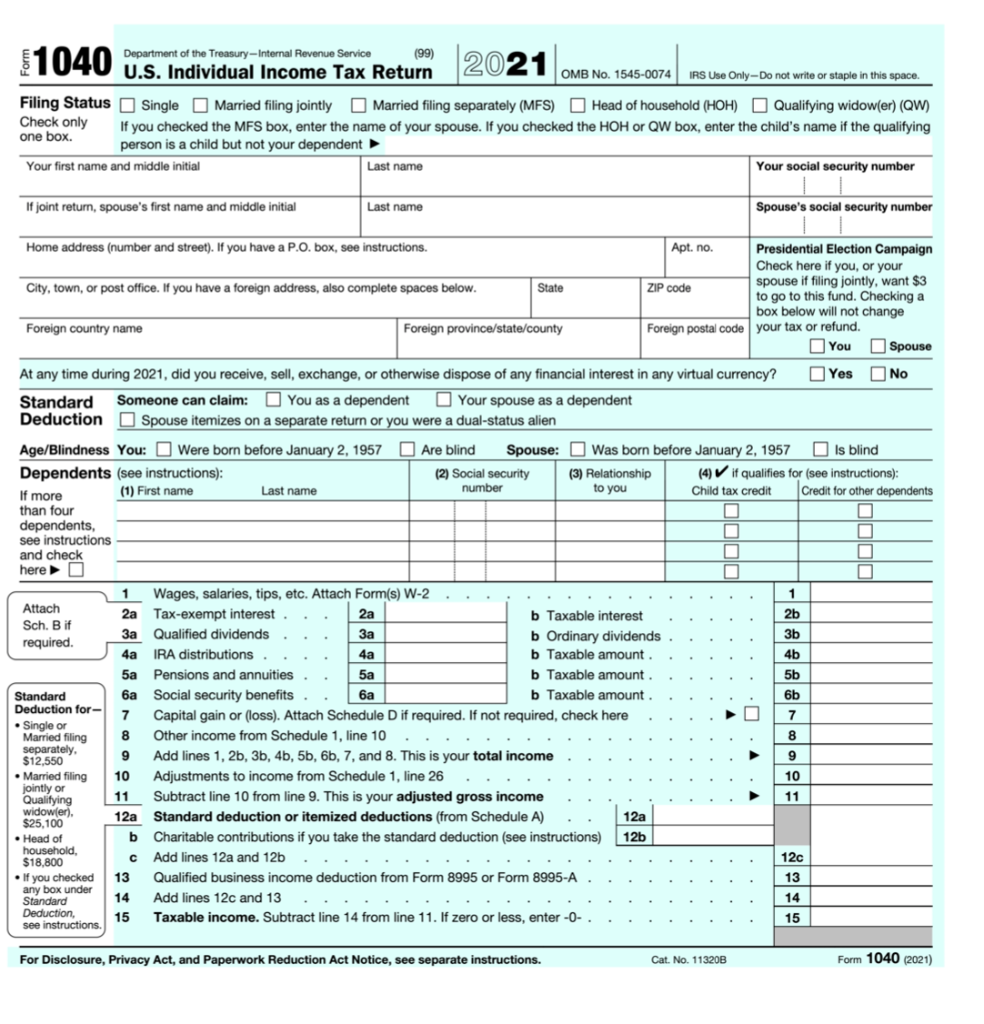

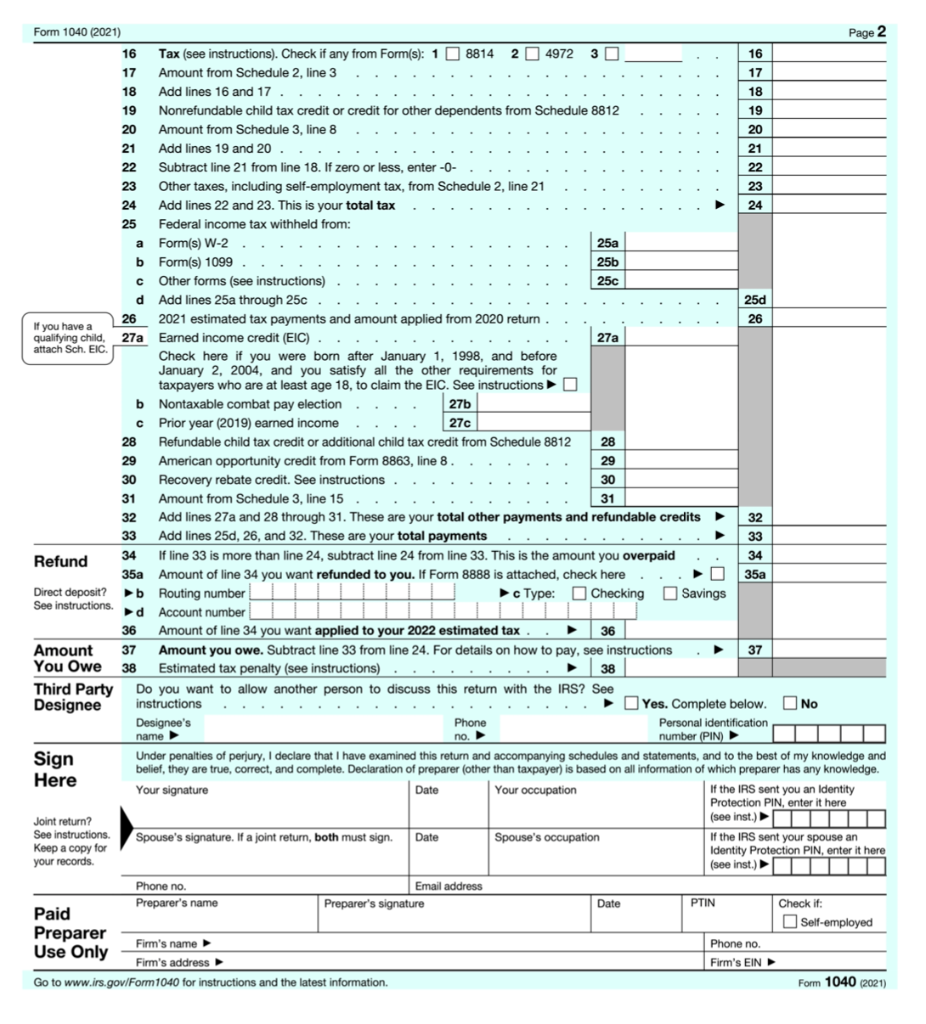

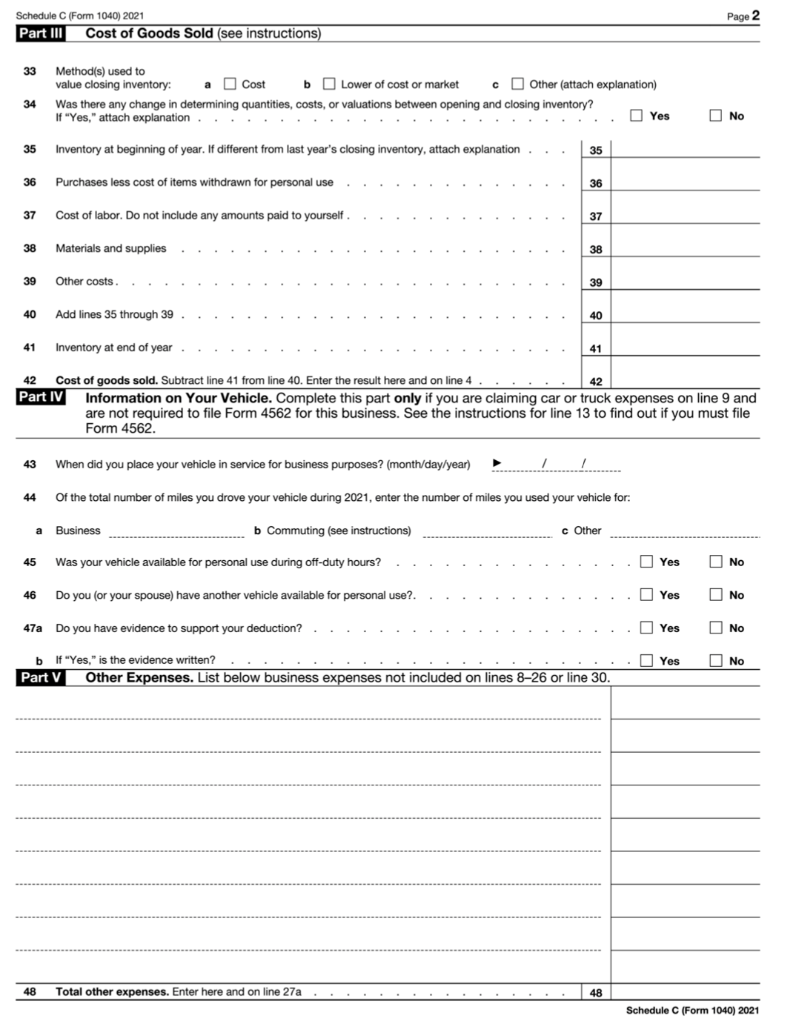

Form 1040

Form 1040

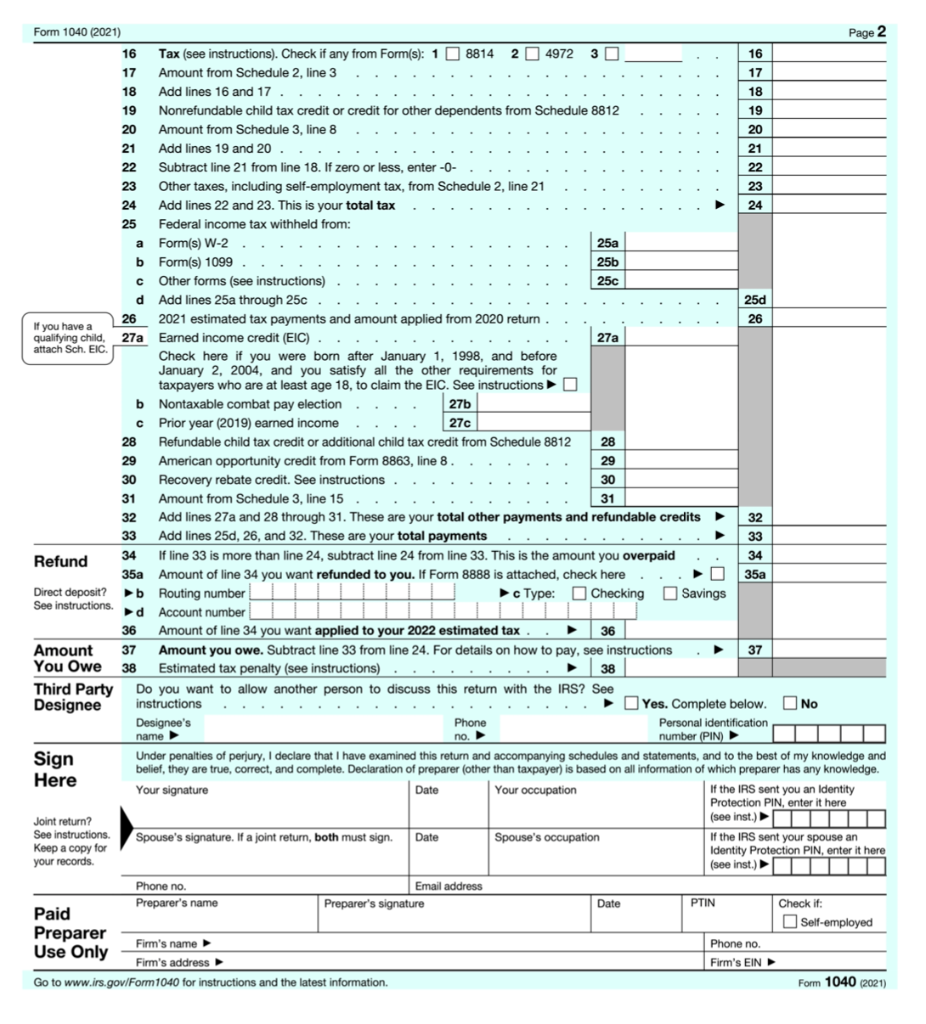

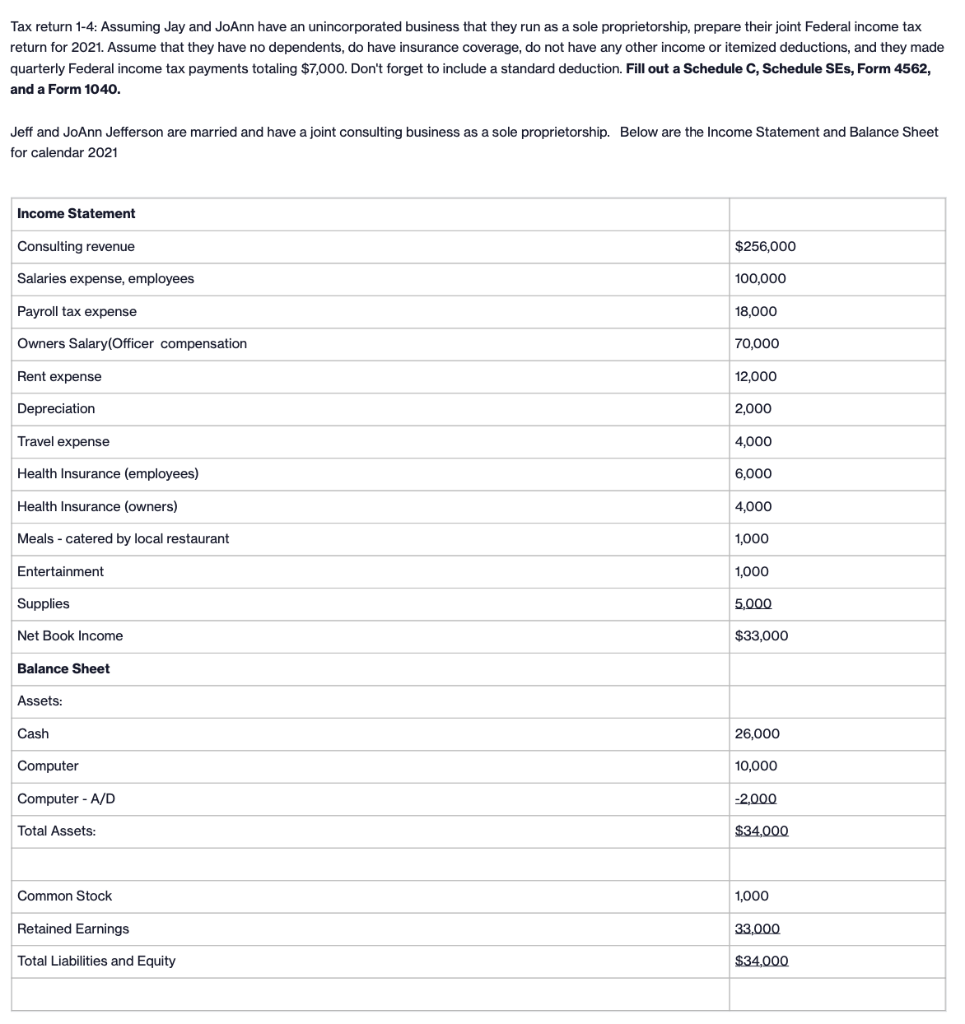

Tax return 1-4: Assuming Jay and JoAnn have an unincorporated business that they run as a sole proprietorship, prepare their joint Federal income tax return for 2021. Assume that they have no dependents, do have insurance coverage, do not have any other income or itemized deductions, and they made quarterly Federal income tax payments totaling $7,000. Don't forget to include a standard deduction. Fill out a Schedule C, Schedule SEs, Form 4562, and a Form 1040. Jeff and JoAnn Jefferson are married and have a joint consulting business as a sole proprietorship. Below are the Income Statement and Balance Sheet for calendar 2021 Income Statement Consulting revenue $256,000 Salaries expense, employees 100,000 Payroll tax expense 18,000 Owners Salary(Officer compensation 70,000 Rent expense 12,000 Depreciation 2,000 Travel expense 4,000 Health Insurance (employees) 6,000 Health Insurance (owners) 4,000 Meals - catered by local restaurant 1,000 Entertainment 1,000 Supplies 5.000 Net Book Income $33,000 Balance Sheet Assets: Cash 26,000 Computer 10,000 Computer - A/D -2.000 Total Assets: $34,000 Common Stock 1,000 Retained Earnings 33.000 Total Liabilities and Equity $34,000 SCHEDULEC Profit or Loss From Business OMB No. 1545-0074 (Form 1040) (Sole Proprietorship) 2021 Department of the Treasury Go to www.irs.gov/Schedule for instructions and the latest information. Attachment Internal Revenue Service (99) Attach to Form 1040, 1040-SR, 1040-NR, or 1041; partnerships must generally file Form 1065. Sequence No. 09 Name of proprietor Social security number (SSN) A Principal business or profession, including product or service (see instructions) B Enter code from instructions Business name. If no separate business name, leave blank. D Employer ID number (EIN) (see instr. ) E 4 5 HHHHH 6 7 9 11 Business address (including suite or room no.) City, town or post office, state, and ZIP code F Accounting method: (1) Cash (2) Accrual (3) Other (specify) G Did you "materially participate in the operation of this business during 2021? If "No," see instructions for limit on losses Yes No H If you started or acquired this business during 2021, check here 1 Did you make any payments in 2021 that would require you to file Form(s) 1099? See instructions Yes No If "Yes," did you or will you file required Form(s) 1099? Yes No Part I Income 1 Gross receipts or sales. See instructions for line 1 and check the box if this income was reported to you on Form W-2 and the "Statutory employee" box on that form was checked 1 2 Returns and allowances. 2 3 Subtract line 2 from line 1 3 4 Cost of goods sold (from line 42) Gross profit. Subtract line 4 from line 3 5 6 Other income, including federal and state gasoline or fuel tax credit or refund (see instructions) Gross income. Add lines 5 and 6 . 5 6 7 Part II Expenses. Enter expenses for business use of your home only on line 30. 8 Advertising. 8 18 Office expense (see instructions) ) 18 9 Car and truck expenses (see 19 Pension and profit-sharing plans. 19 instructions) ) 9 20 Rent or lease (see instructions): : 10 Commissions and fees 10 a Vehicles, machinery, and equipment 20a Contract labor (see instructions) 11 ) Other business property 20b 12 Depletion 12 21 Repairs and maintenance 21 13 Depreciation and section 179 22 Supplies (not included in Part III) 22 expense deduction (not included in Part III) (see 23 Taxes and licenses. 23 instructions) 13 24 Travel and meals: 14 Employee benefit programs a Travel 24a (other than on line 19) 14 b Deductible meals (see 15 Insurance (other than health) 15 instructions) 24b 16 Interest (see instructions): 25 Utilities 25 a Mortgage (paid to banks, etc.) 16a Wages (less employment credits) 26 b Other 27a Other expenses (from line 48) 27a 17 Legal and professional services 17 b Reserved for future use 27b 28 Total expenses before expenses for business use of home. Add lines 8 through 27a 29 Tentative profit or loss). Subtract line 28 from line 7 30 Expenses for business use of your home. Do not report these expenses elsewhere. Attach Form 8829 unless using the simplified method. See instructions, Simplified method filers only: Enter the total square footage of (a) your home: and (b) the part of your home used for business: Use the Simplified Method Worksheet in the instructions to figure the amount to enter on line 30. 30 31 Net profit or loss). Subtract line 30 from line 29. If a profit, enter on both Schedule 1 (Form 1040), line 3, and on Schedule SE, line 2. (If you checked the box on line 1, see instructions). Estates and trusts, enter on Form 1041, line 3. 31 If a loss, you must go to line 32 32 If you have a loss, check the box that describes your investment in this activity. See instructions. a , If you checked 32a, enter the loss on both Schedule 1 (Form 1040), line 3, and on Schedule SE, line 2. (If you checked the box on line 1, see the line 31 instructions.) Estates and trusts, enter on .) 32a All investment is at risk. Form 1041, line 3. 