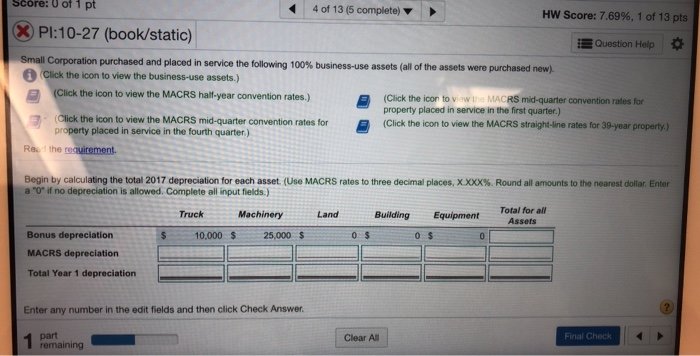

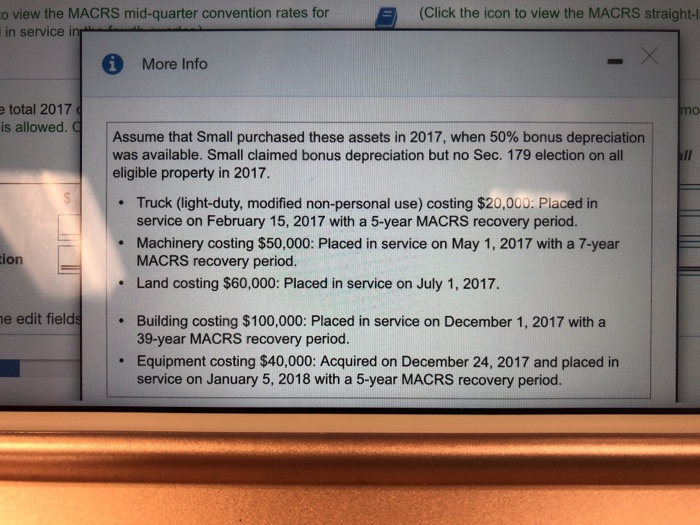

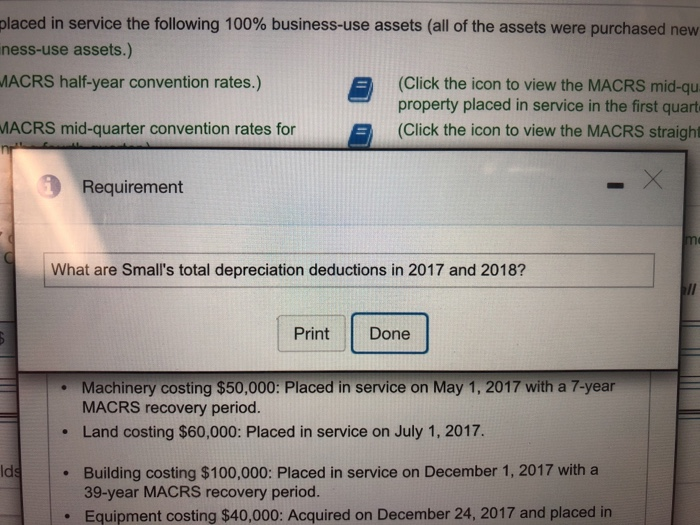

Score: 0 of 1 pt 4 of 13 (5 complete) Hw Score: 7.69%, 1 of 13 pts Pl:10-27 (book/static) Question Help Small Corporation purchased and placed in service the following 100% business-use assets (all of the assets were purchased new). Cickthe con to vew the business use ssets) (Click the icon to view the MACRS halif-year convention rates.) (Click the icon to v vi. MACRS mid-quarter convention rates for property placed in service in the first quarter.) Ock the icon to view the MACRS mid-quarter property placed in service in the fourth quarter.) ' . er convention rates for for (Click the icon to view the MACRS straight -line rates for 39-year property,) Begin by calculating the total 2017 depreciation for each asset Use MACRS rates to three dec al places, XXXX%, Round all a a-o" if no depreciation is allowed. Complete all input fields.) nts to the nearest oo i r Enter Truck MachineryLand Building Equipment Total for all Bonus depreciation MACRS depreciation Total Year 1 depreciation 10,000$25,000 $ 0 $ Enter any number in the edit fields and then click Check Answer Clear All Final Check o view the MACRS mid-quarter convention rates for in service inp (Click the icon to view the MACRS straight- More Info e total 2017 is allowed. Assume that Small purchased these assets in 2017, when 50% bonus depreciation was available. Small claimed bonus depreciation but no Sec. 179 election on all eligible property in 2017. Truck (light-duty, modified non-personal use) costing $20,000: Placed in service on February 15, 2017 with a 5-year MACRS recovery period. Machinery costing $50,000: Placed in service on May 1, 2017 with a 7-year MACRS recovery period. Land costing $60,000: Placed in service on July 1, 2017. . ion e edit field Building costing $100,000: Placed in service on December 1, 2017 with a 39-year MACRS recovery period. Equipment costing $40,000: Acquired on December 24, 2017 and placed in service on January 5, 2018 with a 5-year MACRS recovery period. . placed in service the following 100% business-use assets (all of the assets were purchased new ness-use assets.) MACRS half-year convention rates.) ACRS mid-quarter convention rates for (Click the icon to view the MACRS mid-qu property placed in service in the first quart (Click the icon to view the MACRS straight Requirement What are Small's total depreciation deductions in 2017 and 2018? Print Done Machinery costing $50,000: Placed in service on May 1, 2017 with a 7-year MACRS recovery period. Land costing $60,000: Placed in service on July 1, 2017. . Building costing $100,000: Placed in service on December 1, 2017 with a 39-year MACRS recovery period. Equipment costing $40,000: Acquired on December 24, 2017 and placed in ld