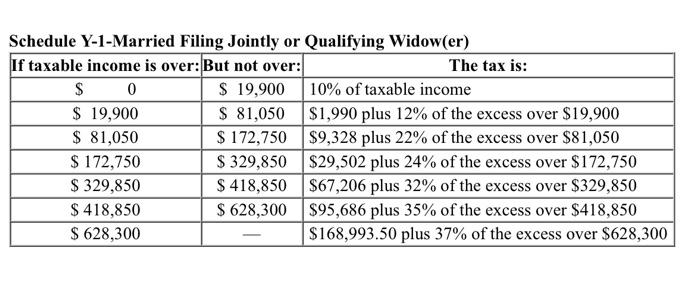

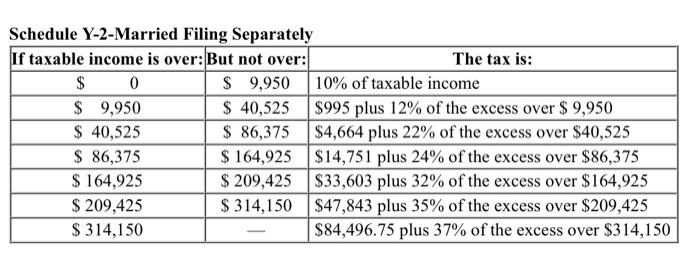

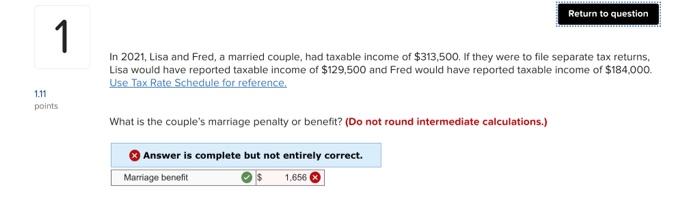

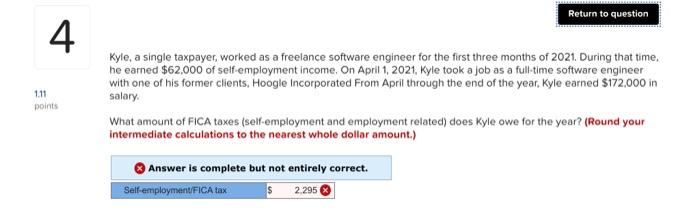

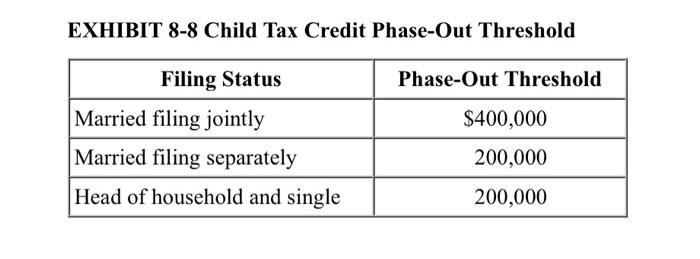

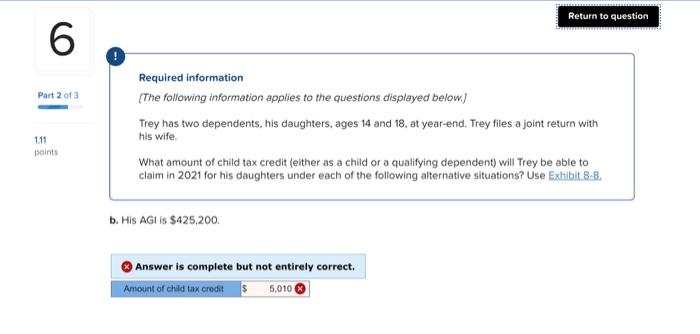

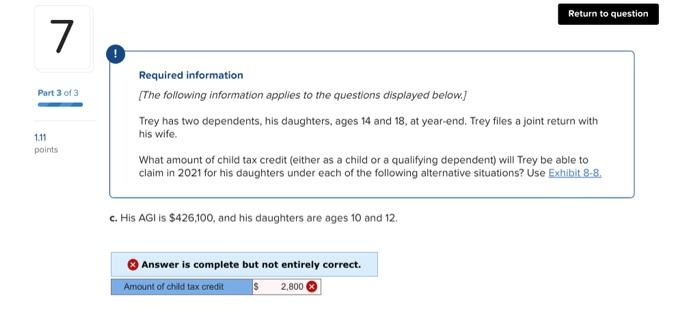

Schedule Y-1-Married Filing Jointly or Qualifying Widow(er) If taxable income is over: But not over: The tax is: $ 0 $ 19,900 10% of taxable income $ 19,900 $ 81,050 $1,990 plus 12% of the excess over $19,900 $ 81,050 $ 172,750 $9,328 plus 22% of the excess over $81,050 $ 172,750 $ 329,850 $29,502 plus 24% of the excess over $172,750 $ 329,850 $ 418,850 $67,206 plus 32% of the excess over $329,850 $ 418,850 $ 628,300 $95,686 plus 35% of the excess over $418,850 $ 628,300 $168,993.50 plus 37% of the excess over $628,300 Schedule Y-2-Married Filing Separately If taxable income is over: But not over: The tax is: $ 0 $ 9,950 10% of taxable income $ 9,950 $ 40,525 $995 plus 12% of the excess over $ 9,950 $ 40,525 $ 86,375 $4,664 plus 22% of the excess over $40,525 $ 86,375 $ 164,925 $14,751 plus 24% of the excess over $86,375 $ 164,925 $ 209,425 $33,603 plus 32% of the excess over $164,925 $ 209,425 $ 314,150 $47,843 plus 35% of the excess over $209,425 $ 314,150 $84,496.75 plus 37% of the excess over $314,150 Return to question 1 In 2021, Lisa and Fred, a married couple, had taxable income of $313,500. If they were to file separate tax returns, Lisa would have reported taxable income of $129,500 and Fred would have reported taxable income of $184.000. Use Tax Rate Schedule for reference. 1.11 points What is the couple's marriage penalty or benefit? (Do not round intermediate calculations.) Answer is complete but not entirely correct. Marriage benefit 1,656 Return to question 4. 