32b Some investment is not If you checked 32b, you must attach Form 6198. Your loss may be limited. at risk. For Paperwork Reduction Act Notice, see the separate instructions. Cat. No. 11334P . Schedule C (Form 1040) 2021 C 16b 28 29 Page 2 Schedule C (Form 1040) 2021 Part III Cost of Goods Sold (see instructions) 33 Method(s) used to value closing inventory: a Cost b Lower of cost or market c Other (attach explanation) Was there any change in determining quantities, costs, or valuations between opening and closing inventory? n If "Yes," attach explanation... Yes 34 No 35 Inventory at beginning of year. If different from last year's closing inventory, attach explanation . . 35 36 Purchases less cost of items withdrawn for personal use 36 37 Cost of labor. Do not include any amounts paid to yourself 37 38 Materials and supplies 38 39 Other costs. 39 40 Add lines 35 through 39 40 41 Inventory at end of year. 41 42 Cost of goods sold. Subtract line 41 from line 40. Enter the result here and on line 4 42 Part IV Information on Your Vehicle. Complete this part only if you are claiming car or truck expenses on line 9 and are not required to file Form 4562 for this business. See the instructions for line 13 to find out if you must file Form 4562. 43 When did you place your vehicle in service for business purposes? (month/day/year) / 44 Of the total number of miles you drove your vehicle during 2021, enter the number of miles you used your vehicle for: a Business b Commuting (see instructions) b ( c Other 45 Was your vehicle available for personal use during off-duty hours? Yes No 46 Do you (or your spouse) have another vehicle available for personal use? Yes No Yes No 47a Do you have evidence to support your deduction? ? b If "Yes," is the evidence written? ..... ? Part V Other Expenses. List below business expenses not included on lines 8-26 or line 30. Yes No 48 Total other expenses. Enter here and on line 27a 48 Schedule C (Form 1040) 2021 6 SCHEDULE SE OMB No. 1545-0074 (Form 1040) Self-Employment Tax 2021 Department of the Treasury Go to www.irs.gov/ScheduleSE for instructions and the latest information Attachment Internal Revenue Service (99) Attach to Form 1040, 1040-SR, or 1040-NR. Sequence No. 17 Name of person with self-employment income (as shown on Form 1040, 1040-SR, or 1040-NR) Social security number of person with self-employment income Partl Self-Employment Tax Note: If your only income subject to self-employment tax is church employee income, see instructions for how to report your income and the definition of church employee income. A If you are a minister, member of a religious order, or Christian Science practitioner and you filed Form 4361, but you had $400 or more of other net earnings from self-employment, check here and continue with Part ... Skip lines 1a and 1b if you use the farm optional method in Part II. See instructions. 1a Net farm profit or loss) from Schedule F, line 34, and farm partnerships, Schedule K-1 (Form 1065), box 14, code A ..... 1a b If you received social security retirement or disability benefits, enter the amount of Conservation Reserve Program payments included on Schedule F, line 4b, or listed on Schedule K-1 (Form 1065), box 20, code AH 1b Skip line 2 if you use the nonfarm optional method in Part II. See instructions. 2 Net profit or loss) from Schedule C, line 31; and Schedule K-1 (Form 1065), box 14, code A (other than farming). See instructions for other income to report or if you are a minister or member of a religious order 2 3 Combine lines 1a, 1b, and 2 3 .. 4a If line 3 is more than zero, multiply line 3 by 92.35% (0.9235). Otherwise, enter amount from line 3 4a Note: If line 4a is less than $400 due to Conservation Reserve Program payments on line 1b, see instructions. b If you elect one or both of the optional methods, enter the total of lines 15 and 17 here 4b c Combine lines 4a and 4b. If less than $400, stop; you don't owe self-employment tax. Exception: If less than $400 and you had church employee income, enter -- and continue. 4c 5a Enter your church employee income from Form W-2. See instructions for definition of church employee income 5a b Multiply line 5a by 92.35% (0.9235). Fless than $100, enter-O- 5b Add lines 4c and 5b 6 7 Maximum amount of combined wages and self-employment earnings subject to social security tax or the 6.2% portion of the 7.65% railroad retirement (tier 1) tax for 2021 7 142,800 8a Total social security wages and tips (total of boxes 3 and 7 on Form(s) W-2) and railroad retirement (tier 1) compensation. If $142,800 or more, skip lines 8b through 10, and go to line 11 b Unreported tips subject to social security tax from Form 4137, line 10 c Wages subject to social security tax from Form 8919, line 10. 8C d Add lines 8a, 8b, and 8C 8d 9 Subtract line 8d from line 7. If zero or less, enter-O- here and on line 10 and go to line 11 10 Multiply the smaller of line 6 or line 9 by 12.4% (0.124). 11 Multiply line 6 by 2.9% (0.029) 12 Self-employment tax. Add lines 10 and 11. Enter here and on Schedule 2 (Form 1040), line 4 13 Deduction for one-half of self-employment tax. Multiply line 12 by 50% (0.50). Enter here and on Schedule 1 (Form 1040), line 15 13 Part II Optional Methods To Figure Net Earnings (see instructions) Farm Optional Method. You may use this method only if (a) your gross farm income wasn't more than $8,820, or (b) your net farm profits were less than $6,367. 