Answered step by step

Verified Expert Solution

Question

1 Approved Answer

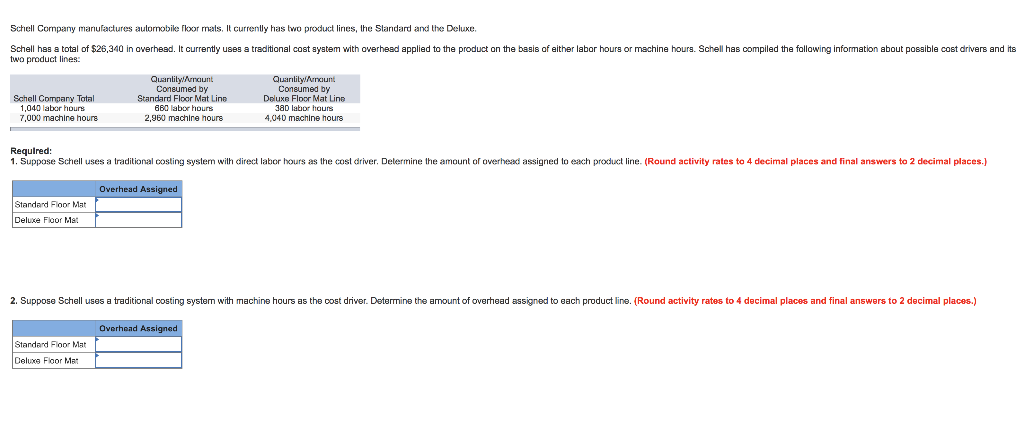

Schell Company manufactures automobile floor mats. It currently has two product lines, the Standard and the Deluxe. Schell has a total of $26,340 in overhead.

Schell Company manufactures automobile floor mats. It currently has two product lines, the Standard and the Deluxe. Schell has a total of $26,340 in overhead. It currently uses a traditional cost system with overhead applied to the product on the basis of either labor hours or machine hours. Schell has compiled the following information about possible cost drivers and its two product lines:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started