Answered step by step

Verified Expert Solution

Question

1 Approved Answer

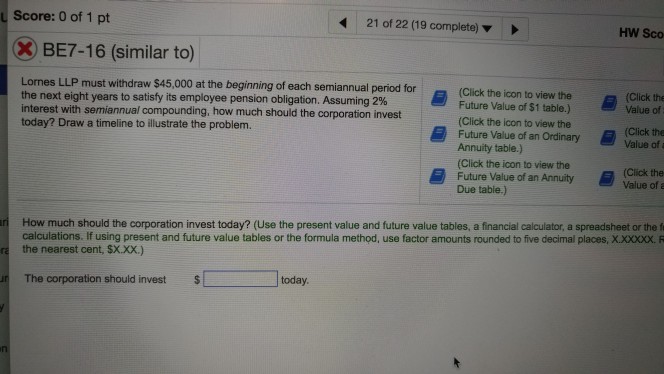

Score: 0 of 1 pt 21 of 22 (19 complete) HW Sco BE7-16 (similar to) Lornes LLP must withdraw $45,000 at the beginning of each

Score: 0 of 1 pt 21 of 22 (19 complete) HW Sco BE7-16 (similar to) Lornes LLP must withdraw $45,000 at the beginning of each semiannual period for (Click the icon to view the the next eight years to satisfy its employee pension obligation Assuming 2% interest with semiannual compounding, how much should the corporation invest today? Draw a timeline to illustrate the problem. Click the Value of Future Value of $1 table.) (Click the icon to view the Future Value of an Ordinary Annuity table.) (Click the icon to view the Future Value of an Annuity Due tabie.) (Click the Value of a (Click the value of a n How much should the corporation invest today? (Use the present value and future value tables, a financial calculator, a spreadsheet or the f calculations. If using present and future value tables or the formula method, use factor amounts rounded to five decimal places, X.Xx0x R the nearest cent, $x.xx.) The corporation should invests today

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started