14 Maximum income for optional methods 14 5,880 15 Enter the smaller of: two-thirds (/) of gross farm income' (not less than zero) or $5,880. Also, include this amount on line 4b above 15 Nonfarm Optional Method. You may use this method only if (a) your net nonfarm profits were less than $6,367 and also less than 72.189% of your gross nonfarm income, and (b) you had net earnings from self-employment of at least $400 in 2 of the prior 3 years. Caution: You may use this method no more than five times. 16 Subtract line 15 from line 14. 16 17 Enter the smaller of: two-thirds (/) of gross nonfarm income (not less than zero) or the amount on line 16. Also, include this amount on line 4b above 17 From Sch. F, line 9; and Sch. K-1 (Form 1065), box 14, code B. From Sch. C, line 31; and Sch. K-1 (Form 1065), box 14, code A. 2 From Sch. F, line 34; and Sch. K-1 (Form 1065), box 14 code A-minus the amount From Sch. C. line 7; and Sch. K-1 (Form 1065), box 14 code C. you would have entered on line 1b had you not used the optional method. For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 11358Z Schedule SE (Form 1040) 2021 8a 8b 9 10 11 12 OMB No. 1545-0172 Form 4562 Depreciation and Amortization (Including Information on Listed Property) Attach to your tax return. Go to www.irs.gov/Form4562 for instructions and the latest information. Business or activity to which this form relates 2021 Department of the Treasury Internal Revenue Service (99) Name(s) shown on return Attachment Sequence No. 179 Identifying number 1 Partl Election To Expense Certain Property Under Section 179 Note: If you have any listed property, complete Part V before you complete Part I. 1 Maximum amount (see instructions) . . . . . . . . 2 Total cost of section 179 property placed service (see instructions) 3 Threshold cost of section 179 property before reduction in limitation (see instructions) 4 Reduction in limitation. Subtract line 3 from line 2. If zero or less, enter-O- 5 Dollar limitation for tax year. Subtract line 4 from line 1. If zero or less, enter -O-. If married filing separately, see instructions 6 (a) Description of property (b) Cost (business use only) (c) Elected cost 3 4 5 8 9 10 11 13 placed in service period 7 Listed property. Enter the amount from line 29 7 8 Total elected cost of section 179 property. Add amounts in column (c), lines 6 and 7 9 Tentative deduction. Enter the smaller of line 5 or line 8 10 Carryover of disallowed deduction from line 13 of f your 2020 Form 4562 11 Business income limitation. Enter the smaller of business income (not less than zero) or line 5. See instructions 12 Section 179 expense deduction. Add lines 9 and 10, but don't enter more than line 11 12 13 Carryover of disallowed deduction to 2022. Add lines 9 and 10, less line 12 Note: Don't use Part II or Part below for listed property. Instead, use Part V. Part II Special Depreciation Allowance and Other Depreciation (Don't include listed property. See instructions.) 14 Special depreciation allowance for qualified property (other than listed property) placed in service during the tax year. See instructions. 14 15 Property subject to section 168(1)(1) election 15 16 Other depreciation (including ACRS) 16 Part III MACRS Depreciation (Don't include listed property. See instructions.) Section A 17 MACRS deductions for assets placed in service in tax years beginning before 2021 17 18 If you are electing to group any assets placed in service during the tax year into one or more general asset accounts, check here ....... Section B-Assets Placed in Service During 2021 Tax Year Using the General Depreciation System b) Month and year (c) Basis for depreciation (a) Classification of property (business/investment use (d) Recovery (e) Convention i Method (g) Depreciation deduction only-see instructions) 19a 3-year property b 5-year property C 7-year property d 10-year property e 15-year property f 20-year property g 25-year property 25 yrs. S/L h Residential rental MM S/L property 27.5 yrs. MM S/L i Nonresidential real 39 yrs. MM SAL property MM SAL Section C-Assets Placed in Service During 2021 Tax Year Using the Alternative Depreciation System 20a Class life S/L b 12-year 12 yrs S/L c 30-year 30 yrs MM S/L d 40-year SIL Part IV Summary (See instructions.) 21 Listed property. Enter amount from line 28 21 22 Total. Add amounts from line 12, lines 14 through 17, lines 19 and 20 in column (g), and line 21. Enter here and on the appropriate lines of your return. Partnerships and S corporations-see instructions 23 For assets shown above and placed in service during the current year, enter the portion of the basis attributable to section 263A costs.. For Paperwork Reduction Act Notice, see separate instructions. Form 4562 (2021) 27.5 yrs. 40 yrs MM 22 23 Cat. No. 12906N 1040 Department of the Treasury - Internal Revenue Service () Return 2021 OMB No. 1545-0074 IRS Use Only-Do not write or staple in this space. Filing Status Single Married filing jointly Married filing separately (MFS) Head of household (HOH) Qualifying widow(er) (QW) Check only If you checked the MFS box, enter the name of your spouse. If you checked the HOH or QW box, enter the child's name if the qualifying one box. person is a child but not your dependent Your first name and middle initial Last name Your social security