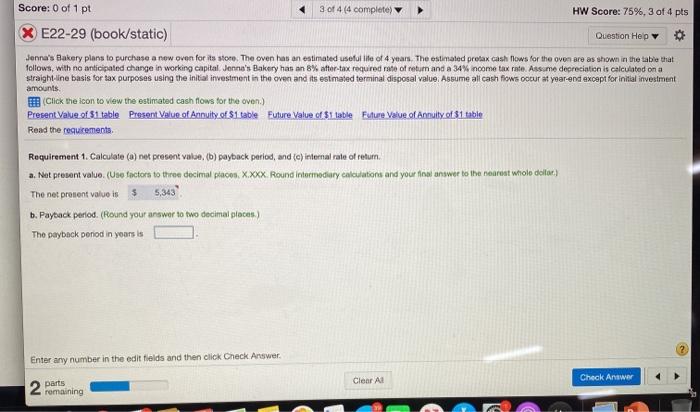

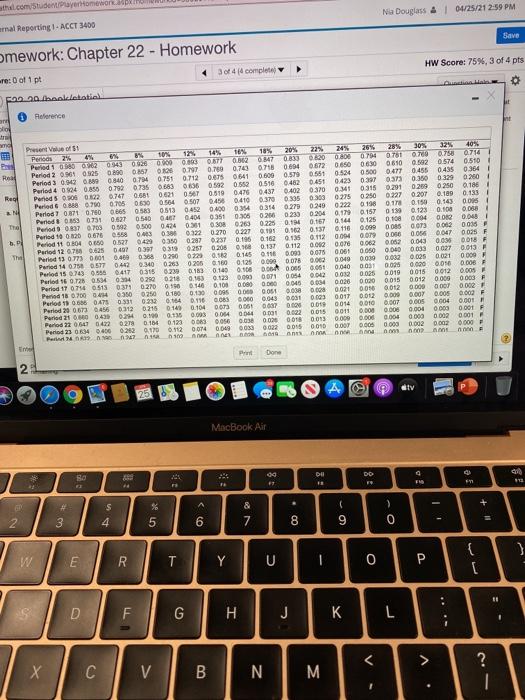

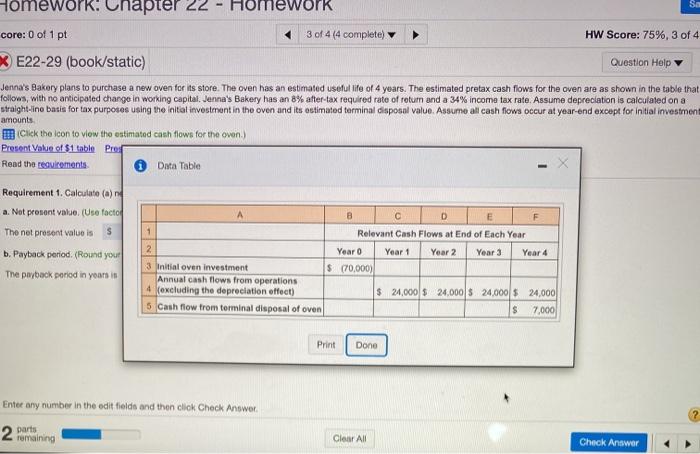

Score: 0 of 1 pt 3 of 4 (4 complete HW Score: 75%, 3 of 4 pts E22-29 (book/static) Question Help Jenna's Bakery plans to purchase a new oven for its store. The oven has an estimated useful life of 4 years. The estimated prelax cash flows for the oven are as shown in the table that follows, with no anticipated change in working capital, Jenna's Bakery hat an 8% after-tax requred rate of return and a 34% ncome tax rate Assame depreciation is calculated on a straight-line basis for tax purposes using the initial investment in the oven and its estimated terminal disposal value Assume all cash flows occur af year-end except for initial investment amounts Click the icon to view the estimated cash flows for the oven.) Present Value of 31 table Present Value of Annuity_o$1 table Future Value of $1 table Future Value of Annuity of 31 table Read the requirements Requirement 1. Calculate () net present valse, (b) payback period, and (c) internal rate of retum. a. Not present value. (Use factors to three decimal piacon. X.XXX. Round intermediary calculators and your final answer to the neareat wholo dollar) The net proient value is $ 5,343 b. Paytack period. (Round your answer to two decimal places) The payback period in yours is Enter any number in the edit fields and then click Check Answer. Clear All Check Anwar 2 remaining ath.com Student payer Homeware Na Douglass 4 1 04/25/21 2:59 PM anal Reporting 1-ACCT 3400 Save amework: Chapter 22 - Homework HW Score: 7596, 3 of 4 pts 304 complete re: 0 of 1 pt FOD 20. hookletatio. Reference 0.257 0.009 RE 0.260 0340 0.552 0.301 0437 Real 0.705 0.314 0.27 0.250 OBS 0279 0.349 NE 0.306 0.068 003 0.144 0.125 TO 0.223 b. Present of Periods 2% 49 6 89 10% 12 TE 185 20% 22% 265 28 30% 32% 40% Period 1 686 162 0143 0926060 0362 OMT 0833 0.000 0794 761 O. 0.758 Period 2 03 0525 126 197 0.19 0.743 0718 0694 0.672 0.650 0.630 0610 0.592 0574 0.510 Period 3 0.942 0.889 0714 0751 0.712 Ques 0641 0579 0.561 0.524 0.500 0.477 0.455 0435 0.364 1 Period 4 014 0853 0.792 0.735 0.083 36 0592 0516 0462 0.451 0423 373 0.350 0.329 1 Periods 0.01 022 0.747 06 0621 OST 0.519 0.476 402 0.370 0315 0.291 0.29 0.250 0.1061 11 Period G 0.88 0.70 060 307 040 0.370 0.335 0.303 0275 MA 0227 0207 109 012 1 Parlos 7 0.371 0760 05 0513 0452 w 0.400 18 0.222 0198 0.150 0.143 Pened 059 0751 06 00 0500 0404 0351 0.204 0199 0.17 0.157 0.123 0.100 Period 097 0700 0.92 0.500 0.44 0.800 0.263 0.14 0.167 0108 0.004 0012 0.048 Period 190-2006 0.558 0463 0322 0.270 0.162 0.227 0.19 0.137 0.116 0.099 Period 11 6 804 0.00 0.527 0085 0.003 0.073 0429 030 0287 0237 0195 0.162 0.135 0.112 0.04 0.079 0.05 01647 O 066 Period 12 678 0.625 0.035 F 04670 0319 0257 0.05 . 