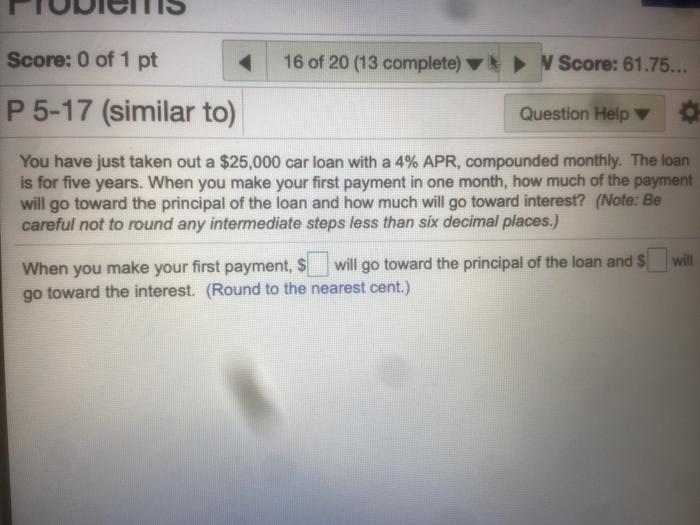

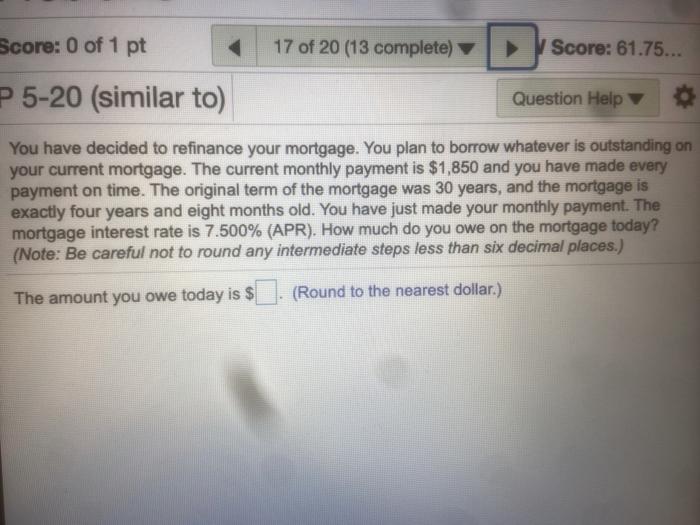

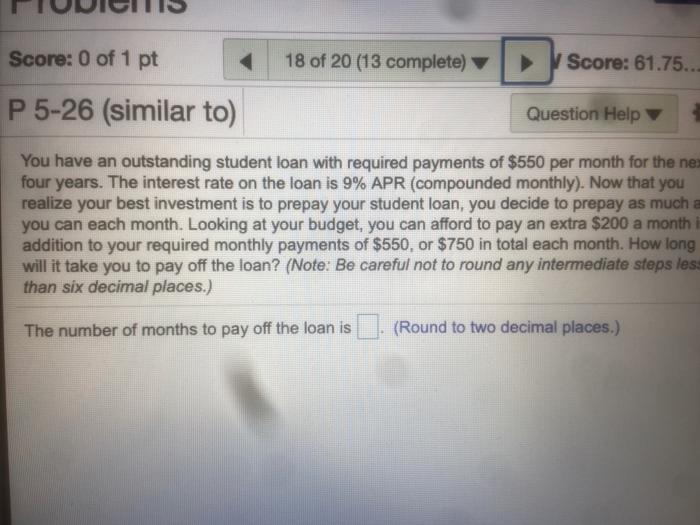

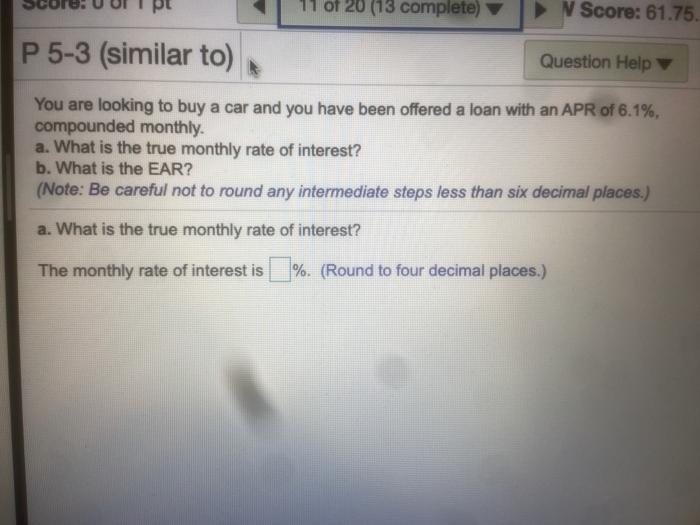

Score: 0 of 1 pt 16 of 20 (13 complete) N Score: 61.75... P 5-17 (similar to) Question Help You have just taken out a $25,000 car loan with a 4% APR, compounded monthly. The loan is for five years. When you make your first payment in one month, how much of the payment will go toward the principal of the loan and how much will go toward interest? (Note: Be careful not to round any intermediate steps less than six decimal places.) will When you make your first payment, $ will go toward the principal of the loan and $ go toward the interest. (Round to the nearest cent.) Score: 0 of 1 pt 17 of 20 (13 complete) Score: 61.75... P 5-20 (similar to) Question Help You have decided to refinance your mortgage. You plan to borrow whatever is outstanding on your current mortgage. The current monthly payment is $1,850 and you have made every payment on time. The original term of the mortgage was 30 years, and the mortgage is exactly four years and eight months old. You have just made your monthly payment. The mortgage interest rate is 7.500% (APR). How much do you owe on the mortgage today? (Note: Be careful not to round any intermediate steps less than six decimal places.) The amount you owe today is $ (Round to the nearest dollar.) Score: 0 of 1 pt 18 of 20 (13 complete) Score: 61.75... P 5-26 (similar to) Question Help You have an outstanding student loan with required payments of $550 per month for the nex four years. The interest rate on the loan is 9% APR (compounded monthly). Now that you realize your best investment is to prepay your student loan, you decide to prepay as much a you can each month. Looking at your budget, you can afford to pay an extra $200 a month i addition to your required monthly payments of $550, or $750 in total each month. How long will it take you to pay off the loan? (Note: Be careful not to round any intermediate steps les than six decimal places.) The number of months to pay off the loan is (Round to two decimal places.) 11 of 20 (13 complete) V Score: 61.75. P 5-3 (similar to) Question Help You are looking to buy a car and you have been offered a loan with an APR of 6.1%, compounded monthly. a. What is the true monthly rate of interest? b. What is the EAR? (Note: Be careful not to round any intermediate steps less than six decimal places.) a. What is the true monthly rate of interest? The monthly rate of interest is %. (Round to four decimal places.)