number If joint return, spouse's first name and middle initial Last name Spouse's social security number Home address (number and street). If you have a P.O. box, see instructions. City, town, or post office. If you have a foreign address, also complete spaces below. State Apt. no. Presidential Election Campaign Check here if you, or your ZIP code spouse if filing jointly, want $3 to go to this fund. Checking a box below will not change Foreign postal code your tax or refund. You Spouse Foreign country name Foreign province/state/county At any time during 2021, did you receive, sell, exchange, or otherwise dispose of any financial interest in any virtual currency? Yes O No Standard Someone can claim: You as a dependent Your spouse as a dependent Deduction Spouse itemizes on a separate return or you were a dual-status alien Age/Blindness You: Were born before January 2, 1957 Are blind Spouse: Was born before January 2, 1957 Is blind Dependents (see instructions): (2) Social security (3) Relationship (4) if qualifies for (see instructions): If more (1) First name Last name number to you Child tax credit Credit for other dependents than four dependents see instructions and check heren 1 Wages, salaries, tips, etc. Attach Form(s) W-2 1 Attach 2a Tax-exempt interest. 2a b Taxable interest 2b Sch. Bif 3a Qualified dividends 3a required. 3b b Ordinary dividends 4a TRA distributions 4a b Taxable amount 4b 5a Pensions and annuities 5a b Taxable amount 5b Standard 6a Social security benefits b Taxable amount 6b Deduction for 7 Capital gain or loss). Attach Schedule D if required. If not required, check here 7 Single or Married filing 8 Other income from Schedule 1, line 10 8 $12,550 9 Add lines 1, 2b, 35, 46, 5b, 6b, 7, and 8. This is your total income 9 Married filing 10 Adjustments to income from Schedule 1, line 26 10 jointly or Qualifying 11 Subtract line 10 from line 9. This is your adjusted gross income 11 widow(er). 12a Standard deduction or itemized deductions (from Schedule A) 12a $25,100 Head of b Charitable contributions if you take the standard deduction (see instructions) 12b household $18.800 Add lines 12a and 12b 12c If you checked 13 Qualified business income deduction from Form 8995 or Form 8995-A 13 any box under Standard 14 Add lines 12c and 13 14 Deduction, 15 Taxable income. Subtract line 14 from line 11. If zero or less, enter-O- 15 see instructions. separately, AA For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. Cat. No. 11320B Form 1040 (2021) Page 2 3 18 19 22 C 26 29 29 Form 1040 (2021) 16 Tax (see instructions). Check if any from Form(s): 1 8814 2 4972 3 16 17 Amount from Schedule 2, line 3 17 18 Add lines 16 and 17 . . 19 Nonrefundable child tax credit or credit for other dependents from Schedule 8812 20 Amount from Schedule 3, line 8 20 21 Add lines 19 and 20.. 21 22 Subtract line 21 from line 18. If zero or less, enter-O- 23 Other taxes, including self-employment tax, from Schedule 2, line 21 23 24 Add lines 22 and 23. This is your total tax 24 25 Federal income tax withheld from: a Form(s) W-2. 25a b Form(s) 1099. s 25b Other forms (see instructions) 25c d Add lines 25a through 250 25d a 2021 estimated tax payments and amount applied from 2020 return 26 If you have a qualifying child 27a Earned income credit (EIC). 27a attach Sch. EIC. Check here if you were born after January 1, 1998, and before January 2, 2004, and you satisfy all the other requirements for taxpayers who are at least age 18, to claim the EIC. See instructions b Nontaxable combat pay election. 27b Prior year (2019) earned income 27c 28 Refundable child tax credit or additional child tax credit from Schedule 8812 28 American opportunity credit from Form 8863, line 8 30 Recovery rebate credit. See instructions. 30 31 Amount from Schedule 3, line 15 31 32 Add lines 27 and 28 through 31. These are your total other payments and refundable credits 32 33 Add lines 25d, 26, and 32. These are your total payments 33 34 Refund If line 33 is more than line 24, subtract line 24 from line 33. This is the amount you overpaid 34 35a Amount of line 34 you want refunded to you. If Form 8888 is attached, check here , 35a Direct deposit? b Routing number c Type: Checking Savings See instructions Account number 36 Amount of line 34 you want applied to your 2022 estimated tax. 36 Amount 37 Amount you owe. Subtract line 33 from line 24. For details on how to pay, see instructions 37 You Owe 38 Estimated tax penalty (see instructions) 38 Third Party Do you want to allow another person to discuss this return with the IRS? See Designee instructions Yes. Complete below. No Designee's Phone Personal identification name no. number (PIN) ) Sign Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief, they are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge. Here Your signature Date Your occupation If the IRS sent you an Identity Protection PIN, enter it here Joint return? (see inst.) See instructions. Spouse's signature. If a joint return, both must sign. Date , Spouse's occupation If the IRS sent your spouse an Keep a copy for Identity Protection PIN, enter it here your records (see inst.) Phone no. Email address Preparer's name Preparer's signature PTIN Check if: Paid : Self-employed Preparer Firm's name Use Only Phone no. Firm's address Firm's EIN Go to