0.131 0.112 0.012 Period 13 0.773 0.601 0.489 0.043 0.07 0.062 0.00 0.018 038 0290 09 0.145 0.003 0.035 0.061 Period 14 0.750 0.577 0.050 0.033 002 0.013 F 0.340 023 0205 0.160 0.125 090 DOP 0.002 0.040 0.039 0.002 Os 0:35 0021 Period 15.743 0.566 6.417 07 0.000 0 149 150 0.051 0 0 0 04 0026 0.0400031 Purid 16 0.28 0.534 0020 0.008 0.00 290 0218 0.153 0.125 000 0073 0054 0032 0.035 019 0015 Period 17 0714 0515 0012 0270 0100546 0.005 OST 0.100 DO 0.034 0.046 0350 Period 18 700 0414 0.0200020 0.012 0015 0009 0.160 0.150 GO 0003 F 00 0.038 0000 0051 012 0.021 00 Period 1 0.6560ATS 0331 0233 . 2007 0.000 0.116 OBS 080 0.043 ODE Period 20 0673 456 0.63 0017 0.312 0.000 0.00Y 0.00 0215 0.002 F 0108 0.104 Period 10:45 0.073 0051 DON70000 0.00014 0010 0.00 0.24 6007 Q.10 0.001 0.004 0.135 0.003 00140044 0.00 Period 22 0.6470422 0.27 0.02200150011 0.008 0.000 0.000 104 0 000 0001 F 0.056 0.03 0.22 0.020 Pero 23 063440 080013 0.000 0.000 0.004 0 000 0002 110 00 00 Per 100 0.001 0033 0.02200150010 0.007 0.005 0.000 0.002 0.002 AM 0.000 Ann Ann 0.00 The 0.250 612 P Done dy MacBook Air DU DD SO ER 9: FM 22 : ( 3 + + 3 $ 4 & 7 00. 2 5 6 W E Y R T Y U 1 D F G H J K L ? X C V B N M 1 Homework. Chapter 22 Homework Sa core: 0 of 1 pt 3 of 4 (4 complete) HW Score: 75%, 3 of 4 XE22-29 (book/static) Question Help Jenna's Bakery plans to purchase a new oven for its store. The oven has an estimated useful life of 4 years. The estimated pretax cash flows for the oven are as shown in the table that follows, with no anticipated change in working capital. Jenna's Bakery has an 8% after-tax required rate of retum and a 34% income tax rate. Assume depreciation is calculated on a straight-line basis for tax purposes using the initial investment in the oven and its estimated terminal disposal value. Assumo all cash flows occur at year-end except for initial investment amounts Click the icon to view the estimated cash flows for the oven. Prosent Value of $1 table Prof Read the requirements Data Table Requirement 1. Calculato(a) a. Not prosent value. (Use facto The net prosent value is s b. Payback period. (Round your A B F Relevant Cash Flows at End of Each Year 2 Year o Year 1 Year 2 Year 3 Year 4 3 Initial oven investment $ 70,000) Annual cash flows from operations 4(excluding the depreciation offect) $ 24,000 $ 24.000 $ 24,000 $ 24,000 5 Cash flow from terminal disposal of oven $ 7,000 The payback period in yours is Print Done Enter any number in the edit fields and then click Check Answer 2 am remaining Clear All Check