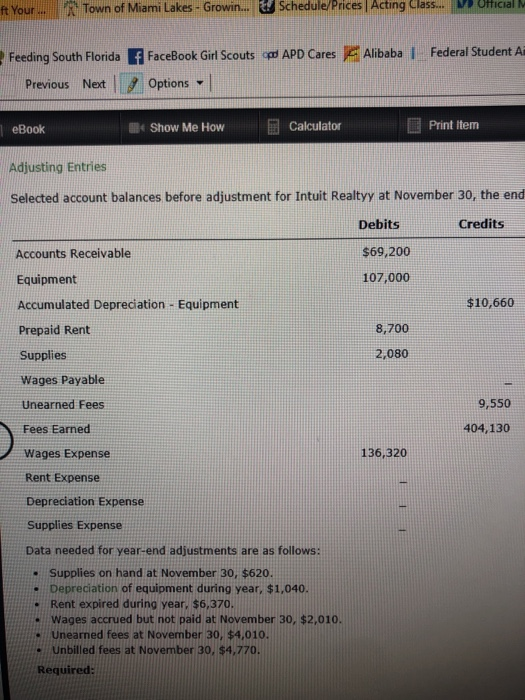

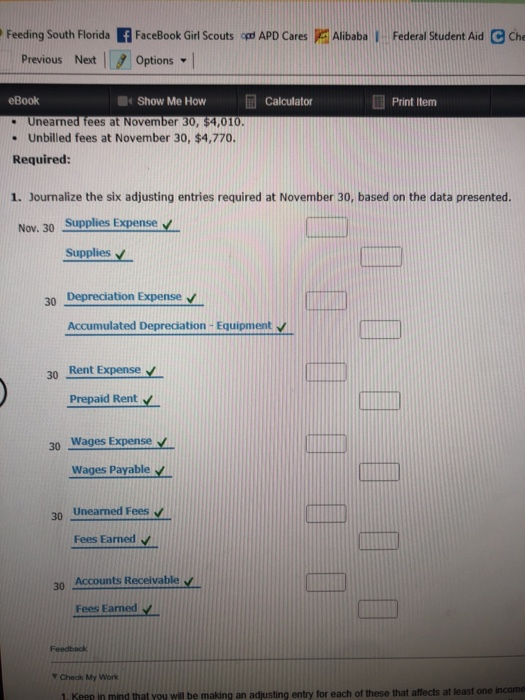

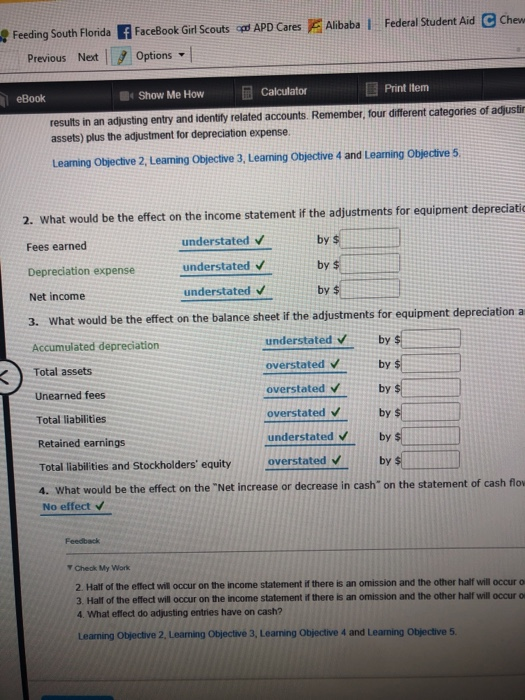

Schedule/Prices Acting Class... V Official M ATown of Miami Lakes- Growin... ft Your... Federal Student Ai Alibaba FaceBook Girl Scouts od APD Cares Feeding South Florida Options Previous Next Print Item Calculator Show Me How eBook Adjusting Entries Selected account balances before adjustment for Intuit Realtyy at November 30, the end Credits Debits $69,200 Accounts Receivable 107,000 Equipment $10,660 Accumulated Depreciation - Equipment 8,700 Prepaid Rent 2,080 Supplies Wages Payable 9,550 Unearned Fees 404,130 Fees Earned Wages Expense 136,320 Rent Expense Depreciation Expense Supplies Expense Data needed for year-end adjustments are as follows: Supplies on hand at November 30, $620. Depreciation of equipment during year, $1,040. Rent expired during year, $6,370. Wages accrued but not paid at November 30, $2,010. Unearned fees at November 30, $4,010. Unbilled fees at November 30, $4,770. Required: Feeding South Florida FaceBook Girl Scouts od APD Cares Alibaba Federal Student Aid C Che Options Previous Next eBook Calculator Show Me How Print Item Unearned fees at November 30, $4,010. Unbilled fees at November 30, $4,770. Required: 1. Journalize the six adjusting entries required at November 30, based on the data presented. Nov. 30 Supplies Expense Supplies 30 Depreciation Expense Accumulated Depreciation-Equipment Rent Expense Prepaid Rent 30 Wages Expense Wages Payable 30 Unearned Fees Fees Earned Accounts Receivable Fees Earned Feedback Y Check My Work of these that affects at least one income 1. Keep in mind that you will be making an adiusting entry for each 30 Chew Federal Student Aid Alibaba f FaceBook Girl Scouts opd APD Cares Feeding South Florida Options Previous Next Print Item Calculator Show Me How eBook results in an adjusting entry and identify related accounts. Remember, four different categories of adjustir assets) plus the adjustment for depreciation expense Leaning Objective 2, Leaming Objective 3, Leaning Objective 4 and Learning Objective 5 2. What would be the effect on the income statement if the adjustments for equipment depreciatic by $ understatedv Fees earned understated by $ Depreciation expense understated by $ Net income a What would be the effect on the balance sheet if the adjustments for equipment depreciation 3. by $ understated V Accumulated depreciation overstated by $ Total assets overstated by $ Unearned fees overstated by $ Total liabilities by $ understated Retained earnings overstated by $ Total liabilities and Stockholders' equity 4. What would be the effect on the "Net increase or decrease in cash" on the statement of cash flow No effect v Feedback Y Check My Work 2. Half of the effect will occur on the income statement if there is an omission and the other half will occur o 3. Half of the effect will occur on the income statement if there is an omission and the other half will occur o 4. What effect do adjusting entries have on cash? Learning Objective 2, Leaning Objective 3, Learning Objective 4 and Leaming Objective 5