www.irs.gov/Form 1040 for instructions and the latest information. Form 1040 (2021) . Date Tax return 1-4: Assuming Jay and JoAnn have an unincorporated business that they run as a sole proprietorship, prepare their joint Federal income tax return for 2021. Assume that they have no dependents, do have insurance coverage, do not have any other income or itemized deductions, and they made quarterly Federal income tax payments totaling $7,000. Don't forget to include a standard deduction. Fill out a Schedule C, Schedule SEs, Form 4562, and a Form 1040. Jeff and JoAnn Jefferson are married and have a joint consulting business as a sole proprietorship. Below are the Income Statement and Balance Sheet for calendar 2021 Income Statement Consulting revenue $256,000 Salaries expense, employees 100,000 Payroll tax expense 18,000 Owners Salary(Officer compensation 70,000 Rent expense 12,000 Depreciation 2,000 Travel expense 4,000 Health Insurance (employees) 6,000 Health Insurance (owners) 4,000 Meals - catered by local restaurant 1,000 Entertainment 1,000 Supplies 5.000 Net Book Income $33,000 Balance Sheet Assets: Cash 26,000 Computer 10,000 Computer - A/D -2.000 Total Assets: $34,000 Common Stock 1,000 Retained Earnings 33.000 Total Liabilities and Equity $34,000 SCHEDULEC Profit or Loss From Business OMB No. 1545-0074 (Form 1040) (Sole Proprietorship) 2021 Department of the Treasury Go to www.irs.gov/Schedule for instructions and the latest information. Attachment Internal Revenue Service (99) Attach to Form 1040, 1040-SR, 1040-NR, or 1041; partnerships must generally file Form 1065. Sequence No. 09 Name of proprietor Social security number (SSN) A Principal business or profession, including product or service (see instructions) B Enter code from instructions Business name. If no separate business name, leave blank. D Employer ID number (EIN) (see instr. ) E 4 5 HHHHH 6 7 9 11 Business address (including suite or room no.) City, town or post office, state, and ZIP code F Accounting method: (1) Cash (2) Accrual (3) Other (specify) G Did you "materially participate in the operation of this business during 2021? If "No," see instructions for limit on losses Yes No H If you started or acquired this business during 2021, check here 1 Did you make any payments in 2021 that would require you to file Form(s) 1099? See instructions Yes No If "Yes," did you or will you file required Form(s) 1099? Yes No Part I Income 1 Gross receipts or sales. See instructions for line 1 and check the box if this income was reported to you on Form W-2 and the "Statutory employee" box on that form was checked 1 2 Returns and allowances. 2 3 Subtract line 2 from line 1 3 4 Cost of goods sold (from line 42) Gross profit. Subtract line 4 from line 3 5 6 Other income, including federal and state gasoline or fuel tax credit or refund (see instructions) Gross income. Add lines 5 and 6 . 5 6 7 Part II Expenses. Enter expenses for business use of your home only on line 30. 8 Advertising. 8 18 Office expense (see instructions) ) 18 9 Car and truck expenses (see 19 Pension and profit-sharing plans. 19 instructions) ) 9 20 Rent or lease (see instructions): : 10 Commissions and fees 10 a Vehicles, machinery, and equipment 20a Contract labor (see instructions) 11 ) Other business property 20b 12 Depletion 12 21 Repairs and maintenance 21 13 Depreciation and section 179 22 Supplies (not included in Part III) 22 expense deduction (not included in Part III) (see 23 Taxes and licenses. 23 instructions) 13 24 Travel and meals: 14 Employee benefit programs a Travel 24a (other than on line 19) 14 b Deductible meals (see 15 Insurance (other than health) 15 instructions) 24b 16 Interest (see instructions): 25 Utilities 25 a Mortgage (paid to banks, etc.) 16a Wages (less employment credits) 26 b Other 27a Other expenses (from line 48) 27a 17 Legal and professional services 17 b Reserved for future use 27b 28 Total expenses before expenses for business use of home. Add lines 8 through 27a 29 Tentative profit or loss). Subtract line 28 from line 7 30 Expenses for business use of your home. Do not report these expenses elsewhere. Attach Form 8829 unless using the simplified method. See instructions, Simplified method filers only: Enter the total square footage of (a) your home: and (b) the part of your home used for business: Use the Simplified Method Worksheet in the instructions to figure the amount to enter on line 30. 30 31 Net profit or loss). Subtract line 30 from line 29. If a profit, enter on both Schedule 1 (Form 1040), line 3, and on Schedule SE, line 2. (If you checked the box on line 1, see instructions). Estates and trusts, enter on Form 1041, line 3. 31 If a loss, you must go to line 32 32 If you have a loss, check the box that describes your investment in this activity. See instructions. a , If you checked 32a, enter the loss on both Schedule 1 (Form 1040), line 3, and on Schedule SE, line 2. (If you checked the box on line 1, see the line 31 instructions.) Estates and trusts, enter on .) 32a All investment is at risk. Form 1041, line 3. 