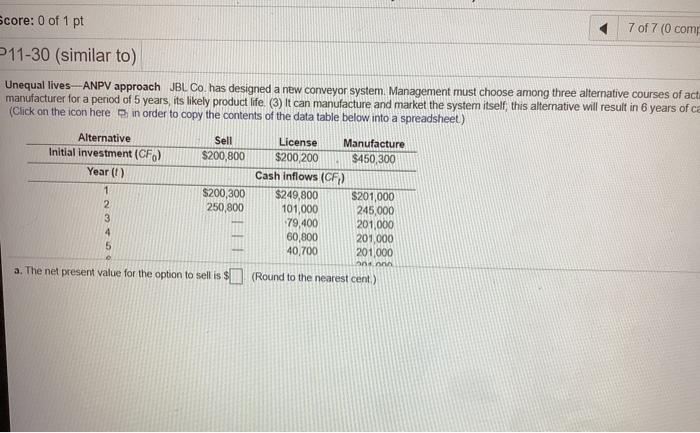

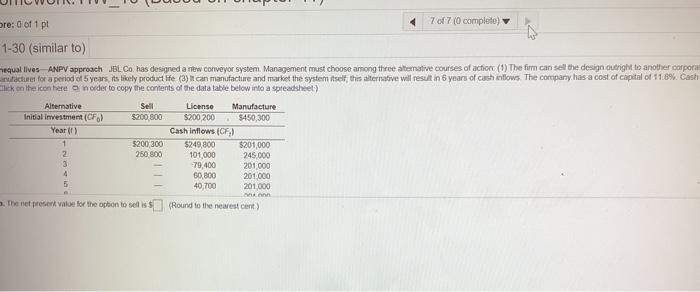

Score: 0 of 1 pt 7 of 7 (0 com 11-30 (similar to) Unequal lives-ANPV approach JBL Co. has designed a new conveyor system. Management must choose among three alternative courses of act manufacturer for a period of 5 years, its likely product life (3) It can manufacture and market the system itselfthis alternative will result in 6 years of ce (Click on the icon here in order to copy the contents of the data table below into a spreadsheet) Alternative Sell License Manufacture Initial investment (CF) $200,800 $200,200 $450,300 Year (0) Cash inflows (CF) 1 $200,300 $249,800 S201,000 2 250,800 101,000 245,000 3 79,400 201,000 60,800 201,000 5 40,700 201,000 a. The net present value for the option to sell is $ (Round to the nearest cent) ter 11) HW Score: 0%, 0 of 7 pts 7 of 7 (0 completo) Question Help Management must choose among three alternative courses of action (1) The firm can sell the design outright to another corporation with payment over 2 years (2) can license the design to another market the syster itself, this alternative will result in 6 years of cash flows. The company has a cost of capital of 11.8% Cash flows associated with each alternative are as shown in the following table a spreadsheet) ture BBO 000 000 000 000 1.000 Ore: 0 of 1 pt 7 of 7 (0 complete) 1-30 (similar to) equal lives ANPV approach JBL Co has designed a new conveyor system. Management must choose among three alternative courses of action (1) The firm can sell the design outright to another corporat factures for a period of 5 years, its likely product life (3) It can manufacture and market the system itself, this alternative will result in 6 years of cash inflows. The company has a cost of chiptal of 11.8% Cash Click on the icon here anorder to copy the contents of the data table below into a spreadsheet) Alternative Sell License Manufacture Initial investment (CF) $200 800 $200 200 $450,300 Year Cash Inflows (CF) + 5200 300 $249,800 5201,000 2 250 800 101 000 245.000 3 79,400 201000 4 60.800 201.000 5 40,700 201000 ma The ne present alue for the option to sell is $(Round to the newest cent)