1.11 points Kyle, a single taxpayer, worked as a freelance software engineer for the first three months of 2021. During that time, he earned $62,000 of self-employment income. On April 1, 2021, Kyle took a job as a full-time software engineer with one of his former clients, Hoogle Incorporated From April through the end of the year, Kyle earned $172,000 in salary What amount of FICA taxes (self-employment and employment related) does Kyle owe for the year? (Round your intermediate calculations to the nearest whole dollar amount.) Answer is complete but not entirely correct. Self-employmentFICA tax $ 2,295 EXHIBIT 8-8 Child Tax Credit Phase-Out Threshold Filing Status Phase-Out Threshold $400,000 Married filing jointly Married filing separately Head of household and single 200,000 200,000 Return to question 6 Part 2 of 3 Required information {The following information applies to the questions displayed below) Trey has two dependents, his daughters, ages 14 and 18, at year-end. Trey files a joint return with his wife. What amount of child tax credit (either as a child or a qualifying dependent) will Trey be able to claim in 2021 for his daughters under each of the following alternative situations? Use Exhibit 8-8. 111 points b. His AGI is $425,200 Answer is complete but not entirely correct. Amount of child tax credits 5,010 Return to question 7 Part 3 of 3 Required information {The following information applies to the questions displayed below.) Trey has two dependents, his daughters, ages 14 and 18, at year-end. Trey files a joint return with his wife. What amount of child tax credit (either as a child or a qualifying dependent) will Trey be able to claim in 2021 for his daughters under each of the following alternative situations? Use Exhibit 8-8. 1.11 points c. His AGI is $426,100, and his daughters are ages 10 and 12. Answer is complete but not entirely correct. Amount of child tax credit $ 2,800