32b Some investment is not If you checked 32b, you must attach Form 6198. Your loss may be limited. at risk. For Paperwork Reduction Act Notice, see the separate instructions. Cat. No. 11334P . Schedule C (Form 1040) 2021 C 16b 28 29 Page 2 Schedule C (Form 1040) 2021 Part III Cost of Goods Sold (see instructions) 33 Method(s) used to value closing inventory: a Cost b Lower of cost or market c Other (attach explanation) Was there any change in determining quantities, costs, or valuations between opening and closing inventory? n If "Yes," attach explanation... Yes 34 No 35 Inventory at beginning of year. If different from last year's closing inventory, attach explanation . . 35 36 Purchases less cost of items withdrawn for personal use 36 37 Cost of labor. Do not include any amounts paid to yourself 37 38 Materials and supplies 38 39 Other costs. 39 40 Add lines 35 through 39 40 41 Inventory at end of year. 41 42 Cost of goods sold. Subtract line 41 from line 40. Enter the result here and on line 4 42 Part IV Information on Your Vehicle. Complete this part only if you are claiming car or truck expenses on line 9 and are not required to file Form 4562 for this business. See the instructions for line 13 to find out if you must file Form 4562. 43 When did you place your vehicle in service for business purposes? (month/day/year) / 44 Of the total number of miles you drove your vehicle during 2021, enter the number of miles you used your vehicle for: a Business b Commuting (see instructions) b ( c Other 45 Was your vehicle available for personal use during off-duty hours? Yes No 46 Do you (or your spouse) have another vehicle available for personal use? Yes No Yes No 47a Do you have evidence to support your deduction? ? b If "Yes," is the evidence written? ..... ? Part V Other Expenses. List below business expenses not included on lines 8-26 or line 30. Yes No 48 Total other expenses. Enter here and on line 27a 48 Schedule C (Form 1040) 2021 6 SCHEDULE SE OMB No. 1545-0074 (Form 1040) Self-Employment Tax 2021 Department of the Treasury Go to www.irs.gov/ScheduleSE for instructions and the latest information Attachment Internal Revenue Service (99) Attach to Form 1040, 1040-SR, or 1040-NR. Sequence No. 17 Name of person with self-employment income (as shown on Form 1040, 1040-SR, or 1040-NR) Social security number of person with self-employment income Partl Self-Employment Tax Note: If your only income subject to self-employment tax is church employee income, see instructions for how to report your income and the definition of church employee income. A If you are a minister, member of a religious order, or Christian Science practitioner and you filed Form 4361, but you had $400 or more of other net earnings from self-employment, check here and continue with Part ... Skip lines 1a and 1b if you use the farm optional method in Part II. See instructions. 1a Net farm profit or loss) from Schedule F, line 34, and farm partnerships, Schedule K-1 (Form 1065), box 14, code A ..... 1a b If you received social security retirement or disability benefits, enter the amount of Conservation Reserve Program payments included on Schedule F, line 4b, or listed on Schedule K-1 (Form 1065), box 20, code AH 1b Skip line 2 if you use the nonfarm optional method in Part II. See instructions. 2 Net profit or loss) from Schedule C, line 31; and Schedule K-1 (Form 1065), box 14, code A (other than farming). See instructions for other income to report or if you are a minister or member of a religious order 2 3 Combine lines 1a, 1b, and 2 3 .. 4a If line 3 is more than zero, multiply line 3 by 92.35% (0.9235). Otherwise, enter amount from line 3 4a Note: If line 4a is less than $400 due to Conservation Reserve Program payments on line 1b, see instructions. b If you elect one or both of the optional methods, enter the total of lines 15 and 17 here 4b c Combine lines 4a and 4b. If less than $400, stop; you don't owe self-employment tax. Exception: If less than $400 and you had church employee income, enter -- and continue. 4c 5a Enter your church employee income from Form W-2. See instructions for definition of church employee income 5a b Multiply line 5a by 92.35% (0.9235). Fless than $100, enter-O- 5b Add lines 4c and 5b 6 7 Maximum amount of combined wages and self-employment earnings subject to social security tax or the 6.2% portion of the 7.65% railroad retirement (tier 1) tax for 2021 7 142,800 8a Total social security wages and tips (total of boxes 3 and 7 on Form(s) W-2) and railroad retirement (tier 1) compensation. If $142,800 or more, skip lines 8b through 10, and go to line 11 b Unreported tips subject to social security tax from Form 4137, line 10 c Wages subject to social security tax from Form 8919, line 10. 8C d Add lines 8a, 8b, and 8C 8d 9 Subtract line 8d from line 7. If zero or less, enter-O- here and on line 10 and go to line 11 10 Multiply the smaller of line 6 or line 9 by 12.4% (0.124). 11 Multiply line 6 by 2.9% (0.029) 12 Self-employment tax. Add lines 10 and 11. Enter here and on Schedule 2 (Form 1040), line 4 13 Deduction for one-half of self-employment tax. Multiply line 12 by 50% (0.50). Enter here and on Schedule 1 (Form 1040), line 15 13 Part II Optional Methods To Figure Net Earnings (see instructions) Farm Optional Method. You may use this method only if (a) your gross farm income wasn't more than $8,820, or (b) your net farm profits were less than $6,367. 14 Maximum income for optional methods 14 5,880 15 Enter the smaller of: two-thirds (/) of gross farm income' (not less than zero) or $5,880. Also, include this amount on line 4b above 15 Nonfarm Optional Method. You may use this method only if (a) your net nonfarm profits were less than $6,367 and also less than 72.189% of your gross nonfarm income, and (b) you had net earnings from self-employment of at least $400 in 2 of the prior 3 years. Caution: You may use this method no more than five times. 16 Subtract line 15 from line 14. 16 17 Enter the smaller of: two-thirds (/) of gross nonfarm income (not less than zero) or the amount on line 16. Also, include this amount on line 4b above 17 From Sch. F, line 9; and Sch. K-1 (Form 1065), box 14, code B. From Sch. C, line 31; and Sch. K-1 (Form 1065), box 14, code A. 2 From Sch. F, line 34; and Sch. K-1 (Form 1065), box 14 code A-minus the amount From Sch. C. line 7; and Sch. K-1 (Form 1065), box 14 code C. you would have entered on line 1b had you not used the optional method. For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 11358Z Schedule SE (Form 1040) 2021 8a 8b 9 10 11 12 OMB No. 1545-0172 Form 4562 Depreciation and Amortization (Including Information on Listed Property) Attach to your tax return. Go to www.irs.gov/Form4562 for instructions and the latest information. Business or activity to which this form relates 2021 Department of the Treasury Internal Revenue Service (99) Name(s) shown on return Attachment Sequence No. 179 Identifying number 1 Partl Election To Expense Certain Property Under Section 179 Note: If you have any listed property, complete Part V before you complete Part I. 1 Maximum amount (see instructions) . . . . . . . . 2 Total cost of section 179 property placed service (see instructions) 3 Threshold cost of section 179 property before reduction in limitation (see instructions) 4 Reduction in limitation. Subtract line 3 from line 2. If zero or less, enter-O- 5 Dollar limitation for tax year. Subtract line 4 from line 1. If zero or less, enter -O-. If married filing separately, see instructions 6 (a) Description of property (b) Cost (business use only) (c) Elected cost 3 4 5 8 9 10 11 13 placed in service period 7 Listed property. Enter the amount from line 29 7 8 Total elected cost of section 179 property. Add amounts in column (c), lines 6 and 7 9 Tentative deduction. Enter the smaller of line 5 or line 8 10 Carryover of disallowed deduction from line 13 of f your 2020 Form 4562 11 Business income limitation. Enter the smaller of business income (not less than zero) or line 5. See instructions 12 Section 179 expense deduction. Add lines 9 and 10, but don't enter more than line 11 12 13 Carryover of disallowed deduction to 2022. Add lines 9 and 10, less line 12 Note: Don't use Part II or Part below for listed property. Instead, use Part V. Part II Special Depreciation Allowance and Other Depreciation (Don't include listed property. See instructions.) 14 Special depreciation allowance for qualified property (other than listed property) placed in service during the tax year. See instructions. 14 15 Property subject to section 168(1)(1) election 15 16 Other depreciation (including ACRS) 16 Part III MACRS Depreciation (Don't include listed property. See instructions.) Section A 17 MACRS deductions for assets placed in service in tax years beginning before 2021 17 18 If you are electing to group any assets placed in service during the tax year into one or more general asset accounts, check here ....... Section B-Assets Placed in Service During 2021 Tax Year Using the General Depreciation System b) Month and year (c) Basis for depreciation (a) Classification of property (business/investment use (d) Recovery (e) Convention i Method (g) Depreciation deduction only-see instructions) 19a 3-year property b 5-year property C 7-year property d 10-year property e 15-year property f 20-year property g 25-year property 25 yrs. S/L h Residential rental MM S/L property 27.5 yrs. MM S/L i Nonresidential real 39 yrs. MM SAL property MM SAL Section C-Assets Placed in Service During 2021 Tax Year Using the Alternative Depreciation System 20a Class life S/L b 12-year 12 yrs S/L c 30-year 30 yrs MM S/L d 40-year SIL Part IV Summary (See instructions.) 21 Listed property. Enter amount from line 28 21 22 Total. Add amounts from line 12, lines 14 through 17, lines 19 and 20 in column (g), and line 21. Enter here and on the appropriate lines of your return. Partnerships and S corporations-see instructions 23 For assets shown above and placed in service during the current year, enter the portion of the basis attributable to section 263A costs.. For Paperwork Reduction Act Notice, see separate instructions. Form 4562 (2021) 27.5 yrs. 40 yrs MM 22 23 Cat. No. 12906N 1040 Department of the Treasury - Internal Revenue Service () Return 2021 OMB No. 1545-0074 IRS Use Only-Do not write or staple in this space. Filing Status Single Married filing jointly Married filing separately (MFS) Head of household (HOH) Qualifying widow(er) (QW) Check only If you checked the MFS box, enter the name of your spouse. If you checked the HOH or QW box, enter the child's name if the qualifying one box. person is a child but not your dependent Your first name and middle initial Last name Your social security number If joint return, spouse's first name and middle initial Last name Spouse's social security number Home address (number and street). If you have a P.O. box, see instructions. City, town, or post office. If you have a foreign address, also complete spaces below. State Apt. no. Presidential Election Campaign Check here if you, or your ZIP code spouse if filing jointly, want $3 to go to this fund. Checking a box below will not change Foreign postal code your tax or refund. You Spouse Foreign country name Foreign province/state/county At any time during 2021, did you receive, sell, exchange, or otherwise dispose of any financial interest in any virtual currency? Yes O No Standard Someone can claim: You as a dependent Your spouse as a dependent Deduction Spouse itemizes on a separate return or you were a dual-status alien Age/Blindness You: Were born before January 2, 1957 Are blind Spouse: Was born before January 2, 1957 Is blind Dependents (see instructions): (2) Social security (3) Relationship (4) if qualifies for (see instructions): If more (1) First name Last name number to you Child tax credit Credit for other dependents than four dependents see instructions and check heren 1 Wages, salaries, tips, etc. Attach Form(s) W-2 1 Attach 2a Tax-exempt interest. 2a b Taxable interest 2b Sch. Bif 3a Qualified dividends 3a required. 3b b Ordinary dividends 4a TRA distributions 4a b Taxable amount 4b 5a Pensions and annuities 5a b Taxable amount 5b Standard 6a Social security benefits b Taxable amount 6b Deduction for 7 Capital gain or loss). Attach Schedule D if required. If not required, check here 7 Single or Married filing 8 Other income from Schedule 1, line 10 8 $12,550 9 Add lines 1, 2b, 35, 46, 5b, 6b, 7, and 8. This is your total income 9 Married filing 10 Adjustments to income from Schedule 1, line 26 10 jointly or Qualifying 11 Subtract line 10 from line 9. This is your adjusted gross income 11 widow(er). 12a Standard deduction or itemized deductions (from Schedule A) 12a $25,100 Head of b Charitable contributions if you take the standard deduction (see instructions) 12b household $18.800 Add lines 12a and 12b 12c If you checked 13 Qualified business income deduction from Form 8995 or Form 8995-A 13 any box under Standard 14 Add lines 12c and 13 14 Deduction, 15 Taxable income. Subtract line 14 from line 11. If zero or less, enter-O- 15 see instructions. separately, AA For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. Cat. No. 11320B Form 1040 (2021) Page 2 3 18 19 22 C 26 29 29 Form 1040 (2021) 16 Tax (see instructions). Check if any from Form(s): 1 8814 2 4972 3 16 17 Amount from Schedule 2, line 3 17 18 Add lines 16 and 17 . . 19 Nonrefundable child tax credit or credit for other dependents from Schedule 8812 20 Amount from Schedule 3, line 8 20 21 Add lines 19 and 20.. 21 22 Subtract line 21 from line 18. If zero or less, enter-O- 23 Other taxes, including self-employment tax, from Schedule 2, line 21 23 24 Add lines 22 and 23. This is your total tax 24 25 Federal income tax withheld from: a Form(s) W-2. 25a b Form(s) 1099. s 25b Other forms (see instructions) 25c d Add lines 25a through 250 25d a 2021 estimated tax payments and amount applied from 2020 return 26 If you have a qualifying child 27a Earned income credit (EIC). 27a attach Sch. EIC. Check here if you were born after January 1, 1998, and before January 2, 2004, and you satisfy all the other requirements for taxpayers who are at least age 18, to claim the EIC. See instructions b Nontaxable combat pay election. 27b Prior year (2019) earned income 27c 28 Refundable child tax credit or additional child tax credit from Schedule 8812 28 American opportunity credit from Form 8863, line 8 30 Recovery rebate credit. See instructions. 30 31 Amount from Schedule 3, line 15 31 32 Add lines 27 and 28 through 31. These are your total other payments and refundable credits 32 33 Add lines 25d, 26, and 32. These are your total payments 33 34 Refund If line 33 is more than line 24, subtract line 24 from line 33. This is the amount you overpaid 34 35a Amount of line 34 you want refunded to you. If Form 8888 is attached, check here , 35a Direct deposit? b Routing number c Type: Checking Savings See instructions Account number 36 Amount of line 34 you want applied to your 2022 estimated tax. 36 Amount 37 Amount you owe. Subtract line 33 from line 24. For details on how to pay, see instructions 37 You Owe 38 Estimated tax penalty (see instructions) 38 Third Party Do you want to allow another person to discuss this return with the IRS? See Designee instructions Yes. Complete below. No Designee's Phone Personal identification name no. number (PIN) ) Sign Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief, they are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge. Here Your signature Date Your occupation If the IRS sent you an Identity Protection PIN, enter it here Joint return? (see inst.) See instructions. Spouse's signature. If a joint return, both must sign. Date , Spouse's occupation If the IRS sent your spouse an Keep a copy for Identity Protection PIN, enter it here your records (see inst.) Phone no. Email address Preparer's name Preparer's signature PTIN Check if: Paid : Self-employed Preparer Firm's name Use Only Phone no. Firm's address Firm's EIN Go to www.irs.gov/Form 1040 for instructions and the latest information. Form 1040 (2021) . Date

Schedule SE

Schedule SE Form 4562

Form 4562 Form 1040

Form 1040